Box A: Australia`s Real Exchange Rate

... Over the past 15 years or so, the mining boom and its aftermath have led to large movements in Australia’s real exchange rate. As has been widely documented, the significant rise in global commodity prices over the decade or so to 2011 resulted in both a significant appreciation of the Australian do ...

... Over the past 15 years or so, the mining boom and its aftermath have led to large movements in Australia’s real exchange rate. As has been widely documented, the significant rise in global commodity prices over the decade or so to 2011 resulted in both a significant appreciation of the Australian do ...

Michael D. Bordo and AnnaJ. Schwartz TRANSMISSION OF REAL AND MONETARY

... outflow from the home country, so its income is raised even more than is the case in the absence of capital mobility. Under fixed exchange rates a real disturbance is exemplified by an increase in government expenditure in one country that raises real expenditure and income, including the demand for ...

... outflow from the home country, so its income is raised even more than is the case in the absence of capital mobility. Under fixed exchange rates a real disturbance is exemplified by an increase in government expenditure in one country that raises real expenditure and income, including the demand for ...

AP Macroeconomics 2015 Free

... (a) Which country has an absolute advantage in producing solar panels? (b) Calculate the opportunity cost of a furnace in Country Y. (c) Which country has the comparative advantage in producing furnaces? Explain. (d) If the terms of trade were that 2 furnaces are exchanged for 1 solar panel, should ...

... (a) Which country has an absolute advantage in producing solar panels? (b) Calculate the opportunity cost of a furnace in Country Y. (c) Which country has the comparative advantage in producing furnaces? Explain. (d) If the terms of trade were that 2 furnaces are exchanged for 1 solar panel, should ...

14.02 Principles of Macroeconomics Problem Set 5 Solutions Spring 2003

... assuming that the net effect of these policies on output is zero. True: Expansionary fiscal policy leads to an increase in the budget deficit. Furthermore, as the net effect on output is assumed to be zero, the domestic interest rate increases, which leads to an appreciation, and thus a worsening of ...

... assuming that the net effect of these policies on output is zero. True: Expansionary fiscal policy leads to an increase in the budget deficit. Furthermore, as the net effect on output is assumed to be zero, the domestic interest rate increases, which leads to an appreciation, and thus a worsening of ...

On the Political Economy of Monetary Policy

... As a result of (1) and (2), the Central Bank has to sell or buy as much foreign exchange as is necessary to maintain the peg. The three conditions imply that the monetary base strictly follows the changes in the stock of international reserves. The regime mimics most features of a gold standard. How ...

... As a result of (1) and (2), the Central Bank has to sell or buy as much foreign exchange as is necessary to maintain the peg. The three conditions imply that the monetary base strictly follows the changes in the stock of international reserves. The regime mimics most features of a gold standard. How ...

Lessons from Monetary and Real Exchange Rate Economics Arnold C. Harberger

... movements in the price level. But that meant that the real exchange rate could not perform its fundamental role of equilibrating the country’s trade and payments. The central bank ended up first having to buy large quantities of foreign currency, and later having to sell. This could unleash huge inf ...

... movements in the price level. But that meant that the real exchange rate could not perform its fundamental role of equilibrating the country’s trade and payments. The central bank ended up first having to buy large quantities of foreign currency, and later having to sell. This could unleash huge inf ...

The Case Against Floating Exchange Rates

... If the Bretton Woods rules on exchange rate adjustment were abandoned, the door would opened to competitive currency practices harmful to the world economy. As happened during the interwar years, countries might adopt policies without considering their possible beggar-thy-neighbor aspects. All count ...

... If the Bretton Woods rules on exchange rate adjustment were abandoned, the door would opened to competitive currency practices harmful to the world economy. As happened during the interwar years, countries might adopt policies without considering their possible beggar-thy-neighbor aspects. All count ...

The economics of currency unions

... tailored to the needs of the region and a flexible exchange rate that can help absorb shocks. A flexible exchange rate acts as a valuable shock absorber when domestic wages and prices are sticky.5 For example, suppose demand for a country’s exports falls. All else equal, its output will fall, unempl ...

... tailored to the needs of the region and a flexible exchange rate that can help absorb shocks. A flexible exchange rate acts as a valuable shock absorber when domestic wages and prices are sticky.5 For example, suppose demand for a country’s exports falls. All else equal, its output will fall, unempl ...

Political Economy in Macroeconomics

... the temptation to engineer a surprise inflation; since this incentive to time-inconsistent behavior is understood by the public, the resulting equilibrium implies lower welfare than if he could commit himself to zero inflation. The problem is how to make such a commitment credible. Giavazzi and Paga ...

... the temptation to engineer a surprise inflation; since this incentive to time-inconsistent behavior is understood by the public, the resulting equilibrium implies lower welfare than if he could commit himself to zero inflation. The problem is how to make such a commitment credible. Giavazzi and Paga ...

Econ 181 Midterm

... Note: R$ – RE= ΠeUS – ΠeE This relation shows a change in the U.S. interest rate due to an increase in expected U.S. inflation has no effect on the euro interest rate. The rise in the interest rate from R1$ to R2$ creates a momentary excess supply of real U.S. money balances at the prevailing price ...

... Note: R$ – RE= ΠeUS – ΠeE This relation shows a change in the U.S. interest rate due to an increase in expected U.S. inflation has no effect on the euro interest rate. The rise in the interest rate from R1$ to R2$ creates a momentary excess supply of real U.S. money balances at the prevailing price ...

EU-China Collaboration in the Reform of the International Monetary

... The global financial crisis initiated in the United States in 2008 has raised doubts about the efficiency of the current dollar-led international monetary system (IMS). Two main structural theories have been put forward to explain the crisis, each with their respective reform solutions. On the one h ...

... The global financial crisis initiated in the United States in 2008 has raised doubts about the efficiency of the current dollar-led international monetary system (IMS). Two main structural theories have been put forward to explain the crisis, each with their respective reform solutions. On the one h ...

Real Exchange Rate, Monetary Policy, and Employment

... price system to the world’s, influences key macro price ratios such as those between tradable and non-tradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and capital goods, for example). The exchange rate is an asset price, partially determines ...

... price system to the world’s, influences key macro price ratios such as those between tradable and non-tradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and capital goods, for example). The exchange rate is an asset price, partially determines ...

Powerpoint Presentation

... The best example of this is computers, whose prices fall at a huge rate year to year as technology improves. But the same is true of any item. The prices of most items drop slower than computers. And their price drop is often obscured by inflation (a rise in the price level). ...

... The best example of this is computers, whose prices fall at a huge rate year to year as technology improves. But the same is true of any item. The prices of most items drop slower than computers. And their price drop is often obscured by inflation (a rise in the price level). ...

No Slide Title

... HM Treasury (2003) suggests that ‘it seems reasonable to assume that each 1 percentage point increase in the trade to GDP ratio increases real GDP per head by at least ⅓ per cent in the long run’ ...

... HM Treasury (2003) suggests that ‘it seems reasonable to assume that each 1 percentage point increase in the trade to GDP ratio increases real GDP per head by at least ⅓ per cent in the long run’ ...

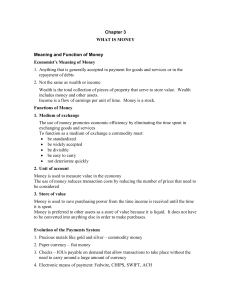

Chapter 3

... Money is used to measure value in the economy The use of money reduces transaction costs by reducing the number of prices that need to be considered 3. Store of value Money is used to save purchasing power from the time income is received until the time it is spent. Money is preferred to other asset ...

... Money is used to measure value in the economy The use of money reduces transaction costs by reducing the number of prices that need to be considered 3. Store of value Money is used to save purchasing power from the time income is received until the time it is spent. Money is preferred to other asset ...

Dollar Driving Change: How the Exchange Rate is

... How owner-managed dealers can insulate their businesses With the lower dollar affecting several areas of the Canadian auto industry, dealers should expect a difficult year. Yet, while approaches may differ depending on location and other factors, dealers can mitigate the effects of the exchange rate ...

... How owner-managed dealers can insulate their businesses With the lower dollar affecting several areas of the Canadian auto industry, dealers should expect a difficult year. Yet, while approaches may differ depending on location and other factors, dealers can mitigate the effects of the exchange rate ...

Course syllabus - City, University of London

... Tel: 020-7040-4506 Office: D311, Social Sciences Building Office Hours: Wednesdays and Thursdays, 2:30-3:30 (or by appt). ...

... Tel: 020-7040-4506 Office: D311, Social Sciences Building Office Hours: Wednesdays and Thursdays, 2:30-3:30 (or by appt). ...

Remarks by Mr. Ivan Iskrov, Governor of the BNB, at the EastEuro

... exchange rate regime and a monetary policy strategy is very enormous and sophisticated to be described in detail in such a short speech. Our countries’ experience proved that both floating and fixed exchange rates can ensure price and financial stability and a favourable environment for economic gro ...

... exchange rate regime and a monetary policy strategy is very enormous and sophisticated to be described in detail in such a short speech. Our countries’ experience proved that both floating and fixed exchange rates can ensure price and financial stability and a favourable environment for economic gro ...

Exchange Market as a Part of International Financial Markets

... are speculative. the person or institution that bought or sold the currency has no plan to actually take delivery of the currency in the end; rather, they were solely speculating on the movement of that particular currency. ...

... are speculative. the person or institution that bought or sold the currency has no plan to actually take delivery of the currency in the end; rather, they were solely speculating on the movement of that particular currency. ...

CHF: Is the minimum rate in danger?

... losses of the SNB. In the long term, an exit may prove to be close to inevitable due to a massive inflow of capital (for instance, if the euro collapses). ...

... losses of the SNB. In the long term, an exit may prove to be close to inevitable due to a massive inflow of capital (for instance, if the euro collapses). ...

Commodity Prices in Argentina: What Moves the Wind?

... flows from the center to the periphery. The US real exchange rate, the international real interest rate and the global liquidity coordinate exogenous cycle in countries like Argentina via two channels: the commercial and the financial channel. These variables induce a positive correlation between ch ...

... flows from the center to the periphery. The US real exchange rate, the international real interest rate and the global liquidity coordinate exogenous cycle in countries like Argentina via two channels: the commercial and the financial channel. These variables induce a positive correlation between ch ...