Three Essays on The Term Structure of Interest Rates

... is equal to the short-term interest rate differential under the covered interest parity) yields negative estimates of the slope coefficient. This is called the forward premium anomaly (also see Backus, Foresi, and Telmer (2001) for a recent discussion). For long-term interest rates, more favorable e ...

... is equal to the short-term interest rate differential under the covered interest parity) yields negative estimates of the slope coefficient. This is called the forward premium anomaly (also see Backus, Foresi, and Telmer (2001) for a recent discussion). For long-term interest rates, more favorable e ...

The Power of Forward Guidance Revisited

... power of automatic stabilizers at the zero lower bound and Gornemann, Kuester, and Nakajima (2014) who investigate the distributional implications of monetary policy shocks. Two other recent papers suggest “solutions” to the forward guidance puzzle. Del Negro, Giannoni, and Patterson (2013) argue t ...

... power of automatic stabilizers at the zero lower bound and Gornemann, Kuester, and Nakajima (2014) who investigate the distributional implications of monetary policy shocks. Two other recent papers suggest “solutions” to the forward guidance puzzle. Del Negro, Giannoni, and Patterson (2013) argue t ...

Public real estate and the term structure of interest rates

... and numerous papers subsequently, have empirically demonstrated that interest rates may represent a systematic risk factor for real estate. Furthermore, interest rate risk can also be transmitted via the yields used to capitalise the income flows from the properties underlying the firms (Lizieri an ...

... and numerous papers subsequently, have empirically demonstrated that interest rates may represent a systematic risk factor for real estate. Furthermore, interest rate risk can also be transmitted via the yields used to capitalise the income flows from the properties underlying the firms (Lizieri an ...

bondch11s

... the mortgage, or adjustable rate, ARM, in which the rate is reset periodically based on some prespecified rate or index. Since the late 1970s, other types of mortgage loans have been introduced. These include graduated payment mortgages (GPM) which start with low monthly payments in earlier years an ...

... the mortgage, or adjustable rate, ARM, in which the rate is reset periodically based on some prespecified rate or index. Since the late 1970s, other types of mortgage loans have been introduced. These include graduated payment mortgages (GPM) which start with low monthly payments in earlier years an ...

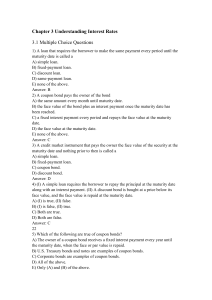

Chapter 3 Understanding Interest Rates

... Answer: C 53) The nominal interest rate minus the expected rate of inflation A) defines the real interest rate. B) is a better measure of the incentives to borrow and lend than is the nominal interest rate. C) is a more accurate indicator of the tightness of credit market conditions than is the nomi ...

... Answer: C 53) The nominal interest rate minus the expected rate of inflation A) defines the real interest rate. B) is a better measure of the incentives to borrow and lend than is the nominal interest rate. C) is a more accurate indicator of the tightness of credit market conditions than is the nomi ...

Title of the Text Crauder

... With an installment loan you borrow money for a fixed period of time, called the term of the loan, and you make regular payments (usually monthly) to pay off the loan plus interest accumulated during that time. ...

... With an installment loan you borrow money for a fixed period of time, called the term of the loan, and you make regular payments (usually monthly) to pay off the loan plus interest accumulated during that time. ...

Interest Rate Policy and the Inflation Scare Problem

... money growth and inflation. To view the Federal Reserve’s policy instrument as the federal funds rate is thus to set money to the side, since at any point in time money demand is accommodated at the going interest rate. This does not say, however, that money can be left out of account altogether. Th ...

... money growth and inflation. To view the Federal Reserve’s policy instrument as the federal funds rate is thus to set money to the side, since at any point in time money demand is accommodated at the going interest rate. This does not say, however, that money can be left out of account altogether. Th ...

Taxation and the Taylor Principle

... the central bank’s inflation target. When depreciation allowances are incorporated into the model, the results are modified in an interesting way. The discounted present value of depreciation allowances enters the user cost of capital. However, because the tax system measures depreciation in histori ...

... the central bank’s inflation target. When depreciation allowances are incorporated into the model, the results are modified in an interesting way. The discounted present value of depreciation allowances enters the user cost of capital. However, because the tax system measures depreciation in histori ...

background on savings institutions

... their owners with greater potential to benefit from their performance. The dividends and/or stock price of a high-performance institution can grow, thereby providing direct benefits to the shareholders. In contrast, the owners (depositors) of a mutual institution do not benefit directly from high pe ...

... their owners with greater potential to benefit from their performance. The dividends and/or stock price of a high-performance institution can grow, thereby providing direct benefits to the shareholders. In contrast, the owners (depositors) of a mutual institution do not benefit directly from high pe ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.