High Quality Dividend Yield

... * Any investment is subject to risk. Past performance is not a guarantee of future results. The data presented was obtained from the Advisor Partners High Quality Dividend Yield Composite, which seeks to invest in dividend paying companies that have high quality financial characteristics within the ...

... * Any investment is subject to risk. Past performance is not a guarantee of future results. The data presented was obtained from the Advisor Partners High Quality Dividend Yield Composite, which seeks to invest in dividend paying companies that have high quality financial characteristics within the ...

Alternative Investment Funds

... Safe Harbour rules - Clarifications sought Investor diversification conditions should incorporate a look-through approach ...

... Safe Harbour rules - Clarifications sought Investor diversification conditions should incorporate a look-through approach ...

private equity in mining - Berwin Leighton Paisner

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

... investment was being increased. The average size of the investment where there was an increased stake was $19.7m and again for the deals reported these were often investments in publicly listed companies. The additional percentage by which the funds’ holdings increased ranged from 0% ...

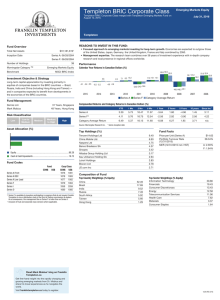

Templeton BRIC Corporate Class Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

Dear All, The Commissione Nazionale per le Società e la Borsa

... Dear All, The Commissione Nazionale per le Società e la Borsa (CONSOB) reports that the companies: ...

... Dear All, The Commissione Nazionale per le Società e la Borsa (CONSOB) reports that the companies: ...

FREE Sample Here - We can offer most test bank and

... during their working years before withdrawing them during their retirement years. Funds originally invested in and accumulated in pension funds are exempt from current taxation. 9. If there were no FIs then the users of funds, such as corporations in the economy, would have to approach the savers of ...

... during their working years before withdrawing them during their retirement years. Funds originally invested in and accumulated in pension funds are exempt from current taxation. 9. If there were no FIs then the users of funds, such as corporations in the economy, would have to approach the savers of ...

Nasdaq Equal Weighted Index Shares: QQQE

... information technology sector! Not to mention it’s the top holding of any index fund position you hold that tracks the S&P 500 index. So much for diversifying away from single-security risk. It may be time to consider another approach. As a result of its equal-weight methodology, QQQE is significant ...

... information technology sector! Not to mention it’s the top holding of any index fund position you hold that tracks the S&P 500 index. So much for diversifying away from single-security risk. It may be time to consider another approach. As a result of its equal-weight methodology, QQQE is significant ...

Norma Nisbet - Vista Properties and Investment

... representation with specialization in land, and development, site acquisition. The spectrum of brokerage services may include retail, industrial, mixed use development projects. and commercial investments, 1031 Exchanges. In addition, Norma Nisbet is FINRA Registered Representative, offering alterna ...

... representation with specialization in land, and development, site acquisition. The spectrum of brokerage services may include retail, industrial, mixed use development projects. and commercial investments, 1031 Exchanges. In addition, Norma Nisbet is FINRA Registered Representative, offering alterna ...

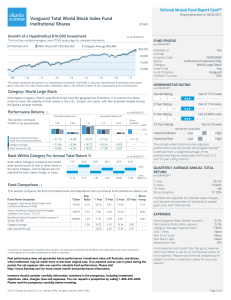

Vanguard Total World Stock Index Fund Institutional Shares

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

• Always deal with the market intermediaries registered with SEBI

... Don't get carried away with advertisements about the financial performance of companies in print and electronic media. ...

... Don't get carried away with advertisements about the financial performance of companies in print and electronic media. ...

November 2011 - Capital Markets Board of Turkey

... Serial: I, No: 44 has been published in the Official Gazette. Key points of new regulation are as follows. Board application has become mandatory for all de-mergers at which at least one party of the process is publicly held corporation. The definitions of “split-up”, “partial de-merger”, “parti ...

... Serial: I, No: 44 has been published in the Official Gazette. Key points of new regulation are as follows. Board application has become mandatory for all de-mergers at which at least one party of the process is publicly held corporation. The definitions of “split-up”, “partial de-merger”, “parti ...

Fact Sheet - Toroso Investments

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

... management of the Sector Opportunities Portfolio. The market price for a share of an ETP may fluctuate from the value of its underlying securities. Consequently, ETPs can trade at a discount or premium to their net asset value. Certain equity and commodity ETPs are often more volatile and less liqui ...

Hope Has Never Been a Winning Investment Strategy PDF

... guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk including the risk of loss of principal. Past performance is no guarantee of future results. The information provided does not constitute investment advice and ...

... guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk including the risk of loss of principal. Past performance is no guarantee of future results. The information provided does not constitute investment advice and ...

Asset-Class Winners and Losers

... to the top position once again in 2011. These types of performance reversals are evident throughout this example. Although investing in a diversified portfolio may prevent an investor from capturing top-performer returns in any given year, this strategy can also protect an investor from experiencing ...

... to the top position once again in 2011. These types of performance reversals are evident throughout this example. Although investing in a diversified portfolio may prevent an investor from capturing top-performer returns in any given year, this strategy can also protect an investor from experiencing ...

UK current account

... (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 23 June 2016. (b) The change in the holding of shares are weighted at each quarterly period by the price of the underlying stock. These data are updated on the date in which a change in shareh ...

... (a) Quarterly net changes in non-resident holdings of FTSE 100 companies’ shares, as listed on the index at 23 June 2016. (b) The change in the holding of shares are weighted at each quarterly period by the price of the underlying stock. These data are updated on the date in which a change in shareh ...

Transamerica ONE and Transamerica ALPHA Digital

... TFA is dedicated to serving people from all walks of life by helping them create an individualized investment strategy. Meet with a TFA Investment Advisor Representative to determine if the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program is an approp ...

... TFA is dedicated to serving people from all walks of life by helping them create an individualized investment strategy. Meet with a TFA Investment Advisor Representative to determine if the Transamerica® ONE Wealth Management Platform or the Transamerica ALPHA Digital Investment Program is an approp ...

Banco Centroamericano de Integración Económica

... Includes a number of mechanisms to identify, manage, implement, monitor, evaluate and measure the impact of its programs and projects. Reduces the cost of granting and managing resources for donors which do not have a strong presence in the Region. ...

... Includes a number of mechanisms to identify, manage, implement, monitor, evaluate and measure the impact of its programs and projects. Reduces the cost of granting and managing resources for donors which do not have a strong presence in the Region. ...

Savings, Investment Spending, and the Financial System

... A mutual fund is a financial intermediary that creates a stock portfolio and then resells shares of this portfolio to individual investors. A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members. Life insurance companies sell policies which gua ...

... A mutual fund is a financial intermediary that creates a stock portfolio and then resells shares of this portfolio to individual investors. A pension fund is a type of mutual fund that holds assets in order to provide retirement income to its members. Life insurance companies sell policies which gua ...

Bhagwati - Academic Commons

... not satisfy Norway’s own menu of social responsibility criteria. Is it alright for Norway then to be influencing other countries’ social policies while it would not want other countries to influence (in however limited and paltry a fashion) Norwegian politics? In fact, before outlining my views on w ...

... not satisfy Norway’s own menu of social responsibility criteria. Is it alright for Norway then to be influencing other countries’ social policies while it would not want other countries to influence (in however limited and paltry a fashion) Norwegian politics? In fact, before outlining my views on w ...

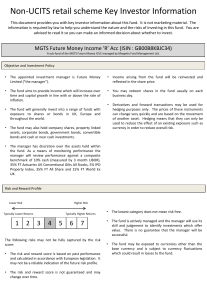

Document

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

... This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to inves ...

Minutes March 2016

... versus the Russell 2000 and the Russell 2000 Value for various periods is summarized ...

... versus the Russell 2000 and the Russell 2000 Value for various periods is summarized ...

Franklin Quotential Growth Portfolio Series A

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

... information. The Morningstar Risk-Adjusted Rating, commonly referred to as the Star Rating, relates the risk-adjusted performance of a fund to that of its category peers and is subject to change every month. The Star Rating is a measure of a fund’s annualized historical excess return (excess is meas ...

Banque de Luxembourg

... and control of risks are the main concerns for investors seeking to invest in equities. Against this backdrop, BLI - Banque de Luxembourg Investments S.A. will launch the BL-European Family Businesses fund, a new equities fund that invests in around 60 listed European family businesses. The current ...

... and control of risks are the main concerns for investors seeking to invest in equities. Against this backdrop, BLI - Banque de Luxembourg Investments S.A. will launch the BL-European Family Businesses fund, a new equities fund that invests in around 60 listed European family businesses. The current ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.