What can company - Bank of England

... (a) 2013 includes data up to October. QE1 refers to £200 billion of assets purchased between March 2009 and January 2010; QE2 refers to £125 billion of assets purchased between October 2011 and May 2012; QE3 refers to £50 billion of assets purchased between July 2012 and November 2012. (b) As the ma ...

... (a) 2013 includes data up to October. QE1 refers to £200 billion of assets purchased between March 2009 and January 2010; QE2 refers to £125 billion of assets purchased between October 2011 and May 2012; QE3 refers to £50 billion of assets purchased between July 2012 and November 2012. (b) As the ma ...

Korea Securities Depository

... Unique model that CSD provides global custody service by expanding the scope of its eligible securities from domestic securities to global securities - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries with 4 custodians for overseas investment by dome ...

... Unique model that CSD provides global custody service by expanding the scope of its eligible securities from domestic securities to global securities - cross-border custody, settlement and corporate action services over the 36 markets of 34 countries with 4 custodians for overseas investment by dome ...

The Effect of Cash Flow on Share Price of the Jordanian

... and instruments be based on accurate standards. In regard to cash flow, it has significant role in determining the need for cash availability in the time of dividends distribution time, and its effect on share price in a way that warranty the interests of stakeholders. Thus, it is inevitable to find ...

... and instruments be based on accurate standards. In regard to cash flow, it has significant role in determining the need for cash availability in the time of dividends distribution time, and its effect on share price in a way that warranty the interests of stakeholders. Thus, it is inevitable to find ...

ch15 - U of L Class Index

... should sell shares when their investment potential has deteriorated to the extent that they no longer merit a place in the portfolio ...

... should sell shares when their investment potential has deteriorated to the extent that they no longer merit a place in the portfolio ...

A Random Walk Down Wall Street Seventh Edition

... from efficient markets, to behavioral finance, as well as sociological models of contagion attempt to explain the behavior of stock prices, this course will introduce you to the rhetoric (an ancient and powerful perspective) of investing and valuation. By analyzing the rhetoric of several classic in ...

... from efficient markets, to behavioral finance, as well as sociological models of contagion attempt to explain the behavior of stock prices, this course will introduce you to the rhetoric (an ancient and powerful perspective) of investing and valuation. By analyzing the rhetoric of several classic in ...

Become a Stockholder Today Complete Our Application Form

... any sale, transfer, or other disposition of the Shares without registration, is available under those acts, respectively. (3) The undersigned is familiar with the business in which the Corporation will be engaged, and based upon its knowledge and experience in financial and business matters, it is f ...

... any sale, transfer, or other disposition of the Shares without registration, is available under those acts, respectively. (3) The undersigned is familiar with the business in which the Corporation will be engaged, and based upon its knowledge and experience in financial and business matters, it is f ...

Index rises by 0.5% as 29 stocks gain

... rose by 0.5 per cent or 97.09 basis points, from 20,314.08 points to 20,411.17 points. Similarly, the market capitalisation of listed equities increased by 0.5 per cent or N31bn to N6.432tn up from N6.402tn recorded the preceding day. The NSE-30 Index rose by 0.6 per cent or 5.52 basis points from 9 ...

... rose by 0.5 per cent or 97.09 basis points, from 20,314.08 points to 20,411.17 points. Similarly, the market capitalisation of listed equities increased by 0.5 per cent or N31bn to N6.432tn up from N6.402tn recorded the preceding day. The NSE-30 Index rose by 0.6 per cent or 5.52 basis points from 9 ...

A Critique of Overreaction Effect in the Global Stock Markets over the

... A Critique of Overreaction Effect in the Global Stock Markets over the past three decades extreme low return securities. Empirical results of the study shows that on an average the loser portfolio outperformed the market by 19.6% and winner underperform the market by 5%. Hence the average cumulativ ...

... A Critique of Overreaction Effect in the Global Stock Markets over the past three decades extreme low return securities. Empirical results of the study shows that on an average the loser portfolio outperformed the market by 19.6% and winner underperform the market by 5%. Hence the average cumulativ ...

Economic Value of Stock Return Forecasts: An

... Only a few researchers have worked on the economic values of the predictable stock returns. Breen et al. (1989) found that the negative relationship between nominal interest rate and stock returns can be utilized by a fund manager to shift her portfolio between market index of stocks in the New Yor ...

... Only a few researchers have worked on the economic values of the predictable stock returns. Breen et al. (1989) found that the negative relationship between nominal interest rate and stock returns can be utilized by a fund manager to shift her portfolio between market index of stocks in the New Yor ...

CWC Well Services Corp. Announces Closing of Bought Deal Equity Financing Including Exercise of Over-Allotment Option

... Management has made certain assumptions and analyses which reflect their experiences and knowledge in the industry, including, without limitations, assumptions pertaining to well services demand as a result of commodity prices and future cash flow and earnings. These assumptions and analyses are bel ...

... Management has made certain assumptions and analyses which reflect their experiences and knowledge in the industry, including, without limitations, assumptions pertaining to well services demand as a result of commodity prices and future cash flow and earnings. These assumptions and analyses are bel ...

No Registration Opinions (2015 Update)

... under the Securities Act or an exemption, such as the exemption provided by Rule 144 or Rule 144A. The second opinion letter contemplates that the Purchase Agreement requires the Initial Purchasers to sell the securities only to qualified institutional buyers or offshore purchasers who agree not to ...

... under the Securities Act or an exemption, such as the exemption provided by Rule 144 or Rule 144A. The second opinion letter contemplates that the Purchase Agreement requires the Initial Purchasers to sell the securities only to qualified institutional buyers or offshore purchasers who agree not to ...

issuance of usd500,000000 3.625% notes due 2021

... This announcement is for information purposes only and does not constitute an invitation or a solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or ...

... This announcement is for information purposes only and does not constitute an invitation or a solicitation of an offer to acquire, purchase or subscribe for securities or an invitation to enter into an agreement to do any such things, nor is it calculated to invite any offer to acquire, purchase or ...

Public Offer of Company Securities: The Legal Perspective A paper

... development of the legal profession through this continuous legal education programme. The topic I have been asked to speak on is very relevant today, apt and timely, because: (i) it is the preferred source of raising capital for project by public companies for obvious economic reasons. (ii) of the ...

... development of the legal profession through this continuous legal education programme. The topic I have been asked to speak on is very relevant today, apt and timely, because: (i) it is the preferred source of raising capital for project by public companies for obvious economic reasons. (ii) of the ...

Chapter 19 Savings and Investment Strategies

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

National Institute of Securities Markets

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

multi-market trading and market liquidity: the post-mifid picture

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

Essentials of Corporate Finance

... • In large firms, shareholders are not involved in the day-to-day operations. Managers are employed as agents of the shareholders to make decisions on their behalf. • The treasurer and controller share financial functions of the firm and they report to the top financial manager within the firm who i ...

... • In large firms, shareholders are not involved in the day-to-day operations. Managers are employed as agents of the shareholders to make decisions on their behalf. • The treasurer and controller share financial functions of the firm and they report to the top financial manager within the firm who i ...

the islamic capital market volatility: a comparative

... integration is the union of stock exchanges of the world. As the index has the largest market capitalization in the United States, fluctuations in Dow Jones Industrial Average Index (DJAI) through economic integration could affect the stock price movement on the stock exchanges around the world. Lik ...

... integration is the union of stock exchanges of the world. As the index has the largest market capitalization in the United States, fluctuations in Dow Jones Industrial Average Index (DJAI) through economic integration could affect the stock price movement on the stock exchanges around the world. Lik ...

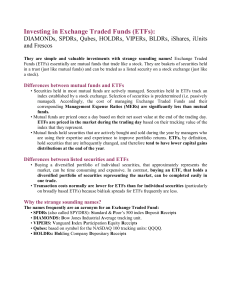

Investing in Exchange Traded Funds (ETFs):

... portfolio performance will approximate stock market returns. Size of the core depends upon the amount of stock market risk that the investor is willing to assume. Investors, who are satisfied with realization of returns that approximate the market, will place a larger portion of their portfolio into ...

... portfolio performance will approximate stock market returns. Size of the core depends upon the amount of stock market risk that the investor is willing to assume. Investors, who are satisfied with realization of returns that approximate the market, will place a larger portion of their portfolio into ...

CFA Institute

... having publicly listed property investment companies of sufficient size.4 The indexes can be aggregated and disaggregated into separate indexes for different continents and economic areas; property types; and for some countries, also for regions within those countries. The indexes are based on the m ...

... having publicly listed property investment companies of sufficient size.4 The indexes can be aggregated and disaggregated into separate indexes for different continents and economic areas; property types; and for some countries, also for regions within those countries. The indexes are based on the m ...

NBER WORKING PAPER SERIES THE TRANSMISSION MECHANISM AND THE Frederic S. Mishkin

... a problem for Israel in the early stages of its inflation targeting regime. As part of this regime, Israel had an intermediate target of an exchange rate band around a crawling peg, whose rate of crawl was set in a forward-looking manner by deriving it from the inflation target for the coming year. ...

... a problem for Israel in the early stages of its inflation targeting regime. As part of this regime, Israel had an intermediate target of an exchange rate band around a crawling peg, whose rate of crawl was set in a forward-looking manner by deriving it from the inflation target for the coming year. ...

448

... it is not clear whether such an increase in the total stock of capital will, ceteris paribus, cause a greater than proportional or less than proportional increase in the stock of residential capital. *Harvard University and the National Bureau of Economic Research. This paper is part of the NBER Pro ...

... it is not clear whether such an increase in the total stock of capital will, ceteris paribus, cause a greater than proportional or less than proportional increase in the stock of residential capital. *Harvard University and the National Bureau of Economic Research. This paper is part of the NBER Pro ...

to Supplement to the Listing Particulars

... This Supplement to the Listing Particulars should be read together with the Listing Particulars issued by Green Flash on 13 January 2015. The Directors of the Company hereby confirm that there has been no significant change to the information provided in the Listing Particulars over the last 12 mont ...

... This Supplement to the Listing Particulars should be read together with the Listing Particulars issued by Green Flash on 13 January 2015. The Directors of the Company hereby confirm that there has been no significant change to the information provided in the Listing Particulars over the last 12 mont ...

Function of Financial Markets

... organize exchanges, where buyers and sellers of securities (or their agents or brokers) meet in one central location to conduct trades. The New York and American stock exchanges for stocks and the Chicago Board of Trade for commodities (wheat, corn, silver, and other raw materials) are examples of o ...

... organize exchanges, where buyers and sellers of securities (or their agents or brokers) meet in one central location to conduct trades. The New York and American stock exchanges for stocks and the Chicago Board of Trade for commodities (wheat, corn, silver, and other raw materials) are examples of o ...

Stock exchange

A stock exchange is an exchange or stock market where stock brokers and traders can buy and/or sell stocks (also called shares), bonds, and other securities. Stock exchanges may also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as ""continuous auction"" markets, with buyers and sellers consummating transactions at a central location, such as the floor of the exchange.To be able to trade a security on a certain stock exchange, it must be listed there. Usually, there is a central location at least for record keeping, but trade is increasingly less linked to such a physical place, as modern markets use electronic networks, which gives them advantages of increased speed and reduced cost of transactions. Trade on an exchange is restricted to brokers who are members of the exchange. In recent years, various other trading venues, such as electronic communication networks, alternative trading systems and ""dark pools"" have taken much of the trading activity away from traditional stock exchanges.The initial public offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks (see stock valuation).There is usually no obligation for stock to be issued via the stock exchange itself, nor must stock be subsequently traded on the exchange. Such trading may be off exchange or over-the-counter. This is the usual way that derivatives and bonds are traded. Increasingly, stock exchanges are part of a global securities market.