More from the full article

... Last month I likened the recent relative calm evidenced in investment markets as being the ‘eye of a storm’ and questioned how much longer the relatively benign ‘eye’ would linger over markets that had been frustrating to both bulls and bears. Well, the ‘eye’, and the frustration, has continued for ...

... Last month I likened the recent relative calm evidenced in investment markets as being the ‘eye of a storm’ and questioned how much longer the relatively benign ‘eye’ would linger over markets that had been frustrating to both bulls and bears. Well, the ‘eye’, and the frustration, has continued for ...

Aberdeen Global – Select Euro High Yield Bond Fund

... For professional investors and financial advisers only – not for use by retail investors Risk factors you should consider before investing: The following risk factors should be carefully considered before making an investment decision: • The value of shares and the income from them can go down as w ...

... For professional investors and financial advisers only – not for use by retail investors Risk factors you should consider before investing: The following risk factors should be carefully considered before making an investment decision: • The value of shares and the income from them can go down as w ...

Chapter 12 - U of L Class Index

... consumption and earn a return to compensate them for doing so – Borrowers have better access to the capital that is available so that they can invest in productive assets Financial markets also provide us with information about the returns that are required for various levels of risk. ...

... consumption and earn a return to compensate them for doing so – Borrowers have better access to the capital that is available so that they can invest in productive assets Financial markets also provide us with information about the returns that are required for various levels of risk. ...

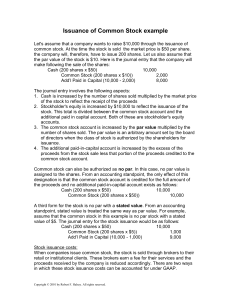

Sample title for chapter 1

... • Here, the price of the bond is essentially the same as its par, or stated value to be received at maturity of $1,000. ...

... • Here, the price of the bond is essentially the same as its par, or stated value to be received at maturity of $1,000. ...

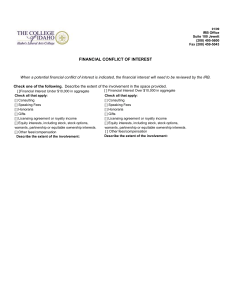

FinancialDisclosure

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

... When a potential financial conflict of interest is indicated, the financial interest will need to be reviewed by the IRB. Check one of the following. Describe the extent of the involvement in the space provided. [ ]Financial Interest Under $10,000 in aggregate Check all that apply: [ ] Consulting [ ...

Causes of The Great Depression

... – Although the workings of the New York Stock Exchange can be quite complex, one simple principle governs the price of stock. When investors believe a stock is a good value they are willing to pay more for a share and its value rises. When traders believe the value of a security will fall, they cann ...

... – Although the workings of the New York Stock Exchange can be quite complex, one simple principle governs the price of stock. When investors believe a stock is a good value they are willing to pay more for a share and its value rises. When traders believe the value of a security will fall, they cann ...

The Indian Financial Market Is Touted as Benchmark in Today`s

... At first instance it seemed to be a risky venture for me but news channels like CNBC and ZEE business facilatated the guidelines. coming to the fundamentals, share trading is done on four major aspects and so it comprises of equity, commodity, currencies and future-options.(call & put).While equity ...

... At first instance it seemed to be a risky venture for me but news channels like CNBC and ZEE business facilatated the guidelines. coming to the fundamentals, share trading is done on four major aspects and so it comprises of equity, commodity, currencies and future-options.(call & put).While equity ...

Further information on valuation methodology

... Return on Capital Employed (ROCE) or Weighted Average Cost of Capital (WACC) and a terminal value. Valuation models (including the underlying assumptions) are dependent on macroeconomic factors such as interest rates, exchange rates and raw material prices, and on assumptions about the economy. Furt ...

... Return on Capital Employed (ROCE) or Weighted Average Cost of Capital (WACC) and a terminal value. Valuation models (including the underlying assumptions) are dependent on macroeconomic factors such as interest rates, exchange rates and raw material prices, and on assumptions about the economy. Furt ...

July 2015 We have all heard the phrase “timing is everything” – and

... particularly smoothly, largely due to the fact Tsipras was unwilling to submit to the proposed austerity measures and Greece defaulted on their $1.6 billion payment on June 30th. Tsipras proposed a Greek referendum and vocally supported a “no” vote to further austerity measures; On July 5th, Greek c ...

... particularly smoothly, largely due to the fact Tsipras was unwilling to submit to the proposed austerity measures and Greece defaulted on their $1.6 billion payment on June 30th. Tsipras proposed a Greek referendum and vocally supported a “no” vote to further austerity measures; On July 5th, Greek c ...

Examining market efficiency in India

... assumptions about the normality of data. This study also uses a non-parametric procedure to examine randomness, the runs test. We seek to test the hypothesis that the series of returns are i.i.d. (independently and identically distributed) random variables. If significant autocorrelations are found ...

... assumptions about the normality of data. This study also uses a non-parametric procedure to examine randomness, the runs test. We seek to test the hypothesis that the series of returns are i.i.d. (independently and identically distributed) random variables. If significant autocorrelations are found ...

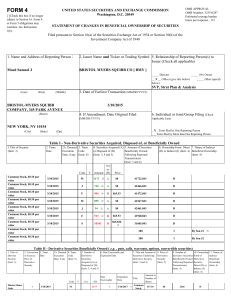

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

... ( 1) Represents vesting of one-quarter of market share units granted on March 10, 2013. ( 2) Adjustment reflects additional shares acquired upon the vesting of market share units due to the performance factor. ( 3) Shares withheld for payment of taxes upon vesting of awards. ( 4) Represents vesting ...

SELL HIGH AND BUY LOW REMAINS THE BEST PLAN!! July 22

... PS--History tells us that after a strong June-July rally that markets are often very weak heading into AugSept, and with a US Presidential Election happening Nov 8 my bet is that we could see a wonderful buying opportunity in short order? ...

... PS--History tells us that after a strong June-July rally that markets are often very weak heading into AugSept, and with a US Presidential Election happening Nov 8 my bet is that we could see a wonderful buying opportunity in short order? ...

THE MARKET CAPITALIZATION VALUE AS A RISK

... within the measurement time interval. Roll (1983-a) suggested that the first strategy produces higher excess return for small company stocks, while the same conclusion reached Blume and Stambaugh (1983), utilizing data from the NYSE. However, even under a buy-and-hold strategy, the effect associated ...

... within the measurement time interval. Roll (1983-a) suggested that the first strategy produces higher excess return for small company stocks, while the same conclusion reached Blume and Stambaugh (1983), utilizing data from the NYSE. However, even under a buy-and-hold strategy, the effect associated ...

The Nasdaq-100 Index Option - The New York Stock Exchange

... expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official Opening Price on Settlement Day, the closing price from the previous trading day will be used to calculate the Settlement Value. The exercise-settlement amount is equal to th ...

... expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official Opening Price on Settlement Day, the closing price from the previous trading day will be used to calculate the Settlement Value. The exercise-settlement amount is equal to th ...

Nedgroup Investments Positive Return Fund

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

... The fund seeks to offer investors total returns that are in excess of inflation over the medium-term through active asset allocation and with a high emphasis on capital protection. The fund specifically aims not to have negative returns over any 12-month period. The manager may invest in a mix of lo ...

ARK_letter10-07 - ARK Financial Services

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...

... How should you respond to these events? Stay disciplined and adhere to your carefully designed investment strategy. Stocks are volatile, so no one can consistently predict when the risks of equity investing will appear. It would be a mistake to try to time the market by reacting to events such as th ...