Correlated Trading and Returns

... and options holdings and trades helps us to classify orders as likely non-speculative, i.e., driven by savings, dissavings, or risk sharing motives, and as likely speculative, i.e., driven by perceived information about the future stock price. For example, the transaction records contain a variable ...

... and options holdings and trades helps us to classify orders as likely non-speculative, i.e., driven by savings, dissavings, or risk sharing motives, and as likely speculative, i.e., driven by perceived information about the future stock price. For example, the transaction records contain a variable ...

ASIAN COMPANIES` Financial reporting frequency

... by regional practices adopted in that region. In Asia, for example, there is the presence of written regulations, effectively enforced, which ensure that the reporting of companies is explained. There are other regions, like EU, outside the scope of this research but reviewed briefly, which will be ...

... by regional practices adopted in that region. In Asia, for example, there is the presence of written regulations, effectively enforced, which ensure that the reporting of companies is explained. There are other regions, like EU, outside the scope of this research but reviewed briefly, which will be ...

Volatility trading in options market: How does it a ect where

... use a sequential trade approach, but examine both the impact of option trading and margin requirements on the behavior of informed traders. They show that, in the absence of margin requirements, informed traders split their trades between the stock and the option, although they exhibit a bias toward ...

... use a sequential trade approach, but examine both the impact of option trading and margin requirements on the behavior of informed traders. They show that, in the absence of margin requirements, informed traders split their trades between the stock and the option, although they exhibit a bias toward ...

Chapter 19X Securities Markets_Fall 15

... Column 9 & 10: Day High and Low - This indicates the price range at which the stock has traded at throughout the day. In other words, these are the maximum and the minimum prices that people have paid for the stock. Column 11: Close - The close is the last trading price recorded when the market clos ...

... Column 9 & 10: Day High and Low - This indicates the price range at which the stock has traded at throughout the day. In other words, these are the maximum and the minimum prices that people have paid for the stock. Column 11: Close - The close is the last trading price recorded when the market clos ...

Chapter 01 Introduction to Financial Management

... A. Compensating a manager based on his or her division's net income B. Giving all employees a bonus if a certain level of efficiency is maintained C. Hiring an independent consultant to study the operating efficiency of the firm D. Rejecting a profitable project to protect employee jobs E. Selling a ...

... A. Compensating a manager based on his or her division's net income B. Giving all employees a bonus if a certain level of efficiency is maintained C. Hiring an independent consultant to study the operating efficiency of the firm D. Rejecting a profitable project to protect employee jobs E. Selling a ...

sole proprietorship

... whose shares are owned by a relatively small group of people. The shares are not traded openly in stock markets. ...

... whose shares are owned by a relatively small group of people. The shares are not traded openly in stock markets. ...

Veritiv Corp (Form: 424B3, Received: 11/15/2016 16

... This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain "forward-looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where possible, the words "believe," "expect," "anti ...

... This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain "forward-looking statements" subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Where possible, the words "believe," "expect," "anti ...

Business Ownership Notes

... whose shares are owned by a relatively small group of people. The shares are not traded openly in stock markets. ...

... whose shares are owned by a relatively small group of people. The shares are not traded openly in stock markets. ...

2016 Proxy Statement - Investor Relations

... The 2016 Annual Meeting of Stockholders (the "Annual Meeting") of Plantronics, Inc. ("Plantronics" or the "Company") will be held at 10:00 a.m. PDT on Thursday, August 4, 2016 at our headquarters located at 345 Encinal Street, Santa Cruz, California 95060. Our Board of Directors ("Board") is solicit ...

... The 2016 Annual Meeting of Stockholders (the "Annual Meeting") of Plantronics, Inc. ("Plantronics" or the "Company") will be held at 10:00 a.m. PDT on Thursday, August 4, 2016 at our headquarters located at 345 Encinal Street, Santa Cruz, California 95060. Our Board of Directors ("Board") is solicit ...

Trading Rules and Practices

... distributions relative to capital gains. Poterba (1986) re-examines the ex-day price drop for two classes of Citizens Utilities originally studied by Long (1978), one of which distributed only a cash dividend while the other distributed only a stock dividend of equal size. He documents that the ex-d ...

... distributions relative to capital gains. Poterba (1986) re-examines the ex-day price drop for two classes of Citizens Utilities originally studied by Long (1978), one of which distributed only a cash dividend while the other distributed only a stock dividend of equal size. He documents that the ex-d ...

Earnings Index Methodology

... Puerto Rico). Preferred stocks, closed-end funds, exchange-traded funds, and derivative securities such as warrants and rights are not eligible. The publicly traded security for WisdomTree Investments, Inc., ticker WETF, is not eligible for inclusion in any of WisdomTree’s equity indexes. Companies ...

... Puerto Rico). Preferred stocks, closed-end funds, exchange-traded funds, and derivative securities such as warrants and rights are not eligible. The publicly traded security for WisdomTree Investments, Inc., ticker WETF, is not eligible for inclusion in any of WisdomTree’s equity indexes. Companies ...

The Return Volatility Effect of Stock Splits

... The main research purpose of this study is to answer the above research question as well as examining if there are differences in effects depending upon the firms’ market capitalization. This is a quantitative study with a deductive approach and a crosssectional and longitudinal research design cove ...

... The main research purpose of this study is to answer the above research question as well as examining if there are differences in effects depending upon the firms’ market capitalization. This is a quantitative study with a deductive approach and a crosssectional and longitudinal research design cove ...

Bubbles

... presence of a bubble need not be commonly known. For example, it might be the case that everybody knows the price exceeds the value of any possible dividend stream, but it is not the case that everybody knows that all the other investors also know this fact. It is this lack of higher-order mutual kn ...

... presence of a bubble need not be commonly known. For example, it might be the case that everybody knows the price exceeds the value of any possible dividend stream, but it is not the case that everybody knows that all the other investors also know this fact. It is this lack of higher-order mutual kn ...

Equity Trading by Institutional Investors: To Cross or Not

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...

... have resulted in a proliferation of market places and trading methods in the US equity market. The consequences of this development for the main functions of the market are complex and not yet well understood. A stated goal of all new trading arrangements is to reduce transactions costs. Current ac ...

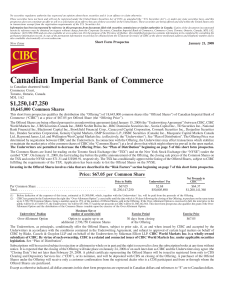

Canadian Imperial Bank of Commerce

... contains forward-looking statements within the meaning of certain securities laws. These statements include, but are not limited to, statements about the operations, business lines, financial condition, risk management, priorities, targets, ongoing objectives, strategies and outlook of CIBC for 2008 ...

... contains forward-looking statements within the meaning of certain securities laws. These statements include, but are not limited to, statements about the operations, business lines, financial condition, risk management, priorities, targets, ongoing objectives, strategies and outlook of CIBC for 2008 ...

Derivatives Trading and Its Impact on the Volatility of NSE, India

... the existence of derivatives markets in particular, might affect the volatility of the underlying asset market. In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors deter ...

... the existence of derivatives markets in particular, might affect the volatility of the underlying asset market. In recent past, the volatility of stock returns has been a major topic in finance literature. Empirical researchers have tried to find a pattern in stock return movements or factors deter ...

Stock Strategies(21)

... their shareholders. The concept is straightforward: Instead of sending participating investors cash dividends, the company applies those dividends to the purchase of additional company shares. There are several advantages to investors who participate: Dividend payments are put to work, transaction c ...

... their shareholders. The concept is straightforward: Instead of sending participating investors cash dividends, the company applies those dividends to the purchase of additional company shares. There are several advantages to investors who participate: Dividend payments are put to work, transaction c ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... stocks for each of the 25 cities with the largest number of Nasdaq firms. The University of Chicago’s Center for Research in Security Prices (CRSP) provides the returns, trading volume, and price information for the sample. To minimize the impact of lowpriced stocks, we require the firm to have a st ...

... stocks for each of the 25 cities with the largest number of Nasdaq firms. The University of Chicago’s Center for Research in Security Prices (CRSP) provides the returns, trading volume, and price information for the sample. To minimize the impact of lowpriced stocks, we require the firm to have a st ...

Form 10-Q Rich Pharmaceuticals, Inc.

... the business of developing, manufacturing, and selling small boilers aimed at farmers primarily in Southeast Asia. On July 18, 2013, we designated, from our 10,000,000 authorized shares of preferred stock, par value $0.001, 6,000,000 shares of Series “A” Preferred Stock. Our Series “A” Preferred Sto ...

... the business of developing, manufacturing, and selling small boilers aimed at farmers primarily in Southeast Asia. On July 18, 2013, we designated, from our 10,000,000 authorized shares of preferred stock, par value $0.001, 6,000,000 shares of Series “A” Preferred Stock. Our Series “A” Preferred Sto ...

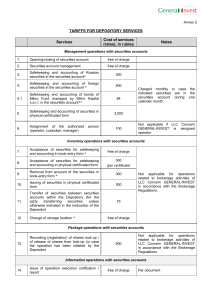

3. Foreign stock exchanges and listing procedures

... The increasing number of corporations whose securities are traded on foreign stock exchanges is rapidly erasing the borders between domestic and international capital markets. Internationalisation of securities markets has accelerated with the easing of foreign exchange controls, floating exchange r ...

... The increasing number of corporations whose securities are traded on foreign stock exchanges is rapidly erasing the borders between domestic and international capital markets. Internationalisation of securities markets has accelerated with the easing of foreign exchange controls, floating exchange r ...

Effects of level of investors confidence and herding behavior on

... changes and other economic processes in the generation of bubbles and crashes, one may question the true contribution of the "herding behavior" to those events. One may wonder how much of the overpricing during the bubble or the underpricing during the crash, may be attributed to herding behavior of ...

... changes and other economic processes in the generation of bubbles and crashes, one may question the true contribution of the "herding behavior" to those events. One may wonder how much of the overpricing during the bubble or the underpricing during the crash, may be attributed to herding behavior of ...

Efficient market hypothesis: is the Croatian stock market as (in

... market counterparts; moving average rules were more profitable when tested using emerging stock market indices. In addition, this profitability persisted for longer moving averages, suggesting that trends in stock returns were larger and more persistent in emerging markets. Jagric et al. (2005) tested ...

... market counterparts; moving average rules were more profitable when tested using emerging stock market indices. In addition, this profitability persisted for longer moving averages, suggesting that trends in stock returns were larger and more persistent in emerging markets. Jagric et al. (2005) tested ...

Takeovers, Freezeouts, and Risk Arbitrage

... to the o¤er, over 50 percent of the voting share capital.10 Although in the U.S., there is no such rule, all o¤ers considered in the paper will be conditional upon the bidder acquiring at least 50 percent of the shares. Unconditional o¤ers, though, are not allowed in our framework.11 However, the bi ...

... to the o¤er, over 50 percent of the voting share capital.10 Although in the U.S., there is no such rule, all o¤ers considered in the paper will be conditional upon the bidder acquiring at least 50 percent of the shares. Unconditional o¤ers, though, are not allowed in our framework.11 However, the bi ...