Money Demand, the Equilibrium Interest Rate, and Monetary Policy

... The Speculation Motive • suppose I bought a bond for $1000 that offers 10% interest and hold it for a year, then decide to sell it. In the meantime, interest rates have risen and a similar bond now offers 12% a year. Could I sell my bond for $1000? No, because why would anyone buy it when he or she ...

... The Speculation Motive • suppose I bought a bond for $1000 that offers 10% interest and hold it for a year, then decide to sell it. In the meantime, interest rates have risen and a similar bond now offers 12% a year. Could I sell my bond for $1000? No, because why would anyone buy it when he or she ...

Interest rate volatility in 1980 - Federal Reserve Bank of Chicago

... 1980, reaching record highs in early spring, then plummeting until midsummer, only to rise above their previous peaks by late fall. Interest rates were more variable not only in a cyclical sense, but also in their weekly and daily behavior. It is unlikely that any single factor was responsible for t ...

... 1980, reaching record highs in early spring, then plummeting until midsummer, only to rise above their previous peaks by late fall. Interest rates were more variable not only in a cyclical sense, but also in their weekly and daily behavior. It is unlikely that any single factor was responsible for t ...

Credit Constraints and Growth in a Global Economy St´ephane Guibaud (LSE)

... investment rates across countries. Together, these facts pose a challenge to existing open-economy macroeconomic models, which must explain not only why savings can outpace investment in a fast-growing economy, but also why the global equilibrium features asymmetric responses of saving rate, leadin ...

... investment rates across countries. Together, these facts pose a challenge to existing open-economy macroeconomic models, which must explain not only why savings can outpace investment in a fast-growing economy, but also why the global equilibrium features asymmetric responses of saving rate, leadin ...

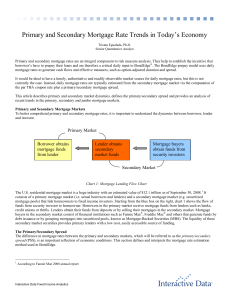

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... From 2003 through 2007, the 30-year Conventional PSS was on average about 71 basis points. During this time, par coupon rates were high (above 5%). However, in the wake of the 2008 credit crisis, par rates dropped below 5% and the PSS rose above 120 basis points as seen in Chart 2. What caused this ...

... From 2003 through 2007, the 30-year Conventional PSS was on average about 71 basis points. During this time, par coupon rates were high (above 5%). However, in the wake of the 2008 credit crisis, par rates dropped below 5% and the PSS rose above 120 basis points as seen in Chart 2. What caused this ...

NBER WORKING PAPER SERIES SOME ESTIMATES FOR OECD COUNTRIES

... 4.5 percent of GDP, compared with 1.5 percent in 2000, and is projected to increase further in the future. Over the same period, Germany’s deÞcit rose to 3.75 percent of GDP from 1 percent; France’s to 3.5 compared with 1.5, and Italy’s to 2.5 from 0.75 percent; as a result, the Stability and Growth ...

... 4.5 percent of GDP, compared with 1.5 percent in 2000, and is projected to increase further in the future. Over the same period, Germany’s deÞcit rose to 3.75 percent of GDP from 1 percent; France’s to 3.5 compared with 1.5, and Italy’s to 2.5 from 0.75 percent; as a result, the Stability and Growth ...

Unit 1:

... markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than one year. Capital market transactions involve ...

... markets versus futures markets is the maturity of the instruments that are traded. Spot market transactions involve securities that have maturities of less than one year whereas futures markets transactions involve securities with maturities greater than one year. Capital market transactions involve ...

FI3300 Corporation Finance

... HMV Inc. needs to raise funds for an expansion project. The company can choose to issue either zerocoupon bonds or semi-annual coupon bonds. In either case the bonds would have the SAME nominal required rate of return, a 20-year maturity and a par value of $1,000. If the company issues the zerocoupo ...

... HMV Inc. needs to raise funds for an expansion project. The company can choose to issue either zerocoupon bonds or semi-annual coupon bonds. In either case the bonds would have the SAME nominal required rate of return, a 20-year maturity and a par value of $1,000. If the company issues the zerocoupo ...

Reassessing the Link between the Japanese Yen and Emerging

... method can help identify key economic factors that play important role for determining the timevarying conditional correlations over time. Previous studies point out that both the real and financial factors affect the co-movement of Asian currencies with JPY. Heavier economic dependence of Asian coun ...

... method can help identify key economic factors that play important role for determining the timevarying conditional correlations over time. Previous studies point out that both the real and financial factors affect the co-movement of Asian currencies with JPY. Heavier economic dependence of Asian coun ...

ACT 240H1F Sum08 Final Privacy code A 02

... question). Under this mortgage, for the first 120 months the interest rate on the debt is 6% per year, compounded monthly. You are allowed to make monthly payments which you can choose from month to month, but at least $1,200 per month. However, if and when the outstanding principal (the loan balanc ...

... question). Under this mortgage, for the first 120 months the interest rate on the debt is 6% per year, compounded monthly. You are allowed to make monthly payments which you can choose from month to month, but at least $1,200 per month. However, if and when the outstanding principal (the loan balanc ...

The Declining U.S. Saving Rate

... • The decline in net worth/disposable income from 6.3 in mid-2007 to 4.7 in early-2009 led households to save more • Households are in about the same position today that they were in the early 1990s; it would not be surprising if this level of savings persisted ...

... • The decline in net worth/disposable income from 6.3 in mid-2007 to 4.7 in early-2009 led households to save more • Households are in about the same position today that they were in the early 1990s; it would not be surprising if this level of savings persisted ...

crowding

... the usual 1/(1-c) multiplier effect. Given m4 > 0, increases in Y imply increases in the transactions demand for money. If the money supply is fixed, then either rB or rK, or both, must rise. (Note: m2,m3 < 0.) ...

... the usual 1/(1-c) multiplier effect. Given m4 > 0, increases in Y imply increases in the transactions demand for money. If the money supply is fixed, then either rB or rK, or both, must rise. (Note: m2,m3 < 0.) ...

The Transmission mechanism of monetary policy

... securities, such as bonds and equities. The price of bonds is inversely related to the long-term interest rate, so a rise in long-term interest rates lowers bond prices, and vice versa for a fall in long rates. If other things are equal (especially inflation expectations), higher interest rates also ...

... securities, such as bonds and equities. The price of bonds is inversely related to the long-term interest rate, so a rise in long-term interest rates lowers bond prices, and vice versa for a fall in long rates. If other things are equal (especially inflation expectations), higher interest rates also ...

Glossary of Money Market Terms

... transactions they can execute and the number of people giving authorisation. More generally, limits can also be applied to the financial risk that a company or organisation is willing to bear. Limits can, for example, be set for the proportion of foreign exchange exposures and the time period within ...

... transactions they can execute and the number of people giving authorisation. More generally, limits can also be applied to the financial risk that a company or organisation is willing to bear. Limits can, for example, be set for the proportion of foreign exchange exposures and the time period within ...

securities

... of 20% the brokerage fee or 50% of the margin interest paid during the Privileged Period, whichever is higher, up to a maximum of HK$3,800. - The brokerage fee and margin interest for IPO subscriptions and stagging loan services will be excluded when calculating the refund. - Eligible customers must ...

... of 20% the brokerage fee or 50% of the margin interest paid during the Privileged Period, whichever is higher, up to a maximum of HK$3,800. - The brokerage fee and margin interest for IPO subscriptions and stagging loan services will be excluded when calculating the refund. - Eligible customers must ...

press release

... In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the trend has continued at a slower pace. For example, according to Citibank research, the spread on originally BB-rated U.S. CLO tranches decreased from approximately 11% at the end of Q2 2012 to 8% as of the end of Septembe ...

... In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the trend has continued at a slower pace. For example, according to Citibank research, the spread on originally BB-rated U.S. CLO tranches decreased from approximately 11% at the end of Q2 2012 to 8% as of the end of Septembe ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.