BRIEF EXERCISE 8-1 (a) Other receivables. (b) Notes receivable. (c

... that receivables are stated at their cash (net) realizable value on the balance sheet. Cash (net) realizable value is the net amount of cash expected to be received. It excludes amounts that the company estimates it will not collect. Receivables are therefore reduced by estimated uncollectible a ...

... that receivables are stated at their cash (net) realizable value on the balance sheet. Cash (net) realizable value is the net amount of cash expected to be received. It excludes amounts that the company estimates it will not collect. Receivables are therefore reduced by estimated uncollectible a ...

POSTGRADUATE DIPLOMA IN MARKETING AND MANAGEMENT

... 2. Purchasing usually receives its cue to purchase from production via purchase requisitions or bills of material. However, in the case of strategic materials of long-delivery items it is useful for purchasing to have some advance warning of likely impending material or component purchases in order ...

... 2. Purchasing usually receives its cue to purchase from production via purchase requisitions or bills of material. However, in the case of strategic materials of long-delivery items it is useful for purchasing to have some advance warning of likely impending material or component purchases in order ...

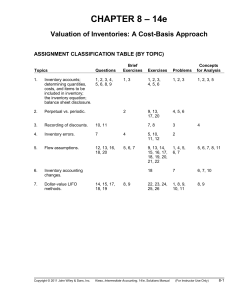

chapter 8 - Csulb.edu

... Which of the following statements is not valid as it applies to inventory costing methods? a. If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net incom ...

... Which of the following statements is not valid as it applies to inventory costing methods? a. If inventory quantities are to be maintained, part of the earnings must be invested (plowed back) in inventories when FIFO is used during a period of rising prices. b. LIFO tends to smooth out the net incom ...

0001047469-11-001850 - Douglas Dynamics Investor Relations

... breadth of products. As the market leader in snow and ice control equipment for light trucks, we enjoy a set of competitive advantages versus smaller equipment providers, which allows us to generate robust cash flows in all snowfall environments and to support continued investment in our products, d ...

... breadth of products. As the market leader in snow and ice control equipment for light trucks, we enjoy a set of competitive advantages versus smaller equipment providers, which allows us to generate robust cash flows in all snowfall environments and to support continued investment in our products, d ...

1. Which of the following statements best describes the IFRS

... Which of the following statements best describes the IFRS conceptual framework? A. It provides a set of rules for accountants to follow. B. It provides concepts, since accounting is based on nature of law. C. It helps equity investors interpret the earnings per share. D. It provides a basis for prep ...

... Which of the following statements best describes the IFRS conceptual framework? A. It provides a set of rules for accountants to follow. B. It provides concepts, since accounting is based on nature of law. C. It helps equity investors interpret the earnings per share. D. It provides a basis for prep ...

VT Transaction user guide

... journal method. Each outstanding invoice should be given its original date. The total of the invoices posted this way should match the summary amount in the trial balance. When you enter each invoice in this way, no VAT is entered on the invoices (unless you are operating VAT cash accounting – see b ...

... journal method. Each outstanding invoice should be given its original date. The total of the invoices posted this way should match the summary amount in the trial balance. When you enter each invoice in this way, no VAT is entered on the invoices (unless you are operating VAT cash accounting – see b ...

FASB: Status of Statement 5

... financial statements with pro forma financial data giving effect to the loss as if it had occurred at the date of the financial statements. It may be desirable to present pro forma statements, usually a balance sheet only, in columnar form on the face of the historical financial statements. 12. Cert ...

... financial statements with pro forma financial data giving effect to the loss as if it had occurred at the date of the financial statements. It may be desirable to present pro forma statements, usually a balance sheet only, in columnar form on the face of the historical financial statements. 12. Cert ...

FASB: Status of Statement 5

... financial statements with pro forma financial data giving effect to the loss as if it had occurred at the date of the financial statements. It may be desirable to present pro forma statements, usually a balance sheet only, in columnar form on the face of the historical financial statements. 12. Cert ...

... financial statements with pro forma financial data giving effect to the loss as if it had occurred at the date of the financial statements. It may be desirable to present pro forma statements, usually a balance sheet only, in columnar form on the face of the historical financial statements. 12. Cert ...

Download attachment

... Paragraph 37 of Concepts Statement 1 states that: Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the ...

... Paragraph 37 of Concepts Statement 1 states that: Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the ...

FREE Sample Here - We can offer most test bank and

... Allen Company used $71,000 of direct materials and incurred $37,000 of direct labor costs during 2011. Indirect labor amounted to $2,700 while indirect materials used totaled $1,600. Other operating costs pertaining to the factory included utilities of $3,100; maintenance of $4,500; supplies of $1,8 ...

... Allen Company used $71,000 of direct materials and incurred $37,000 of direct labor costs during 2011. Indirect labor amounted to $2,700 while indirect materials used totaled $1,600. Other operating costs pertaining to the factory included utilities of $3,100; maintenance of $4,500; supplies of $1,8 ...

ActionAid International Financial Management Framework

... This framework establishes the financial policies and standards (and procedures) for ActionAid International (AAI) and its Affiliates and Associates. The framework demonstrates AAI‟s concern for financial integrity; as such it is important evidence of our accountability to all stakeholders. Finance ...

... This framework establishes the financial policies and standards (and procedures) for ActionAid International (AAI) and its Affiliates and Associates. The framework demonstrates AAI‟s concern for financial integrity; as such it is important evidence of our accountability to all stakeholders. Finance ...

Top of Form Week 2: The Accounting Information System and

... I believe that a accrual basis method provides a better picture of the overall profitability of a company because you have more accurate books especially when going between accounting periods, including month to month or from one fiscal year to the next. Using cash based would create a lot of inaccu ...

... I believe that a accrual basis method provides a better picture of the overall profitability of a company because you have more accurate books especially when going between accounting periods, including month to month or from one fiscal year to the next. Using cash based would create a lot of inaccu ...

(revised) compilation engagements

... provision or continuation of a grant). For transactional purposes, for example to support a transaction involving changes to the entity’s ownership or financing structure (such as for a merger or acquisition). ...

... provision or continuation of a grant). For transactional purposes, for example to support a transaction involving changes to the entity’s ownership or financing structure (such as for a merger or acquisition). ...

User guide to Standing Direction 1

... government consolidated ‘Annual Financial Report for the State of Victoria’. ...

... government consolidated ‘Annual Financial Report for the State of Victoria’. ...

THE VALUE RELEVANCE OF MANAGERS` AND

... When accounting standards allow managers discretion in measuring complex financial statement estimates, reported amounts represent a point estimate among a range of reasonable values (e.g., Bratten, Gaynor, McDaniel, Montague, and Sierra 2013). The range of reasonable values for an estimate often in ...

... When accounting standards allow managers discretion in measuring complex financial statement estimates, reported amounts represent a point estimate among a range of reasonable values (e.g., Bratten, Gaynor, McDaniel, Montague, and Sierra 2013). The range of reasonable values for an estimate often in ...

cash flows

... portion of the costs of fixed assets against annual revenues over time. • Depreciation for tax purposes is determined by using the Modified Accelerated Cost Recovery System (MACRS). • On the other hand, a variety of other depreciation methods are often used for reporting purposes (e.g. straight-line ...

... portion of the costs of fixed assets against annual revenues over time. • Depreciation for tax purposes is determined by using the Modified Accelerated Cost Recovery System (MACRS). • On the other hand, a variety of other depreciation methods are often used for reporting purposes (e.g. straight-line ...

Moderate

... 10. Cash discounts (purchase discounts) should not be accounted for as financial income when payments are made. Income should be recognized when the earning process is complete (when the company sells the inventory). Furthermore, a company does not earn revenue from purchasing goods. Cash discounts ...

... 10. Cash discounts (purchase discounts) should not be accounted for as financial income when payments are made. Income should be recognized when the earning process is complete (when the company sells the inventory). Furthermore, a company does not earn revenue from purchasing goods. Cash discounts ...

extract

... students. Current financial accounting textbooks routinely introduce accounting history with the formation of the SEC in 1934 and its delegation of accounting rule-making to private standard-setting bodies. Accounting students often get the mistaken impression that the accounting profession was crea ...

... students. Current financial accounting textbooks routinely introduce accounting history with the formation of the SEC in 1934 and its delegation of accounting rule-making to private standard-setting bodies. Accounting students often get the mistaken impression that the accounting profession was crea ...

Chapter 18 Notes File - National Trail Local School District

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

Does Fair Value Reporting Affect Risk Management?

... Many firms, however, employ economically effective hedging strategies which are designed such that the derivative instrument’s value and the underlying exposure are not highly correlated. For example, Brown and Toft (2002) show that it is often optimal for a firm to hedge using derivative strategies ...

... Many firms, however, employ economically effective hedging strategies which are designed such that the derivative instrument’s value and the underlying exposure are not highly correlated. For example, Brown and Toft (2002) show that it is often optimal for a firm to hedge using derivative strategies ...

Auditor Liability and Professional Skepticism: A Look at Lehman

... Given that the concept of skepticism has long been firmly enshrined in auditing standards and that its importance, if not its operationalization, is taught to all nascent auditors during their collegiate training, it is not likely that many practicing auditors are ignorant of this requirement, at le ...

... Given that the concept of skepticism has long been firmly enshrined in auditing standards and that its importance, if not its operationalization, is taught to all nascent auditors during their collegiate training, it is not likely that many practicing auditors are ignorant of this requirement, at le ...

The Role of Accounting in a Society

... & Chand, 2012). A higher level of transparency and more detailed rules of measurement would help establish the desired social balance. In times of crisis, mainstream accounting, which is based on this perception, can merely—as expressed nicely by Arnold (2009, p. 805)—“cling to the disfunct notion t ...

... & Chand, 2012). A higher level of transparency and more detailed rules of measurement would help establish the desired social balance. In times of crisis, mainstream accounting, which is based on this perception, can merely—as expressed nicely by Arnold (2009, p. 805)—“cling to the disfunct notion t ...

A GUIDE TO STATUTORY AUDIT PROCEDURES ON EXPECTED

... In the specific case of work on IFRS 9, given the particularly high number of transactions managed by information systems, it seems essential to rely on internal controls to reach a conclusion. In particular, this means testing the key controls embedded in these information systems via computerized ...

... In the specific case of work on IFRS 9, given the particularly high number of transactions managed by information systems, it seems essential to rely on internal controls to reach a conclusion. In particular, this means testing the key controls embedded in these information systems via computerized ...

chapter 1 power point notes

... Accounting is an information system that identifies, measures, records, and communicates information that has relevance and is a faithful representation of an organization’s economic activities. Its objective is to help people make better ...

... Accounting is an information system that identifies, measures, records, and communicates information that has relevance and is a faithful representation of an organization’s economic activities. Its objective is to help people make better ...