LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 1. What is mean by investment? 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form ...

... 1. What is mean by investment? 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form ...

Next Generation (East vs West Perspectives) – What our

... Corporate Governance Scorecard Project • Survey results based on publicly available information • HSI, HSHKCI, HSCCI, and HSCEI constituent stocks • 2002: 168 companies are covered • 2005: 174 companies are covered Section/ Year Role of Stakeholders in Corporate Governance ...

... Corporate Governance Scorecard Project • Survey results based on publicly available information • HSI, HSHKCI, HSCCI, and HSCEI constituent stocks • 2002: 168 companies are covered • 2005: 174 companies are covered Section/ Year Role of Stakeholders in Corporate Governance ...

State Street Invite

... necessarily reflect those of Morgan Stanley. Individuals should consult with their tax/legal advisors before making any tax/legal-related investment decisions as Morgan Stanley and its Financial Advisors do not provide tax/legal advice. The appropriateness of a particular investment or strategy will ...

... necessarily reflect those of Morgan Stanley. Individuals should consult with their tax/legal advisors before making any tax/legal-related investment decisions as Morgan Stanley and its Financial Advisors do not provide tax/legal advice. The appropriateness of a particular investment or strategy will ...

Downlaod File

... He owns a home and life insurance. Liquidity is not one of the objectives of the investment due to the fact that is a long-term investment. ...

... He owns a home and life insurance. Liquidity is not one of the objectives of the investment due to the fact that is a long-term investment. ...

government - Humble ISD

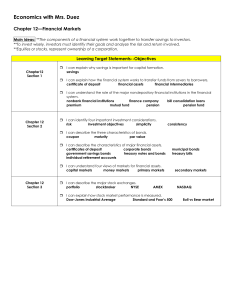

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

... Main Ideas: **The components of a financial system work together to transfer savings to investors. **To invest wisely, investors must identify their goals and analyze the risk and return involved. **Equities or stocks, represent ownership of a corporation. ...

Foresti v South Africa (Italy-South Africa BIT) AREAS OF POLICY

... AREAS OF POLICY AFFECTED: resource management (mining), industrial policy (diversification of ownership), human rights (racial discrimination, affirmative action). CASE SUMMARY: A group of investors sued South Africa due to the impact of its Black Economic Empowerment legislation on their assets. Th ...

... AREAS OF POLICY AFFECTED: resource management (mining), industrial policy (diversification of ownership), human rights (racial discrimination, affirmative action). CASE SUMMARY: A group of investors sued South Africa due to the impact of its Black Economic Empowerment legislation on their assets. Th ...

Real Assets and Inflation Hedging Strategies

... Indices included in this document are for purposes of comparing returns to broad-based indices most comparable to the types of investments held in the fund(s). The fund(s)’ strategy, industry segments, geographic regions, asset types, and investment weightings do not necessarily track the index. Thi ...

... Indices included in this document are for purposes of comparing returns to broad-based indices most comparable to the types of investments held in the fund(s). The fund(s)’ strategy, industry segments, geographic regions, asset types, and investment weightings do not necessarily track the index. Thi ...

SEBI (Venture Capital Funds) Regulations, 1996

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

... ARDC credited with the first major venture capital success story when its 1957 investment of $70,000 in Digital Equipment Corporation (DEC) would be valued at over $355 million after the company's IPO in 1968 ARDC made an annualized return of 101% on the transaction ...

Stock Market directions

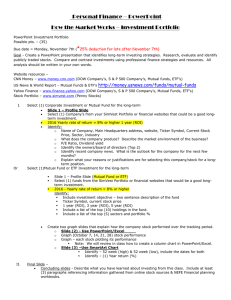

... Personal Finance – PowerPoint How the Market Works – Investment Portfolio PowerPoint Investment Portfolio Possible pts. – (35) Due date = Monday, November 7th (*25% deduction for late after November 7th) Goal - Create a PowerPoint presentation that identifies long-term investing strategies. Research ...

... Personal Finance – PowerPoint How the Market Works – Investment Portfolio PowerPoint Investment Portfolio Possible pts. – (35) Due date = Monday, November 7th (*25% deduction for late after November 7th) Goal - Create a PowerPoint presentation that identifies long-term investing strategies. Research ...

Lehigh Hanson Materials Limited Community

... based at locations where Lehigh Hanson Canada Region does business; complement the company’s interests and values and according to HeidelbergCement’s values; supports one of Canada Region’s four areas of focus (environment, community, education and safety & health) not-for-profit organization; fills ...

... based at locations where Lehigh Hanson Canada Region does business; complement the company’s interests and values and according to HeidelbergCement’s values; supports one of Canada Region’s four areas of focus (environment, community, education and safety & health) not-for-profit organization; fills ...

Selling an Idea or a Product

... Structure of the Money Management Process Outside money managers are hired to make money for various types of organizations. If they are successful, they will attract more clients, increase their money under management and generate more fees for their money management firm. Organizations include: F ...

... Structure of the Money Management Process Outside money managers are hired to make money for various types of organizations. If they are successful, they will attract more clients, increase their money under management and generate more fees for their money management firm. Organizations include: F ...

Job Description Job title Senior Investment Manager, Northern

... The role requires that the candidate should have a good commercial understanding of small businesses operations and finances or of debt or venture fund investing in order to contribute effectively towards the following activities: ...

... The role requires that the candidate should have a good commercial understanding of small businesses operations and finances or of debt or venture fund investing in order to contribute effectively towards the following activities: ...

Savings and Investment

... 4. Floor broker (buyer) signals the transaction back to the clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account exe ...

... 4. Floor broker (buyer) signals the transaction back to the clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account exe ...

Ecosystem Investing: Achieving Impact at Scale

... drive programs. Ecosystems require a host of partners—each of which brings its own set of priorities —and are constantly re-establishing equilibrium and redefining roles. We saw United Ways model this behavior by engaging relevant community partners, and then making adjustments to their own approach ...

... drive programs. Ecosystems require a host of partners—each of which brings its own set of priorities —and are constantly re-establishing equilibrium and redefining roles. We saw United Ways model this behavior by engaging relevant community partners, and then making adjustments to their own approach ...

objective straightforward communications generating potential

... No strategy assures success or protects against loss. Derivatives strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the ...

... No strategy assures success or protects against loss. Derivatives strategies are not suitable for all investors and certain option strategies may expose investors to significant potential losses such as losing entire amount paid for the option. This information is presented as an introduction to the ...

Golden rules of investing in stock market

... A well thought out plan and discipline in implementing it can safeguard your portfolio from impulsive mistakes. Good financial investment advice is to have an investment plan for investment in stock. This is an important means of controlling the potential emotional roller coaster that can be associa ...

... A well thought out plan and discipline in implementing it can safeguard your portfolio from impulsive mistakes. Good financial investment advice is to have an investment plan for investment in stock. This is an important means of controlling the potential emotional roller coaster that can be associa ...

UK life insurers can help boost infrastructure

... stopping the UK from entering a new era of major infrastructure investment. How have we reached such an impasse? First, the emerging regulatory environment does not support insurers’ critical role as longterm investors. Regulation has created perverse incentives for companies to become highly conser ...

... stopping the UK from entering a new era of major infrastructure investment. How have we reached such an impasse? First, the emerging regulatory environment does not support insurers’ critical role as longterm investors. Regulation has created perverse incentives for companies to become highly conser ...

social impact investing and existent possibilities mika pyykkö

... - Guidelines for Impact Investor - Guidelines of innovative procurement, payment by results and SIB model payment by results training for municipalities, provinces and government offices ...

... - Guidelines for Impact Investor - Guidelines of innovative procurement, payment by results and SIB model payment by results training for municipalities, provinces and government offices ...

more of something often means less of something else

... contains varying elements of fixed income. Of course, every investor is a complex individual and often has many nuanced investment objectives and accompanying emotions about investing. The answer of how to address these competing agendas is to reconcile your asset constituencies with your various, c ...

... contains varying elements of fixed income. Of course, every investor is a complex individual and often has many nuanced investment objectives and accompanying emotions about investing. The answer of how to address these competing agendas is to reconcile your asset constituencies with your various, c ...

`It can be difficult to achieve harmony`

... years; more than $100 billion of FDI came into the country in this period, all in the form of M&A. $14 billion of this FDI was private equity. I expect $100 billion to $150 billion in the next three to five years, with private equity making up a much larger portion. There are many reasons for this, ...

... years; more than $100 billion of FDI came into the country in this period, all in the form of M&A. $14 billion of this FDI was private equity. I expect $100 billion to $150 billion in the next three to five years, with private equity making up a much larger portion. There are many reasons for this, ...

Thailand Ends 2014 with Record High Number of Investment

... Thailand wrapped up 2014 with record high number of investment applications from foreign investors. The Thailand Board of Investment (BOI) reported that the value of foreign direct investment applied through BOI totaled 1.02 trillion Baht (approximately $31 billion USD) in 2014. Japan tops the list ...

... Thailand wrapped up 2014 with record high number of investment applications from foreign investors. The Thailand Board of Investment (BOI) reported that the value of foreign direct investment applied through BOI totaled 1.02 trillion Baht (approximately $31 billion USD) in 2014. Japan tops the list ...

Q1 2017 Quarterly Letter - Carmel Capital Partners

... them have been held for greater than 10 years. This allows us to capitalize on short-term dislocations to purchase investments at very attractive valuations and sets us apart from most other investors. Patient Capital: None of the above would be possible without a capital base that is patient and lo ...

... them have been held for greater than 10 years. This allows us to capitalize on short-term dislocations to purchase investments at very attractive valuations and sets us apart from most other investors. Patient Capital: None of the above would be possible without a capital base that is patient and lo ...

FCF New York Life Anchor IV

... ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and diversity of areas in which the fund may invest and may not be representative of the fund’s current or future investments. The top ten ...

... ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and diversity of areas in which the fund may invest and may not be representative of the fund’s current or future investments. The top ten ...

Personal Finance Unit Study Guide

... b. Use a rational decision making model to select one option over another. c. Create a savings or financial investment plan for a future goal. SSEPF2 The student will explain that banks and other financial institutions are businesses that channel funds from savers to investors. a. Compare services o ...

... b. Use a rational decision making model to select one option over another. c. Create a savings or financial investment plan for a future goal. SSEPF2 The student will explain that banks and other financial institutions are businesses that channel funds from savers to investors. a. Compare services o ...

Problem Sheet 1

... What is the value of private saving? What is the value of public saving? Is the government’s budget policy contributing to growth in this country or harming it? Why? Why don’t countries reduce their budget deficits? ...

... What is the value of private saving? What is the value of public saving? Is the government’s budget policy contributing to growth in this country or harming it? Why? Why don’t countries reduce their budget deficits? ...

Socially responsible investing

Socially responsible investing (SRI), also known as sustainable, socially conscious, ""green"" or ethical investing, is any investment strategy which seeks to consider both financial return and social good.In general, socially responsible investors encourage corporate practices that promote environmental stewardship, consumer protection, human rights, and diversity. Some avoid businesses involved in alcohol, tobacco, gambling, pornography, weapons, contraception/abortifacients/abortion, fossil fuel production, and/or the military. The areas of concern recognized by the SRI industry are sometimes summarized as ESG issues: environment, social justice, and corporate governance.""Socially responsible investing"" is one of several related concepts and approaches that influence and, in some cases govern, how asset managers invest portfolios. The term ""socially responsible investing"" sometimes narrowly refers to practices that seek to avoid harm by screening companies included in an investment portfolio. However, the term is also used more broadly to include more proactive practices such as impact investing, shareholder advocacy and community investing. According to investor Amy Domini, shareholder advocacy and community investing are pillars of socially responsible investing, while doing only negative screening is inadequate.