Intelligence in Securities Finance: Where Is It Going?

... and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every facet of the financing and collateral world. Our feature story covers the exodus o ...

... and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every facet of the financing and collateral world. Our feature story covers the exodus o ...

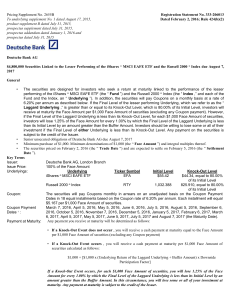

DEUTSCHE BANK AKTIENGESELLSCHAFT (Form

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

... Issuer’s Estimated Value of the Securities The Issuer’s estimated value of the securities is equal to the sum of our valuations of the following two components of the securities: (i) a bond and (ii) an embedded derivative(s). The value of the bond component of the securities is calculated based on ...

Custody of Client Assets

... – If the adviser or one of its related persons actually maintains client funds or securities as a qualified custodian, the adviser must obtain an internal control report from an independent public accountant on an annual basis in addition to the surprise examination. In these cases, the independent ...

... – If the adviser or one of its related persons actually maintains client funds or securities as a qualified custodian, the adviser must obtain an internal control report from an independent public accountant on an annual basis in addition to the surprise examination. In these cases, the independent ...

StarMine Methodology

... awards for Iberia are based on the 2008 calendar-year performance of recommendations and estimates on companies that are based in Spain and Portugal. ...

... awards for Iberia are based on the 2008 calendar-year performance of recommendations and estimates on companies that are based in Spain and Portugal. ...

Document

... 34. A five-year security was purchased two years ago by an investor who plans to resell it. The security will be sold by the investor in the so-called a. secondary market. b. primary market. c. deficit market. d. surplus market. ANS: A ...

... 34. A five-year security was purchased two years ago by an investor who plans to resell it. The security will be sold by the investor in the so-called a. secondary market. b. primary market. c. deficit market. d. surplus market. ANS: A ...

Perfect Legal System of Securities Market Information Disclosure

... client's regulatory costs is the principal agent in order to control the behavior of the costs incurred; (2) agent guarantee costs, it refers to an agent because of against the interests of clients should be given to the client's compensation; (3) the remaining losses, it refers to the agents deviat ...

... client's regulatory costs is the principal agent in order to control the behavior of the costs incurred; (2) agent guarantee costs, it refers to an agent because of against the interests of clients should be given to the client's compensation; (3) the remaining losses, it refers to the agents deviat ...

Interaction Between Value Line`s Timeliness and

... diminished. Exhibit 6 shows the average betas of securities across timeliness and safety ranks. For the sample as a whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 an ...

... diminished. Exhibit 6 shows the average betas of securities across timeliness and safety ranks. For the sample as a whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 an ...

Chapter 8: Tax-Deferred Exchanges

... split between two or more new companies and the stock of each company is distributed to the shareholders in exchange for their stock in the original corporation Original corporation goes out of business Stock can be distributed to shareholders tax-free ...

... split between two or more new companies and the stock of each company is distributed to the shareholders in exchange for their stock in the original corporation Original corporation goes out of business Stock can be distributed to shareholders tax-free ...

() - ETF Securities

... We believe Europe will survive populism, although markets will continue to worry. These concerns will be primarily played-out in the currency markets. By year-end greater clarity over Brexit, the German and French elections and President Trumps ability to enact reform will lead to calm. Populist mov ...

... We believe Europe will survive populism, although markets will continue to worry. These concerns will be primarily played-out in the currency markets. By year-end greater clarity over Brexit, the German and French elections and President Trumps ability to enact reform will lead to calm. Populist mov ...

American Funds® IS US Govt/AAA

... applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that the advisor's usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, ...

... applicable underlying fund prospectus for more complete information regarding investment risks. Active Management The investment is actively managed and subject to the risk that the advisor's usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, ...

schedule 13g - corporate

... Act ”), and any and all rules and regulations promulgated thereunder (including, without limitation, filings pursuant to Rule 144 (Form 144)) or the Securities Exchange Act of 1934, as amended (the “ Exchange Act ”), and any and all rules and regulations promulgated thereunder (including, without li ...

... Act ”), and any and all rules and regulations promulgated thereunder (including, without limitation, filings pursuant to Rule 144 (Form 144)) or the Securities Exchange Act of 1934, as amended (the “ Exchange Act ”), and any and all rules and regulations promulgated thereunder (including, without li ...

Download attachment

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

... The development of a yield curve on a wide range of actively traded debt securities will result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary mar ...

Title Is Times New Roman 28 Pt., Line Spacing .9 Lines

... Source: Morgan Stanley & Co. Research, CIRA, Bloomberg, Morgan Stanley Smith Barney LLC. Data as of December 2011. Estimates of future performance are based on assumptions that may not be realized. This material is not a solicitation of any offer to buy or sell any security or other financial instru ...

... Source: Morgan Stanley & Co. Research, CIRA, Bloomberg, Morgan Stanley Smith Barney LLC. Data as of December 2011. Estimates of future performance are based on assumptions that may not be realized. This material is not a solicitation of any offer to buy or sell any security or other financial instru ...

ENDOLOGIX INC /DE/ (Form: 10-Q, Received: 07/31/2014 13:40:04)

... The accompanying Condensed Consolidated Financial Statements in this Quarterly Report on Form 10-Q have been prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") and the rules and regulations of the U.S. Securities and Exchange Commission ("SE ...

... The accompanying Condensed Consolidated Financial Statements in this Quarterly Report on Form 10-Q have been prepared in accordance with generally accepted accounting principles in the United States of America ("GAAP") and the rules and regulations of the U.S. Securities and Exchange Commission ("SE ...

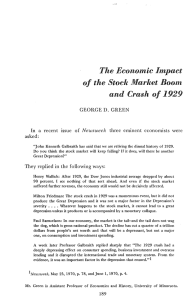

What`s New - Global Financial Data

... smaller declines than the markets that led the 1920s bull market, but their overall decline from their 1920 highs remained substantial. The only markets that came out of the 1929-1932 bear market relatively unscathed were South Africa and Australia. Not only did these markets have smaller declines, ...

... smaller declines than the markets that led the 1920s bull market, but their overall decline from their 1920 highs remained substantial. The only markets that came out of the 1929-1932 bear market relatively unscathed were South Africa and Australia. Not only did these markets have smaller declines, ...

fundamental analysis in security investment and its

... business activities, and both international and national economic indicators, especially, microeconomics and macroeconomics. After having studied these, analysts have a duty to make feasible predictions about core elements, such as, earnings momentum, book and tangible book value of shares, as well ...

... business activities, and both international and national economic indicators, especially, microeconomics and macroeconomics. After having studied these, analysts have a duty to make feasible predictions about core elements, such as, earnings momentum, book and tangible book value of shares, as well ...

The place for listing Alternative Investment Funds

... major holdings and apply to both holders and issuers of shares. Issuers must also take into consideration the reporting obligations foreseen in the Market Abuse Directive concerning particularly the price sensitive information. Open-ended funds should comply with the ongoing obligations required by ...

... major holdings and apply to both holders and issuers of shares. Issuers must also take into consideration the reporting obligations foreseen in the Market Abuse Directive concerning particularly the price sensitive information. Open-ended funds should comply with the ongoing obligations required by ...

BlackRock US Corporate Bond Index Fund

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

information memorandum of anubhav industrial resources

... The Company was incorporated as a Public Limited Company in the year 1985, with the following main objects as powered by the Memorandum of Association of the Company: 1. To carry on the business as traders, dealers, manufactures wholesalers, retailers, combers, scourers, spinners, weavers finishers, ...

... The Company was incorporated as a Public Limited Company in the year 1985, with the following main objects as powered by the Memorandum of Association of the Company: 1. To carry on the business as traders, dealers, manufactures wholesalers, retailers, combers, scourers, spinners, weavers finishers, ...

Market Segmentation, Information Asymmetry

... Shanghai and the Shenzhen Stock Exchanges could only be traded by domestic investors. The only opportunity for foreign participation in the Chinese equity markets was through companies that issued a separate, restricted class of shares for foreigners. In Shanghai or Shenzhen foreign investors could ...

... Shanghai and the Shenzhen Stock Exchanges could only be traded by domestic investors. The only opportunity for foreign participation in the Chinese equity markets was through companies that issued a separate, restricted class of shares for foreigners. In Shanghai or Shenzhen foreign investors could ...

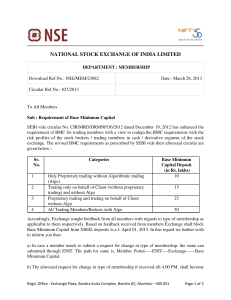

Ref No

... effective on next working day. Accordingly, all requests received after 4.00 PM, shall be processed in next cycle. Example: - In case a request is received for change in type of membership on April 01, 2013 at 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. Apri ...

... effective on next working day. Accordingly, all requests received after 4.00 PM, shall be processed in next cycle. Example: - In case a request is received for change in type of membership on April 01, 2013 at 3.00 PM, the revised BMC requirement shall become effective on next working day i.e. Apri ...

IB Comment Letter to SEC Opposing New Margin Requirements for

... customers who would never consider themselves “day traders” but who may wish to take advantage of a short-term profit (or minimize a short-term loss) by closing out a position quickly. The new rules will be a trap for the unwary for these customers, and the member firms that carry their accounts To ...

... customers who would never consider themselves “day traders” but who may wish to take advantage of a short-term profit (or minimize a short-term loss) by closing out a position quickly. The new rules will be a trap for the unwary for these customers, and the member firms that carry their accounts To ...

MEASURING INVESTMENT RETURNS AND RISKS

... In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it because, on the line, the deviations from the means of each ...

... In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it because, on the line, the deviations from the means of each ...

Limit Orders - Fight Finance

... The limit order book shows the prices at which buyers and sellers are willing to trade at. Traders who submit 'limit orders' will have their order sit in the queue until another trader submits a 'market order' which executes with the limit order. Limit orders are queued by price and then by time. Li ...

... The limit order book shows the prices at which buyers and sellers are willing to trade at. Traders who submit 'limit orders' will have their order sit in the queue until another trader submits a 'market order' which executes with the limit order. Limit orders are queued by price and then by time. Li ...