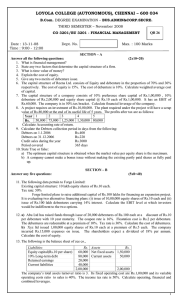

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... a) The optimum capital structure is obtained when the market value per equity share is the maximum. b) A company cannot make a bonus issue without making the existing partly paid shares as fully paid up. SECTION – B Answer any five questions: ...

... a) The optimum capital structure is obtained when the market value per equity share is the maximum. b) A company cannot make a bonus issue without making the existing partly paid shares as fully paid up. SECTION – B Answer any five questions: ...

0000892626-03-000340 - Lasalle Hotel Properties

... 8.375% per year. All of the shares are being sold by the Company. The offering is expected to close on September 30, 2003. The Company expects to list the shares on the New York Stock Exchange. The net proceeds of the offering will be used to repay existing indebtedness under the Company's senior un ...

... 8.375% per year. All of the shares are being sold by the Company. The offering is expected to close on September 30, 2003. The Company expects to list the shares on the New York Stock Exchange. The net proceeds of the offering will be used to repay existing indebtedness under the Company's senior un ...

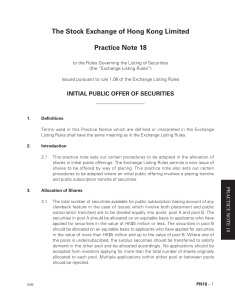

initial public offer of securities

... applied for securities in the value of HK$5 million or less. The securities in pool B should be allocated on an equitable basis to applicants who have applied for securities in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus s ...

... applied for securities in the value of HK$5 million or less. The securities in pool B should be allocated on an equitable basis to applicants who have applied for securities in the value of more than HK$5 million and up to the value of pool B. Where one of the pools is undersubscribed, the surplus s ...

FINTRONICS HOLDINGS COMPANY LIMITED 銀創控股有限公司

... The percentage of shareholding of the other public Shareholders immediately after the Rights Issue if the Underwriter is required to take up all Rights Shares pursuant to the Underwriting Agreement (assuming all of the Outstanding Options and Outstanding Warrants are exercised on or before the Recor ...

... The percentage of shareholding of the other public Shareholders immediately after the Rights Issue if the Underwriter is required to take up all Rights Shares pursuant to the Underwriting Agreement (assuming all of the Outstanding Options and Outstanding Warrants are exercised on or before the Recor ...

Aktiengesellschaft (AG) - Grant Thornton Schweiz/Liechtenstein

... The Swiss “Aktiengesellschaft” or abbreviated “AG” (in English: “company limited by shares” / “Ltd.”) is the most preferred legal form of a Swiss company. In contrast to the Swiss “Gesellschaft mit beschränkter Haftung (GmbH)” which can be established with a capital of CHF 20,000, the shareholders m ...

... The Swiss “Aktiengesellschaft” or abbreviated “AG” (in English: “company limited by shares” / “Ltd.”) is the most preferred legal form of a Swiss company. In contrast to the Swiss “Gesellschaft mit beschränkter Haftung (GmbH)” which can be established with a capital of CHF 20,000, the shareholders m ...

PRESS RELEASE UniCredit Board approves rights issue terms and

... Prospectus will be published and made available in Germany and Poland free of charge on the Company’s Internet website at www.unicreditgroup.eu, and will be available in English together with the German and Polish translation of the Summary Note. Accordingly, any person making or intending to make a ...

... Prospectus will be published and made available in Germany and Poland free of charge on the Company’s Internet website at www.unicreditgroup.eu, and will be available in English together with the German and Polish translation of the Summary Note. Accordingly, any person making or intending to make a ...

Attention: President The Stock Exchange of Thailand Attachment

... 8. Other details necessary to support shareholder’s decision to approve the capital increase/share allotment 8.1 The reason that the Company offering of newly issued share to the Private Placement (PP) rather than offer new shares existing shareholders and the public is because the company will be a ...

... 8. Other details necessary to support shareholder’s decision to approve the capital increase/share allotment 8.1 The reason that the Company offering of newly issued share to the Private Placement (PP) rather than offer new shares existing shareholders and the public is because the company will be a ...