The Economics of Primary Markets

... of companies to remain private, thereby, reducing the number of IPOs. Little is known about why firms go public and the trade-offs they make in obtaining private versus public capital. It is clear from the discussion in this paper that a more holistic analysis of the transition from private to publi ...

... of companies to remain private, thereby, reducing the number of IPOs. Little is known about why firms go public and the trade-offs they make in obtaining private versus public capital. It is clear from the discussion in this paper that a more holistic analysis of the transition from private to publi ...

Private Equity Investment in Latin America

... economies benefit from an influx of private equity which aims to achieve profits through the long-term growth of target companies, as opposed to more traditional investments in local capital markets which have proven all too often to be speculative and short-term in nature. ...

... economies benefit from an influx of private equity which aims to achieve profits through the long-term growth of target companies, as opposed to more traditional investments in local capital markets which have proven all too often to be speculative and short-term in nature. ...

Chapter 7 12

... year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, this means lowest variance of return. Half of the portfolio is invested in Alcan stock, an ...

... year and the $50,000 cash must be entirely invested in one of the stocks shown in Table 7.8. What is the safest attainable portfolio under these restrictions? Safest” means lowest risk; in a portfolio context, this means lowest variance of return. Half of the portfolio is invested in Alcan stock, an ...

Calvert High Yield Bond Fund

... Mortgage-Backed Security Risk (Government-Sponsored Enterprises). Debt and mortgage-backed securities issued by government-sponsored enterprises (“GSEs”) such as the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) are neither insured nor guaran ...

... Mortgage-Backed Security Risk (Government-Sponsored Enterprises). Debt and mortgage-backed securities issued by government-sponsored enterprises (“GSEs”) such as the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) are neither insured nor guaran ...

Centene Corporation - corporate

... Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process, we and/or certain selling securityholders, if applicable, may, from time to time, sell the securities described in ...

... Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process, we and/or certain selling securityholders, if applicable, may, from time to time, sell the securities described in ...

Lei, Noussair, and Plott: Non-Speculative Bubbles in Experimental

... of the apparently irrational behavior – particularly the high volume of trading and the prevalence of dominated trades. However, the most striking feature of bubbles, the boom and then crash in prices, is not eliminated by using a methodology that gives subjects an option other than trading in the a ...

... of the apparently irrational behavior – particularly the high volume of trading and the prevalence of dominated trades. However, the most striking feature of bubbles, the boom and then crash in prices, is not eliminated by using a methodology that gives subjects an option other than trading in the a ...

Eagle Materials Incorporated

... Pursuant to the instructions in Item 7 of Schedule 13G, Fidelity Management & Research Company ("Fidelity"), 82 Devonshire Street, Boston, Massachusetts 02109, a wholly- owned subsidiary of FMR Corp. and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is th ...

... Pursuant to the instructions in Item 7 of Schedule 13G, Fidelity Management & Research Company ("Fidelity"), 82 Devonshire Street, Boston, Massachusetts 02109, a wholly- owned subsidiary of FMR Corp. and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is th ...

1 Getting new regulatory policy done: Crowdfunding

... Title III—also known as the ‘crowdfunding provision’—allows companies to raise up to $1 million every year from the general public through a broker-‐dealer or ‘funding portal’ website without registering throug ...

... Title III—also known as the ‘crowdfunding provision’—allows companies to raise up to $1 million every year from the general public through a broker-‐dealer or ‘funding portal’ website without registering throug ...

Far East Hospitality Trust - Singapore

... in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd. The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd, its respective connected and associated c ...

... in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd. The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd, its respective connected and associated c ...

XPP-PDF Support Utility

... are exempt from registration under the Securities Act of 19333 and the Investment Company Act of 1940.4 To fall within applicable exemptions, as a general matter, such private investment funds permit only those investors who are ‘‘accredited investors’’ (as defined in the 1933 Act) and ‘‘qualified p ...

... are exempt from registration under the Securities Act of 19333 and the Investment Company Act of 1940.4 To fall within applicable exemptions, as a general matter, such private investment funds permit only those investors who are ‘‘accredited investors’’ (as defined in the 1933 Act) and ‘‘qualified p ...

Securities Trading of Concepts (STOC)

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

0000950123-06-011711 - Investor Relations

... These forward looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and similar terms and phrases, including references to assumptions. Such statements are ba ...

... These forward looking statements are identified by their use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will” and similar terms and phrases, including references to assumptions. Such statements are ba ...

Malaysia Low inflation, but at high price…

... The SRP outlined periodic reviews of price subsidies between 2H 2010 until 2014, where the subsidised prices of fuel, food and energy are supposed to be adjusted every six months by specified or fixed amounts or percentages. Inflation rate would have been at least one percentage point higher on the ...

... The SRP outlined periodic reviews of price subsidies between 2H 2010 until 2014, where the subsidised prices of fuel, food and energy are supposed to be adjusted every six months by specified or fixed amounts or percentages. Inflation rate would have been at least one percentage point higher on the ...

ZKB Warrant Put on Troy Ounce of Silver

... If, due to the occurrence of a Market Disruption in relation to the Underlying/a component of the Underlying no market price can be determined, the Issuer or the Calculation Agent shall determine the market price of the Underlying/the component of the Underlying at its free discretion, considering t ...

... If, due to the occurrence of a Market Disruption in relation to the Underlying/a component of the Underlying no market price can be determined, the Issuer or the Calculation Agent shall determine the market price of the Underlying/the component of the Underlying at its free discretion, considering t ...

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and signifi ...

... obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and signifi ...

How to Invest in REITs

... • All annual reports must be in English • Specific guidelines for each geographic series • Free float market cap and liquidity standards • Structured to represent general trends in all eligible real estate stocks worldwide • Quarterly reviews and rebalancing by separate index ...

... • All annual reports must be in English • Specific guidelines for each geographic series • Free float market cap and liquidity standards • Structured to represent general trends in all eligible real estate stocks worldwide • Quarterly reviews and rebalancing by separate index ...

Cost Basis Reporting Law - Wolters Kluwer Financial Services

... reflect corporate actions that may occur between the date of death and conveyance of those shares to the recipient. In the case of reporting of inheritance related transfers, the broker does not need to contact the representative of estate and request values as of date of death for transferred securi ...

... reflect corporate actions that may occur between the date of death and conveyance of those shares to the recipient. In the case of reporting of inheritance related transfers, the broker does not need to contact the representative of estate and request values as of date of death for transferred securi ...

50 The LC Gupta Committee Report: Some Observations

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

... India has seen significant improvements during the nineties with the introduction of screen-based trading, creation of depositories, and dematerialisation of some of the shares; the participants in equity trading have had long exposures to this activity and hence have a fairly good understanding of ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... certain sales price rebates and limited product return privileges. Given the uncertainties associated with the levels of pricing rebates, the ultimate sales price on domestic distributor sales transactions is not fixed or determinable until domestic distributors sell the merchandise to the end-custo ...

... certain sales price rebates and limited product return privileges. Given the uncertainties associated with the levels of pricing rebates, the ultimate sales price on domestic distributor sales transactions is not fixed or determinable until domestic distributors sell the merchandise to the end-custo ...

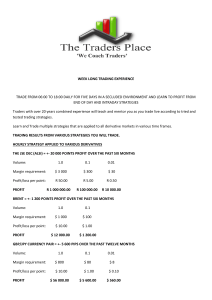

week long trading experience trade from 06:00 to 18:00 daily for five

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

Algorithms for VWAP and Limit Order Trading

... • Note if all orders executed, we are within (1-ε) of overall VWAP - since each limit order is (1-ε) close to VWAP_j ...

... • Note if all orders executed, we are within (1-ε) of overall VWAP - since each limit order is (1-ε) close to VWAP_j ...

The Relationship between Information Asymmetry and Stock Return

... these studies sought to examine the relationship between these variables, which found that there is a positive relationship between risk, trading volume, and stock return. Also (Wang et al., 2005) tested the relationship between the behavior of market stock returns, volatility of returns (Risk), and ...

... these studies sought to examine the relationship between these variables, which found that there is a positive relationship between risk, trading volume, and stock return. Also (Wang et al., 2005) tested the relationship between the behavior of market stock returns, volatility of returns (Risk), and ...

New Investment Portfolios

... Cap Value Portfolio which seeks to achieve long-term capital appreciation. The portfolio seeks to capture the returns and diversification benefits of a broad crosssection of US value companies with market capitalizations within the largest 90% of the market universe. T. Rowe Price Large-Cap Growth 5 ...

... Cap Value Portfolio which seeks to achieve long-term capital appreciation. The portfolio seeks to capture the returns and diversification benefits of a broad crosssection of US value companies with market capitalizations within the largest 90% of the market universe. T. Rowe Price Large-Cap Growth 5 ...

U.S. TREAS Form treas-irs-1065-schedule-d-1992

... For exchanges of capital assets, enter the gain or loss from Form 8824, if any, on line 3 or 8. If an exchange was made with a related party, write “Related Party Like-Kind Exchange” in the top margin of Schedule D. See Form 8824 and its instructions for details. ...

... For exchanges of capital assets, enter the gain or loss from Form 8824, if any, on line 3 or 8. If an exchange was made with a related party, write “Related Party Like-Kind Exchange” in the top margin of Schedule D. See Form 8824 and its instructions for details. ...

Intelligence in Securities Finance: Where Is It Going?

... and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every facet of the financing and collateral world. Our feature story covers the exodus o ...

... and technology that turn change from the enemy into an opportunity for growth. A common theme in this edition of Securities Finance Monitor is that the scope of change is broad, incisive, and seeping into almost every facet of the financing and collateral world. Our feature story covers the exodus o ...