Equity Trading by Institutional Investors: To Cross or Not

... failure. The cost of this trading failure has two components. One component is that the investor’s portfolio does not contain IBM. This cost depends on the investor’s motivation for wanting to add IBM to his or her portfolio, and it is hard to say much about this cost in general. The other componen ...

... failure. The cost of this trading failure has two components. One component is that the investor’s portfolio does not contain IBM. This cost depends on the investor’s motivation for wanting to add IBM to his or her portfolio, and it is hard to say much about this cost in general. The other componen ...

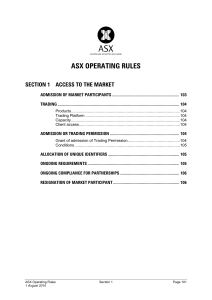

ASX Operating Rules Section 01

... appropriate and is satisfied that the applicant will have in place and maintain adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge required to exercise the Trading Permission for those Products and will meet a ...

... appropriate and is satisfied that the applicant will have in place and maintain adequate clearing arrangements in accordance with Rule [1003] and Schedule 1 for those products and have the technical capacity and knowledge required to exercise the Trading Permission for those Products and will meet a ...

Financial Statement Analysis and Security Valuation

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

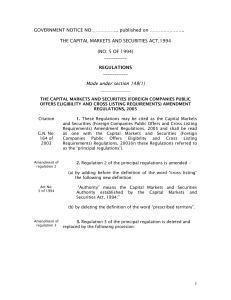

Cross Listing Requirement - Capital Markets and Securities Authority

... negative statement. Where options have been granted or agreed to be granted to all the holders of shares or debt securities, or of any class thereof, or to employees under an employees’ share scheme, it will be sufficient, so far as the names are concerned, to record that fact without giving names B ...

... negative statement. Where options have been granted or agreed to be granted to all the holders of shares or debt securities, or of any class thereof, or to employees under an employees’ share scheme, it will be sufficient, so far as the names are concerned, to record that fact without giving names B ...

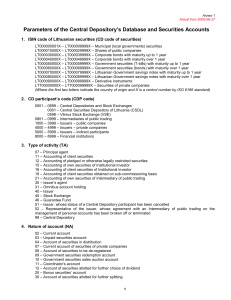

1. ISIN code of Lithuanian securities (CD code of securities)

... 105 – Redemption of the Lithuanian Government savings notes 106 – Redemption of corporate bonds through the Central Depository 109 – Government securities redemption from the participants 111 – Government securities redemption through the Central Depository 112 – Premature Government securities rede ...

... 105 – Redemption of the Lithuanian Government savings notes 106 – Redemption of corporate bonds through the Central Depository 109 – Government securities redemption from the participants 111 – Government securities redemption through the Central Depository 112 – Premature Government securities rede ...

Internationalization of Stock Markets: Potential Problems for United

... It is not surprising that little attention has been paid to the potential problems faced by United States shareholders as a result of foreign listings and stock offerings by their corporations. This is a consequence of the market-oriented paradigm in which many in the United States view the securiti ...

... It is not surprising that little attention has been paid to the potential problems faced by United States shareholders as a result of foreign listings and stock offerings by their corporations. This is a consequence of the market-oriented paradigm in which many in the United States view the securiti ...

Multimarket Trading and Market Liquidity Author(s): Bhagwan

... the like, and remember that the less regulated London and Tokyo stock markets are now but a (1987e).] quick phone call away." [See also Wall StreetJournal These claims voiced in the popular press may have some validity if there are significant errors in detecting the true "insiders," in which case t ...

... the like, and remember that the less regulated London and Tokyo stock markets are now but a (1987e).] quick phone call away." [See also Wall StreetJournal These claims voiced in the popular press may have some validity if there are significant errors in detecting the true "insiders," in which case t ...

bid, ask and` transaction prices in a specialist

... problems and cause the next bid price to be lower and the next ask price to be higher than would otherwise be the case. Furthermore, a market, once closed, will stay closed until the insiders go away or their information is at least partly disseminated to market participants from some other informat ...

... problems and cause the next bid price to be lower and the next ask price to be higher than would otherwise be the case. Furthermore, a market, once closed, will stay closed until the insiders go away or their information is at least partly disseminated to market participants from some other informat ...

Trading and Electronic Markets

... that stood when the trades were first ordered. The VWAP (volume-weighted average price) method, which managers commonly use, has many problems. Keeping track of the opportunity costs associated with trades ordered but not executed is very important because this information can help traders know when ...

... that stood when the trades were first ordered. The VWAP (volume-weighted average price) method, which managers commonly use, has many problems. Keeping track of the opportunity costs associated with trades ordered but not executed is very important because this information can help traders know when ...

Performance Measurement

... • Trader 1 builds it gradually and has an average gap to the pace position of 40.6. • Trader 2 waits until the end of the day to sell the last 850 and has an average ...

... • Trader 1 builds it gradually and has an average gap to the pace position of 40.6. • Trader 2 waits until the end of the day to sell the last 850 and has an average ...

Circular 2018/2 Duty to report securities transactions Duty to

... transaction chain must additionally report the unique transaction identification code (trade ID) provided by the trading venue. If there is more than one trade ID due to partial execution, all trade IDs must be reported. The participants are also entitled to entrust a single participant or a suitabl ...

... transaction chain must additionally report the unique transaction identification code (trade ID) provided by the trading venue. If there is more than one trade ID due to partial execution, all trade IDs must be reported. The participants are also entitled to entrust a single participant or a suitabl ...

Corporate Action Guidelines

... However its announcement about book closure dates was as below: “…In order to establish entitlements to the proposed final dividend, all transfers accompanied by the relevant share certificates must be lodged with the Company’s Hong Kong branch share registrar and transfer office… not later than 4:3 ...

... However its announcement about book closure dates was as below: “…In order to establish entitlements to the proposed final dividend, all transfers accompanied by the relevant share certificates must be lodged with the Company’s Hong Kong branch share registrar and transfer office… not later than 4:3 ...

1 WORKDAY, INC. POLICY ON HEDGING IN SECURITIES The

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

... Investing in Workday’s securities provides an opportunity to share in the future growth of Workday. Investment in Workday and sharing in the growth of Workday, however, does not mean short-range speculation based on fluctuations in the market. Therefore, you may not trade in options, warrants, puts ...

Non-Display Declaration Form

... As noted in Section 6.b of the Market Data Distribution Agreement, market data recipients are required to declare all Real Time Non-Display usage annually by January 31 of the current year. OTC Markets Non-Display Usage is broken down into three (3) categories: Category 1—Non-Display Trading Platfor ...

... As noted in Section 6.b of the Market Data Distribution Agreement, market data recipients are required to declare all Real Time Non-Display usage annually by January 31 of the current year. OTC Markets Non-Display Usage is broken down into three (3) categories: Category 1—Non-Display Trading Platfor ...

handbill on eligibility to bid for government securities in the primary

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

Shopping - MBA6113-Technology

... electronic exchanges. In their quest for the choicest locations, at least 40 of Tradebot's competitors have carted their computers to the same buildings, a practice known as co-location. The kind of trading practiced by Mr. Cummings is a particularly fast form of "algorithmic" or "black-box" trading ...

... electronic exchanges. In their quest for the choicest locations, at least 40 of Tradebot's competitors have carted their computers to the same buildings, a practice known as co-location. The kind of trading practiced by Mr. Cummings is a particularly fast form of "algorithmic" or "black-box" trading ...

First North Price List

... market value of the shares traded. The market value of shares is calculated as the arithmetic average of the market values obtained by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is ca ...

... market value of the shares traded. The market value of shares is calculated as the arithmetic average of the market values obtained by multiplying the number of shares by the closing prices for all trading days of the previous calendar year. Upon admission for trade, the market value of shares is ca ...

CME Group customer forum

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

... Futures and swaps trading is not suitable for all investors, and involves the risk of loss. Futures and swaps are leveraged investments, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures an ...

The Dual-Listing Law:

... Companies that have traded on the Nasdaq, the New York Stock Exchange, the American Stock Exchange, or the London Stock Exchange’s Main Market (Primary Listing) for at least a year since their IPOs are eligible to dual-list. Also eligible are companies that have traded for less than a year but maint ...

... Companies that have traded on the Nasdaq, the New York Stock Exchange, the American Stock Exchange, or the London Stock Exchange’s Main Market (Primary Listing) for at least a year since their IPOs are eligible to dual-list. Also eligible are companies that have traded for less than a year but maint ...

FREE Manual

... As mentioned above, this tool is used to define the trend of the market in question for the remainder of the trading session. The seasoned chart observer will agree that quite often the high or low of the trading session will be established within the first hour of the day. This trading aid attempts ...

... As mentioned above, this tool is used to define the trend of the market in question for the remainder of the trading session. The seasoned chart observer will agree that quite often the high or low of the trading session will be established within the first hour of the day. This trading aid attempts ...

BAML Partners with Thesys on New High-Speed Trading

... for high performance trading platforms.” The platform was provided by Thesys Technologies, a subsidiary of a trading firm called Tradeworx that developed an expertise in low-latency automated trading technology for its own trading strategies. “We felt they had the best handle on the high-frequency s ...

... for high performance trading platforms.” The platform was provided by Thesys Technologies, a subsidiary of a trading firm called Tradeworx that developed an expertise in low-latency automated trading technology for its own trading strategies. “We felt they had the best handle on the high-frequency s ...

Revised Securities Trading Policy

... provisions may also be liable to compensate any person who suffers loss or damage resulting from the conduct. ...

... provisions may also be liable to compensate any person who suffers loss or damage resulting from the conduct. ...

code of practices and procedures for fair disclosure of unpublished

... The Company shall provide only public information to the analyst/research persons/large investors like institutions. The Company shall ensure that the information shared with analyst and research personnel is not Unpublished Price Sensitive Information. 7. Unpublished price sensitive information o ...

... The Company shall provide only public information to the analyst/research persons/large investors like institutions. The Company shall ensure that the information shared with analyst and research personnel is not Unpublished Price Sensitive Information. 7. Unpublished price sensitive information o ...

Securities Markets Primary Versus Secondary Markets How

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...