RBI/2013-14/490 AP (DIR Series) Circular No

... details of the amount of consideration received for issuing shares and convertible debentures under the Foreign Direct Investment (FDI) scheme to the Regional Office of the Reserve Bank in whose jurisdiction the Registered Office of the company operates, within 30 days of receipt of the amount of co ...

... details of the amount of consideration received for issuing shares and convertible debentures under the Foreign Direct Investment (FDI) scheme to the Regional Office of the Reserve Bank in whose jurisdiction the Registered Office of the company operates, within 30 days of receipt of the amount of co ...

GLAXOSMITHKLINE PLC (Form: 6-K, Received: 02/23/2017 11:33:29)

... PCA of Dr M M Slaoui (Chairman, Global Vaccines) Initial notification/ Initial notification amendment Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section ...

... PCA of Dr M M Slaoui (Chairman, Global Vaccines) Initial notification/ Initial notification amendment Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor Name GlaxoSmithKline plc LEI 5493000HZTVUYLO1D793 Details of the transaction(s): section ...

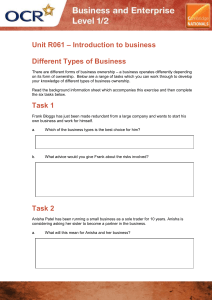

Unit R061 - Different types of business - Activity

... the tax office and keep good records to enable the tax to be paid once a year. As well as being the simplest type of business to set up but it is also the most risky. All finance, debt or legal issues are the responsibility of the owner and it may be difficult to get financial backing from external ...

... the tax office and keep good records to enable the tax to be paid once a year. As well as being the simplest type of business to set up but it is also the most risky. All finance, debt or legal issues are the responsibility of the owner and it may be difficult to get financial backing from external ...

Telefónica, SA

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

Final Exam, Fall 09 - Department of Finance, Insurance and

... assigned to their capital budgeting department. You have determined the following information to be accurate. The firm's shares are currently selling for $40.00, the estimated growth rate of earnings is 7%, and the expected dividend is $2.40. Talks with the investment banking company with which the ...

... assigned to their capital budgeting department. You have determined the following information to be accurate. The firm's shares are currently selling for $40.00, the estimated growth rate of earnings is 7%, and the expected dividend is $2.40. Talks with the investment banking company with which the ...

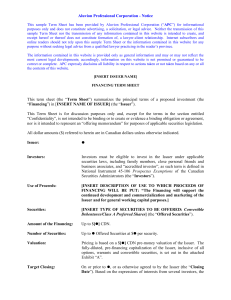

Polaris Seed Round Term Sheet

... (4) Antidilution Provisions: If the Company issues additional shares at a purchase price less than the applicable conversion price of the Preferred, the conversion price will be reduced, based on a "weighted average" formula. (5) Voting Rights: So long as any Preferred is outstanding, the holders of ...

... (4) Antidilution Provisions: If the Company issues additional shares at a purchase price less than the applicable conversion price of the Preferred, the conversion price will be reduced, based on a "weighted average" formula. (5) Voting Rights: So long as any Preferred is outstanding, the holders of ...