mezzanine financing

... a typical mezzanine format, giving MB Capital the right to purchase a predetermined number of shares of stock in the client company. These warrants are usually repurchased by the client at the end of the investment period at fair market value or under a predetermined formula. As an alternative to wa ...

... a typical mezzanine format, giving MB Capital the right to purchase a predetermined number of shares of stock in the client company. These warrants are usually repurchased by the client at the end of the investment period at fair market value or under a predetermined formula. As an alternative to wa ...

What are these called

... SPACE PROVIDED: 1. What is corporate culture? At its most basic, its described as the personality of an organization, or simply as “how things are done around here.”_______ it’s 2. It guides how employees think, acting, and feel. _________ act 3. Corporate culture is a broad term using to define the ...

... SPACE PROVIDED: 1. What is corporate culture? At its most basic, its described as the personality of an organization, or simply as “how things are done around here.”_______ it’s 2. It guides how employees think, acting, and feel. _________ act 3. Corporate culture is a broad term using to define the ...

Armine Yalnizyan: Income Inequality and Investment

... • Slow growth? Boost profit by lowering costs (lower wages) BUT • If I can’t buy, you can’t sell Inadequate aggregate demand, slower growth • Lower wages means less saving, smaller base for investments down the road....or dramatically shifting geo-political realities ...

... • Slow growth? Boost profit by lowering costs (lower wages) BUT • If I can’t buy, you can’t sell Inadequate aggregate demand, slower growth • Lower wages means less saving, smaller base for investments down the road....or dramatically shifting geo-political realities ...

Active Management

... The Money Market Continued • Repurchase Agreements (RPs) and Reverse RPs • It is used by dealers with government securities • Form of short term borrowing • Most deposits are in large sum, time deposit less then 6 months • Overnight • Dealer sells government securities on an overnight basis with th ...

... The Money Market Continued • Repurchase Agreements (RPs) and Reverse RPs • It is used by dealers with government securities • Form of short term borrowing • Most deposits are in large sum, time deposit less then 6 months • Overnight • Dealer sells government securities on an overnight basis with th ...

View - Ferguson Wellman

... brings us back to what we know as the current economic reality: slow growth (about two percent annualized real GDP growth) and modest-but-increasing inflation (also at about 2 percent). Though the economic expansion is now in its eighth year, we do not believe a recession is imminent. As the economy ...

... brings us back to what we know as the current economic reality: slow growth (about two percent annualized real GDP growth) and modest-but-increasing inflation (also at about 2 percent). Though the economic expansion is now in its eighth year, we do not believe a recession is imminent. As the economy ...

Non-Client Copy Page - MKG Financial Group, Inc.

... clients will continue to report good earnings for the second quarter. In long-term investing, we have found two important corporate characteristics are competitive strength and fundamental growth. When investors focus on the eurozone challenges, slowing world economies, like China, and U.S. politics ...

... clients will continue to report good earnings for the second quarter. In long-term investing, we have found two important corporate characteristics are competitive strength and fundamental growth. When investors focus on the eurozone challenges, slowing world economies, like China, and U.S. politics ...

September 23, 2016

... stated “German economic growth was robust in the first half of the year, but the latest economic data indicate a slowdown in economic momentum in the second half of the year.” Growth in industrial orders came to a halt in July and factory output and exports fell unexpectedly. The ministry blamed wea ...

... stated “German economic growth was robust in the first half of the year, but the latest economic data indicate a slowdown in economic momentum in the second half of the year.” Growth in industrial orders came to a halt in July and factory output and exports fell unexpectedly. The ministry blamed wea ...

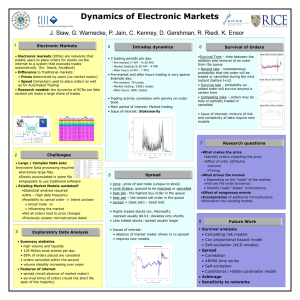

A Collaborative Kalman Filter for Time

... the only aim of the research in finance market is predicting the trendency ,But what the information that we can use? only use its own history to predict its future? ...

... the only aim of the research in finance market is predicting the trendency ,But what the information that we can use? only use its own history to predict its future? ...

Can someone please provide some assistance with responding to the

... I need help with writing a response to the students post below. My response has to be significant and advanced the discussion and needs to be between 250 and 350 words. Thank you so much in advance for all your help. I really appreciate it! Cynthia’s post below Capital structure refers to the divisi ...

... I need help with writing a response to the students post below. My response has to be significant and advanced the discussion and needs to be between 250 and 350 words. Thank you so much in advance for all your help. I really appreciate it! Cynthia’s post below Capital structure refers to the divisi ...

Emerging Market Overview_March 2016

... engulfed the market, resulting in a 15% correction in US-dollar terms in one day, as investors speculated about hindrance in the implementation of reforms and concerns over the economy’s recovery. To calm the market, the Finance Ministry stressed its commitment to the reform agenda and fiscal target ...

... engulfed the market, resulting in a 15% correction in US-dollar terms in one day, as investors speculated about hindrance in the implementation of reforms and concerns over the economy’s recovery. To calm the market, the Finance Ministry stressed its commitment to the reform agenda and fiscal target ...

Financial services Commission proposes to improve

... extend its scope and bring it into line with new practices so as to create a truly Single Market for collective investment vehicles. The proposed legislative framework would ensure a high level of protection for individual investors by setting standards for both the investment products and the manag ...

... extend its scope and bring it into line with new practices so as to create a truly Single Market for collective investment vehicles. The proposed legislative framework would ensure a high level of protection for individual investors by setting standards for both the investment products and the manag ...

Reverse engineering network structures from dynamic features: the

... Introduction - Foreign Exchange Market • Most liquid financial market in the world • Average daily turnover was USD 3.98 trillion in April 2010 • Growth of approximately 20% as compared to 2007 • United States GDP is around USD 16.62 trillion • Operates 24 hours a day except on weekends • Geographi ...

... Introduction - Foreign Exchange Market • Most liquid financial market in the world • Average daily turnover was USD 3.98 trillion in April 2010 • Growth of approximately 20% as compared to 2007 • United States GDP is around USD 16.62 trillion • Operates 24 hours a day except on weekends • Geographi ...

Newsletter-2007-12 - Patient Capital Management Inc

... popular media and market pundits. However, aggregate equity valuations do not reflect the risk that the current environment poses or the downbeat mood of many market participants. As the following graphs indicate, valuations are still far above their long term averages and nowhere near the valuation ...

... popular media and market pundits. However, aggregate equity valuations do not reflect the risk that the current environment poses or the downbeat mood of many market participants. As the following graphs indicate, valuations are still far above their long term averages and nowhere near the valuation ...

Chapter 8 - FIU Faculty Websites

... The Bond Market - the market in which certificates of indebtedness (bonds) are traded; when companies wish to borrow money they do so by issuing a bond. ...

... The Bond Market - the market in which certificates of indebtedness (bonds) are traded; when companies wish to borrow money they do so by issuing a bond. ...

inflation, real interest rates and the shiller p/e

... Why this matters: Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shl ...

... Why this matters: Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shl ...

Marketing Management

... • Diversification into related bus (concentric diversification) • Diversification into unrelated businesses (conglomerate diversification) ...

... • Diversification into related bus (concentric diversification) • Diversification into unrelated businesses (conglomerate diversification) ...

File

... financing government issues treasury bills, notes, and bonds to borrow from public. • Financial Intermediaries: – Banks: Deals with other people’s money with interest margin. The balance sheet is characterized by very small amount of tangible assets. – Mutual funds : pool and manage the scattered sa ...

... financing government issues treasury bills, notes, and bonds to borrow from public. • Financial Intermediaries: – Banks: Deals with other people’s money with interest margin. The balance sheet is characterized by very small amount of tangible assets. – Mutual funds : pool and manage the scattered sa ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

Chapter 19 -- The Capital Market

... The issuing company selects an investment banking firm and works directly with the firm to determine the essential features of the issue. Together they discuss and negotiate a price for the security and the timing of the issue. Depending on the size of the issue, the investment banker may invite oth ...

... The issuing company selects an investment banking firm and works directly with the firm to determine the essential features of the issue. Together they discuss and negotiate a price for the security and the timing of the issue. Depending on the size of the issue, the investment banker may invite oth ...