CHAPTER 9 The Cost of Capital

... Flotation costs are highest for common equity. However, since most firms issue equity infrequently, We will frequently ignore flotation costs when calculating the WACC. ...

... Flotation costs are highest for common equity. However, since most firms issue equity infrequently, We will frequently ignore flotation costs when calculating the WACC. ...

Montshire Advisors` Federal Home Loan Bank Program White Paper

... Due to the improvement in financial flexibility and liquidity, rating agencies generally view membership as a credit positive for insurance companies that become members and plan a conservative amount of borrowing. The credit impact of borrowings is considered with respect to the magnitude and plann ...

... Due to the improvement in financial flexibility and liquidity, rating agencies generally view membership as a credit positive for insurance companies that become members and plan a conservative amount of borrowing. The credit impact of borrowings is considered with respect to the magnitude and plann ...

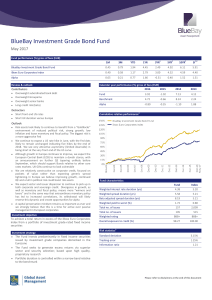

BlueBay Investment Grade Bond Fund

... has led to increased correlations, its withdrawal will likely reverse this dynamic and create opportunities for alpha A capital preservation mindset remains as important as ever and we strongly believe that this is a time for active over passive management in European corporates ...

... has led to increased correlations, its withdrawal will likely reverse this dynamic and create opportunities for alpha A capital preservation mindset remains as important as ever and we strongly believe that this is a time for active over passive management in European corporates ...

SIS Performance versus Benchmark to 31 March 2016

... into unlisted property and infrastructure. These changes will assist to reduce the volatility of the funds and aims to enhance the income returns for our customers. If you would like to add to your portfolio, you may do so at any time. Please contact Elaine Pringle (08) 8226 1746 for more informatio ...

... into unlisted property and infrastructure. These changes will assist to reduce the volatility of the funds and aims to enhance the income returns for our customers. If you would like to add to your portfolio, you may do so at any time. Please contact Elaine Pringle (08) 8226 1746 for more informatio ...

Changes in the investor base for Emerging Market public debt: What

... EM local currency debt markets were also supported by the view that EM currencies will strengthen given EM’s growth differential with developed markets and their lower level of government debt. There is limited systematic information available that provides color on how institutional investors (pens ...

... EM local currency debt markets were also supported by the view that EM currencies will strengthen given EM’s growth differential with developed markets and their lower level of government debt. There is limited systematic information available that provides color on how institutional investors (pens ...

Slide 1

... We have looked at a single asset manager, now we explore the case of multiple managers trading the same asset N agents, they “share” the liquidity option, the impact on the given asset ...

... We have looked at a single asset manager, now we explore the case of multiple managers trading the same asset N agents, they “share” the liquidity option, the impact on the given asset ...

PDF - EMM Wealth Management

... investors. Short-term, risk-free rates within the developed world remain at historic lows, while investors have clamored for securities that provide high immediate income and the potential to hedge rising rates. This phenomenon ignores the fact that attractive, high-yielding products often hide sign ...

... investors. Short-term, risk-free rates within the developed world remain at historic lows, while investors have clamored for securities that provide high immediate income and the potential to hedge rising rates. This phenomenon ignores the fact that attractive, high-yielding products often hide sign ...

Asset Allocation and Diversification

... Aim to get the right eggs in the right baskets. Asset Allocation is a term that describes how much money you have invested in each of the main investment asset classes; Cash and Fixed Income/ Interest, Property and Shares/Equities. How you decide to split your investments between these categories wi ...

... Aim to get the right eggs in the right baskets. Asset Allocation is a term that describes how much money you have invested in each of the main investment asset classes; Cash and Fixed Income/ Interest, Property and Shares/Equities. How you decide to split your investments between these categories wi ...

Homework #5

... from the government in order to be willing to produce the socially optimal amount of the good? c. Suppose this industry is regulated as a natural monopoly and the regulators set price so that the natural monopolist breaks even. What will be the price, quantity, and level of profits for the natural m ...

... from the government in order to be willing to produce the socially optimal amount of the good? c. Suppose this industry is regulated as a natural monopoly and the regulators set price so that the natural monopolist breaks even. What will be the price, quantity, and level of profits for the natural m ...

Clinton Vs. Trump

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

The Efficient Markets Hypothesis

... E rt E rt | t zt 0 t Tests of Efficient Markets Hypothesis Does the market efficiently process information? What is information? ...

... E rt E rt | t zt 0 t Tests of Efficient Markets Hypothesis Does the market efficiently process information? What is information? ...

CORPORATE FINANCE

... where outflows, rather than inflows, are being discounted. 13 percent; the firm’s cost of capital should not be adjusted when evaluating outflow only projects. 16 percent; since A is more risky, its cash flows should be discounted at a higher rate, because this correctly penalizes the project for it ...

... where outflows, rather than inflows, are being discounted. 13 percent; the firm’s cost of capital should not be adjusted when evaluating outflow only projects. 16 percent; since A is more risky, its cash flows should be discounted at a higher rate, because this correctly penalizes the project for it ...

Finance Policy Supporting Organization

... measured against standard specific benchmarks. Specific total rate of return goals are expected to be met on a cumulative basis over a 3-5 year time period and shall be evaluated accordingly. Capital values do fluctuate over shorter periods and the Finance Committee recognizes that the possibility o ...

... measured against standard specific benchmarks. Specific total rate of return goals are expected to be met on a cumulative basis over a 3-5 year time period and shall be evaluated accordingly. Capital values do fluctuate over shorter periods and the Finance Committee recognizes that the possibility o ...

Money Market Securities

... May be used to make sure bid is accepted Price is the weighted average of the accepted competitive ...

... May be used to make sure bid is accepted Price is the weighted average of the accepted competitive ...

Selecting sources of finance for business

... If the required cash cannot be provided in this way then the company should consider its future cash flow. A cash budget can be prepared, but it is probably too detailed at this stage. A cash flow statement as shown in Example 1 would probably be more practical. If the company’s projected cash flow ...

... If the required cash cannot be provided in this way then the company should consider its future cash flow. A cash budget can be prepared, but it is probably too detailed at this stage. A cash flow statement as shown in Example 1 would probably be more practical. If the company’s projected cash flow ...

Financial markets in popular culture

... Gordon Gekko is a famous caricature of a rogue financial markets operator, famous for saying "greed ... is good". Only negative stories about financial markets tend to make the news. The general perception, for those not involved in the world of financial markets is of a place full of crooks and con ...

... Gordon Gekko is a famous caricature of a rogue financial markets operator, famous for saying "greed ... is good". Only negative stories about financial markets tend to make the news. The general perception, for those not involved in the world of financial markets is of a place full of crooks and con ...

Week 4 assignment

... a. Mr. Wayne thinks that the gross margin may shrink to 27.5 percent because of higher purchase prices. He is concerned about what impact this will have on borrowings. It may sound obvious, but understanding gross margin is often overlooked. This can have a direct impact on your ability to effective ...

... a. Mr. Wayne thinks that the gross margin may shrink to 27.5 percent because of higher purchase prices. He is concerned about what impact this will have on borrowings. It may sound obvious, but understanding gross margin is often overlooked. This can have a direct impact on your ability to effective ...

The Implications of the Stock Market Crash and the Philippine

... ted to prevent the further fall of the dollar (which at that time stood at 150 yen). However, the dollar continued to slide meted out a new agreement, calledthe and the Baker statement, delivered immediately before the crash, was interpreted as a breakdown of fhe difficult efforts at coordination, ( ...

... ted to prevent the further fall of the dollar (which at that time stood at 150 yen). However, the dollar continued to slide meted out a new agreement, calledthe and the Baker statement, delivered immediately before the crash, was interpreted as a breakdown of fhe difficult efforts at coordination, ( ...

PDF - Lazard Asset Management

... would be stimulative to the US economy. In our view, this would have two likely outcomes—equity assets with exposure to US growth will be supported, while interest rates would experience upward pressure. The implications are significant for investors in US fixed income, which have been bid up over t ...

... would be stimulative to the US economy. In our view, this would have two likely outcomes—equity assets with exposure to US growth will be supported, while interest rates would experience upward pressure. The implications are significant for investors in US fixed income, which have been bid up over t ...

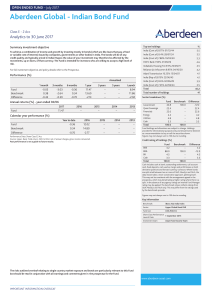

Aberdeen Global - Indian Bond Fund

... Risk factors you should consider before investing: l The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have ...

... Risk factors you should consider before investing: l The value of shares and the income from them can go down as well as up and you may get back less than the amount invested. l Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have ...