ECONOMIC EFFECTS OF MONEY LAUNDERING – THE IMPACT

... In recent ten years, the phenomenon of money laundering became a problem perceived by both theorists and practitioners especially those who are responsible for the financial security of economic turnover. In the era of globalization, this problem should not be limited only to seek regulatory solutio ...

... In recent ten years, the phenomenon of money laundering became a problem perceived by both theorists and practitioners especially those who are responsible for the financial security of economic turnover. In the era of globalization, this problem should not be limited only to seek regulatory solutio ...

2,5 times greater than in the BAU scenario. Assumption : a

... Training provisions in the construction sector in EU are generally narrow in scope & poorly financed Conference « Jobs in a low carbon Europe », 20 – 21 February 2007, Brussels ...

... Training provisions in the construction sector in EU are generally narrow in scope & poorly financed Conference « Jobs in a low carbon Europe », 20 – 21 February 2007, Brussels ...

Some preliminary proposals for re-regulating financial systems

... same basic features: they originated from financial liberalisation and de-regulation and were characterised by assets and real estate bubbles. ...

... same basic features: they originated from financial liberalisation and de-regulation and were characterised by assets and real estate bubbles. ...

The Market of Financial Services: Segmentation and Targeting

... Culture refers to a set of values, ideas, artifacts and other meaningful symbols that help individuals communicate, interpret and evaluate as members of society (Engel, Blackwell and Miniard, 1995) Financial institutions that expand their operations abroad must be aware of the impact of some sensiti ...

... Culture refers to a set of values, ideas, artifacts and other meaningful symbols that help individuals communicate, interpret and evaluate as members of society (Engel, Blackwell and Miniard, 1995) Financial institutions that expand their operations abroad must be aware of the impact of some sensiti ...

Optimal credit flows - Lorenzo Bini Smaghi

... underestimate risks as they reach for higher yields. In periods of market euphoria, market participants can make credit and investment decisions that might not otherwise have been made. In hindsight, the failures on the part of lenders and supervisors in the major countries include poor risk managem ...

... underestimate risks as they reach for higher yields. In periods of market euphoria, market participants can make credit and investment decisions that might not otherwise have been made. In hindsight, the failures on the part of lenders and supervisors in the major countries include poor risk managem ...

The Relationship between Ownership Structure and the Probability

... the correct accounting of the company and its financial reporting. The board of directors are requested to handle company business, make fair and objective judgments, and have enough external board of director member who will exercise their independent judgment when the firm faces a business conflic ...

... the correct accounting of the company and its financial reporting. The board of directors are requested to handle company business, make fair and objective judgments, and have enough external board of director member who will exercise their independent judgment when the firm faces a business conflic ...

letter

... believe the FASB should consider during its deliberations. Proposed OTTI FSP We believe that the FASB should revise the proposed OTTI FSP to not require the non-credit impairment of held-to-maturity investment securities to be recorded in accumulated othercomprehensive-income (AOCI). We agree with r ...

... believe the FASB should consider during its deliberations. Proposed OTTI FSP We believe that the FASB should revise the proposed OTTI FSP to not require the non-credit impairment of held-to-maturity investment securities to be recorded in accumulated othercomprehensive-income (AOCI). We agree with r ...

External Financial Stress and External Financing Vulnerability in Turkey: Some

... outflows and deleveraging. These developments obviously put the domestic currency under pressure. A depreciation of domestic currency inflates the foreign currency liabilities of domestic agents, which eventually increases the possibility of bankruptcies in the real sector. An increase in non-perfo ...

... outflows and deleveraging. These developments obviously put the domestic currency under pressure. A depreciation of domestic currency inflates the foreign currency liabilities of domestic agents, which eventually increases the possibility of bankruptcies in the real sector. An increase in non-perfo ...

What does the global financial crisis tell us about Anglo

... We argue that the British financial system looked more Continental than Anglo-Saxon in some ways and the US financial system differed materially from the British system. We question the existence of a single Anglo-Saxon system. In the UK, not only have banks remained central, but their importance in ...

... We argue that the British financial system looked more Continental than Anglo-Saxon in some ways and the US financial system differed materially from the British system. We question the existence of a single Anglo-Saxon system. In the UK, not only have banks remained central, but their importance in ...

America and the Profit Motive - Our Reason Not to Abandon It

... released in 2009 when many people were still more emotional than rational about the financial crises. It makes the point that “there is democracy under capitalism ”and shows a “solution” by having a socialist economy that would end the problem of crises (Michel 2009, 1). The movie demonstrates the p ...

... released in 2009 when many people were still more emotional than rational about the financial crises. It makes the point that “there is democracy under capitalism ”and shows a “solution” by having a socialist economy that would end the problem of crises (Michel 2009, 1). The movie demonstrates the p ...

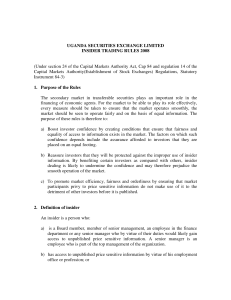

USE Insider Trading Rules-2009

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

... An insider shall not trade in securities during the closed periods which shall be periods 8 weeks to the publication of financial information. However, the prohibition on purchases, sales, pledges and gifts of listed securities during closed periods does not apply to: a) Purchases made under an empl ...

Lifeplan ICFS Financial Advice Satisfaction Index

... group invests a much smaller amount. ¡¡ Analysis of the duration of taking advice, especially with the same advisor, provides slightly contrasting results to past surveys. In accordance with previous surveys longer duration of advice and advice with the same advisor does result in higher levels of p ...

... group invests a much smaller amount. ¡¡ Analysis of the duration of taking advice, especially with the same advisor, provides slightly contrasting results to past surveys. In accordance with previous surveys longer duration of advice and advice with the same advisor does result in higher levels of p ...

Q2- A basic rationale for the objective of maximizing the wealth

... Ans7- As in other thing, there is a completive market for good managers. A company must pay them their opportunity cost, and indeed this is the interest of the stockholders. To the extent managers are paid in excess of their economic contribution, the returns available to investor will be less. Howe ...

... Ans7- As in other thing, there is a completive market for good managers. A company must pay them their opportunity cost, and indeed this is the interest of the stockholders. To the extent managers are paid in excess of their economic contribution, the returns available to investor will be less. Howe ...

Shining a light

... areas and explore “opportunities to take better advantage of EPA data that may be relevant”. However, the SEC did not heed these or other calls, including a 2007 petition filed by investor and environmental coalition Ceres on climate change. That is, until recently. In January 2009, the 400-member S ...

... areas and explore “opportunities to take better advantage of EPA data that may be relevant”. However, the SEC did not heed these or other calls, including a 2007 petition filed by investor and environmental coalition Ceres on climate change. That is, until recently. In January 2009, the 400-member S ...

Securities Analysts JournalR

... introduced for the Next-generation EDINET. InlineXBRL is a breakthrough technology that enables both reusability and readability of financial information prepared in XBRL format. A knowledge of Dimensions is also useful for understanding the structure of XBRL instance documents. Such knowledge will ...

... introduced for the Next-generation EDINET. InlineXBRL is a breakthrough technology that enables both reusability and readability of financial information prepared in XBRL format. A knowledge of Dimensions is also useful for understanding the structure of XBRL instance documents. Such knowledge will ...

AAA

... sub-prime delinquency ratio up to 13.8% in 1Q07 and 14.8% in 2Q07 US sub-prime related credit loss at around US$50-100 billion (Fed estimate) ...

... sub-prime delinquency ratio up to 13.8% in 1Q07 and 14.8% in 2Q07 US sub-prime related credit loss at around US$50-100 billion (Fed estimate) ...

Stockholding ad Financial Literacy in the French Population

... literature several measures of financial literacy have been proposed; one has nevertheless emerged as a benchmark. In 2004, Lusardi and Mitchell designed a questionnaire for the 2004 US Health and Retirement Study. Their aim was to identify three economic concepts that individuals should have some u ...

... literature several measures of financial literacy have been proposed; one has nevertheless emerged as a benchmark. In 2004, Lusardi and Mitchell designed a questionnaire for the 2004 US Health and Retirement Study. Their aim was to identify three economic concepts that individuals should have some u ...

Forensic Accounting Slides

... Trace assets in bankruptcy or divorce cases. Consulting. Work for government agencies such as IRS, FBI, SEC, law enforcement agencies, corporate security specialists. ...

... Trace assets in bankruptcy or divorce cases. Consulting. Work for government agencies such as IRS, FBI, SEC, law enforcement agencies, corporate security specialists. ...

duETS™ US Commercial Property 2X

... Global Index Group, Inc. (“GIG”) is the sponsor of the Global Index Group Real Estate Trust (the “Trust”). duETS U.S. Commercial Property 2X (the “Series”) is one series of the Trust and issues the securities described in this document. The securities may only be purchased and traded by “Qualified I ...

... Global Index Group, Inc. (“GIG”) is the sponsor of the Global Index Group Real Estate Trust (the “Trust”). duETS U.S. Commercial Property 2X (the “Series”) is one series of the Trust and issues the securities described in this document. The securities may only be purchased and traded by “Qualified I ...