Advances in Environmental Biology

... with financial importance. They selected the time period from 1990 to 2000 and indicated that the complicated moving averages are able to created long-term advantages[2]. Erlzlend and Norman, in a research titled as "Above average? This moving average technical trading rules" evaluated this issue th ...

... with financial importance. They selected the time period from 1990 to 2000 and indicated that the complicated moving averages are able to created long-term advantages[2]. Erlzlend and Norman, in a research titled as "Above average? This moving average technical trading rules" evaluated this issue th ...

RTF - Vornado Realty Trust

... In March 1995, the Company lent Alexander's $45 million, the subordinated tranche of a $75 million secured financing, the balance of which was funded by a bank. The Company's loan has a three-year term and bears interest at 16.43% per annum for the first two years and at a fixed rate for the third y ...

... In March 1995, the Company lent Alexander's $45 million, the subordinated tranche of a $75 million secured financing, the balance of which was funded by a bank. The Company's loan has a three-year term and bears interest at 16.43% per annum for the first two years and at a fixed rate for the third y ...

Derivatives and their feedback effects on the spot markets

... ture in one single transaction instead of deal- ...

... ture in one single transaction instead of deal- ...

Investment Banks, Scope, and Unavoidable Conflicts of Interest

... are the acknowledged to be customary part of the analyst’s job. This includes developing an expertise in the covered firms and about the industry in which they operate. This expertise extends to include competitors, suppliers, customers, etc. With this knowledge the analyst will customarily make fo ...

... are the acknowledged to be customary part of the analyst’s job. This includes developing an expertise in the covered firms and about the industry in which they operate. This expertise extends to include competitors, suppliers, customers, etc. With this knowledge the analyst will customarily make fo ...

Phillip Securities Account Opening Application. (Only

... otherwise provides) to all transactions that I enter into with and/or through PSPL; as well as for all services provided by PSPL to me. The specific additional terms and/or details of each individual transaction or service, including the details for each distinct service or transaction for any finan ...

... otherwise provides) to all transactions that I enter into with and/or through PSPL; as well as for all services provided by PSPL to me. The specific additional terms and/or details of each individual transaction or service, including the details for each distinct service or transaction for any finan ...

Certified Annual Report

... accounts and are reported as receivable from and payable to clients and counterparties on the Consolidated Statement of Financial Condition. Balances in securities accounts are regulated by the SEC and balances in commodity accounts, which include futures and other derivative transactions, are regul ...

... accounts and are reported as receivable from and payable to clients and counterparties on the Consolidated Statement of Financial Condition. Balances in securities accounts are regulated by the SEC and balances in commodity accounts, which include futures and other derivative transactions, are regul ...

Core High Yield Fund - John Hancock Investments

... An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money. The fund’s investment strategy may not ...

... An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Many factors affect performance, and fund shares will fluctuate in price, meaning you could lose money. The fund’s investment strategy may not ...

OMB APPROVAL ------------------------------ OMB NUMBER: 3235

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...

... ------------------------------------------------The securities with respect to which this Amended Schedule 13D is filed were purchased by the Funds using working capital contributed by their respective partners and shareholders. ITEM 4: PURPOSE OF TRANSACTION: ---------------------The securities wer ...

securities and exchange commission

... Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercisable within sixty days of December ...

... Provide the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in Item 1. (a) Amount Beneficially Owned as of December 31, 2002: 1,200,439 (includes 374,000 shares purchasable under options exercisable within sixty days of December ...

Market Linked Securities

... • If you are considering Market Linked Securities with downside protection, does protection against moderate market declines take precedence for you over uncapped returns, dividend payments, or fixed returns? • What is your outlook on the market? • What is your sensitivity to the tax treatment fo ...

... • If you are considering Market Linked Securities with downside protection, does protection against moderate market declines take precedence for you over uncapped returns, dividend payments, or fixed returns? • What is your outlook on the market? • What is your sensitivity to the tax treatment fo ...

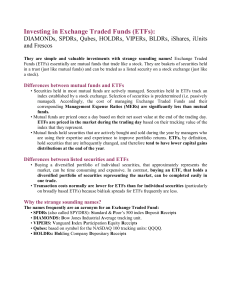

Investing in Exchange Traded Funds (ETFs):

... • A low Management Expense Ratio (MER) relative to actively managed investments. The average MER on a broadly based Canadian or U.S. mutual fund actively managed by a Canadian based investment firm is 2.72%. In contrast, the MER on iUnits on the S&P/TSX 60 Index is only 0.17% and the MER on SPYDRs i ...

... • A low Management Expense Ratio (MER) relative to actively managed investments. The average MER on a broadly based Canadian or U.S. mutual fund actively managed by a Canadian based investment firm is 2.72%. In contrast, the MER on iUnits on the S&P/TSX 60 Index is only 0.17% and the MER on SPYDRs i ...

funding for- profit social enterprises

... limits profit distributions) and, for tax-exempt not-for-profit firms, the prohibition on private inurement, for example, also are challenges in that they present barriers to the kind of profit-sharing ownership interest or revenue-sharing ownership rights that social enterprise typically seeks to e ...

... limits profit distributions) and, for tax-exempt not-for-profit firms, the prohibition on private inurement, for example, also are challenges in that they present barriers to the kind of profit-sharing ownership interest or revenue-sharing ownership rights that social enterprise typically seeks to e ...

Les faits

... jurisdiction by the respondent’s improper activities, (j) the need to deter not only those involved in the case being considered, but also any others who participate in the capital markets, from engaging in similar improper activity, (k) the need to alert others to the consequences of inappropriate ...

... jurisdiction by the respondent’s improper activities, (j) the need to deter not only those involved in the case being considered, but also any others who participate in the capital markets, from engaging in similar improper activity, (k) the need to alert others to the consequences of inappropriate ...

Chapter One * Introduction - Mutual Fund Directors Forum

... This has no connection with securities lending as, by its nature, it is a sale by someone who does not have, and has no intention of obtaining, the security they are selling. This practice has now been banned by a number of regulators worldwide and has also been condemned by the international securi ...

... This has no connection with securities lending as, by its nature, it is a sale by someone who does not have, and has no intention of obtaining, the security they are selling. This practice has now been banned by a number of regulators worldwide and has also been condemned by the international securi ...

What are commercial mortgage-backed securities?

... relied upon as the sole factor in an investment making decision. As with all investments there are associated inherent risks. Please obtain and review all financial material carefully before investing. Issued in Canada by Invesco Canada Ltd., 5140 Yonge Street, Suite 800, Toronto, Ontario, M2N 6X7 ...

... relied upon as the sole factor in an investment making decision. As with all investments there are associated inherent risks. Please obtain and review all financial material carefully before investing. Issued in Canada by Invesco Canada Ltd., 5140 Yonge Street, Suite 800, Toronto, Ontario, M2N 6X7 ...

Unit-2-A5

... been made at the end of the financial year. • This account can help a bank or lender decide whether a business is worth the investment. • For smaller businesses like sole traders and LTDs it is useful to see how much profit is made at the end of the year. ...

... been made at the end of the financial year. • This account can help a bank or lender decide whether a business is worth the investment. • For smaller businesses like sole traders and LTDs it is useful to see how much profit is made at the end of the year. ...

Liquidity article - Zebra Capital Management

... computer assembly business, but can be more profitable than the latter. Similarly, a financial service firm may not have as much book value as a traditional brick-and-mortar manufacturing business, so book value is not comparable across industries either. Lastly, a dividend weighted strategy has eve ...

... computer assembly business, but can be more profitable than the latter. Similarly, a financial service firm may not have as much book value as a traditional brick-and-mortar manufacturing business, so book value is not comparable across industries either. Lastly, a dividend weighted strategy has eve ...

Empirical Evidence : CAPM and APT

... – Individual stock returns are so volatile that one cannot reject the null hypothesis that average returns across different stocks are the same (s ≈ 30 – 80% p.a., hence cannot reject the null that average returns across different stocks are the same.) – Betas are measured with errors ...

... – Individual stock returns are so volatile that one cannot reject the null hypothesis that average returns across different stocks are the same (s ≈ 30 – 80% p.a., hence cannot reject the null that average returns across different stocks are the same.) – Betas are measured with errors ...

Heading 3

... company. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. We undertake no obligation to publicly update or revise any forward-looking statements. Readers are cautioned not to place undue reliance on these forwar ...

... company. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. We undertake no obligation to publicly update or revise any forward-looking statements. Readers are cautioned not to place undue reliance on these forwar ...

NOTICE OF MATERIAL EVENT UNDER SEC RULE 15c2

... (“Issuer”) is required to file notice to satisfy the Issuer’s continuing disclosure requirements under Rule 15c2‐12 of the Securities and Exchange Commission (SEC) with respect to the Issuer’s obligations listed above. An explanation of the sigificance of the new rating may be obtained from the ra ...

... (“Issuer”) is required to file notice to satisfy the Issuer’s continuing disclosure requirements under Rule 15c2‐12 of the Securities and Exchange Commission (SEC) with respect to the Issuer’s obligations listed above. An explanation of the sigificance of the new rating may be obtained from the ra ...

Life Technologies Corporation

... This supplement to the Prospectus was prepared pursuant to Article 34 of the Belgian Law of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This ...

... This supplement to the Prospectus was prepared pursuant to Article 34 of the Belgian Law of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This ...

SUMMARY PROSPECTUS Tortoise North American Pipeline Fund

... Canadian Securities Risk. The Canadian economy may be significantly affected by the U.S. economy because the U.S. is Canada’s largest trading partner and foreign investor. Canada’s largest exports are its natural resources, so the Canadian economy is dependent on the demand for, and supply and pric ...

... Canadian Securities Risk. The Canadian economy may be significantly affected by the U.S. economy because the U.S. is Canada’s largest trading partner and foreign investor. Canada’s largest exports are its natural resources, so the Canadian economy is dependent on the demand for, and supply and pric ...

Introduction Hypothesis Central Limit Theorem Objective Madoff

... Our goal is to develop an innovative method for calculating the probability distribution function of a randomly selected portfolio of known size from a large population of potential investments. Given a known universe of potential investments and a known portfolio size and holding period, this metho ...

... Our goal is to develop an innovative method for calculating the probability distribution function of a randomly selected portfolio of known size from a large population of potential investments. Given a known universe of potential investments and a known portfolio size and holding period, this metho ...

New York Stock Exchange

... The credit rating agencies relied on, among other things, Enron’s public filings, including its financial statements filed with SEC, in rating Enron’s debt. In addition, members of Enron’s senior management spoke regularly with, and provided financial and other information to, representatives of cr ...

... The credit rating agencies relied on, among other things, Enron’s public filings, including its financial statements filed with SEC, in rating Enron’s debt. In addition, members of Enron’s senior management spoke regularly with, and provided financial and other information to, representatives of cr ...

TCW High Dividend Equities Fund Summary Prospectus

... Under normal circumstances, the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities listed on U.S. financial markets. If the Fund changes this investment policy, it will notify shareholders in writing at least 60 days in advance ...

... Under normal circumstances, the Fund invests at least 80% of the value of its net assets, plus any borrowings for investment purposes, in equity securities listed on U.S. financial markets. If the Fund changes this investment policy, it will notify shareholders in writing at least 60 days in advance ...