A KEY TO CAPITAL MARKETS IN EMERGING COUNTRIES

... provide domestic capital, at longer maturities and denominated local currency make EMs less vulnerable to external financial shocks ...

... provide domestic capital, at longer maturities and denominated local currency make EMs less vulnerable to external financial shocks ...

Earnings Index Methodology

... Note: all sector cappings are conducted based on the old GICS sector classifications, i.e. real estate and financials are aggregated into one sector. The following liquidity adjustment factors will be applied to all the Indexes after top holdings and sector caps have been applied. ...

... Note: all sector cappings are conducted based on the old GICS sector classifications, i.e. real estate and financials are aggregated into one sector. The following liquidity adjustment factors will be applied to all the Indexes after top holdings and sector caps have been applied. ...

Sample title for chapter 1

... • Only way to retain power in long run is by becoming sensitive to shareholder concerns • Sufficient stock option incentives to motivate achievement of market value maximization • Powerful institutional investors are making management more responsive to shareholders ...

... • Only way to retain power in long run is by becoming sensitive to shareholder concerns • Sufficient stock option incentives to motivate achievement of market value maximization • Powerful institutional investors are making management more responsive to shareholders ...

- Lotus Live Projects

... This study tries to analyze the relation between BSE sensex with NASDAQ. When BSE sensex increases to new highs questions arises that weather there is an increase in other world stock market or not, I tried to find out the correlation between BSE sensex with NASDAQ For this purpose I have collected ...

... This study tries to analyze the relation between BSE sensex with NASDAQ. When BSE sensex increases to new highs questions arises that weather there is an increase in other world stock market or not, I tried to find out the correlation between BSE sensex with NASDAQ For this purpose I have collected ...

1 Newsletter no. 42 “V”, “ W” OR SQUARE ROOT? During times of

... 47% drop, helped by a little “medicine”, the market rebounded, but earnings growth was kept in check as a result of rising inflation (or costs). The S&P500 high of 1973 was not surpassed until 1980 while the TSX broke its 1973 high in 1979. History also shows that the Canadian market outperforms its ...

... 47% drop, helped by a little “medicine”, the market rebounded, but earnings growth was kept in check as a result of rising inflation (or costs). The S&P500 high of 1973 was not surpassed until 1980 while the TSX broke its 1973 high in 1979. History also shows that the Canadian market outperforms its ...

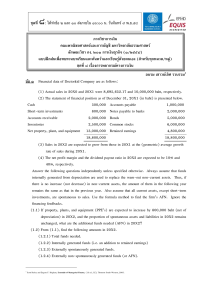

อบรม เชาวน์เลิศ รวบรวม1 ข้อ ๑ Financial data of Doctorkid Company

... หมายเหตุสําหรับข้อ ๓ – ๙ Profit margin ในข้ อ ๓ – ๙ (ถ้ ามีการกล่าวถึง) หมายถึง Net profit margin ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (- ...

... หมายเหตุสําหรับข้อ ๓ – ๙ Profit margin ในข้ อ ๓ – ๙ (ถ้ ามีการกล่าวถึง) หมายถึง Net profit margin ข้อ ๓ Suppose a firm makes the following policy changes. If the change means that external, nonspontaneous financial requirements (AFN) will increase, indicate this by a (+); indicate a decrease by a (- ...

Chapter 7 12

... For any investment, we can find the opportunity cost of capital using the security market line. With = 0.8, the opportunity cost of capital is: r = rf + (rm – rf) r = 0.04 + [0.8 (0.12 – 0.04)] = 0.104 = 10.4% The opportunity cost of capital is 10.4% and the investment is expected to earn 9.8%. ...

... For any investment, we can find the opportunity cost of capital using the security market line. With = 0.8, the opportunity cost of capital is: r = rf + (rm – rf) r = 0.04 + [0.8 (0.12 – 0.04)] = 0.104 = 10.4% The opportunity cost of capital is 10.4% and the investment is expected to earn 9.8%. ...

Be Careful of What You Think You Know

... investors, looking at the global landscape, we prefer US fixed income markets over those in Europe and Japan on a relative basis given the largely negative yields on offer in those markets. Against a backdrop of fairly conservative US corporate balance sheets, we favor a mix of high-grade and high-y ...

... investors, looking at the global landscape, we prefer US fixed income markets over those in Europe and Japan on a relative basis given the largely negative yields on offer in those markets. Against a backdrop of fairly conservative US corporate balance sheets, we favor a mix of high-grade and high-y ...

A Multiple Lender Approach to Understanding Supply and Search in

... The S.E.C., which also filed civil fraud allegations, says the actions brought in $12 million for the traders. This is a $700 million [sic] market, according to calculations by Vodia Group, a research firm, but one that is so hidden from view that this suspected fraud could go on for more than five ...

... The S.E.C., which also filed civil fraud allegations, says the actions brought in $12 million for the traders. This is a $700 million [sic] market, according to calculations by Vodia Group, a research firm, but one that is so hidden from view that this suspected fraud could go on for more than five ...

"To improve the financing of our economy, we should further

... “The direction we need to take is clear: to build a single market for capital from the bottom up, identifying barriers and knocking them down one by one. Capital Markets Union is about unlocking liquidity that is abundant, but currently frozen and putting it to work in support of Europe's businesses ...

... “The direction we need to take is clear: to build a single market for capital from the bottom up, identifying barriers and knocking them down one by one. Capital Markets Union is about unlocking liquidity that is abundant, but currently frozen and putting it to work in support of Europe's businesses ...

IBM announces 50 percent increase in quarterly dividend

... Q. Why did the IBM Board increase the dividend ? A. The IBM Board has approved dividend increases in each of the last eleven years. This year the Board recognized IBM´s growing cash flow, strong financial condition and elected to increase the return to shareholders in the form of a dividend. The div ...

... Q. Why did the IBM Board increase the dividend ? A. The IBM Board has approved dividend increases in each of the last eleven years. This year the Board recognized IBM´s growing cash flow, strong financial condition and elected to increase the return to shareholders in the form of a dividend. The div ...

Gradual Return to Normalcy for Bond Markets Expected

... Treasury bonds over the next two to three years. “These low Treasury yields will get eaten up by inflation when we return to a more normal economic environment.” Still, Mr. Tiberii advises caution because “the economic cloud on the horizon looks very bad and could potentially push defaults or downgr ...

... Treasury bonds over the next two to three years. “These low Treasury yields will get eaten up by inflation when we return to a more normal economic environment.” Still, Mr. Tiberii advises caution because “the economic cloud on the horizon looks very bad and could potentially push defaults or downgr ...

The Financialization of Commodity Futures Markets Christopher L. Gilbert

... investment theory looks at financial assets in terms of how they impact the risk-returns profile of an overall investment portfolio, not the individual risk-returns characteristics. Through asset diversification, an investor can increase the expected return holding risk constant, or equivalently red ...

... investment theory looks at financial assets in terms of how they impact the risk-returns profile of an overall investment portfolio, not the individual risk-returns characteristics. Through asset diversification, an investor can increase the expected return holding risk constant, or equivalently red ...

The Efficiency of Developed Markets

... Market represents that all marketable assets reflect new released information in relevant market immediately [7]. In other words, it is impossible to beat the market by using information which has been already known or used in the market [8]. However, many studies show, specifically last three decad ...

... Market represents that all marketable assets reflect new released information in relevant market immediately [7]. In other words, it is impossible to beat the market by using information which has been already known or used in the market [8]. However, many studies show, specifically last three decad ...

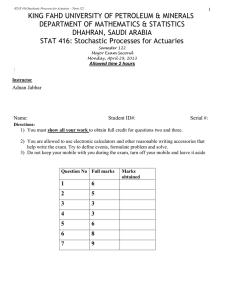

Exam2 - Academic Information System (KFUPM AISYS)

... Consider an apple juice company controls 20% of the apple market. Suppose they hire a market research company to predict the effect on an aggressive advertisement campaign. Suppose they conclude: someone using brand A will stay with brand A with 90% probability. Someone not using brand A switch to b ...

... Consider an apple juice company controls 20% of the apple market. Suppose they hire a market research company to predict the effect on an aggressive advertisement campaign. Suppose they conclude: someone using brand A will stay with brand A with 90% probability. Someone not using brand A switch to b ...

Project Conference: The Future of National Development Banks

... strategies. Also growing rapidly are Sovereign Wealth Funds (SWFs), with assets under management at end 2011 exceeding US$5 trillion. (G ...

... strategies. Also growing rapidly are Sovereign Wealth Funds (SWFs), with assets under management at end 2011 exceeding US$5 trillion. (G ...