Why Canada Needs a Flexible Exchange Rate

... makes us very unusual; indeed, no other country during the post-war period has been as devoted to the flexible exchange rate system. Most countries have preferred to tie their currencies to that of another trading partner and to operate under some form of fixed exchange rate arrangement. This global ...

... makes us very unusual; indeed, no other country during the post-war period has been as devoted to the flexible exchange rate system. Most countries have preferred to tie their currencies to that of another trading partner and to operate under some form of fixed exchange rate arrangement. This global ...

Money Market

... given day. These forecasts are prepared some months ahead and are then updated on an ongoing basis, as more information comes to hand. ...

... given day. These forecasts are prepared some months ahead and are then updated on an ongoing basis, as more information comes to hand. ...

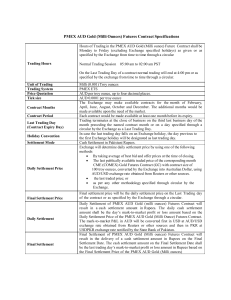

PMEX AUD Gold Futures Contract

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

... AUD per troy ounce, up to four decimal places. AUD 0.0001 per troy ounce The Exchange may make available contracts for the month of February, April, June, August, October and December. The additional months would be made available upon the need of the market. Each contract would be made available at ...

NBER WORKING PAPER SERIES MANAGING CURRENCY PEGS Stephanie Schmitt-Grohé Martín Uribe

... When confronted with the current crisis in peripheral Europe, many specialists in emergingmarket macroeconomics feel that it is déjà vu all over again. An implication of this feeling is that in order to understand the current situation in southern Europe, one should dust off the theories of excha ...

... When confronted with the current crisis in peripheral Europe, many specialists in emergingmarket macroeconomics feel that it is déjà vu all over again. An implication of this feeling is that in order to understand the current situation in southern Europe, one should dust off the theories of excha ...

Chapter 12national Income, Accounting and the Balance of Payments

... A. If the demand for money increases, a budget surplus will result, and the money supply will have to decrease to maintain equilibrium. B. If the demand for money increases, a budget surplus will result, and the money supply will have to increase to maintain equilibrium. C. If the demand for money i ...

... A. If the demand for money increases, a budget surplus will result, and the money supply will have to decrease to maintain equilibrium. B. If the demand for money increases, a budget surplus will result, and the money supply will have to increase to maintain equilibrium. C. If the demand for money i ...

Relationship Between Real Exchange Rates Real Interest Rate Differentials: The Co-Integration Approach

... Great deal of research has been done in to study the relationship between real exchange rates and real interest rates differential. Frankel (1979) used a sample of monthly observations between July 1974 and February 1978 for mark/dollar exchange rate and used OLS technique and found that nominal exc ...

... Great deal of research has been done in to study the relationship between real exchange rates and real interest rates differential. Frankel (1979) used a sample of monthly observations between July 1974 and February 1978 for mark/dollar exchange rate and used OLS technique and found that nominal exc ...

Singapore`s Exchange Rate Policy - Monetary Authority of Singapore

... major trading partners and competitors. The various currencies are given different degrees of importance, or weights, depending on the extent of our trade dependence with that particular country. The composition of the basket is revised periodically to take into account changes in Singapore's trade ...

... major trading partners and competitors. The various currencies are given different degrees of importance, or weights, depending on the extent of our trade dependence with that particular country. The composition of the basket is revised periodically to take into account changes in Singapore's trade ...

The Asian Crisis, the IMF and Dr Mahathir

... There will be excess demand for tradeables, i.e. a deficit on the current account. At any point on N to the left of the point of intersection there is a surplus on the current account. Unemployment and sticky prices could be included. At any point to the left of N wealth, and consequently aggregate ...

... There will be excess demand for tradeables, i.e. a deficit on the current account. At any point on N to the left of the point of intersection there is a surplus on the current account. Unemployment and sticky prices could be included. At any point to the left of N wealth, and consequently aggregate ...

DISINFLATION PROGRAM FOR THE YEAR 2000: GAZ ERÇEL

... 1.As you will recall, we have passed several hard tests in the international and national arena since July 1998, and have gained enormous experience in the area of budgetary, monetary and structural reforms as required under the Staff Monitored Program signed with the International Monetary Fund. 2. ...

... 1.As you will recall, we have passed several hard tests in the international and national arena since July 1998, and have gained enormous experience in the area of budgetary, monetary and structural reforms as required under the Staff Monitored Program signed with the International Monetary Fund. 2. ...

Real Exchange Rate, Monetary Policy and Employment: Economic

... The exchange rate affects any economy through many channels. It scales the national price system to the world’s, influences key macro price ratios such as those between tradable and nontradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and cap ...

... The exchange rate affects any economy through many channels. It scales the national price system to the world’s, influences key macro price ratios such as those between tradable and nontradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and cap ...

Real Exchange Rate, Monetary Policy, and Economic Development

... The exchange rate affects any economy through many channels. It scales the national price system to the world’s, influences key macro price ratios such as those between tradable and nontradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and cap ...

... The exchange rate affects any economy through many channels. It scales the national price system to the world’s, influences key macro price ratios such as those between tradable and nontradable goods, capital goods and labor, and even exports and imports (via the costs of intermediate inputs and cap ...

NBER WORKING PAPER SERIES DOES EXCHANGE RATE RISK MATTER FOR WELFARE?

... model equations, which would only capture the direct effects of exchange rate variability on utility through the fact that people dislike variance in consumption and leisure. A second order approximation to the full set of model equations additionally picks up the effects of variability on the means ...

... model equations, which would only capture the direct effects of exchange rate variability on utility through the fact that people dislike variance in consumption and leisure. A second order approximation to the full set of model equations additionally picks up the effects of variability on the means ...

Dollarization in Ukraine: 1991 to the Present

... could be sold for foreign currency and vice versa. These general licenses remain in effect today. Individual licenses were given to companies for a specified period of time, to conduct trades of goods and services on Ukrainian territory in foreign currency, to open accounts in banks outside Ukraine, ...

... could be sold for foreign currency and vice versa. These general licenses remain in effect today. Individual licenses were given to companies for a specified period of time, to conduct trades of goods and services on Ukrainian territory in foreign currency, to open accounts in banks outside Ukraine, ...

reasury Initiatives

... Lending and borrowing rates are freed, access to capital markets is made easier for corporates The rupee is convertible on trade account, FDI is welcomed with a plethora of incentives, FIIs are an established force in stock markets The government has liberalised the ECB policy and a large number ...

... Lending and borrowing rates are freed, access to capital markets is made easier for corporates The rupee is convertible on trade account, FDI is welcomed with a plethora of incentives, FIIs are an established force in stock markets The government has liberalised the ECB policy and a large number ...

Foreign Exchange solutions for you and your

... • Earn up to 50% in eBucks on your transaction charges when using Online Banking to send and receive money in foreign currency • Standing instructions for recurring payments from abroad can earn you up to 100% back in eBucks on your transaction charges • Get up to 40% off flights and free access ...

... • Earn up to 50% in eBucks on your transaction charges when using Online Banking to send and receive money in foreign currency • Standing instructions for recurring payments from abroad can earn you up to 100% back in eBucks on your transaction charges • Get up to 40% off flights and free access ...

Macroeconomic Policy

... BoP surplus (overall balance) is too large. If central bank buys less foreign reserves, there will be some real appreciation, which would help reduce inflation. ...

... BoP surplus (overall balance) is too large. If central bank buys less foreign reserves, there will be some real appreciation, which would help reduce inflation. ...

Federal Fund Rate Increase Frequently Asked

... Q: Why is the Federal Reserve Fund (the Fed) raising rates again? A: Since the financial crisis of 2008, job growth has been steadily increasing and unemployment rates have fallen below 5%. This is an indicator of a growing economy. With modest rate adjustments, the Fed wants to moderate growth to a ...

... Q: Why is the Federal Reserve Fund (the Fed) raising rates again? A: Since the financial crisis of 2008, job growth has been steadily increasing and unemployment rates have fallen below 5%. This is an indicator of a growing economy. With modest rate adjustments, the Fed wants to moderate growth to a ...

PDF Download

... (CCA) reduces the transaction cost in international trade and therefore stimulates the integration of national markets for traded goods. This in turn creates opportunities to reduce costs through economies of scale and increased competition. The efficiency gains of this kind should be enjoyed by all ...

... (CCA) reduces the transaction cost in international trade and therefore stimulates the integration of national markets for traded goods. This in turn creates opportunities to reduce costs through economies of scale and increased competition. The efficiency gains of this kind should be enjoyed by all ...

Alan C. Stockman Working Paper No. 113 1050 EFFECTS OF INFLATION ON

... changes, is independent of demand for those goods, given employment of labor in the traded good industries. However, that is not true in the nontraded goods industry. There, the equilibrium conditions impose domestic marketclearing, so the response of demand for the nontraded good is central, as ...

... changes, is independent of demand for those goods, given employment of labor in the traded good industries. However, that is not true in the nontraded goods industry. There, the equilibrium conditions impose domestic marketclearing, so the response of demand for the nontraded good is central, as ...

FRBSF L CONOMIC

... money supply. It is through its effects on interest rates and other financial conditions that monetary policy affects the economy. But, once the economy improves sufficiently, won’t banks start lending more actively, causing the historical money multiplier to reassert itself? And can’t the resulting ...

... money supply. It is through its effects on interest rates and other financial conditions that monetary policy affects the economy. But, once the economy improves sufficiently, won’t banks start lending more actively, causing the historical money multiplier to reassert itself? And can’t the resulting ...

Section 5

... – We expect these changes to be temporary, and to have no effect on the long-run expected exchange rate. – So, we only worry about the short run, because we go back to the initial equilibrium. ...

... – We expect these changes to be temporary, and to have no effect on the long-run expected exchange rate. – So, we only worry about the short run, because we go back to the initial equilibrium. ...