Europe ex UK Smaller Companies Fund

... The fund aims to provide long term capital growth by investing predominantly in the shares of smaller companies listed on European stock markets, excluding the UK. The fund is actively managed by our investment team, who will select stocks to try to take advantage of opportunities they have identifi ...

... The fund aims to provide long term capital growth by investing predominantly in the shares of smaller companies listed on European stock markets, excluding the UK. The fund is actively managed by our investment team, who will select stocks to try to take advantage of opportunities they have identifi ...

Financial Planning Canberra - Milestone Financial

... We appear to have reached the fourth or fifth points, which provides grounds for confidence. What’s more December quarter GDP saw an uptick in GDP growth to 0.8% quarter on quarter and 2.8% year on year, but more importantly it showed growth is far from collapsing and that other sectors of the econo ...

... We appear to have reached the fourth or fifth points, which provides grounds for confidence. What’s more December quarter GDP saw an uptick in GDP growth to 0.8% quarter on quarter and 2.8% year on year, but more importantly it showed growth is far from collapsing and that other sectors of the econo ...

1 - The North West Fund

... 3) Business Loan Fund, £35m, administered by FW Capital Ltd. Business Loan Fund is aimed at those businesses that can demonstrate a strong case for investment; which includes business plans to show growth and ability to service a loan. Loans can typically be repaid over 3.5 to 5 years. Security, suc ...

... 3) Business Loan Fund, £35m, administered by FW Capital Ltd. Business Loan Fund is aimed at those businesses that can demonstrate a strong case for investment; which includes business plans to show growth and ability to service a loan. Loans can typically be repaid over 3.5 to 5 years. Security, suc ...

Southeastern Asset Management

... each had one new addition in the fourth quarter, but there were more opportunities internationally. Thus far in the first quarter of 2017, we can’t show the world yet, but we’ve found some promising internationally headquartered investments. We continue to search the world, but find more things outs ...

... each had one new addition in the fourth quarter, but there were more opportunities internationally. Thus far in the first quarter of 2017, we can’t show the world yet, but we’ve found some promising internationally headquartered investments. We continue to search the world, but find more things outs ...

- Schroders

... The debate on whether trading in commodities has an important impact on pricing is becoming a hot issue. This is primarily due to the spread in pricing impact from commodities such as copper and nickel (which whilst important, only constitute relatively small markets in dollar value terms), to the e ...

... The debate on whether trading in commodities has an important impact on pricing is becoming a hot issue. This is primarily due to the spread in pricing impact from commodities such as copper and nickel (which whilst important, only constitute relatively small markets in dollar value terms), to the e ...

(BPM6) and Fourth Edition

... entity or group of related entities that is able to exercise influence over another entity that is resident of a different economy. FDI reflects the objective of gaining control or a significant degree of influence by an entity in one economy over the management of an enterprise resident in another ...

... entity or group of related entities that is able to exercise influence over another entity that is resident of a different economy. FDI reflects the objective of gaining control or a significant degree of influence by an entity in one economy over the management of an enterprise resident in another ...

Portfolio Management

... An investment policy statement (IPS) is a written document that clearly sets out a client’s return objectives and risk tolerance over that client’s relevant time horizon, along with applicable constraints such as liquidity needs, tax considerations, regulatory requirements and unique ...

... An investment policy statement (IPS) is a written document that clearly sets out a client’s return objectives and risk tolerance over that client’s relevant time horizon, along with applicable constraints such as liquidity needs, tax considerations, regulatory requirements and unique ...

Investment Fund Sample Portfolios

... options solely on determining whether or not to make such investment options available to its clients, not in a fiduciary or investment advisory capacity. Therefore, please be advised that ADP is not in a position to provide you with information about those investment options that have not met ADP’s ...

... options solely on determining whether or not to make such investment options available to its clients, not in a fiduciary or investment advisory capacity. Therefore, please be advised that ADP is not in a position to provide you with information about those investment options that have not met ADP’s ...

EIF Presentation Template - EU Strategy for the Baltic Sea Region

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

... This presentation was prepared by EIF. The information included in this presentation is based on figures available for March 2011 Any estimates and projections contained herein involve significant elements of subjective judgment and analysis, which may or may not be correct. ...

Clarification on Government Debt Investment Limits

... All Foreign Portfolio Investors through their Designated Depository Participants The Depositories (NSDL and CDSL) ...

... All Foreign Portfolio Investors through their Designated Depository Participants The Depositories (NSDL and CDSL) ...

The case for investing in smaller companies

... track record in smaller companies investing. At the heart of their success is over 1700 investment professionals and support staff working for Standard Life Investments around the world. They thoroughly research and analyse each company before they add it to any fund. They constantly look ahead to a ...

... track record in smaller companies investing. At the heart of their success is over 1700 investment professionals and support staff working for Standard Life Investments around the world. They thoroughly research and analyse each company before they add it to any fund. They constantly look ahead to a ...

Foreign Investment Review Board Annual Report 2002-03

... of existing businesses or the establishment of new businesses valued at less than $10 million, and offshore takeovers where the Australian assets represent less than 50 per cent of the total assets of the business being acquired.” Was replaced with: “The types of proposals that are decided under del ...

... of existing businesses or the establishment of new businesses valued at less than $10 million, and offshore takeovers where the Australian assets represent less than 50 per cent of the total assets of the business being acquired.” Was replaced with: “The types of proposals that are decided under del ...

Summer Doldrums - RBC Wealth Management

... improving. The bank stress test, believe it a farce or not, went “OK”. Business confidence in Germany is running at a 3-year high in July. The UK GDP numbers beat expectations, as did their retail sales. The BP oil spill news is better. At some point, the huge $15 trillion US economy can reverse cou ...

... improving. The bank stress test, believe it a farce or not, went “OK”. Business confidence in Germany is running at a 3-year high in July. The UK GDP numbers beat expectations, as did their retail sales. The BP oil spill news is better. At some point, the huge $15 trillion US economy can reverse cou ...

Legg Mason Western Asset US Money Market Fund

... least two-thirds of its Net Asset Value in Money Market Instruments denominated in US Dollars and issued by US Issuers. The Sub-Investment Manager will invest at least 95% of the Fund’s Net Asset Value in ...

... least two-thirds of its Net Asset Value in Money Market Instruments denominated in US Dollars and issued by US Issuers. The Sub-Investment Manager will invest at least 95% of the Fund’s Net Asset Value in ...

Help satisfy participant investment needs

... The Nationwide Group Retirement Series includes unregistered group fixed and variable annuities and trust programs. The unregistered group fixed and variable annuities are issued by Nationwide Life Insurance Company. Trust programs and trust services are offered by Nationwide Trust Company, FSB, a d ...

... The Nationwide Group Retirement Series includes unregistered group fixed and variable annuities and trust programs. The unregistered group fixed and variable annuities are issued by Nationwide Life Insurance Company. Trust programs and trust services are offered by Nationwide Trust Company, FSB, a d ...

Would a free-market be a perfect market?

... Market, even in the freest society, would still be an imperfect market, often very imperfect. You only have to drive down your street to see this. Even in the case of a commodity like unleaded gas, you can often see a difference of 5% between two stations in the same vicinity. If perfect market does ...

... Market, even in the freest society, would still be an imperfect market, often very imperfect. You only have to drive down your street to see this. Even in the case of a commodity like unleaded gas, you can often see a difference of 5% between two stations in the same vicinity. If perfect market does ...

Pre-Appointment Forms - GCSB Investment Center

... In order to make your “Retirement Profile” personal and accurate, you will need to have the following information when we get together: 1. Recent pay stub(s) so we can accurately calculate current income. 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement ...

... In order to make your “Retirement Profile” personal and accurate, you will need to have the following information when we get together: 1. Recent pay stub(s) so we can accurately calculate current income. 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement ...

economic update - Personal Investment Centre

... Both countries are in a clear slowdown and one that may last for a good part of this year. The better news is that New Zealand and Australia continue to be less affected by the global slowdown than many other developed economies. Australasian shares therefore continue to look well-placed compared to ...

... Both countries are in a clear slowdown and one that may last for a good part of this year. The better news is that New Zealand and Australia continue to be less affected by the global slowdown than many other developed economies. Australasian shares therefore continue to look well-placed compared to ...

Finance Glossary of Terms

... True Endowment – An endowment fund, the principal of which is designated by its donor to be held in perpetuity or permanently, and the income/payout from which is used to support the specified purpose of the endowment. Founders Fund – The remaining balance of the funds given to the UC Santa Cruz Fo ...

... True Endowment – An endowment fund, the principal of which is designated by its donor to be held in perpetuity or permanently, and the income/payout from which is used to support the specified purpose of the endowment. Founders Fund – The remaining balance of the funds given to the UC Santa Cruz Fo ...

minutes - San Antonio Fire and Police Pension Fund

... capitalized (small cap) stocks. As of fiscal-year first quarter end (FYQ1-07), SAFP had 13.15% in small cap stock with a target rate of 13.00%. The asset class has a range of 818%. Given present market valuations, CSG preferred reallocating to an all-cap manager which could seek out the best invest ...

... capitalized (small cap) stocks. As of fiscal-year first quarter end (FYQ1-07), SAFP had 13.15% in small cap stock with a target rate of 13.00%. The asset class has a range of 818%. Given present market valuations, CSG preferred reallocating to an all-cap manager which could seek out the best invest ...

Standard Risk Measures - netwealth Investments

... The SRM is not a complete assessment of all forms of investment risk. Risk is multifaceted and subjective in nature. There is no one measure that can be consistently relied upon to determine investment risk. The SRM is based on industry guidance but should not be viewed as being representative of al ...

... The SRM is not a complete assessment of all forms of investment risk. Risk is multifaceted and subjective in nature. There is no one measure that can be consistently relied upon to determine investment risk. The SRM is based on industry guidance but should not be viewed as being representative of al ...

Chapter 18

... Investment funds allow investors to pool their resources under professional managers Closed-end a fixed number of shares, and purchasers and sellers of shares must deal with each other (via brokers) Open-end fund are more prevalent • Ready to sell new shares or buy back old shares ...

... Investment funds allow investors to pool their resources under professional managers Closed-end a fixed number of shares, and purchasers and sellers of shares must deal with each other (via brokers) Open-end fund are more prevalent • Ready to sell new shares or buy back old shares ...

Are hedge funds a suitable investment for taxable investors?

... tax liability on the unrealized gains. The reason is that the funds will not have liquidity to make distributions until the investments have been realized. It’s important to note that in the initial year of the election, the taxable gain will incorporate multiple years of unrealized appreciation, cr ...

... tax liability on the unrealized gains. The reason is that the funds will not have liquidity to make distributions until the investments have been realized. It’s important to note that in the initial year of the election, the taxable gain will incorporate multiple years of unrealized appreciation, cr ...

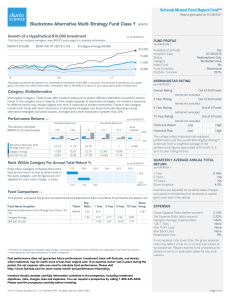

Blackstone Alternative Multi-Strategy Fund Class Y BXMYX

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

... This Mutual Fund Report Card is informational in nature and is not a recommendation or solicitation for any person to buy, sell or hold any particular security; nor is it intended to address any individual's investment objectives, financial situation or personal circumstances. We recommend that inve ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.