International Monetary System 2

... other side, reduced money supply pushes up the interest rate and the credit restrictions imposed by the apex banks will push up the bank interest rate, resulting in the foreign investment moving into the economy and off-setting any deficit on the capital account. ...

... other side, reduced money supply pushes up the interest rate and the credit restrictions imposed by the apex banks will push up the bank interest rate, resulting in the foreign investment moving into the economy and off-setting any deficit on the capital account. ...

euro – advantages and disadvantages

... currencies like peseta, drachma, or escudo, but did not remove all the dangers of discretionary monetary issues and of a lax fiscal policy. The second major disadvantage of the euro is that it limits freedom of choice for citizens. Given the existence of national currencies, there was a money market ...

... currencies like peseta, drachma, or escudo, but did not remove all the dangers of discretionary monetary issues and of a lax fiscal policy. The second major disadvantage of the euro is that it limits freedom of choice for citizens. Given the existence of national currencies, there was a money market ...

Problem_Set8 - Homework Minutes

... 4. Capital markets have high mobility if foreign capital tends to flow rapidly into the nation when real risk-free interest rates rise slightly above the rates available in other nations. With high capital mobility, R tends to be (more or less) influential on exchange rates than PI and RGDP. For pro ...

... 4. Capital markets have high mobility if foreign capital tends to flow rapidly into the nation when real risk-free interest rates rise slightly above the rates available in other nations. With high capital mobility, R tends to be (more or less) influential on exchange rates than PI and RGDP. For pro ...

Chapter 38 – fiscal policy - The Good, the Bad and the Economist

... Revision questions 1. How did CBs across the world act during the “financial meltdown” in ...

... Revision questions 1. How did CBs across the world act during the “financial meltdown” in ...

MACROECONOMICS

... slide. Higher r reduces IS but increases LM. In the bottom slide, this should show as a disequilibrium, since r is on the vertical ...

... slide. Higher r reduces IS but increases LM. In the bottom slide, this should show as a disequilibrium, since r is on the vertical ...

International reserves

... 1. Created the International Monetary Fund (IMF), which sets rules and provides loans to deficit countries 2. Setup the International Bank for Reconstruction and Development (World Bank), which provides loans to developing countries ...

... 1. Created the International Monetary Fund (IMF), which sets rules and provides loans to deficit countries 2. Setup the International Bank for Reconstruction and Development (World Bank), which provides loans to developing countries ...

Document

... Fit for Dollarization-history of Hyperinflation Lower inflation since U.S. monetary policy is imported Increase in growth because of absence of devaluation risk. Should spur in local savings, lower interest rates, and increase FDI Less perceived volatility especially capital outflows- Mex. Peso Cris ...

... Fit for Dollarization-history of Hyperinflation Lower inflation since U.S. monetary policy is imported Increase in growth because of absence of devaluation risk. Should spur in local savings, lower interest rates, and increase FDI Less perceived volatility especially capital outflows- Mex. Peso Cris ...

1. Over the past 20 years, the US net foreign asset position has

... a. the US has been running a current account surplus b. the US has been running a financial and capital account surplus c. US receipts of capital income from the rest of the world have been less than US payments of capital income to the rest of the world. d. The US did not run the appropriate moneta ...

... a. the US has been running a current account surplus b. the US has been running a financial and capital account surplus c. US receipts of capital income from the rest of the world have been less than US payments of capital income to the rest of the world. d. The US did not run the appropriate moneta ...

Briefing Paper: North American Monetary Union (NAMU)

... the central banks of all three countries would be replaced by a North American Central Bank. New notes and coins would be produced for the North American monetary unit, replacing the notes and coins of each country. As occurred in the European case, the first phase of the transition to NAMU would b ...

... the central banks of all three countries would be replaced by a North American Central Bank. New notes and coins would be produced for the North American monetary unit, replacing the notes and coins of each country. As occurred in the European case, the first phase of the transition to NAMU would b ...

The IMF Role in Bank and Bond Markets By Eichengreen, Kletzer

... • 6,700 loan transactions between emerging market borrowers and banks, 3,500 new bond issues ...

... • 6,700 loan transactions between emerging market borrowers and banks, 3,500 new bond issues ...

Panel on Remarks by Robert T. Parry

... slow down. But certainly globalization hasn’t severed the connections to those brake and gas pedals. Now let me turn to an instance when foreign developments did influence Fed policy decisions—the global financial crises of the late 1990s. The currency crises in East Asia that began in 1997 had pret ...

... slow down. But certainly globalization hasn’t severed the connections to those brake and gas pedals. Now let me turn to an instance when foreign developments did influence Fed policy decisions—the global financial crises of the late 1990s. The currency crises in East Asia that began in 1997 had pret ...

Globalization

... other countries met at Bretton Woods, a resort in New Hampshire, to lay the foundation for the post-war international financial order. Such a new system, they hoped, would prevent another worldwide economic cataclysm like the Great Depression that had destabilized Europe and the U.S. in the 1930s an ...

... other countries met at Bretton Woods, a resort in New Hampshire, to lay the foundation for the post-war international financial order. Such a new system, they hoped, would prevent another worldwide economic cataclysm like the Great Depression that had destabilized Europe and the U.S. in the 1930s an ...

The European Monetary System (1)

... maintain the exchange rates between their currencies within a certain band around fixed central exchange rates. This system is called a Target Zone Arrangement. Convergence of economic policies of the participating countries is a prerequisite for the sustenance of this system. An example of this sys ...

... maintain the exchange rates between their currencies within a certain band around fixed central exchange rates. This system is called a Target Zone Arrangement. Convergence of economic policies of the participating countries is a prerequisite for the sustenance of this system. An example of this sys ...

AP Macroeconomics

... should specialize in the making of trousers because he can make a pair of trousers like nobodies business. And _____________ should specialize in jackets because he is the “Jacket King”! ...

... should specialize in the making of trousers because he can make a pair of trousers like nobodies business. And _____________ should specialize in jackets because he is the “Jacket King”! ...

Economics 4333/5333

... bank, that means the central bank is selling the foreign currency and buying the domestic currency. (This means the country’s central bank is losing reserves.) b. If the country’s central bank is not intervening, the one or more other central banks must be intervening to sell FX and buy the country’ ...

... bank, that means the central bank is selling the foreign currency and buying the domestic currency. (This means the country’s central bank is losing reserves.) b. If the country’s central bank is not intervening, the one or more other central banks must be intervening to sell FX and buy the country’ ...

Dollarization: Controlling Risk Is Key

... may try to resist dollarization by promoting financial indexation schemes or resorting to capital controls. That said, the lack of deep financial markets to support a liquid market for indexed instruments and the simplicity, transparency, and credibility of dollar instruments may tilt the balance in ...

... may try to resist dollarization by promoting financial indexation schemes or resorting to capital controls. That said, the lack of deep financial markets to support a liquid market for indexed instruments and the simplicity, transparency, and credibility of dollar instruments may tilt the balance in ...

Transmission of the Great Depression

... running a surplus could import gold. Consistently running a deficit threatened running out of gold (or foreign reserves) which meant that the country would no longer be able to maintain the fixed value of its currency. Defaulting on this commitment meant the cessation of foreign loans and, in the ea ...

... running a surplus could import gold. Consistently running a deficit threatened running out of gold (or foreign reserves) which meant that the country would no longer be able to maintain the fixed value of its currency. Defaulting on this commitment meant the cessation of foreign loans and, in the ea ...

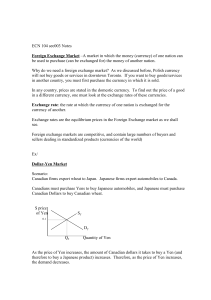

ECN 104 sec003 Notes Foreign Exchange Market –A market in

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

Forget the U.S. Dollar: The Bullish Case for Gold Yogi Berra, a

... devaluation of the yuan by the Chinese central bank has increased the value of gold for anyone in China who holds it. Investors who may be looking for an alternative investment to the stock market may turn to bullion as they watch their government deliberately devalue their currency in an attempt to ...

... devaluation of the yuan by the Chinese central bank has increased the value of gold for anyone in China who holds it. Investors who may be looking for an alternative investment to the stock market may turn to bullion as they watch their government deliberately devalue their currency in an attempt to ...

Chapter 21

... directly through its constraint on the value of money. It can also limit the timeinconsistency problem by providing an expected constraint on monetary policy. 3. Central bankers might think they can boost output or lower unemployment by pursuing overly expansionary monetary policy even though in the ...

... directly through its constraint on the value of money. It can also limit the timeinconsistency problem by providing an expected constraint on monetary policy. 3. Central bankers might think they can boost output or lower unemployment by pursuing overly expansionary monetary policy even though in the ...

Section1b

... U.S. Financial Crisis of 1931: Summary • The quantity equation of money is an accounting identity linking money to the larger economy. • Monetarism implies that careful control of the money supply is sufficient to stabilize the economy (PQ). • Money multiplier story. Fed doesn't set the money suppl ...

... U.S. Financial Crisis of 1931: Summary • The quantity equation of money is an accounting identity linking money to the larger economy. • Monetarism implies that careful control of the money supply is sufficient to stabilize the economy (PQ). • Money multiplier story. Fed doesn't set the money suppl ...

Global monetary and financial disorder

... looks indeed as though too much extra demand is pressing on too little ability to increase global supply. Inflation is the result of too much demand chasing too few goods and services: put simply, the world economy has been growing faster than, with present technology and resources, it can sustainab ...

... looks indeed as though too much extra demand is pressing on too little ability to increase global supply. Inflation is the result of too much demand chasing too few goods and services: put simply, the world economy has been growing faster than, with present technology and resources, it can sustainab ...

Introduction

... different times. Targets include short-term interest rates, growth rates of narrow money and broad money, monetary conditions, inflation, the exchange rate and other economic indicators. The Saudi Arabia monetary policy is provide a stable monetary environment for the economy , and encouraging the f ...

... different times. Targets include short-term interest rates, growth rates of narrow money and broad money, monetary conditions, inflation, the exchange rate and other economic indicators. The Saudi Arabia monetary policy is provide a stable monetary environment for the economy , and encouraging the f ...

No Slide Title

... the relative value of the domestic and foreign currency Total Return = Investment return plus return on foreign exchange Not possible to completely hedge a foreign investment ...

... the relative value of the domestic and foreign currency Total Return = Investment return plus return on foreign exchange Not possible to completely hedge a foreign investment ...