Private Placements and Infrastructure Finance.qxp

... are uncovered by delving further into the fixed income markets. It is likely that the majority of readers will have never considered assets such as private placements and project and infrastructure finance in any form. These assets are commonly accused of being illiquid, expensive to access and unra ...

... are uncovered by delving further into the fixed income markets. It is likely that the majority of readers will have never considered assets such as private placements and project and infrastructure finance in any form. These assets are commonly accused of being illiquid, expensive to access and unra ...

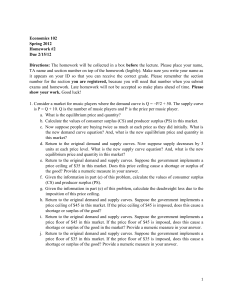

Economics 102 Spring 2012 Homework #2 Due 2/15/12 Directions

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

... number for the section you are registered, because you will need that number when you submit exams and homework. Late homework will not be accepted so make plans ahead of time. Please show your work. Good luck! 1. Consider a market for music players where the demand curve is Q = P/2 + 50. The suppl ...

I_Ch03

... – Stop orders (停損委託單) Stop-loss (buy) orders specify that a stock share should be sold (bought) immediately when its price falls below (rises above) a limit In other words, investors who send stop-loss (stop-buy) orders will sell (buy) shares equal to or lower (higher) than the specified limit Once ...

... – Stop orders (停損委託單) Stop-loss (buy) orders specify that a stock share should be sold (bought) immediately when its price falls below (rises above) a limit In other words, investors who send stop-loss (stop-buy) orders will sell (buy) shares equal to or lower (higher) than the specified limit Once ...

Corporate bonds

... portions known as shares Dividend: profit paid to shareholders Common stock provides shareholders with a voice in how the company is run and a share in any potential dividends Preferred stock provides guaranteed dividends— paid before any received by holders of common stock—but does not grant shareh ...

... portions known as shares Dividend: profit paid to shareholders Common stock provides shareholders with a voice in how the company is run and a share in any potential dividends Preferred stock provides guaranteed dividends— paid before any received by holders of common stock—but does not grant shareh ...

Market Insights - Quarterly outlook

... LGIM is authorised and regulated by the Financial Conduct Authority. This document is designed for our corporate clients and for the use of professional advisers and agents of Legal & General. The views expressed within this document are those of Legal & General Investment Management, who may or may ...

... LGIM is authorised and regulated by the Financial Conduct Authority. This document is designed for our corporate clients and for the use of professional advisers and agents of Legal & General. The views expressed within this document are those of Legal & General Investment Management, who may or may ...

Developing a Financial Planning Model

... The balance-sheet item which will “close” or balance the balance sheet model so that Total Assets will always equal Total Liabilities & Equity Models the assumption of how the firm finances itself Examples are cash & marketable securities, debt, debt & equity See Plugs.xlsx ...

... The balance-sheet item which will “close” or balance the balance sheet model so that Total Assets will always equal Total Liabilities & Equity Models the assumption of how the firm finances itself Examples are cash & marketable securities, debt, debt & equity See Plugs.xlsx ...

Price Dispersion in OTC Markets: A New

... standard deviation of 71.85 bp → no economically significant bias. • Price dispersion measure (i.e. root mean squared difference) is 49.94 bp with a standard deviation of 63.36 bp. • Market-wide average bid-ask spread is only 35.90 bp with a standard deviation of 23.73 bp. • Overall, we find signifi ...

... standard deviation of 71.85 bp → no economically significant bias. • Price dispersion measure (i.e. root mean squared difference) is 49.94 bp with a standard deviation of 63.36 bp. • Market-wide average bid-ask spread is only 35.90 bp with a standard deviation of 23.73 bp. • Overall, we find signifi ...

7-22-11-vandenberg-presentation-2

... company), and Stein Roe Investment Counsel, Inc. (a registered investment adviser), both of which are wholly-owned subsidiaries of Atlantic Trust Group, Inc. This document is intended for educational purposes only and the material presented should not be construed as an offer or recommendation to bu ...

... company), and Stein Roe Investment Counsel, Inc. (a registered investment adviser), both of which are wholly-owned subsidiaries of Atlantic Trust Group, Inc. This document is intended for educational purposes only and the material presented should not be construed as an offer or recommendation to bu ...

Hot Wire - December 2011

... cost and profit associated with manufacturing and distributing the product. If two suppliers quote product, one with a COMEX copper adder and another with a Camden copper adder, all other things equal, the supplier quoting COMEX will sell at a higher base price. The COMEX supplier must use a higher ...

... cost and profit associated with manufacturing and distributing the product. If two suppliers quote product, one with a COMEX copper adder and another with a Camden copper adder, all other things equal, the supplier quoting COMEX will sell at a higher base price. The COMEX supplier must use a higher ...

Short-Term Income Fund - Investor Fact Sheet

... The fund is not a “money market” mutual fund. Some money market mutual funds attempt to maintain a stable net asset value through compliance with relevant Securities and Exchange Commission (SEC) rules. The fund is not governed by those rules, and its shares will fluctuate in value. Definitions The ...

... The fund is not a “money market” mutual fund. Some money market mutual funds attempt to maintain a stable net asset value through compliance with relevant Securities and Exchange Commission (SEC) rules. The fund is not governed by those rules, and its shares will fluctuate in value. Definitions The ...

Slide 1

... investment managers. Brand and past performance are unreliable predictors of future performance 3. Diversification leads to more consistent investment outcomes ...

... investment managers. Brand and past performance are unreliable predictors of future performance 3. Diversification leads to more consistent investment outcomes ...

First Quarter 2015 Securities Markets Commentary Index

... The American economy limped its way forward into 2015, chaotic yet cautious, ears perked to catch every last utterance of Federal Reserve Chair Janet Yellen. Here at home the effects of the dramatic drop in the price of oil continue to reverberate. At one point in March the price per barrel fell to ...

... The American economy limped its way forward into 2015, chaotic yet cautious, ears perked to catch every last utterance of Federal Reserve Chair Janet Yellen. Here at home the effects of the dramatic drop in the price of oil continue to reverberate. At one point in March the price per barrel fell to ...

Overview

... previous research, with very low incremental information being provided by lagged oil prices. This suggests that some results in previous literature may be a result of failing to model dynamics thoroughly. ...

... previous research, with very low incremental information being provided by lagged oil prices. This suggests that some results in previous literature may be a result of failing to model dynamics thoroughly. ...

Research on the Relationship Between Financial Structure and

... system seems more important for the economic growth of Shanghai and Shannxi. The coefficient for Zhejing is positive, which means that in open economy market-based financial system seems more important for the economic growth of Zhejiang. The coefficient of both FS and FD for Jiangsu is statisticall ...

... system seems more important for the economic growth of Shanghai and Shannxi. The coefficient for Zhejing is positive, which means that in open economy market-based financial system seems more important for the economic growth of Zhejiang. The coefficient of both FS and FD for Jiangsu is statisticall ...

9.4 Predation

... in the market in question, it can be seen as a sign of “weakness”. This may encourage other firms to enter the market in question and/or other markets, because potential entrants anticipate that, rather than being preyed upon, they will make profits in those markets or else will be bought out at goo ...

... in the market in question, it can be seen as a sign of “weakness”. This may encourage other firms to enter the market in question and/or other markets, because potential entrants anticipate that, rather than being preyed upon, they will make profits in those markets or else will be bought out at goo ...

Chapter 22 - The Citadel

... But this has not served as much of a stimulus, because the other legal and financial requirements applying to new businesses are more of an impediment. Slide 22-21 ...

... But this has not served as much of a stimulus, because the other legal and financial requirements applying to new businesses are more of an impediment. Slide 22-21 ...

Are markets anticipating a new world order?

... The elements contained in this document have been prepared solely for the purpose of information and do not constitute an offer, in particular a prospectus or any invitation to treat, buy or sell any security or to participate in any trading strategy. This document is intended only for MiFID profess ...

... The elements contained in this document have been prepared solely for the purpose of information and do not constitute an offer, in particular a prospectus or any invitation to treat, buy or sell any security or to participate in any trading strategy. This document is intended only for MiFID profess ...

Real estate as a long-term investment plays vital economic role

... leads to large influxes of capital which drive real estate ...

... leads to large influxes of capital which drive real estate ...

Introduction

... • Arbitrageurs Some of the large trading losses in derivatives occurred because individuals who had a mandate to hedge risks switched to being speculators (See Chapter 21) ...

... • Arbitrageurs Some of the large trading losses in derivatives occurred because individuals who had a mandate to hedge risks switched to being speculators (See Chapter 21) ...

Electricity Markets Market Power Definition Monopoly Power

... Exercise occurs in RT markets Waiting for a better price is not possible in RT, contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the pr ...

... Exercise occurs in RT markets Waiting for a better price is not possible in RT, contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the pr ...