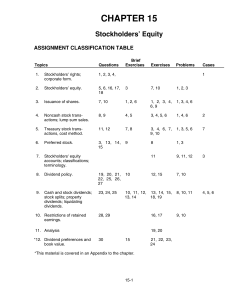

CHAPTER 15 Stockholders` Equity

... (a) A stock split effected in the form of a dividend is a distribution of corporate stock to present stockholders in proportion to each stockholder’s current holdings and can be expected to cause a material decrease in the market value per share of the stock. Accounting Research Bulletin No. 43 spec ...

... (a) A stock split effected in the form of a dividend is a distribution of corporate stock to present stockholders in proportion to each stockholder’s current holdings and can be expected to cause a material decrease in the market value per share of the stock. Accounting Research Bulletin No. 43 spec ...

An Overview of Investor Sentiment in Stock Market

... sentiment and market performance,” but he does discover that excessive investor sentiment in either a bullish or bearish direction would signal a significant opposing response over the following 52 weeks. This perspective leads to viewing the investor sentiment as a contrarian indicator in the spec ...

... sentiment and market performance,” but he does discover that excessive investor sentiment in either a bullish or bearish direction would signal a significant opposing response over the following 52 weeks. This perspective leads to viewing the investor sentiment as a contrarian indicator in the spec ...

30DC, INC. (Form: SC 13D/A, Received: 01/08/2016

... 4. Remedy. If Client breaches this Agreement by not paying any compensation or fee payments due, Consultant may terminate or suspend all performances or services remaining to be rendered by Consultant under this Agreement and Client will remain liable for all remaining payments due under this Agreem ...

... 4. Remedy. If Client breaches this Agreement by not paying any compensation or fee payments due, Consultant may terminate or suspend all performances or services remaining to be rendered by Consultant under this Agreement and Client will remain liable for all remaining payments due under this Agreem ...

ACT 3216 ADVANCED FINANCIAL ACCOUNTING 1

... Also known as founder’s shares. Normally issued to founders/ promoter The rights to dividend and return of capital come after right of ordinary shareholder ...

... Also known as founder’s shares. Normally issued to founders/ promoter The rights to dividend and return of capital come after right of ordinary shareholder ...

Durability, Re-trading and Market Performance

... the supply and demand environment, subject pools, numbers of buyers and/or sellers, multiple interdependent commodities, and, with some qualifications, the exchange institution. 2 These experiments reflected several abstract features of the Walrasian general equilibrium models that motivated them. I ...

... the supply and demand environment, subject pools, numbers of buyers and/or sellers, multiple interdependent commodities, and, with some qualifications, the exchange institution. 2 These experiments reflected several abstract features of the Walrasian general equilibrium models that motivated them. I ...

Term Sheet Form - Israel Advanced Technology Industries

... Founders, as long as each holds at least [1-5]% of the issued and outstanding share capital of the Company (on a fully diluted and asconverted basis) (each a (“Major Shareholder”), will have the right ...

... Founders, as long as each holds at least [1-5]% of the issued and outstanding share capital of the Company (on a fully diluted and asconverted basis) (each a (“Major Shareholder”), will have the right ...

Stock dividends - McGraw Hill Higher Education

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

... Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. ...

Introduction to Financial Management

... • Announcements and news contain both expected and surprise components • The surprise component affects stock prices • Efficient markets result from investors trading on unexpected news – The easier it is to trade on surprises, the more efficient markets should be ...

... • Announcements and news contain both expected and surprise components • The surprise component affects stock prices • Efficient markets result from investors trading on unexpected news – The easier it is to trade on surprises, the more efficient markets should be ...

Efficient market hypothesis: is the Croatian stock market as (in

... returns. Lo and MacKinlay (1988) detected positive serial correlation of shortterm price changes (less than one year). Although the outcome of these studies points to the presence of short-term trends and long-term mean-reversion in the stock markets, this ultimately did not lead to the formulation ...

... returns. Lo and MacKinlay (1988) detected positive serial correlation of shortterm price changes (less than one year). Although the outcome of these studies points to the presence of short-term trends and long-term mean-reversion in the stock markets, this ultimately did not lead to the formulation ...

Crude Oil Price Uncertainty and Stock Markets in Gulf Corporation

... Crude Oil Price Uncertainty and Stock Markets in Gulf Corporation Countries: A Var-Garch Copula Model ...

... Crude Oil Price Uncertainty and Stock Markets in Gulf Corporation Countries: A Var-Garch Copula Model ...

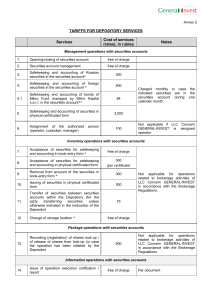

ร่าง

... shall not proceed following actions until the securities company would be able to maintain net capital and having obtained an approval from the SEC Office to continue its business: (1) increasing the amount of trading securities to cash account of clients, unless the clients have already left the mo ...

... shall not proceed following actions until the securities company would be able to maintain net capital and having obtained an approval from the SEC Office to continue its business: (1) increasing the amount of trading securities to cash account of clients, unless the clients have already left the mo ...

Technical Analysis - SelectedWorks

... “Some very recent research has emphasized that, even though the aggregate stock market appears to be wildly inefficient, individual stock prices do show some correspondence to efficient markets theory (page 89).” ...

... “Some very recent research has emphasized that, even though the aggregate stock market appears to be wildly inefficient, individual stock prices do show some correspondence to efficient markets theory (page 89).” ...

Instructions - Creative Financial Solutions

... others) continue to be very vocal in stating that the Fed is not close to starting to unwind their stimulative policies, which involve purchasing $85 billion per month of Treasury bonds and mortgagebacked securities (quantitative easing) and holding the federal funds policy rate near zero percent. B ...

... others) continue to be very vocal in stating that the Fed is not close to starting to unwind their stimulative policies, which involve purchasing $85 billion per month of Treasury bonds and mortgagebacked securities (quantitative easing) and holding the federal funds policy rate near zero percent. B ...

Securities markets regulators in transition

... banking, insurance and securities regulator in Kazakhstan. The aims of the Agency are to ensure a stable financial market and maintain confidence in the financial system; to protect the interests of investors; to develop sound policies for financial market participants and to maintain fair competiti ...

... banking, insurance and securities regulator in Kazakhstan. The aims of the Agency are to ensure a stable financial market and maintain confidence in the financial system; to protect the interests of investors; to develop sound policies for financial market participants and to maintain fair competiti ...

Power law in market capitalization during Dot

... In previous studies, stock price fluctuations attracted more attention than firm size distribution in stock markets, and several models for price dynamics were proposed [11, 12]. The PACK and LPPL models simulated the price fluctuations of a stock during bubble periods [13, 14]. However, the firm size d ...

... In previous studies, stock price fluctuations attracted more attention than firm size distribution in stock markets, and several models for price dynamics were proposed [11, 12]. The PACK and LPPL models simulated the price fluctuations of a stock during bubble periods [13, 14]. However, the firm size d ...

Procedure for Submission of Information and Reports to Closed

... 4.3.6. Registration and storage of the Registration Card and reports received by the Exchange in the form of electronic documents shall be effected in compliance with the EDI Rules. Furthermore, the Exchange shall secure maintenance of an electronic log of electronic documents received from Trading ...

... 4.3.6. Registration and storage of the Registration Card and reports received by the Exchange in the form of electronic documents shall be effected in compliance with the EDI Rules. Furthermore, the Exchange shall secure maintenance of an electronic log of electronic documents received from Trading ...

ImmunoGen, Inc.: Investors

... ImmunoGen, Inc. Announces Addition of Nicole Onetto, MD, to the Board of Directors CAMBRIDGE, MA, June 9, 2005 – ImmunoGen, Inc. (Nasdaq: IMGN) is pleased to announce the addition of Nicole Onetto, MD, to the Company’s Board of Directors. Dr. Onetto has over fifteen years of clinical drug developmen ...

... ImmunoGen, Inc. Announces Addition of Nicole Onetto, MD, to the Board of Directors CAMBRIDGE, MA, June 9, 2005 – ImmunoGen, Inc. (Nasdaq: IMGN) is pleased to announce the addition of Nicole Onetto, MD, to the Company’s Board of Directors. Dr. Onetto has over fifteen years of clinical drug developmen ...

Surprise Effect of European Macroeconomic Announcements on

... frontier economies have become of interest to the international investment community as a source for possible higher returns that may escape the well-known negative spillovers from one developed market to another one. CIVETS countries have, however, in the recent years opened their markets to foreig ...

... frontier economies have become of interest to the international investment community as a source for possible higher returns that may escape the well-known negative spillovers from one developed market to another one. CIVETS countries have, however, in the recent years opened their markets to foreig ...

Document

... Holding Period Returns A famous set of studies dealing with the rates of returns on common stocks, bonds, and Treasury bills was conducted by Roger Ibbotson and Rex Sinquefield. They present year-by-year historical rates of return starting in 1926 for the following five important types of financial ...

... Holding Period Returns A famous set of studies dealing with the rates of returns on common stocks, bonds, and Treasury bills was conducted by Roger Ibbotson and Rex Sinquefield. They present year-by-year historical rates of return starting in 1926 for the following five important types of financial ...

Securities Trading of Concepts (STOC)

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

... 1992, Calder 1977, Fern 1982). However, concept markets may be a useful alternative to these methods for several reasons: 1. Accuracy: In order to win the game, participants have the incentive to trade according to the best, most up-to-date knowledge because of their financial stake in the market. S ...

Full article text

... relevant shorter forecasting horizons in which significant local differences in forecasting approaches can be found. The convergence of forecasting approaches on longer horizons might therefore also be explained by traders' lower exposure with longer forecasting horizons, a circumstance which might ...

... relevant shorter forecasting horizons in which significant local differences in forecasting approaches can be found. The convergence of forecasting approaches on longer horizons might therefore also be explained by traders' lower exposure with longer forecasting horizons, a circumstance which might ...

Chapter 1: An Introduction to Corporate Finance

... to cancel the futures positions, increasing the flexibility in their use • The term of a futures contract is set by individual exchanges: • Delivery months are: March, June, September, and December • Underlying assets are standardized so that even if delivery rarely takes place, investors know what ...

... to cancel the futures positions, increasing the flexibility in their use • The term of a futures contract is set by individual exchanges: • Delivery months are: March, June, September, and December • Underlying assets are standardized so that even if delivery rarely takes place, investors know what ...

STOCCER – A Forecasting Market for the FIFA World

... STOCCER is highly dynamic. New markets and stocks can be added during the tournament. This is required since we plan to trade stocks for several rounds, such as quarter finals, and it is not known in advance which teams will in the end take part in those rounds. Giving out new stocks can be done in ...

... STOCCER is highly dynamic. New markets and stocks can be added during the tournament. This is required since we plan to trade stocks for several rounds, such as quarter finals, and it is not known in advance which teams will in the end take part in those rounds. Giving out new stocks can be done in ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... that overcast weather is associated with downbeat moods and that moods affect stock prices. Coefficients from the Hirshleifer and Shumway (2003) pooled regressions suggest that the difference in returns between completely overcast and completely sunny days is about nine basis points, which they clai ...

... that overcast weather is associated with downbeat moods and that moods affect stock prices. Coefficients from the Hirshleifer and Shumway (2003) pooled regressions suggest that the difference in returns between completely overcast and completely sunny days is about nine basis points, which they clai ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.