Professor Venkatesh Panchapagesan

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

... This course examines the theory and practice behind the organization of world’s major financial markets. Students will learn about key economic principles that drive wellfunctioning financial markets along with practical, institutional details necessary to navigate them. The course covers equity, de ...

MODELS FOR THE ASSESSMENT OF THE ENTREPRISE

... The calculation of the score function requires the prior awareness of certain rates that help determine the bankruptcy risk of an enterprise and the early protection by correcting measures. A note (Z), called score, is given for the enterprise, representing a l inear combination of rates and, varyin ...

... The calculation of the score function requires the prior awareness of certain rates that help determine the bankruptcy risk of an enterprise and the early protection by correcting measures. A note (Z), called score, is given for the enterprise, representing a l inear combination of rates and, varyin ...

IFRS 9 Financial Instruments

... is being carried out by EFRAG in partnership with the ANC, ASCG, FRC and the OIC. This questionnaire has been sent to respondents to the three 2012-2013 field-tests, European banking and insurance associations and European National Standard Setters. All responses are welcomed: please feel free to pa ...

... is being carried out by EFRAG in partnership with the ANC, ASCG, FRC and the OIC. This questionnaire has been sent to respondents to the three 2012-2013 field-tests, European banking and insurance associations and European National Standard Setters. All responses are welcomed: please feel free to pa ...

The Pros and Cons of Regulating Corporate Reporting: A Critical

... including recent discussion in the U.S. Congress to transfer oversight of accounting standards from the SEC to a systemic risk council charged with preserving the soundness of the banking system. Our second objective is to isolate issues for future research. In this spirit, we conclude the paper wit ...

... including recent discussion in the U.S. Congress to transfer oversight of accounting standards from the SEC to a systemic risk council charged with preserving the soundness of the banking system. Our second objective is to isolate issues for future research. In this spirit, we conclude the paper wit ...

A Financial Risk and Fraud Model Comparison of Bear Stearns and

... ---Insert Tables 1- 6 Here--To help assess the risk management of both firms, their condensed balance sheets were compiled in Tables 7 and 8 for 2003 and 2007. A major problem was the traditional lack of classified balance sheets for banks. No current and long-term categories of assets and liabiliti ...

... ---Insert Tables 1- 6 Here--To help assess the risk management of both firms, their condensed balance sheets were compiled in Tables 7 and 8 for 2003 and 2007. A major problem was the traditional lack of classified balance sheets for banks. No current and long-term categories of assets and liabiliti ...

Personal Finance on the Web

... Quick Guide to Estate Planning, which, like the IRA Corner, is a set of advice articles on passing your estate on to your heirs. A tax guide has a wealth of information on everything from tax traps to investor tax breaks. Tax Matters is simply an archived set of current and semi-current tax-related ...

... Quick Guide to Estate Planning, which, like the IRA Corner, is a set of advice articles on passing your estate on to your heirs. A tax guide has a wealth of information on everything from tax traps to investor tax breaks. Tax Matters is simply an archived set of current and semi-current tax-related ...

FIN_Course_SLO

... 6. Explain how real estate value is determined by market supply and demand, as well as capital market conditions. 7. Make mortgage calculations, e.g. monthly payment, amortization table construction and effective borrowing cost. 8. Interpret a real estate listing contract and a sales contract. ...

... 6. Explain how real estate value is determined by market supply and demand, as well as capital market conditions. 7. Make mortgage calculations, e.g. monthly payment, amortization table construction and effective borrowing cost. 8. Interpret a real estate listing contract and a sales contract. ...

A Single Protocol for Clearing and Settlement?

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

... “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” ...

Overview of the Consumer Financial Protection Bureau

... when a bank turns over documents containing privileged information to a specific list of regulators — the Federal Reserve System, the Federal Deposit Insurance Corp. or the Office of the Comptroller of the Currency — the bank is assured that its right to privilege will not be w aived. This guarantee ...

... when a bank turns over documents containing privileged information to a specific list of regulators — the Federal Reserve System, the Federal Deposit Insurance Corp. or the Office of the Comptroller of the Currency — the bank is assured that its right to privilege will not be w aived. This guarantee ...

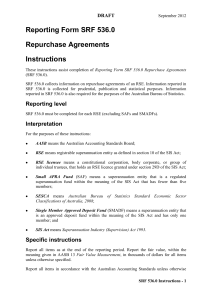

Reporting Form SRF 536.0 Repurchase Agreements Instructions

... holding gains (and losses) and income generated by the security remains with the original holder. Repos and securities lending/borrowing both occur at a specified price with a commitment to repurchase the same or similar securities at a fixed price on a future date, which is specified in the contrac ...

... holding gains (and losses) and income generated by the security remains with the original holder. Repos and securities lending/borrowing both occur at a specified price with a commitment to repurchase the same or similar securities at a fixed price on a future date, which is specified in the contrac ...

Repurchase agreements and the law

... borrower filed for bankruptcy, the lender could retain possession of the securities. In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market ...

... borrower filed for bankruptcy, the lender could retain possession of the securities. In 2000, however, a court ruling in the bankruptcy of Criimi Mae, a publicly held commercial mortage REIT, took market ...

Financing Young, Beginning, and Small Farmers: The Farm Credit System

... Development at the Farm Credit Council, based in Washington, D.C. The Farm Credit Council is the national trade organization representing the Farm Credit System's interests before Congress and others. Congress chartered the Farm Credit System (FCS) in 1916 to finance agriculture. It is a system of f ...

... Development at the Farm Credit Council, based in Washington, D.C. The Farm Credit Council is the national trade organization representing the Farm Credit System's interests before Congress and others. Congress chartered the Farm Credit System (FCS) in 1916 to finance agriculture. It is a system of f ...

The Financial Transaction Tax

... The rates of the tax varied from 0.02 to 0.06 percent. For most of the time, the tax was levied on the “par value” of a stock, which is the listed value on stock certificates and is usually below market value. Transfers of bonds, as well as new issues of stocks and bonds also were taxed at varying r ...

... The rates of the tax varied from 0.02 to 0.06 percent. For most of the time, the tax was levied on the “par value” of a stock, which is the listed value on stock certificates and is usually below market value. Transfers of bonds, as well as new issues of stocks and bonds also were taxed at varying r ...

forecasting the romanian financial system stability using a stochastic

... a “stress index” for the banking sector (Hanschel and Monnin, 2005). Schweizerische Nationalbank (2006) has built a stress index for the Switzerland's banking system using this technique. Experts from the Netherlands Central Bank had an original approach to the construction of the index (Van den End ...

... a “stress index” for the banking sector (Hanschel and Monnin, 2005). Schweizerische Nationalbank (2006) has built a stress index for the Switzerland's banking system using this technique. Experts from the Netherlands Central Bank had an original approach to the construction of the index (Van den End ...

PROVIDENT FINANCIAL PLC £2,000,000,000 Euro Medium Term

... the FSA in respect of capital adequacy and large exposures but not in respect of liquidity. On 16 December 2010, the Basel Committee on Banking Supervision (the Basel Committee) published the Basel III rules in documents entitled "Basel III: A global regulatory framework for more resilient banks and ...

... the FSA in respect of capital adequacy and large exposures but not in respect of liquidity. On 16 December 2010, the Basel Committee on Banking Supervision (the Basel Committee) published the Basel III rules in documents entitled "Basel III: A global regulatory framework for more resilient banks and ...

Financial Competence, Overconfidence, and Trusting

... session subjects completed four tasks. After providing informed, signed consent subjects engaged in an experiment. Second, a risk assessment was completed. Finally, at the end of each session, subjects completed a background information questionnaire and took a financial literacy quiz. In the exper ...

... session subjects completed four tasks. After providing informed, signed consent subjects engaged in an experiment. Second, a risk assessment was completed. Finally, at the end of each session, subjects completed a background information questionnaire and took a financial literacy quiz. In the exper ...

SECURITIZATION, RISK TRANSFERRING AND FINANCIAL

... rising interest has recently emerged with the financial crisis. There is an empirical literature studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez- ...

... rising interest has recently emerged with the financial crisis. There is an empirical literature studying the interaction of lending and housing prices both at the international (Hofmann, 2001; Tsatsaronis and Zhu, 2004) and the individual country levels (Gerlach and Peng, 2005; Gimeno and Martínez- ...