SET2 - CBSE

... When government imposes an upper limit on the price of a good , it is called price ceiling. It is generally imposed on essential items and is fixed below the market determined price. The reason being the equilibrium price is too high for the common people to afford. Under increasing returns to a fac ...

... When government imposes an upper limit on the price of a good , it is called price ceiling. It is generally imposed on essential items and is fixed below the market determined price. The reason being the equilibrium price is too high for the common people to afford. Under increasing returns to a fac ...

L4 bond1 - people.bath.ac.uk

... maturity on the bond is the annual rate of interest you will receive if you buy the bond now for price P and ...

... maturity on the bond is the annual rate of interest you will receive if you buy the bond now for price P and ...

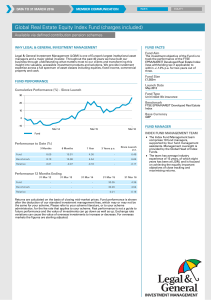

Global Real Estate Equity Index Fund

... This document should not be taken as an invitation to deal in Legal & General investments or any of the stated stock markets. Legal & General Assurance (Pensions Management) Limited ("PMC") is a life insurance company and manages this investment using a policy notional divided into a number of PF se ...

... This document should not be taken as an invitation to deal in Legal & General investments or any of the stated stock markets. Legal & General Assurance (Pensions Management) Limited ("PMC") is a life insurance company and manages this investment using a policy notional divided into a number of PF se ...

Merger Arbitrage & Shareholder Wealth Effects of M&A

... Fig. 2. Cumulative average abnormal returns to target firms’ stocks from trading day –126 to +253 relative to the first bid in the period 1975 – 91. Market model parameters are used to calculate abnormal returns. The full sample of 1,815 offers for NYSE- and AMEX-listed target firms is broken into 1 ...

... Fig. 2. Cumulative average abnormal returns to target firms’ stocks from trading day –126 to +253 relative to the first bid in the period 1975 – 91. Market model parameters are used to calculate abnormal returns. The full sample of 1,815 offers for NYSE- and AMEX-listed target firms is broken into 1 ...

Basics of Investment

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...

... To invest is to allocate money (or sometimes another resource, such as time) in the expectation of some benefit in the future. Investing means putting your money to work for you in future. In finance, the expected future benefit from investment is a return. The return may consist of capital gai ...

Earnings Release

... information are more regular). Nevertheless, investors’ uncertainty cannot be captured by the dispersion observed between analysts’ predictions [Abarbanell, Lanen and Verrechia (1995)]. Finally, an alternative method presented by Maddala and Nimalendran (1995) is the non-observed component approach ...

... information are more regular). Nevertheless, investors’ uncertainty cannot be captured by the dispersion observed between analysts’ predictions [Abarbanell, Lanen and Verrechia (1995)]. Finally, an alternative method presented by Maddala and Nimalendran (1995) is the non-observed component approach ...

Company: Arab Bank Group Date: Oct 12, 2011 Stock Code on: ASE

... 2011 is expected to be another difficult year for ARBK. The unrest in several regional countries were ARBK operates, is expected to result in lower business activities and a hike in non-performing loans (NPL). Although as of mid-2011 no such impact was reflected on the Group’s profitability or asset ...

... 2011 is expected to be another difficult year for ARBK. The unrest in several regional countries were ARBK operates, is expected to result in lower business activities and a hike in non-performing loans (NPL). Although as of mid-2011 no such impact was reflected on the Group’s profitability or asset ...

Chapter 15 Packet-

... ____ 24. Which statement best describes the American economy in the 1920s? a. Wages decreased and the economy appeared weak. b. Unemployment was at an all-time high. c. Stock prices rose and the economy appeared healthy. d. Small businesses dominated American industry. ____ 25. Which group faced har ...

... ____ 24. Which statement best describes the American economy in the 1920s? a. Wages decreased and the economy appeared weak. b. Unemployment was at an all-time high. c. Stock prices rose and the economy appeared healthy. d. Small businesses dominated American industry. ____ 25. Which group faced har ...

Capital Market Presentation September 2011

... Allianz Global Investors GmbH has established branches in Switzerland (Zürich), Italy (Milan), United Kingdom (London), Spain (Madrid) and the Netherlands (Utrecht). Allianz Global Investors GmbH also has established representative offices in the Kingdom of Bahrain (Bahrain), Portugal (Lisbon) and S ...

... Allianz Global Investors GmbH has established branches in Switzerland (Zürich), Italy (Milan), United Kingdom (London), Spain (Madrid) and the Netherlands (Utrecht). Allianz Global Investors GmbH also has established representative offices in the Kingdom of Bahrain (Bahrain), Portugal (Lisbon) and S ...

Celsion Corporation Announces $5.4 Million Registered Direct

... prospectus supplement and the accompanying prospectus relating to the securities being offered may also be obtained, when available, from Oppenheimer & Co. Inc. Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8563, or by email ...

... prospectus supplement and the accompanying prospectus relating to the securities being offered may also be obtained, when available, from Oppenheimer & Co. Inc. Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8563, or by email ...

Answers to Workshop 9

... (f) What is the new equilibrium level of national income in February 2011? ................... £1020bn (g) What is the rate of inflation in February 2011? ...... 5% (Price index goes up from 100 to 105) Assume that over the following 12 months aggregate demand rises by a further £50 billion at all p ...

... (f) What is the new equilibrium level of national income in February 2011? ................... £1020bn (g) What is the rate of inflation in February 2011? ...... 5% (Price index goes up from 100 to 105) Assume that over the following 12 months aggregate demand rises by a further £50 billion at all p ...

Document

... We talked about how you can forecast revenue by taking analyst estimates for the next 5 years, reading their report on why they picked their numbers, then using your own opinion about the company to adjust the projection accordingly. ...

... We talked about how you can forecast revenue by taking analyst estimates for the next 5 years, reading their report on why they picked their numbers, then using your own opinion about the company to adjust the projection accordingly. ...

Life Settlements as an Asset Class

... policy increases (since the insured has a statistically lower life expectancy). With the help of Brookfield Insurance Partners, you can resell the policy into the open market and potentially make a profit on a policy “flip”. If at any time you need to liquidate your position in a policy, you have th ...

... policy increases (since the insured has a statistically lower life expectancy). With the help of Brookfield Insurance Partners, you can resell the policy into the open market and potentially make a profit on a policy “flip”. If at any time you need to liquidate your position in a policy, you have th ...

end of the golden age? - Virtus Investment Partners

... bedrock of investment decisions, rather than one where allocating among equities, bonds, and other asset classes does. This shift should apply to all investors, be they pension plans, companies, or individuals, regardless of whether they are aiming to obtain consistent capital appreciation, regular ...

... bedrock of investment decisions, rather than one where allocating among equities, bonds, and other asset classes does. This shift should apply to all investors, be they pension plans, companies, or individuals, regardless of whether they are aiming to obtain consistent capital appreciation, regular ...

Document

... 1. Identifies the amount of preferred dividends deducted to determine the income available to When a corporation reports its basic and common stockholders. diluted earnings per share on its income 2. Describes the potential common shares that were statement, it also required to make not included in ...

... 1. Identifies the amount of preferred dividends deducted to determine the income available to When a corporation reports its basic and common stockholders. diluted earnings per share on its income 2. Describes the potential common shares that were statement, it also required to make not included in ...

Reading - Willis Investment Counsel

... margins and positive abnormal stock returns. Said another way, the strong companies got ...

... margins and positive abnormal stock returns. Said another way, the strong companies got ...

Major Points

... Finance is closely related to the fields of accounting and economics. From accounting we get financial statements and other tools for measuring financial values. From economics we get such philosophical ideas as value maximization (in fact, finance generally is seen as a branch of economics). While ...

... Finance is closely related to the fields of accounting and economics. From accounting we get financial statements and other tools for measuring financial values. From economics we get such philosophical ideas as value maximization (in fact, finance generally is seen as a branch of economics). While ...