Got a question on where to invest?

... investable equity market are Mexico and Brazil. Of the two, Brazil has a more dynamic capital market. They have made many improvements to the soundness of their equity market over the last decade. The combination of good demographics, agricultural and energy riches and true commercial instinct make ...

... investable equity market are Mexico and Brazil. Of the two, Brazil has a more dynamic capital market. They have made many improvements to the soundness of their equity market over the last decade. The combination of good demographics, agricultural and energy riches and true commercial instinct make ...

Professional Letter

... VALIC that existing assets in the Government Agency Fund were automatically mapped to the Capital Preservation Fund on August 31, 2007. Adds a socially responsible fund to AIG VALIC’s core fund lineup. This fund invests in larger companies that meet certain social screening criteria such as being en ...

... VALIC that existing assets in the Government Agency Fund were automatically mapped to the Capital Preservation Fund on August 31, 2007. Adds a socially responsible fund to AIG VALIC’s core fund lineup. This fund invests in larger companies that meet certain social screening criteria such as being en ...

Stable Value: Not all funds are created equal

... fixed income securities. In a normal interest rate environment, with an upward sloping yield curve, lower duration generally means lower yielding securities. Compared with higher duration funds, lower duration portfolios have greater cash flows from maturing securities and allow managers to track th ...

... fixed income securities. In a normal interest rate environment, with an upward sloping yield curve, lower duration generally means lower yielding securities. Compared with higher duration funds, lower duration portfolios have greater cash flows from maturing securities and allow managers to track th ...

AP8200-investment

... This investment policy applies to all financial assets of Big Bend Community College. These funds are accounted for in Big Bend Community College’s Comprehensive Annual Financial Report and include: General Fund Special Revenue Funds Capital Project Funds Enterprise Funds Agency Funds Any new fund c ...

... This investment policy applies to all financial assets of Big Bend Community College. These funds are accounted for in Big Bend Community College’s Comprehensive Annual Financial Report and include: General Fund Special Revenue Funds Capital Project Funds Enterprise Funds Agency Funds Any new fund c ...

Exploring the Investment Behavior of Minorities in America

... However, a majority of respondents made investment decisions jointly with their spouse. A very small proportion of respondents in this study involved other adults in investment decision-making, and this proportion was highest among Hispanics and whites. Investors may begin their financial socializat ...

... However, a majority of respondents made investment decisions jointly with their spouse. A very small proportion of respondents in this study involved other adults in investment decision-making, and this proportion was highest among Hispanics and whites. Investors may begin their financial socializat ...

Solicitor struck off after referring clients to tied adviser

... to IFAs. This is particularly important after the RDR when advisers may describe themselves as restricted whole of market but are not truly independent.” ...

... to IFAs. This is particularly important after the RDR when advisers may describe themselves as restricted whole of market but are not truly independent.” ...

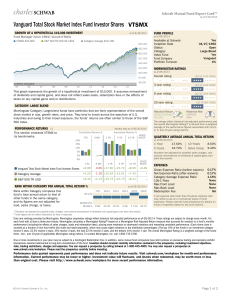

Vanguard Total Stock Market Index Fund Investor Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

News release - EY`s 2016 study on direct investment in Europe

... every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and marketing, but they tend to be small-scale. This is how they gain entry into new markets. ...

... every two manufacturing jobs created by Swiss companies is in this region, with Poland benefitting the most out of the 13 target countries. Most investment projects launched by Swiss companies are in sales and marketing, but they tend to be small-scale. This is how they gain entry into new markets. ...

Oando Group to offer investors 49% of marketing arm in strategy shift

... exploration portfolio and with a marketing operation that has been on for 54 years. “What this means is that the creation of Oando Marketing plc from the group will favour shareholders who seek yearly dividends from a company that on its own will no longer be tied to the very long term nature of oil ...

... exploration portfolio and with a marketing operation that has been on for 54 years. “What this means is that the creation of Oando Marketing plc from the group will favour shareholders who seek yearly dividends from a company that on its own will no longer be tied to the very long term nature of oil ...

Money Market Fund Reform and Your Corporate

... fund families will produce, like the weekly or daily liquidity tests? ...

... fund families will produce, like the weekly or daily liquidity tests? ...

December 2011 - Capital Markets Board of Turkey

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

Chapter 10

... Operating profit, on the other hand, is profit calculated after a large number of expenses and additional costs. So it is not so easy to control and there are often wide variations, even within industries and sectors. Question 3 The most commonly employed ROI measure is return on capital employed (R ...

... Operating profit, on the other hand, is profit calculated after a large number of expenses and additional costs. So it is not so easy to control and there are often wide variations, even within industries and sectors. Question 3 The most commonly employed ROI measure is return on capital employed (R ...

September 2010 - Capital Markets Board of Turkey

... •Founded on December 26, 1986, the Istanbul Stock Exchange (ISE) is organizing a series of activities to mark its twenty-fifth anniversary. •On this occasion, the ISE organizes a two-day conference at Haliç Congress Center, Istanbul on December 9-10, 2010. The conference is aimed at providing an int ...

... •Founded on December 26, 1986, the Istanbul Stock Exchange (ISE) is organizing a series of activities to mark its twenty-fifth anniversary. •On this occasion, the ISE organizes a two-day conference at Haliç Congress Center, Istanbul on December 9-10, 2010. The conference is aimed at providing an int ...

Land Market - Property News

... which they can start with the investment process as soon as possible. Nowadays the investments are planned short-term – they are expected to begin and end within 5 years due to less stable situation on the market. If there are any problems with the site that can be solved in a relatively short time, ...

... which they can start with the investment process as soon as possible. Nowadays the investments are planned short-term – they are expected to begin and end within 5 years due to less stable situation on the market. If there are any problems with the site that can be solved in a relatively short time, ...

ScholarShare Gift Deposit Form

... Ask the account owner for the account number you should use for your gift, and list it on the form. Mail the completed form to: ScholarShare College Savings Plan, P.O. Box 55205, Boston, MA 02205-5205. Consider the investment objectives, risks, charges and expenses before investing in the ScholarSha ...

... Ask the account owner for the account number you should use for your gift, and list it on the form. Mail the completed form to: ScholarShare College Savings Plan, P.O. Box 55205, Boston, MA 02205-5205. Consider the investment objectives, risks, charges and expenses before investing in the ScholarSha ...

Long-Term Investment Policy - American Speech

... 1. Based on the recommendation(s) of the Investment Advisor, the FPB shall select one or more Allowable Investments or Investment Managers. 2. The Investment Advisor shall meet as necessary with the ASHA Staff, but no less than quarterly, to review investment results and policy compliance as well as ...

... 1. Based on the recommendation(s) of the Investment Advisor, the FPB shall select one or more Allowable Investments or Investment Managers. 2. The Investment Advisor shall meet as necessary with the ASHA Staff, but no less than quarterly, to review investment results and policy compliance as well as ...

Merk Investments

... Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest ra ...

... Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest ra ...

clearbridge dividend strategy portfolios

... Rigorous portfolio review to ensure fundamental and valuation case intact. ...

... Rigorous portfolio review to ensure fundamental and valuation case intact. ...

CF Canlife Portfolio Funds

... By investing primarily in in-house funds, Canada Life Investments is able to maintain low costs across their suite of CF Canlife Portfolio Funds. Canada Life Investments Canada Life Investments is a UK-based asset manager responsible for managing more than £35bn of equities, fixed income and propert ...

... By investing primarily in in-house funds, Canada Life Investments is able to maintain low costs across their suite of CF Canlife Portfolio Funds. Canada Life Investments Canada Life Investments is a UK-based asset manager responsible for managing more than £35bn of equities, fixed income and propert ...

69155 INVESTING AT AN EARLY AGE The benefits of advance

... different ways that a young person can invest their money (and their time) wisely. While it’s true that some people begin investing later in life and still manage to enjoy comfortable returns on their investments, one only needs to see a few friends have financial troubles to realize that things don ...

... different ways that a young person can invest their money (and their time) wisely. While it’s true that some people begin investing later in life and still manage to enjoy comfortable returns on their investments, one only needs to see a few friends have financial troubles to realize that things don ...

Investment in private and public sectors

... undertaken to increase profitability. • Organizations will seek to invest in those projects which yield the highest return. • The profitability of an investment project can be analysed by investigating its costs and revenue. ...

... undertaken to increase profitability. • Organizations will seek to invest in those projects which yield the highest return. • The profitability of an investment project can be analysed by investigating its costs and revenue. ...

Colorado Springs Press Release

... RIA is comprised of highly successful former wirehouse advisors and their support teams who were looking for an evolved business model that places clients at the center of all that they do. We have decided to affiliate with HighTower, Charles Schwab Institutional and Fidelity. HighTower is our broke ...

... RIA is comprised of highly successful former wirehouse advisors and their support teams who were looking for an evolved business model that places clients at the center of all that they do. We have decided to affiliate with HighTower, Charles Schwab Institutional and Fidelity. HighTower is our broke ...

essential super lifestage option

... Fees and other costs for a member with a $50,000 balance throughout the year. 1 Level of investment risk The level of investment risk is the Trustee’s estimate of the risk of negative investment returns over a 20-year period. It is not a complete assessment of all forms of investment risk. For in ...

... Fees and other costs for a member with a $50,000 balance throughout the year. 1 Level of investment risk The level of investment risk is the Trustee’s estimate of the risk of negative investment returns over a 20-year period. It is not a complete assessment of all forms of investment risk. For in ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.