2015-230 Presentation of Financial Statements of Not-for

... Additionally, I have worked as both a user of not-for-profit financial information in a financing role for not-for-profits, as a preparer of not-for-profit financial information as a consultant to a range of non-profits and now as an auditor of not-for-profit financial information. Importance of the ...

... Additionally, I have worked as both a user of not-for-profit financial information in a financing role for not-for-profits, as a preparer of not-for-profit financial information as a consultant to a range of non-profits and now as an auditor of not-for-profit financial information. Importance of the ...

chapter_1-guidedoutlinestud

... a. Records economic data but does not communicate the data to users according to any specific rules b. Can be thought of as the “language of business” c. Is of no use by individuals outside of the business d. Is used only for filling out tax returns and for financial statements for various type of g ...

... a. Records economic data but does not communicate the data to users according to any specific rules b. Can be thought of as the “language of business” c. Is of no use by individuals outside of the business d. Is used only for filling out tax returns and for financial statements for various type of g ...

APES 205 Conformity with Accounting Standards

... Professional Activity means an activity requiring accountancy or related skills undertaken by a Member, including accounting, auditing, taxation, management consulting, and financial management. Professional Bodies means Chartered Accountants Australia and New Zealand, CPA Australia and the Institut ...

... Professional Activity means an activity requiring accountancy or related skills undertaken by a Member, including accounting, auditing, taxation, management consulting, and financial management. Professional Bodies means Chartered Accountants Australia and New Zealand, CPA Australia and the Institut ...

ACCOUNTING is primarily a system of

... UNIT OF MEASURE CONCEPT is the accounting principle that requires all financial statements to be denominated in a consistent currency type which for companies in the United States is the US dollar. MATCHING CONCEPT is the accounting principle that requires the recognition of all costs that are direc ...

... UNIT OF MEASURE CONCEPT is the accounting principle that requires all financial statements to be denominated in a consistent currency type which for companies in the United States is the US dollar. MATCHING CONCEPT is the accounting principle that requires the recognition of all costs that are direc ...

Chapter 5 The Time Value of Money

... Companies reporting in the U.S. follow the principles promulgated by the Financial Accounting Standards Board (FASB), whereas members of the European Economic Community, and other countries, follow the principles promulgated by the International Accounting Standards Board (IASB). ...

... Companies reporting in the U.S. follow the principles promulgated by the Financial Accounting Standards Board (FASB), whereas members of the European Economic Community, and other countries, follow the principles promulgated by the International Accounting Standards Board (IASB). ...

topic 1 - WordPress.com

... should be reported at fair value (the price received to sell an asset or settle a liability). ...

... should be reported at fair value (the price received to sell an asset or settle a liability). ...

November 12, 2014 International Ethics Standards Board for

... the balance between the familiarity treat that comes by long association with the client and the need to maintain appropriate knowledge and experience to support audit quality. As a basis for the proposal, IESBA evaluates whether the current time-on/time-off period of 7/2 remains appropriate to addr ...

... the balance between the familiarity treat that comes by long association with the client and the need to maintain appropriate knowledge and experience to support audit quality. As a basis for the proposal, IESBA evaluates whether the current time-on/time-off period of 7/2 remains appropriate to addr ...

FRANKLIN ELECTRIC CO., INC. AUDIT COMMITTEE CHARTER

... principles, (ii) management’s assessment of the effectiveness of internal control over financial reporting, and (iii) the effectiveness of internal control over financial reporting. The Committee shall perform its responsibilities in accordance with the requirements of the Act, the SEC and Nasdaq. I ...

... principles, (ii) management’s assessment of the effectiveness of internal control over financial reporting, and (iii) the effectiveness of internal control over financial reporting. The Committee shall perform its responsibilities in accordance with the requirements of the Act, the SEC and Nasdaq. I ...

Module 5 – Understanding the Basic Elements of School Board

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

... To recommend, to the Board of Trustees, the approval of the annual audited financial statements ...

Lesson 1 PowerPoint

... the residual interest in the assets of an entity that remains after deducting its liabilities. Called shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to ob ...

... the residual interest in the assets of an entity that remains after deducting its liabilities. Called shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to ob ...

Professional Ethics in Accounting and Auditing

... population, and the education of ethics, It can be said that the divine revelations and raising people's introduction to the issue of self-purification is what the original purpose of the ethics Form. Ethics is one of its components, including rules and procedures that are acceptable to be used in a ...

... population, and the education of ethics, It can be said that the divine revelations and raising people's introduction to the issue of self-purification is what the original purpose of the ethics Form. Ethics is one of its components, including rules and procedures that are acceptable to be used in a ...

Lecture Syllabus Financial Assurance and

... (6) The significance and (actual and potential) consequences of external accounting (7) Ethics, public trust and the role of audit (8) The audit expectations gap (9) The nature of the audit in public sector organisations (10) The role of education, training and development for the audit practitioner ...

... (6) The significance and (actual and potential) consequences of external accounting (7) Ethics, public trust and the role of audit (8) The audit expectations gap (9) The nature of the audit in public sector organisations (10) The role of education, training and development for the audit practitioner ...

Transaction Analysis

... Congress passed Sarbanes-Oxley Act of 2002 – internal control standards. ...

... Congress passed Sarbanes-Oxley Act of 2002 – internal control standards. ...

DOC, 113 Kb

... concepts of modern financial reporting and techniques of management accounting. It provides basic knowledge in preparing, processing and interpreting the data about business transactions for different types of external as well as internal investors, management and other accounting information users. ...

... concepts of modern financial reporting and techniques of management accounting. It provides basic knowledge in preparing, processing and interpreting the data about business transactions for different types of external as well as internal investors, management and other accounting information users. ...

chapter 2

... termed expense. The income statement details the revenues and expenses of the business, usually for a year, sometimes for shorter periods. If revenues exceed expenses, the business has been profitable. Other terms that indicate the profitability of a business are net earnings and net income. If expe ...

... termed expense. The income statement details the revenues and expenses of the business, usually for a year, sometimes for shorter periods. If revenues exceed expenses, the business has been profitable. Other terms that indicate the profitability of a business are net earnings and net income. If expe ...

ch_1_intro_to_accoun..

... that each business maintains its own accounts, & that these accounts are separate from other interests of the owners ...

... that each business maintains its own accounts, & that these accounts are separate from other interests of the owners ...

Elements of the Income Statement

... Cash Flows from Investing Activities Cash Flows from Financing Activities ...

... Cash Flows from Investing Activities Cash Flows from Financing Activities ...

download

... • Firms would like to report revenue when contracts are signed or partially complete rather than waiting until the promised product or service has been fully delivered. • The SEC has released SAB 101 to more carefully identify the circumstances in which it is appropriate for a company to recognize r ...

... • Firms would like to report revenue when contracts are signed or partially complete rather than waiting until the promised product or service has been fully delivered. • The SEC has released SAB 101 to more carefully identify the circumstances in which it is appropriate for a company to recognize r ...

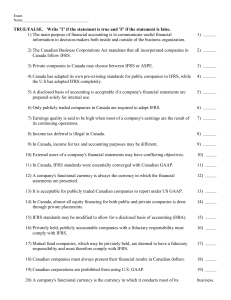

Exam Name___________________________________ TRUE

... E) Studies have shown that a cash flows report is more relevant to investor decisions than a working capital report. ...

... E) Studies have shown that a cash flows report is more relevant to investor decisions than a working capital report. ...

Quadrant 4 System Corp (Form: 8-K, Received: 04/14

... (b) Effective April 6, 2015, the Company engaged Schulman Lobel Zand Katzen Williams & Blackman LLP, Certified Public Accountants (“Schulman Lobel” ) as our independent accountants for the year ended December 31, 2014. The Company has not consulted with Schulman Lobel during our two most recent fisc ...

... (b) Effective April 6, 2015, the Company engaged Schulman Lobel Zand Katzen Williams & Blackman LLP, Certified Public Accountants (“Schulman Lobel” ) as our independent accountants for the year ended December 31, 2014. The Company has not consulted with Schulman Lobel during our two most recent fisc ...

The Impact Of Switching To International Financial Reporting

... single set of standards include the costs of training professionals and business owners, comparability to prior years, and phasing out any old information previously reported under the old system into a newly adopted set of standards. There are considerations regarding problems caused by worldwide a ...

... single set of standards include the costs of training professionals and business owners, comparability to prior years, and phasing out any old information previously reported under the old system into a newly adopted set of standards. There are considerations regarding problems caused by worldwide a ...

Post(s): S7 Grade Syllabus Total No. of Questions

... Income Tax-basic concepts Income Tax-residential status Income Tax-exempted income Business laws-contract act Business laws-sale of goods act Company law Cost Accounting-Concepts Cost Accounting-Marginal costing Cost Accounting- Budgetary control Financial management-basic concepts Financial manage ...

... Income Tax-basic concepts Income Tax-residential status Income Tax-exempted income Business laws-contract act Business laws-sale of goods act Company law Cost Accounting-Concepts Cost Accounting-Marginal costing Cost Accounting- Budgetary control Financial management-basic concepts Financial manage ...

LO 5 - Test Banks Shop

... FASB and administers the CPA exam (www.aicpa.org) CPA is an individual who has passed a uniform exam administered by the AICPA and has met other requirements as determined by individual states Public Company Accounting Oversight Board (PCAOB): a five-member body created by an act of Congress in ...

... FASB and administers the CPA exam (www.aicpa.org) CPA is an individual who has passed a uniform exam administered by the AICPA and has met other requirements as determined by individual states Public Company Accounting Oversight Board (PCAOB): a five-member body created by an act of Congress in ...

Developing a Cost Accounting System for First Government Contract

... Phase III effort was launched to test the operational effectiveness of implemented changes through a mock audit two months after Phase II was completed. ...

... Phase III effort was launched to test the operational effectiveness of implemented changes through a mock audit two months after Phase II was completed. ...

Cost Centre Create procedures

... Cost centre create form is available on Financial Services Portal. Completed forms to be reviewed by Financial Services Advisor or ORS/OIA Financial Analysts and then forwarded to Senior Accountant, Financial Services (Nadia Ferrari) for approval. Senior Accountant to forward approved cost centre cr ...

... Cost centre create form is available on Financial Services Portal. Completed forms to be reviewed by Financial Services Advisor or ORS/OIA Financial Analysts and then forwarded to Senior Accountant, Financial Services (Nadia Ferrari) for approval. Senior Accountant to forward approved cost centre cr ...