The Causes of the Japanese Lost Decade: An Extension of

... spurred by the combined effects of the boom in asset prices and the lax lending policies of banks. The collapse of the asset price bubble was followed by a sharp decline in domestic demand. Investment contracted particularly as returns to capital dropped. Investment by small and medium-sized enterpr ...

... spurred by the combined effects of the boom in asset prices and the lax lending policies of banks. The collapse of the asset price bubble was followed by a sharp decline in domestic demand. Investment contracted particularly as returns to capital dropped. Investment by small and medium-sized enterpr ...

Innovations in Financial Engineering Solution to Homework One 3

... 6. In this case σ = 0.25, δt = 1, r = 0.05 and the tree parameters are u = 1.2840, d = 0.7788, a = 1.0513, p = 0.5394, and 1 − p = 0.4606. The upper number at each node is the stock price, the second number is the equity component of the value, the third number is the debt component of the value, an ...

... 6. In this case σ = 0.25, δt = 1, r = 0.05 and the tree parameters are u = 1.2840, d = 0.7788, a = 1.0513, p = 0.5394, and 1 − p = 0.4606. The upper number at each node is the stock price, the second number is the equity component of the value, the third number is the debt component of the value, an ...

In general, equities have outperformed bonds this

... quickly than is currently priced in. Personally I can see the Fed Funds rate at between 2% and 3% sometime in 2017 and perhaps higher. Since the early 1980s, the average total move from trough to peak in the Fed Funds rate has been 325 basis points and tightening cycles have lasted between 1 and 3 y ...

... quickly than is currently priced in. Personally I can see the Fed Funds rate at between 2% and 3% sometime in 2017 and perhaps higher. Since the early 1980s, the average total move from trough to peak in the Fed Funds rate has been 325 basis points and tightening cycles have lasted between 1 and 3 y ...

chapter 12 - Routledge

... Become familiar with terminology and principles associated with RPM performance evaluation Understand that performance analysis approaches will vary between retailers Appreciate the contribution that cost control and shrinkage control can make to financial performance Understand how customers evalua ...

... Become familiar with terminology and principles associated with RPM performance evaluation Understand that performance analysis approaches will vary between retailers Appreciate the contribution that cost control and shrinkage control can make to financial performance Understand how customers evalua ...

No Slide Title

... – Health and education cheap in developing countries – China’s improvement in life expectency all came before 1979 (no improvement since then) ...

... – Health and education cheap in developing countries – China’s improvement in life expectency all came before 1979 (no improvement since then) ...

Weekly Review Quiz as of 2008-08-14

... d) provide up to $200 billion in capital to restore the financial health of Fannie Mae and Freddie Mac * e) all of the above 4. As a part of its intervention, the Treasury a) said it would buy on the open market at least $5 billion of new mortgage-backed securities issued by Fannie and Freddie b) ag ...

... d) provide up to $200 billion in capital to restore the financial health of Fannie Mae and Freddie Mac * e) all of the above 4. As a part of its intervention, the Treasury a) said it would buy on the open market at least $5 billion of new mortgage-backed securities issued by Fannie and Freddie b) ag ...

CHAPTER 9 The Cost of Capital

... ks is the marginal cost of common equity using retained earnings. The rate of return investors require on the firm’s common equity using new equity is ke. ...

... ks is the marginal cost of common equity using retained earnings. The rate of return investors require on the firm’s common equity using new equity is ke. ...

Appendix 5

... otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests in the CIS. An issuer which is not a company should adapt this form as necessary to change references that apply only to companies. To: The Head o ...

... otherwise agreed by the Exchange, prior to the date on which it is expected that the Exchange will consider approving the listing of additional interests in the CIS. An issuer which is not a company should adapt this form as necessary to change references that apply only to companies. To: The Head o ...

Note 22 - Measurement of fair value of financial instruments

... market price utilised for financial assets is the applicable buy price, for financial liabilities the applicable sell price is used. These instruments are included in level 1. Instruments included in level 1 are exclusively equity instruments quoted on the Oslo Stock Exchange and classified as held ...

... market price utilised for financial assets is the applicable buy price, for financial liabilities the applicable sell price is used. These instruments are included in level 1. Instruments included in level 1 are exclusively equity instruments quoted on the Oslo Stock Exchange and classified as held ...

2007 JAN - CI Investments

... large pools of under-employed and/or underpaid labour encourages companies to arbitrage wage differentials across countries boosting profit margins while creating unemployment in higher-wage operating regions. Moreover, with free trade and increased global integration, several sheltered industries i ...

... large pools of under-employed and/or underpaid labour encourages companies to arbitrage wage differentials across countries boosting profit margins while creating unemployment in higher-wage operating regions. Moreover, with free trade and increased global integration, several sheltered industries i ...

Code Of Corporate Disclosure Practices For Prevention Of Insider

... All the stock exchanges where the Securities of the Company are listed are required to be informed well in advance the name and address of the Compliance Officer to whom the exchanges may refer any market rumours for verification. Such a communication to the stock exchange may include fax number, te ...

... All the stock exchanges where the Securities of the Company are listed are required to be informed well in advance the name and address of the Compliance Officer to whom the exchanges may refer any market rumours for verification. Such a communication to the stock exchange may include fax number, te ...

Statement of Investment Objectives, Policies and Guidelines For The

... The primary objective of the Section’s Investment Program is to provide sufficient Reserve funds while growing the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to th ...

... The primary objective of the Section’s Investment Program is to provide sufficient Reserve funds while growing the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to th ...

Buoyant economy, buoyant bond issuance

... The New Zealand Fixed Income Commentary is given in good faith and has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation but its accuracy and completeness is not guaranteed. Information and any analysis, opinions or v ...

... The New Zealand Fixed Income Commentary is given in good faith and has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation but its accuracy and completeness is not guaranteed. Information and any analysis, opinions or v ...

top fund fortissimo - (c)

... Amount by which the price of a convertible security exceeds the current market value of the common stock into which it may be converted. Convexity Convexity measures the sensitivity of the price to interest rate fluctuations. Generally, bonds exhibit positive convexity. Coupon A certificate attached ...

... Amount by which the price of a convertible security exceeds the current market value of the common stock into which it may be converted. Convexity Convexity measures the sensitivity of the price to interest rate fluctuations. Generally, bonds exhibit positive convexity. Coupon A certificate attached ...

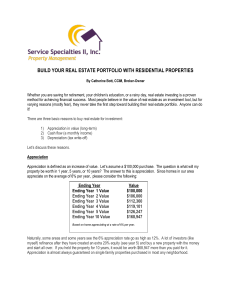

as PDF

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

... Naturally, some areas and some years see the 6% appreciation rate go as high as 12%. A lot of investors (like myself) refinance after they have created an extra 20% equity (see year 5) and buy a new property with the money and start all over. If you held the property for 10 years, it would be worth ...

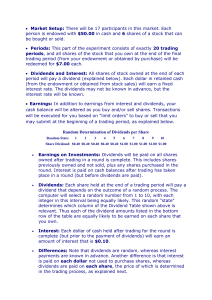

Experimental Instructions

... Limit Orders to Buy or Sell: At the beginning of a trading period, those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and th ...

... Limit Orders to Buy or Sell: At the beginning of a trading period, those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and th ...

1 Quarterly Commentary December 2015 Wishing all our clients a

... Amazon has also hardly ever declared a profit, and it trades at a P/E Ratio of over 900. The China Enterprises Index trades at an average PE ratio of 7.13 times earnings. Furthermore, Amazon has never declared a dividend – the China Enterprises Index generates an USD4.25% dividend every year for its ...

... Amazon has also hardly ever declared a profit, and it trades at a P/E Ratio of over 900. The China Enterprises Index trades at an average PE ratio of 7.13 times earnings. Furthermore, Amazon has never declared a dividend – the China Enterprises Index generates an USD4.25% dividend every year for its ...

overweight europe consider sectors european small

... at the end of 2011, a positive sign for active managers. Lower correlations can improve active returns for skilled managers and present opportunities for adding value. Active management primarily makes sense when an asset manager is managing a complex strategy that invests in less-widely researched ...

... at the end of 2011, a positive sign for active managers. Lower correlations can improve active returns for skilled managers and present opportunities for adding value. Active management primarily makes sense when an asset manager is managing a complex strategy that invests in less-widely researched ...

N1DM01 - The University of Nottingham

... and profit until such projects are finished. The Novotel project is 95% complete. On completion it is expected that the contract price of £40million will be settled and that the company will make £10million profit. The company’s directors are coming under increased pressure to outperform its competi ...

... and profit until such projects are finished. The Novotel project is 95% complete. On completion it is expected that the contract price of £40million will be settled and that the company will make £10million profit. The company’s directors are coming under increased pressure to outperform its competi ...

Standards and Analysis: Part II - National Farm Viability Conference

... + Accrual Income - Accrual Expense - Depreciation NFIFO - Owner Draw ...

... + Accrual Income - Accrual Expense - Depreciation NFIFO - Owner Draw ...

POLICY CONFUSION, CROWDED TRADES, AND A RISE IN Highlights

... As we begin to see nascent signs of wage inflation, there are also secular dynamics at play (in the energy sector, in particular) that are creating what might be termed “positive disinflation.” Specifically, since mid-2014 we have seen commodity prices decline across the board, resulting in an effec ...

... As we begin to see nascent signs of wage inflation, there are also secular dynamics at play (in the energy sector, in particular) that are creating what might be termed “positive disinflation.” Specifically, since mid-2014 we have seen commodity prices decline across the board, resulting in an effec ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...