Networks of Economic Market Interdependence and Systemic Risk

... slope, p < 10−64 ). The oil cluster is only sometimes correlated to oil prices (large black dots) (linked for 7 of 27 quarters). We will show that the network dynamics are consistent with the sequence of economic events of the financial crisis [5]. In traditional external factor models and models of ...

... slope, p < 10−64 ). The oil cluster is only sometimes correlated to oil prices (large black dots) (linked for 7 of 27 quarters). We will show that the network dynamics are consistent with the sequence of economic events of the financial crisis [5]. In traditional external factor models and models of ...

financial ratios - Timeless Investor

... • Loan Loss Reserves (part of the common equity account) should be sufficient to meet actual and potential losses. • Review footnotes and management discussion for disclosure of non-performing assets- observe trend. ...

... • Loan Loss Reserves (part of the common equity account) should be sufficient to meet actual and potential losses. • Review footnotes and management discussion for disclosure of non-performing assets- observe trend. ...

quarterly update - Strategic Asset Management Group

... Founder of Atalanta Sosnoff Capital Corporation, Mr. Sosnoff was formerly chairman of Atalanta Capital Corporation. He also was director of research at Starwood Corporation, a private investment firm, and a research analyst at E.F. Hutton. Mr. Sosnoff has authored two books on the money management b ...

... Founder of Atalanta Sosnoff Capital Corporation, Mr. Sosnoff was formerly chairman of Atalanta Capital Corporation. He also was director of research at Starwood Corporation, a private investment firm, and a research analyst at E.F. Hutton. Mr. Sosnoff has authored two books on the money management b ...

Genesis and prospects of the Ukrainian stock market

... affirmed on the basis of quite high development of its components. It is characterized by features that distinguish it among others, such as: the advantage of the primary market, issue of shares, small proportion of the stock market, lack of awareness of investors about the debt securities, low guar ...

... affirmed on the basis of quite high development of its components. It is characterized by features that distinguish it among others, such as: the advantage of the primary market, issue of shares, small proportion of the stock market, lack of awareness of investors about the debt securities, low guar ...

The TAMRIS Consultancy - Money Managed Properly

... fund the necessary research that lies behind security selection, asset allocation and portfolio management? ...

... fund the necessary research that lies behind security selection, asset allocation and portfolio management? ...

SPECULATIVE BUBBLES – A BEHAVIORAL APPROACH

... only very well prepared and skilled people invest. It is usually the market phase where stocks (investments) are considered to be a “dirty word”. People usually keep out of the markets and some even confound trading with gambling. 2. Awareness – It is the phase when very few of the initial investors ...

... only very well prepared and skilled people invest. It is usually the market phase where stocks (investments) are considered to be a “dirty word”. People usually keep out of the markets and some even confound trading with gambling. 2. Awareness – It is the phase when very few of the initial investors ...

Analysis Methods Procedures for Assessing the Stability of Business

... All these phenomena can cause distortions in the allocation of scarce resources is capital, disturbing signal constellation which economic agents base their decisions: artificial prices, profitability erroneous assessments, deformed division of risks, insufficient or excessive risk premiums etc. Du ...

... All these phenomena can cause distortions in the allocation of scarce resources is capital, disturbing signal constellation which economic agents base their decisions: artificial prices, profitability erroneous assessments, deformed division of risks, insufficient or excessive risk premiums etc. Du ...

THIS RELEASE (AND THE INFORMATION CONTAINED

... The Shares (including the exchangeable shares of an indirect subsidiary of Jackpotjoy expected to be offered to Canadian resident shareholders, which may be exchanged for Shares) anticipated to be issued pursuant to Intertain's corporate reorganisation pursuant to a court supervised plan of arrangem ...

... The Shares (including the exchangeable shares of an indirect subsidiary of Jackpotjoy expected to be offered to Canadian resident shareholders, which may be exchanged for Shares) anticipated to be issued pursuant to Intertain's corporate reorganisation pursuant to a court supervised plan of arrangem ...

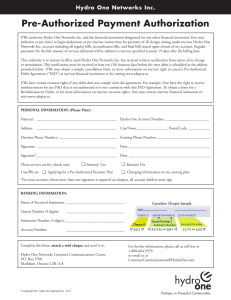

Pre-Authorized form En

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

A KEY TO CAPITAL MARKETS IN EMERGING COUNTRIES

... Unlike borrowing, equity does not have principal and interest repayment obligations that may pressure the cash flow of a company ...

... Unlike borrowing, equity does not have principal and interest repayment obligations that may pressure the cash flow of a company ...

Civics and Economics - NCDPI Social Studies Wiki

... 3. Use various types of technology to research and present information on financial planning, investing, government regulation and consumer protection; orally, virtually and on paper. 4. Formulate financial and economic questions by deconstructing a variety of sources, such as personal financial dec ...

... 3. Use various types of technology to research and present information on financial planning, investing, government regulation and consumer protection; orally, virtually and on paper. 4. Formulate financial and economic questions by deconstructing a variety of sources, such as personal financial dec ...

the financial aid formula 529 college savings plans

... Please consider the investment objectives, risks, charges and expenses associated with 529 plan investments before investing. Contact your financial advisor or visit columbiathreadneedle.com/us for a program brochure, which contains this and other important information about the plan. Read it carefu ...

... Please consider the investment objectives, risks, charges and expenses associated with 529 plan investments before investing. Contact your financial advisor or visit columbiathreadneedle.com/us for a program brochure, which contains this and other important information about the plan. Read it carefu ...

Lecture 6

... B be the market value of the debt issued by the firm S be the market value of the equity issued by the firm rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

... B be the market value of the debt issued by the firm S be the market value of the equity issued by the firm rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

Countrywide Financial

... who could not afford them for the sake of quick profits. Others accuse the company of even more unethical dealings. Some homeowners who are now struggling under liar loans are accusing Countrywide of predatory lending, saying the company misled them. Although some homeowners may have been truly misl ...

... who could not afford them for the sake of quick profits. Others accuse the company of even more unethical dealings. Some homeowners who are now struggling under liar loans are accusing Countrywide of predatory lending, saying the company misled them. Although some homeowners may have been truly misl ...

Statistical overview Types of financial misconduct cases reported

... accountability in respect of public funds, and the management of government programmes and services. The State and public servants are the custodians of public resources, and should administer public resources in an accountable and transparent manner on behalf of the entire citizenry. Effective acco ...

... accountability in respect of public funds, and the management of government programmes and services. The State and public servants are the custodians of public resources, and should administer public resources in an accountable and transparent manner on behalf of the entire citizenry. Effective acco ...

DOC, 126KB - Test Bank For

... The evolution of markets and institutions so that geographic boundaries do not restrict financial transactions. e. Joint ownership of international electronic payments systems. Answer: ...

... The evolution of markets and institutions so that geographic boundaries do not restrict financial transactions. e. Joint ownership of international electronic payments systems. Answer: ...

Institutions, Financial Systems and Transformation

... The purpose of institutions is to reduce uncertainty. Uncertainty exists when individuals have an incomplete idea about a (future) state of affairs, and when they are unable to calculate the benefits of the variety of options open to them.1 In this case, one cannot assume that decisions will be comp ...

... The purpose of institutions is to reduce uncertainty. Uncertainty exists when individuals have an incomplete idea about a (future) state of affairs, and when they are unable to calculate the benefits of the variety of options open to them.1 In this case, one cannot assume that decisions will be comp ...

Will the Global Crisis Lead to Global Transformations?

... functioning of unregulated national economy and the one of the modern global economy. We believe that this similarity accounts for the recurrence of some features of cyclical crises of the earlier epoch (see Grinin 2009a, 2009c; Grinin and Korotayev 2010; Grinin, Korotayev, and Malkov 2010 for more ...

... functioning of unregulated national economy and the one of the modern global economy. We believe that this similarity accounts for the recurrence of some features of cyclical crises of the earlier epoch (see Grinin 2009a, 2009c; Grinin and Korotayev 2010; Grinin, Korotayev, and Malkov 2010 for more ...

Manulife Investments announces securityholder results of Special

... the Corporation for an additional term of five years from May 31, 2011 to May 31, 2016. The Corporation will, therefore, terminate effective May 31, 2011 in accordance with its constating documents. On termination, shares of the Corporation will be redeemed and, following the payment or reservation ...

... the Corporation for an additional term of five years from May 31, 2011 to May 31, 2016. The Corporation will, therefore, terminate effective May 31, 2011 in accordance with its constating documents. On termination, shares of the Corporation will be redeemed and, following the payment or reservation ...

SMERA Press Release: 20 September, 2016 Jahir Impex (JI)

... SMERA Ratings Limited is a joint initiative of SIDBI, Dun & Bradstreet Information Services India Private Limited (D&B) and leading public and private sector banks in India. SMERA is registered with SEBI as a Credit Rating Agency and accredited by Reserve Bank of India. For more details, please visi ...

... SMERA Ratings Limited is a joint initiative of SIDBI, Dun & Bradstreet Information Services India Private Limited (D&B) and leading public and private sector banks in India. SMERA is registered with SEBI as a Credit Rating Agency and accredited by Reserve Bank of India. For more details, please visi ...

Executive Compensation under the Emergency Economic

... to purchase residential and commercial mortgages, mortgage-backed securities and other instruments from financial institutions. EESA also permits Treasury to acquire an equity or debt interest in the financial institution. The financial rescue plan seeks to ensure that senior executives will not be ...

... to purchase residential and commercial mortgages, mortgage-backed securities and other instruments from financial institutions. EESA also permits Treasury to acquire an equity or debt interest in the financial institution. The financial rescue plan seeks to ensure that senior executives will not be ...