Word - corporate

... Before the merger can be completed, the stockholders of AAM must vote to approve the issuance of shares of AAM common stock in the merger to securityholders of MPG on the terms and conditions set out in the merger agreement, and the stockholders of MPG must vote to adopt the merger agreement and app ...

... Before the merger can be completed, the stockholders of AAM must vote to approve the issuance of shares of AAM common stock in the merger to securityholders of MPG on the terms and conditions set out in the merger agreement, and the stockholders of MPG must vote to adopt the merger agreement and app ...

devon energy corporation

... Notice is hereby given that a special meeting of stockholders (the "Devon Meeting") of Devon Energy Corporation ("Devon") will be held at 10:00 a.m. (local time) on December 9, 1998, at the Community Room, Bank of Oklahoma, Robinson Avenue at Robert S. Kerr, Oklahoma City, Oklahoma, for the followin ...

... Notice is hereby given that a special meeting of stockholders (the "Devon Meeting") of Devon Energy Corporation ("Devon") will be held at 10:00 a.m. (local time) on December 9, 1998, at the Community Room, Bank of Oklahoma, Robinson Avenue at Robert S. Kerr, Oklahoma City, Oklahoma, for the followin ...

LILIS ENERGY, INC. (Form: S-4/A, Received: 05/11

... 2016, and as it may be further amended from time to time, which we refer to as the merger agreement, by and among Lilis, Lilis Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Lilis, which we refer to as Merger Sub, and Brushy, and which is attached as Annexes A.1, A.2 and A ...

... 2016, and as it may be further amended from time to time, which we refer to as the merger agreement, by and among Lilis, Lilis Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Lilis, which we refer to as Merger Sub, and Brushy, and which is attached as Annexes A.1, A.2 and A ...

OFFERING CIRCULAR 27 April 2016* J.P. Morgan Structured

... ("Rule 144A") and in reliance upon the relevant exemptions from state securities laws and any other applicable laws of other jurisdictions. Hedging transactions involving "equity securities" of "domestic issuers" (as each such term is defined in the Securities Act and regulations thereunder) may onl ...

... ("Rule 144A") and in reliance upon the relevant exemptions from state securities laws and any other applicable laws of other jurisdictions. Hedging transactions involving "equity securities" of "domestic issuers" (as each such term is defined in the Securities Act and regulations thereunder) may onl ...

ace limited - cloudfront.net

... to the merger agreement in accordance with NYSE requirements and ACE’s commitment in its 2014 Proxy Statement not to issue more than 68,000,000 ACE common shares pursuant to Article 6 of its Articles of Association without either providing ACE’s shareholders with the opportunity to exercise preempti ...

... to the merger agreement in accordance with NYSE requirements and ACE’s commitment in its 2014 Proxy Statement not to issue more than 68,000,000 ACE common shares pursuant to Article 6 of its Articles of Association without either providing ACE’s shareholders with the opportunity to exercise preempti ...

words - Investor Relations Solutions

... Immediately prior to the effective time of the merger, each unvested outstanding option to purchase Pinnacle common stock will be accelerated in full, and each option holder will have the right to exercise his or her option in exchange for Pinnacle common stock. Shares of Pinnacle common stock issue ...

... Immediately prior to the effective time of the merger, each unvested outstanding option to purchase Pinnacle common stock will be accelerated in full, and each option holder will have the right to exercise his or her option in exchange for Pinnacle common stock. Shares of Pinnacle common stock issue ...

Word - corporate

... sum of (i) 50,730,029 ordinary shares, with a nominal value of €0.01 per share, of AVG Technologies N.V. multiplied by the offer price of $25.00 per share, (ii) the net offer price for 2,522,480 shares issuable pursuant to outstanding options with an exercise price less than $25.00 per share (which ...

... sum of (i) 50,730,029 ordinary shares, with a nominal value of €0.01 per share, of AVG Technologies N.V. multiplied by the offer price of $25.00 per share, (ii) the net offer price for 2,522,480 shares issuable pursuant to outstanding options with an exercise price less than $25.00 per share (which ...

Form POS EX, 9/23/11

... This Post-Effective Amendment No. 1 to Form S-4 amends the Registration Statement on Form S-4 of Liberty Media Corporation (f/k/a Liberty CapStarz, Inc. and prior thereto Liberty Splitco, Inc.) (Registration No. 333-171201), as amended prior to the date hereto (the "Registration Statement"), which w ...

... This Post-Effective Amendment No. 1 to Form S-4 amends the Registration Statement on Form S-4 of Liberty Media Corporation (f/k/a Liberty CapStarz, Inc. and prior thereto Liberty Splitco, Inc.) (Registration No. 333-171201), as amended prior to the date hereto (the "Registration Statement"), which w ...

1 AS FILED WITH THE SECURITIES AND EXCHANGE

... - -----------------------------------------------------------------------------------------------------------------------Per Share................................. ...

... - -----------------------------------------------------------------------------------------------------------------------Per Share................................. ...

securities and exchange commission - corporate

... The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its Effective Date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8 ...

... The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its Effective Date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8 ...

FORM 10-K - Media Corporate IR Net

... within a system. Xilinx develops PLDs, a type of logic device. Alternatives to PLDs include custom gate arrays, application specific integrated circuits (ASICs) and application specific standard products (ASSPs). These devices all compete with each other since they may be utilized in many of the sam ...

... within a system. Xilinx develops PLDs, a type of logic device. Alternatives to PLDs include custom gate arrays, application specific integrated circuits (ASICs) and application specific standard products (ASSPs). These devices all compete with each other since they may be utilized in many of the sam ...

Why do foreign firms leave US equity markets?

... explicitly test the loss of competitiveness hypothesis in the context of the passage of SOX, but some of our results apply to more general causes of a loss of competitiveness. The SOX explanation predicts that there are cross-listed firms for which SOX imposed deadweight costs big enough to make it ...

... explicitly test the loss of competitiveness hypothesis in the context of the passage of SOX, but some of our results apply to more general causes of a loss of competitiveness. The SOX explanation predicts that there are cross-listed firms for which SOX imposed deadweight costs big enough to make it ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... accounting standards (SEC 2007d). Our results, based on the data from the most two recent years before the elimination of the reconciliation requirement, suggest that U.S. investors in general use the earnings reconciliation from IFRS to U.S. GAAP in their trading decision and hence may not complete ...

... accounting standards (SEC 2007d). Our results, based on the data from the most two recent years before the elimination of the reconciliation requirement, suggest that U.S. investors in general use the earnings reconciliation from IFRS to U.S. GAAP in their trading decision and hence may not complete ...

Form S-4 GENERAL ELECTRIC CO - GE Filed: December 23, 2002

... Osmonics and its shareholders and recommends that you vote "FOR" adoption of the merger agreement and the merger. The merger cannot be completed unless the holders of a majority of the outstanding shares of Osmonics common stock vote to adopt the merger agreement. Whether or not you plan to attend t ...

... Osmonics and its shareholders and recommends that you vote "FOR" adoption of the merger agreement and the merger. The merger cannot be completed unless the holders of a majority of the outstanding shares of Osmonics common stock vote to adopt the merger agreement. Whether or not you plan to attend t ...

Did Stop Signs Stop Investor Trading?

... the salience in which information is disclosed (Maines and McDaniel 2000; Barber and Odean 2008) and individuals pay more attention to simple versus complex messages (Lerman 2011), so using simple salient graphic to reveal disclosure levels should attract investor attention. Second, given that indi ...

... the salience in which information is disclosed (Maines and McDaniel 2000; Barber and Odean 2008) and individuals pay more attention to simple versus complex messages (Lerman 2011), so using simple salient graphic to reveal disclosure levels should attract investor attention. Second, given that indi ...

Automated Trading Desk and Price Prediction in High

... aided by clerks, maintained the order book for it and matched bids to buy and offers to sell, or if there was no match could trade himself (nearly all specialists were men). The specialist’s privileged role brought with it the responsibility to ensure orderly, continuous trading – which could mean h ...

... aided by clerks, maintained the order book for it and matched bids to buy and offers to sell, or if there was no match could trade himself (nearly all specialists were men). The specialist’s privileged role brought with it the responsibility to ensure orderly, continuous trading – which could mean h ...

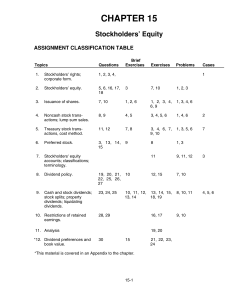

CHAPTER 15 Stockholders` Equity

... 3. Additional Paid-in Capital is credited for the excess of the proceeds from the issuance of the common stock over its stated value. ...

... 3. Additional Paid-in Capital is credited for the excess of the proceeds from the issuance of the common stock over its stated value. ...

words - Nasdaq`s INTEL Solutions

... structured as a share for share exchange in which the Company issued 263,048 shares of Common Stock to the two holders of capital stock in NBG and Target in exchange for their equity interests in these companies. At the time of the closing of the transaction, the Common Stock issued by the Company h ...

... structured as a share for share exchange in which the Company issued 263,048 shares of Common Stock to the two holders of capital stock in NBG and Target in exchange for their equity interests in these companies. At the time of the closing of the transaction, the Common Stock issued by the Company h ...

Eighths, sixteenths, and market depth: changes in tick

... as they could be forced to eat into the limit order book to "nd su$cient liquidity. The question remains, therefore, whether the change in tick size will cause su$cient changes in the cumulative depth to increase costs for larger orders while still reducing costs for smaller ones. As Lee et al. (199 ...

... as they could be forced to eat into the limit order book to "nd su$cient liquidity. The question remains, therefore, whether the change in tick size will cause su$cient changes in the cumulative depth to increase costs for larger orders while still reducing costs for smaller ones. As Lee et al. (199 ...

Tender Offers: Safeguards and Restraints-An

... not to reduce pension and fringe benefits of Hartford Fire employees, (4) not to take any cash out of Hartford Fire except to pay dividends, (5) not to reduce the level of insurance in any line being written by Hartford Fire for at least 5 years, (6) not to make investments of Hartford Fire in IT&T ...

... not to reduce pension and fringe benefits of Hartford Fire employees, (4) not to take any cash out of Hartford Fire except to pay dividends, (5) not to reduce the level of insurance in any line being written by Hartford Fire for at least 5 years, (6) not to make investments of Hartford Fire in IT&T ...

Shareholder Wealth and Volatility Effects of Stock Splits Some

... The ex-date effect of stock splits has been explained by market microstructure anomalies, e.g. by the bid-ask spread and price discreteness. Blume & Stambaugh (1983) show that the bid-ask spread causes an upward bias in rates of return. Gottlieb & Kalay (1985) show that rounding continuous prices to ...

... The ex-date effect of stock splits has been explained by market microstructure anomalies, e.g. by the bid-ask spread and price discreteness. Blume & Stambaugh (1983) show that the bid-ask spread causes an upward bias in rates of return. Gottlieb & Kalay (1985) show that rounding continuous prices to ...

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

... 6:00 p.m. are shipped on the same day the order is received. In addition, the Company estimates that over 90% of orders are received by its customers within two days of placing the order. The Company intends to increase its sales to existing dental customers by intensifying its direct marketing effo ...

... 6:00 p.m. are shipped on the same day the order is received. In addition, the Company estimates that over 90% of orders are received by its customers within two days of placing the order. The Company intends to increase its sales to existing dental customers by intensifying its direct marketing effo ...

the law of insider trading: legal theories, common

... (as a means to help ascertain the level of demand for a product) cannot form the basis of an insider trading claim. Likewise, to adequately state a cause of action for insider trading, the information at issue must be “material.” The Supreme Court has said that information is material if “there is a ...

... (as a means to help ascertain the level of demand for a product) cannot form the basis of an insider trading claim. Likewise, to adequately state a cause of action for insider trading, the information at issue must be “material.” The Supreme Court has said that information is material if “there is a ...

Policies and Procedures

... law for the time being in force, at such rates and in such form as it my deem fit. Further where the stock broker has to pay any fine or bear any punishment from any authority in connection with / as a consequence of /in relation to any of the orders / trades / deals actions of the client, the same ...

... law for the time being in force, at such rates and in such form as it my deem fit. Further where the stock broker has to pay any fine or bear any punishment from any authority in connection with / as a consequence of /in relation to any of the orders / trades / deals actions of the client, the same ...

to Official Notice - The Stock Exchange of Mauritius

... (ii) the listing of up to 425,342,317 ordinary shares of BLL on the Official Market of the Stock Exchange of Mauritius Ltd following the above amalgamation, which will involve the migration of BLL from the DEM to the Official Market and consequently, the withdrawal of BLL from the DEM. 2. Suspension ...

... (ii) the listing of up to 425,342,317 ordinary shares of BLL on the Official Market of the Stock Exchange of Mauritius Ltd following the above amalgamation, which will involve the migration of BLL from the DEM to the Official Market and consequently, the withdrawal of BLL from the DEM. 2. Suspension ...

Naked short selling

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the security or ensuring that the security can be borrowed, as is conventionally done in a short sale. When the seller does not obtain the shares within the required time frame, the result is known as a ""failure to deliver"". The transaction generally remains open until the shares are acquired by the seller, or the seller's broker settles the trade.Short selling is used to anticipate a price fall, but exposes the seller to the risk of a price rise.In 2008, the SEC banned what it called ""abusive naked short selling"" in the United States, as well as some other jurisdictions, as a method of driving down share prices. Failing to deliver shares is legal under certain circumstances, and naked short selling is not per se illegal. In the United States, naked short selling is covered by various SEC regulations which prohibit the practice.Critics, including Overstock.com's Patrick M. Byrne, have advocated for stricter regulations against naked short selling.In 2005, ""Regulation SHO"" was enacted; requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period.As part of its response to the crisis in the North American markets in 2008, the SEC issued a temporary order restricting short-selling in the shares of 19 financial firms deemed systemically important, by reinforcing the penalties for failing to deliver the shares in time.Effective September 18, 2008, amid claims that aggressive short selling had played a role in the failure of financial giant Lehman Brothers, the SEC extended and expanded the rules to remove exceptions and to cover all companies, including market makers.A 2014 study by researchers at the University of Buffalo, published in the Journal of Financial Economics, found no evidence that failure to deliver stock ""caused price distortions or the failure of financial firms during the 2008 financial crisis"" and that ""greater FTDs lead to higher liquidity and pricing efficiency, and their impact is similar to our estimate of delivered short sales."" Some commentators have contended that despite regulations, naked shorting is widespread and that the SEC regulations are poorly enforced. Its critics have contended that the practice is susceptible to abuse, can be damaging to targeted companies struggling to raise capital, and has led to numerous bankruptcies. However, other commentators have said that the naked shorting issue is a ""devil theory"", not a bona fide market issue and a waste of regulatory resources.