Presented by

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

... Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The ...

Document

... – experts hold their share (do not hedge) aggregate risk Z, market price of risk depends on tf (pt + tp) – with securitization, experts lever up more (as a function of t) and pay themselves sooner ...

... – experts hold their share (do not hedge) aggregate risk Z, market price of risk depends on tf (pt + tp) – with securitization, experts lever up more (as a function of t) and pay themselves sooner ...

International Bond - American Century Investments

... Source: Bloomberg Index Services Ltd. Bloomberg Barclays Global Aggregate Bond ex-USD (Unhedged) is a broad-based measure of the global investment-grade fixed income markets, excluding U.S. dollar-denominated securities. The three major components of this index are the U.S. Aggregate, the Pan-Europe ...

... Source: Bloomberg Index Services Ltd. Bloomberg Barclays Global Aggregate Bond ex-USD (Unhedged) is a broad-based measure of the global investment-grade fixed income markets, excluding U.S. dollar-denominated securities. The three major components of this index are the U.S. Aggregate, the Pan-Europe ...

Schedule 14D-9 - Piedmont Office Realty Trust, Inc.

... Conditions in the credit and financial markets, availability of financing, interest rates, and other factors, all of which are beyond the Company’s control, affect the real estate market and the value of the Company’s assets, which consequently affects the value of your investment in the Company and ...

... Conditions in the credit and financial markets, availability of financing, interest rates, and other factors, all of which are beyond the Company’s control, affect the real estate market and the value of the Company’s assets, which consequently affects the value of your investment in the Company and ...

The Puzzle of UK Business Investment - Speech

... One recent concern is that funds may have been diverted from investment to finance pension fund deficits. In 2005, companies made one-off payments of almost £11 billion to reduce pension deficits, five times more than payments in 2001. In a recent survey of Bank contacts conducted by our Agents, we ...

... One recent concern is that funds may have been diverted from investment to finance pension fund deficits. In 2005, companies made one-off payments of almost £11 billion to reduce pension deficits, five times more than payments in 2001. In a recent survey of Bank contacts conducted by our Agents, we ...

AS 13 - CAalley.com

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...

Competition and Regulation in Trading Arenas

... The trading markets for equities and derivatives are in a state of transition. Both the NYSE and NASDAQ are now private corporations and are behaving as such, as both pursue mergers and alliances across the entire world. 2 Investors can increasingly trade the same security anywhere in the world. Fi ...

... The trading markets for equities and derivatives are in a state of transition. Both the NYSE and NASDAQ are now private corporations and are behaving as such, as both pursue mergers and alliances across the entire world. 2 Investors can increasingly trade the same security anywhere in the world. Fi ...

THE DREYFUS CORPORATION August 11, 2016 Mr. Dale

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

Long-Term Capital Market Assumptions

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

... returns are not always available in sectors such as infrastructure and private equity. To overcome these hurdles, we start with the same multifactor model as described on page 1 to form our assumptions for a public market proxy. We then adjust our assumptions to incorporate a few differences between ...

Market Perspective

... by it. And as the crisis drops out of the 10-year moving average, they will rebound – as a shorter one, for example, has already been doing (figure 2). If anything, this might understate the impact of the GFC on the dynamics of trend growth. Arguably, pre-crisis growth was boosted unsustainably by f ...

... by it. And as the crisis drops out of the 10-year moving average, they will rebound – as a shorter one, for example, has already been doing (figure 2). If anything, this might understate the impact of the GFC on the dynamics of trend growth. Arguably, pre-crisis growth was boosted unsustainably by f ...

Befimmo (Hold - EUR 45.5) Tough times for the Brussels office market

... 1. Full year figures were bang in line with our expectations on all levels. Epra earnings arrived at EUR 5.35, (diluted at EUR 5.15/share) while it stood at EUR 6.6/share last year (-19% YoY). Average financing costs were 3.55% over ’11, while at 2.97% last year. At the ’11 results, Befimmo forecast ...

... 1. Full year figures were bang in line with our expectations on all levels. Epra earnings arrived at EUR 5.35, (diluted at EUR 5.15/share) while it stood at EUR 6.6/share last year (-19% YoY). Average financing costs were 3.55% over ’11, while at 2.97% last year. At the ’11 results, Befimmo forecast ...

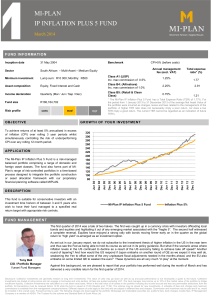

mi-plan ip inflation plus 5 fund

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

Competition - Tiemann Investment Advisors, LLC

... match variations in demand. Think about the production of bread for London or any other city. Somehow, farmers grow about the right amount of wheat. Millers buy that wheat and process it into about the right amount of flour. Bakers buy that flour and bake it into about the right number of loaves of ...

... match variations in demand. Think about the production of bread for London or any other city. Somehow, farmers grow about the right amount of wheat. Millers buy that wheat and process it into about the right amount of flour. Bakers buy that flour and bake it into about the right number of loaves of ...

quarterly update - Strategic Asset Management Group

... Congressional stalemate seems an ongoing condition, unlikely to change, barring one party’s hegemony in the Congress. The fragility of our trading partners and any future strength of the dollar could impact our GDP by as much as one percentage point. Our call is the dollar will attain parity with th ...

... Congressional stalemate seems an ongoing condition, unlikely to change, barring one party’s hegemony in the Congress. The fragility of our trading partners and any future strength of the dollar could impact our GDP by as much as one percentage point. Our call is the dollar will attain parity with th ...

Vietnam Today: GAS leads market higher to break four-day

... year to VND4.88 trillion in the period, PVX said in the mid-term financial statement. Its cash and cash equivalents came up 2.68% from end-2015 to VND896.7 billion as of June 30. Its inventory increased 9.6% to VND5.06 trillion (pvc.vn Sept 07) BCC: to Issue 14.3M New Shares for Dividend Payment Vie ...

... year to VND4.88 trillion in the period, PVX said in the mid-term financial statement. Its cash and cash equivalents came up 2.68% from end-2015 to VND896.7 billion as of June 30. Its inventory increased 9.6% to VND5.06 trillion (pvc.vn Sept 07) BCC: to Issue 14.3M New Shares for Dividend Payment Vie ...

Page 1 Important information This information has been provided by

... objectives, financial situation and needs. You should obtain a Product Disclosure Statement or other disclosure document relating to any financial product issued by MLC Investments Limited (ABN 30 002 641 661) and MLC Nominees Pty Ltd (ABN 93 002 814 959) as trustee of The Universal Super Scheme (AB ...

... objectives, financial situation and needs. You should obtain a Product Disclosure Statement or other disclosure document relating to any financial product issued by MLC Investments Limited (ABN 30 002 641 661) and MLC Nominees Pty Ltd (ABN 93 002 814 959) as trustee of The Universal Super Scheme (AB ...

Managerial Economics

... • Pursuit of market share usually reduces profit • Focusing on profit margin won’t maximize total profit • Maximizing total revenue reduces profit • Cost-plus pricing formulas don’t produce profit-maximizing prices ...

... • Pursuit of market share usually reduces profit • Focusing on profit margin won’t maximize total profit • Maximizing total revenue reduces profit • Cost-plus pricing formulas don’t produce profit-maximizing prices ...

Farm Business Management Part 1

... d. None of the above 22. Pasture cost for beef cattle has been increasing over time. Grazing land can be rented by the per acre cost for the season, or sometimes is paid for by the AUM (animal unit month) which a cow grazing for a months’ time. What is the least expensive way given this info: the pa ...

... d. None of the above 22. Pasture cost for beef cattle has been increasing over time. Grazing land can be rented by the per acre cost for the season, or sometimes is paid for by the AUM (animal unit month) which a cow grazing for a months’ time. What is the least expensive way given this info: the pa ...

Schroders Responsible Investment Report Q1 2015

... We conclude that both the costs and potential benefits are most material across the retail and leisure sectors. Our engagements with companies across these sectors reveal that there are challenges to introducing a living wage. We believe that the feasibility of increasing pay should be understood on ...

... We conclude that both the costs and potential benefits are most material across the retail and leisure sectors. Our engagements with companies across these sectors reveal that there are challenges to introducing a living wage. We believe that the feasibility of increasing pay should be understood on ...

Business Cycle Update Impact of Fed Tightening

... occurred during the early cycle, one during the late cycle). During the mid-cycle, the Fed typically neutralises accommodative monetary conditions by raising rates around 150 basis points (bps) on average, and continues tightening during the late cycle by approximately 75 bps (see Exhibit B, below). ...

... occurred during the early cycle, one during the late cycle). During the mid-cycle, the Fed typically neutralises accommodative monetary conditions by raising rates around 150 basis points (bps) on average, and continues tightening during the late cycle by approximately 75 bps (see Exhibit B, below). ...

INVESTMENT BANKING

... cash flow. The 1st years of an LBO pay down debt Let’s assume in 5 years the firm will still sell an EBITDA multiple of 7.5 times, although this could be higher as debt is paid down. Firm is till valued at 2.25 billion. However, debt is paid down $900 million so equity increased in value by $900 mil ...

... cash flow. The 1st years of an LBO pay down debt Let’s assume in 5 years the firm will still sell an EBITDA multiple of 7.5 times, although this could be higher as debt is paid down. Firm is till valued at 2.25 billion. However, debt is paid down $900 million so equity increased in value by $900 mil ...

LoneStar 529 Fund Allocation Sheet

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...