ADVANCED DRAINAGE SYSTEMS, INC. (Form: 8-K

... Safe Harbor and Non-GAAP Financial Metrics Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are not ...

... Safe Harbor and Non-GAAP Financial Metrics Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are not ...

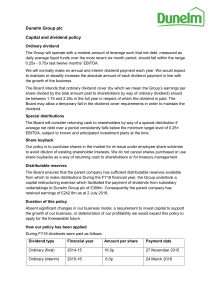

Dunelm Group plc Capital and dividend policy

... The Group will operate with a modest amount of leverage such that net debt, measured as daily average liquid funds over the most recent six month period, should fall within the range 0.25x - 0.75x last twelve months’ EBITDA. We will normally make an annual and interim dividend payment each year. We ...

... The Group will operate with a modest amount of leverage such that net debt, measured as daily average liquid funds over the most recent six month period, should fall within the range 0.25x - 0.75x last twelve months’ EBITDA. We will normally make an annual and interim dividend payment each year. We ...

Corporate Taxation Chapter Three: Capital Structure Professors Wells Presentation:

... 2) Subordination to other corporate debt 3) Debt/equity ratio 4) Convertibility of debt into stock 5) Proportionality in the holdings of the several shareholders Possible bifurcation of the instrument – p.141 ...

... 2) Subordination to other corporate debt 3) Debt/equity ratio 4) Convertibility of debt into stock 5) Proportionality in the holdings of the several shareholders Possible bifurcation of the instrument – p.141 ...

Stock Splits and Stock Dividends: Implications for Bid Ask Spread

... consist to hold a minimal stock at the end of trading day; they seek to reduce this cost to the minimum. The risk of price decline in the inventory of securities generates very high costs, the investor or the market makers must be compensated by supporting this risk. The most used measurement of thi ...

... consist to hold a minimal stock at the end of trading day; they seek to reduce this cost to the minimum. The risk of price decline in the inventory of securities generates very high costs, the investor or the market makers must be compensated by supporting this risk. The most used measurement of thi ...

Kiplinger - American Capital Planning

... 1) Protect your stocks’ gains. Financial advisers get frustrated when there’s a market setback and they hear, “Why didn’t you warn me? That’s what I’m paying you for!” Well, he or she can’t possibly know when this or any other bull market will end. However, we all know that it will end sometime, so ...

... 1) Protect your stocks’ gains. Financial advisers get frustrated when there’s a market setback and they hear, “Why didn’t you warn me? That’s what I’m paying you for!” Well, he or she can’t possibly know when this or any other bull market will end. However, we all know that it will end sometime, so ...

Social Investor Meeting on Responsible Inclusive Finance 2017

... awareness and education. For example, we are working on developing a framework to help understand and measure investment opportunities within inclusive finance for asset owners. The Secretariat will be sharing this tool with investor members to gather their feedback. 4. Issue of taxonomy and rig ...

... awareness and education. For example, we are working on developing a framework to help understand and measure investment opportunities within inclusive finance for asset owners. The Secretariat will be sharing this tool with investor members to gather their feedback. 4. Issue of taxonomy and rig ...

Essay on Agent-Principal Conflicts in Corporations

... rate that reflects the stock’s marginal contribution to the systematic risk of his or her portfolio. This systematic component of risk usually comprises only a small portion of a company’s total risk as measured by the total variability of returns or cash flows. Unlike investors, managers are not we ...

... rate that reflects the stock’s marginal contribution to the systematic risk of his or her portfolio. This systematic component of risk usually comprises only a small portion of a company’s total risk as measured by the total variability of returns or cash flows. Unlike investors, managers are not we ...

2017 Global Market Outlook — Q2 update

... resilience. Japan’s economy remains lackluster, China is balancing slightly better growth against rising interest rates, and both Australia and New Zealand are in reasonable shape. He expects low returns and high volatility across the region. The U.S. dollar still has some limited upside potential, ...

... resilience. Japan’s economy remains lackluster, China is balancing slightly better growth against rising interest rates, and both Australia and New Zealand are in reasonable shape. He expects low returns and high volatility across the region. The U.S. dollar still has some limited upside potential, ...

Chapter 5 Roles for other players

... The business case matrix summarizing those relationships, however, shows that there are several areas where the business case can be further strengthened. Undoubtedly some business benefits exist which are simply not being attributed or reported, which helps to explain ‘holes’ in the matrix. But the ...

... The business case matrix summarizing those relationships, however, shows that there are several areas where the business case can be further strengthened. Undoubtedly some business benefits exist which are simply not being attributed or reported, which helps to explain ‘holes’ in the matrix. But the ...

Schroders Economic and Strategy Viewpoint - September 2014

... risen early to hear the results from Scotland's referendum on independence. In the end, the victory of the pro-union camp was wider than most of the polls had suggested. With an enormous turnout of 84.6%, Scotland backed the union by 55.3% to 44.7%. The immediate reaction was a bounce in GBP against ...

... risen early to hear the results from Scotland's referendum on independence. In the end, the victory of the pro-union camp was wider than most of the polls had suggested. With an enormous turnout of 84.6%, Scotland backed the union by 55.3% to 44.7%. The immediate reaction was a bounce in GBP against ...

The Evolution of Diversification

... Smaller companies tend to perform well in the early stages of economic recovery, with large caps leading the way as the economic cycle starts to mature. This was the case following the market bottom in March 2009, with large-cap stocks only recently beginning to perform more in line with small- and ...

... Smaller companies tend to perform well in the early stages of economic recovery, with large caps leading the way as the economic cycle starts to mature. This was the case following the market bottom in March 2009, with large-cap stocks only recently beginning to perform more in line with small- and ...

Abstract

... identical risk yield the same return regardless of their domicile. During the integration process, emerging market stocks, with diversification potential, are bought by foreign investors, leading to higher prices. At the same time, both local and international investors stop investing in inefficient ...

... identical risk yield the same return regardless of their domicile. During the integration process, emerging market stocks, with diversification potential, are bought by foreign investors, leading to higher prices. At the same time, both local and international investors stop investing in inefficient ...

Chapter 16

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

... However, the efficient market hypothesis states that no such profits exist because events and circumstances that lead to changing profits are usually incremental and partially anticipated in advance. Thus the gains from substantial gaps in the financial markets are rare exceptions rather than common ...

Financial Statement Analysis Paper Example

... In general, the company had a good fiscal year. It improved its ability to generate profit. All three of the main profitability’s ratio (profit margin, return on assets and return on equity) have increased from the previous year; it means that the company is using its resources more efficiently. Con ...

... In general, the company had a good fiscal year. It improved its ability to generate profit. All three of the main profitability’s ratio (profit margin, return on assets and return on equity) have increased from the previous year; it means that the company is using its resources more efficiently. Con ...

1 The Solow Growth Model

... so the smaller is the initial capital stock k (t) the faster is growth. Note that when k (t) = k∗ and the distance from the steady-state is zero, gk (t) = 0 (just substitute k (t) = k∗ in the equation above). Remark: consider two countries with the same parameters, then growth is only determined by ...

... so the smaller is the initial capital stock k (t) the faster is growth. Note that when k (t) = k∗ and the distance from the steady-state is zero, gk (t) = 0 (just substitute k (t) = k∗ in the equation above). Remark: consider two countries with the same parameters, then growth is only determined by ...

A Tactical Handbook of Sector Rotations

... sectors, historically have outperformed the market by roughly 13 percentage points and 7 percentage points respectively, on average, and have done so 86% of the time (Exhibit 2). These sectors do well in part due to industries that benefit from increased borrowing, which includes banks (financials) ...

... sectors, historically have outperformed the market by roughly 13 percentage points and 7 percentage points respectively, on average, and have done so 86% of the time (Exhibit 2). These sectors do well in part due to industries that benefit from increased borrowing, which includes banks (financials) ...

The Capital Asset Pricing model is based on the relationship

... The Capital Asset Pricing model is based on the relationship between a stocks return and the overall market return. The “beta” of a given stock is the slope coefficient, B of the linear regression which is in the form Y = A + BX + where Y is the stock’s return and X is the corresponding market ...

... The Capital Asset Pricing model is based on the relationship between a stocks return and the overall market return. The “beta” of a given stock is the slope coefficient, B of the linear regression which is in the form Y = A + BX + where Y is the stock’s return and X is the corresponding market ...

Final Results - caledonian trust plc

... recognition. Thus the current level of subsidy from the Group is not necessary for the charity's purposes, and, indeed, a transition, carefully modulated to ensure possible deleterious effects are mitigated, will allow the charity to develop into an organisation that can support its causes amongst a ...

... recognition. Thus the current level of subsidy from the Group is not necessary for the charity's purposes, and, indeed, a transition, carefully modulated to ensure possible deleterious effects are mitigated, will allow the charity to develop into an organisation that can support its causes amongst a ...

Financially Speaking

... Australian dollar, and higher interest rates than international peers. It’s hard to see them improving without a radical fall in the Australian dollar. ...

... Australian dollar, and higher interest rates than international peers. It’s hard to see them improving without a radical fall in the Australian dollar. ...