Merger Review - The Commission’s Green Paper

... Probability as to the assessment of the operation (“more likely than not that the operation modified significantly impedes effective competition”) ...

... Probability as to the assessment of the operation (“more likely than not that the operation modified significantly impedes effective competition”) ...

NBER WORKING PAPER SERIES IS FINANCIAL GLOBALIZATION BENEFICIAL? Frederic S. Mishkin

... should be far lower to poor countries where it is higher. We sometimes see this happening and it does explain why there has been a big increase in the amount of capital that has moved to poor countries in recent years, but most capital instead flows from one rich country to another where the returns ...

... should be far lower to poor countries where it is higher. We sometimes see this happening and it does explain why there has been a big increase in the amount of capital that has moved to poor countries in recent years, but most capital instead flows from one rich country to another where the returns ...

Morgan Stanley

... • Affected by inability to raise funds in the long/shortterm debt/equity capital markets or inability to access secured lending markets – Caused by: • Disruption of the financial markets • Negative views about the financial services industry • Negative perception of long or short term financial pros ...

... • Affected by inability to raise funds in the long/shortterm debt/equity capital markets or inability to access secured lending markets – Caused by: • Disruption of the financial markets • Negative views about the financial services industry • Negative perception of long or short term financial pros ...

Sources of Corporate Financing and Economic Crisis in

... The paper suggests that large firms, to some extent, are leaving banks and going to the capital market for their financing after the crisis. The paper also suggests that profitable small firms are gaining easier access to credit by financial institutions after the crisis. There has been a shift in t ...

... The paper suggests that large firms, to some extent, are leaving banks and going to the capital market for their financing after the crisis. The paper also suggests that profitable small firms are gaining easier access to credit by financial institutions after the crisis. There has been a shift in t ...

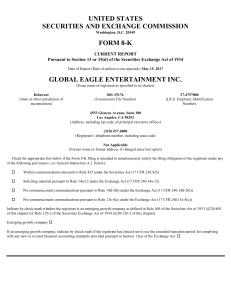

IB Group Comment Letter to SEC Urging Market Data Distribution

... As we show below, the current market data fee structure discourages a substantial majority of the investing public from subscribing to real-time data from the various exchanges and trading venues upon which their trades might be executed. Lack of real-time data causes these customers disproportionat ...

... As we show below, the current market data fee structure discourages a substantial majority of the investing public from subscribing to real-time data from the various exchanges and trading venues upon which their trades might be executed. Lack of real-time data causes these customers disproportionat ...

Stock Underwriting

... A shell is an inactive public company with securities traded in the marketplace. It can be used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little ...

... A shell is an inactive public company with securities traded in the marketplace. It can be used as a backdoor way of becoming a public company. The easiest way to become a public company is to merge into the public shell. – One big advantage is the time and money saved. The entrepreneurs pay little ...

Macroprudential Policy Frameworks and Tools

... be related to the distribution of risk in the financial system (the cross-sectional dimension). In addition to addressing the sources of risk, macroprudential policy also aims to ensure that financial system resilience is proportionate to the level of risk. Macroprudential policy is often discussed ...

... be related to the distribution of risk in the financial system (the cross-sectional dimension). In addition to addressing the sources of risk, macroprudential policy also aims to ensure that financial system resilience is proportionate to the level of risk. Macroprudential policy is often discussed ...

Economics and Financial Literacy

... best alternative given up when an economic choice is made. For example, a high school student wants to buy a car. He decides not to try out for the football team in order to get a job to enable him to buy the car. The opportunity cost is playing football. ...

... best alternative given up when an economic choice is made. For example, a high school student wants to buy a car. He decides not to try out for the football team in order to get a job to enable him to buy the car. The opportunity cost is playing football. ...

Who Regulates Whom and How? An Overview of U.S. Financial

... regulates some of the activities that the firm is engaging in, but a third agency controls a government initiative to resolve or alleviate a problem related to the firm or its activities. On the other hand, there are regulatory gaps in which some of the firms participating in a financial activity do ...

... regulates some of the activities that the firm is engaging in, but a third agency controls a government initiative to resolve or alleviate a problem related to the firm or its activities. On the other hand, there are regulatory gaps in which some of the firms participating in a financial activity do ...

Atradius NV - Crédito y Caución

... While reinsurance recoverables have decreased significantly in recent years, down to 48% of shareholders' equity at YE2015, from 83% at YE2009, they remain at a level higher than peers due to the group's reliance on quota share reinsurance. Reliance on reinsurance to support capital requirements on ...

... While reinsurance recoverables have decreased significantly in recent years, down to 48% of shareholders' equity at YE2015, from 83% at YE2009, they remain at a level higher than peers due to the group's reliance on quota share reinsurance. Reliance on reinsurance to support capital requirements on ...

Koovs plc Koovs plc closes current round of capital raising at £26.2

... United Kingdom may be restricted by law. Persons into whose possession these documents come should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws or regulations of any such jurisdiction. In pa ...

... United Kingdom may be restricted by law. Persons into whose possession these documents come should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws or regulations of any such jurisdiction. In pa ...

Causes of Financial Distress - This Webs.com site has not yet been

... The many years of DFI mismanagement and lack of adequate funding from government is clearly reflected in the firms they have funded. For example, in Uchumi Supermarket Ltd, where ICDC has a shareholding of 32%, it has been experiencing financial and operational difficulties occasioned by sub-optimal ...

... The many years of DFI mismanagement and lack of adequate funding from government is clearly reflected in the firms they have funded. For example, in Uchumi Supermarket Ltd, where ICDC has a shareholding of 32%, it has been experiencing financial and operational difficulties occasioned by sub-optimal ...

Standard Operating Procedures - TheMat.com

... regulations can be found using the following link) ● https://www.childwelfare.gov/systemwide/laws_polici es/state/ ● If the state regulations do not require background checks for persons working in the youth sports arena then each BTS organization will be required to have a current background check ...

... regulations can be found using the following link) ● https://www.childwelfare.gov/systemwide/laws_polici es/state/ ● If the state regulations do not require background checks for persons working in the youth sports arena then each BTS organization will be required to have a current background check ...

Bulgarian Academy of Sciences Economic Research Institute

... • An important factor for the development of the BSE was the increase of retail investors’ deals. The relatively simplified procedures, as well as the similarities with the investment companies regulations, made the BSE deals a preferred form of investment capitals’ consolidation for the Managerial ...

... • An important factor for the development of the BSE was the increase of retail investors’ deals. The relatively simplified procedures, as well as the similarities with the investment companies regulations, made the BSE deals a preferred form of investment capitals’ consolidation for the Managerial ...

COURSE TITLE DERIVATIVES MARKETS (200 characters max

... The course aims at profound understanding the specifics of derivative markets. Vast scope of real derivative instruments traded on world exchanges will be described: starting with plain futures/forwards, swaps, through vanilla options, exotic options, ending with advanced financial instruments (like ...

... The course aims at profound understanding the specifics of derivative markets. Vast scope of real derivative instruments traded on world exchanges will be described: starting with plain futures/forwards, swaps, through vanilla options, exotic options, ending with advanced financial instruments (like ...

Professor Venkatesh Panchapagesan

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

FREE Sample Here

... D) financial crises that have occurred at various times. Answer: D Diff: 1 Topic: 1.5 The Role of the Government in Financial Markets Objective: 1.16 the U.S. Department of the Treasury's proposed plan for regulatory reform 4) The proposal by the U.S. Department of the Treasury, popularly referred t ...

... D) financial crises that have occurred at various times. Answer: D Diff: 1 Topic: 1.5 The Role of the Government in Financial Markets Objective: 1.16 the U.S. Department of the Treasury's proposed plan for regulatory reform 4) The proposal by the U.S. Department of the Treasury, popularly referred t ...