Mortgage Safety Tips

... make the payment on a rate adjustment or run into difficult times due to a job layoff or major medical operation pending, you may qualify for a loan workout plan or other options that are much less damaging than a foreclosure. Keeping the lines of communication open with your lender may be the most ...

... make the payment on a rate adjustment or run into difficult times due to a job layoff or major medical operation pending, you may qualify for a loan workout plan or other options that are much less damaging than a foreclosure. Keeping the lines of communication open with your lender may be the most ...

Factors to Consider When Thinking About Purchasing a Short Sale

... is estimated that the average cost of handling a foreclosure for the financial institution is $50,000 +/-. In most cases the listing broker is responsible for all services and repairs necessary to get a house ready to sell. Also they must arrange for lawn care, utilities, and maintenance and will be ...

... is estimated that the average cost of handling a foreclosure for the financial institution is $50,000 +/-. In most cases the listing broker is responsible for all services and repairs necessary to get a house ready to sell. Also they must arrange for lawn care, utilities, and maintenance and will be ...

Covered Bonds

... Covered Bonds in Spain Almost 1/5 of mortgages funded by Cédulas, and 1/3 of new lending In 2005, issuance highest in Europe surpassing that of Jumbo Pfandbriefe Issuance open to all types of institutions (multi-sellers, direct) 80% LTV limit on residential or 70% for commercial property ...

... Covered Bonds in Spain Almost 1/5 of mortgages funded by Cédulas, and 1/3 of new lending In 2005, issuance highest in Europe surpassing that of Jumbo Pfandbriefe Issuance open to all types of institutions (multi-sellers, direct) 80% LTV limit on residential or 70% for commercial property ...

Yale School of Management

... Bankruptcy Risk for Lending Institutions Deposits normally are short term, whereas the mortgage are longer term. There is a huge duration difference between the bank’s liabilities and assets. This leads to high bankruptcy risk. An example: In 1971, a 30-year $200K mortgage had a fixed rate of ...

... Bankruptcy Risk for Lending Institutions Deposits normally are short term, whereas the mortgage are longer term. There is a huge duration difference between the bank’s liabilities and assets. This leads to high bankruptcy risk. An example: In 1971, a 30-year $200K mortgage had a fixed rate of ...

Bulletin COR 14-045: Cash Reserve Requirements

... SunTrust Mortgage periodically reviews guidelines seeking opportunity to enhance clarity and increase efficiency. By revising the cash reserve requirements for the Key Loan Program, we strive to delight our correspondent ...

... SunTrust Mortgage periodically reviews guidelines seeking opportunity to enhance clarity and increase efficiency. By revising the cash reserve requirements for the Key Loan Program, we strive to delight our correspondent ...

Asociación de Bancos de México MORTGAGE LENDING IN MEXICO

... In the last 10 years Almost 1 million of credits were granted ...

... In the last 10 years Almost 1 million of credits were granted ...

Course Home. - Primary Residential Mortgage

... mortgage banking platform. As a debt-free organization, PRMI has incredible capacity to support its Branches with competitive pricing, make investments in leadingedge technology, and support the growth and business development goals of our partners in the field. Employees and partners know that PRMI ...

... mortgage banking platform. As a debt-free organization, PRMI has incredible capacity to support its Branches with competitive pricing, make investments in leadingedge technology, and support the growth and business development goals of our partners in the field. Employees and partners know that PRMI ...

invest in syndicate mortgages

... schedules are based on expected absorption. The original schedules may make assumptions on what the market will be 1-3 years down the road, such as competing projects, ...

... schedules are based on expected absorption. The original schedules may make assumptions on what the market will be 1-3 years down the road, such as competing projects, ...

Real estate terms and definitions

... A cosigner cannot improve a credit report, but can improve the chances of getting a mortgage. Cosigners should be aware that cosigning for a loan will adversely affect future creditworthiness since that loan becomes what is known as a contingent liability against future borrowing power. Credit Repor ...

... A cosigner cannot improve a credit report, but can improve the chances of getting a mortgage. Cosigners should be aware that cosigning for a loan will adversely affect future creditworthiness since that loan becomes what is known as a contingent liability against future borrowing power. Credit Repor ...

New Economic Bubbles

... 6) a) @ 4% = $477 X 4 = $1,908 per month for 30-years (fixed rate loan paying back all principal & interest in 30 years) b) @ 8% = $734 X 4 = $2,936 per month for 30-years 7) $500,000 X 1.2% = $6,000 per year in taxes or $500 per month Full Payment for $500,000 home is $2,408 per month at 4.0% loan ...

... 6) a) @ 4% = $477 X 4 = $1,908 per month for 30-years (fixed rate loan paying back all principal & interest in 30 years) b) @ 8% = $734 X 4 = $2,936 per month for 30-years 7) $500,000 X 1.2% = $6,000 per year in taxes or $500 per month Full Payment for $500,000 home is $2,408 per month at 4.0% loan ...

Institutional Use of Mortgage Markets

... • Servicing simplicity: Collecting principal and interest when rates are changing For mortgages allowing negative amortization, tracking changing principal and interest payments can be difficult ...

... • Servicing simplicity: Collecting principal and interest when rates are changing For mortgages allowing negative amortization, tracking changing principal and interest payments can be difficult ...

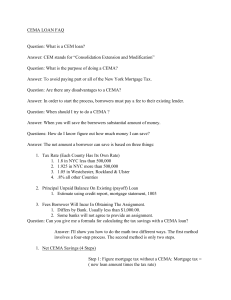

CEMA LOAN FAQ - Adams Law Group LLC

... Step 2: Subtract Bank And Recording Fees This shortcut works because the purpose of a CEMA is to give borrowers a credit for mortgage taxes paid but not "used" as represented by the PUB of a mortgage at the time of payoff. Imagine that you have a borrower who wants to take a loan for 250,000. Imagin ...

... Step 2: Subtract Bank And Recording Fees This shortcut works because the purpose of a CEMA is to give borrowers a credit for mortgage taxes paid but not "used" as represented by the PUB of a mortgage at the time of payoff. Imagine that you have a borrower who wants to take a loan for 250,000. Imagin ...

Full Committee Markup - American Bankers Association

... defaults. Banks commonly sell mortgage loans into the secondary market but retain the right to service the loan (called “servicing retained”). This strategy is an important way for banks to maintain valuable connections with their customers, while managing interest rate risk by selling long-term cre ...

... defaults. Banks commonly sell mortgage loans into the secondary market but retain the right to service the loan (called “servicing retained”). This strategy is an important way for banks to maintain valuable connections with their customers, while managing interest rate risk by selling long-term cre ...

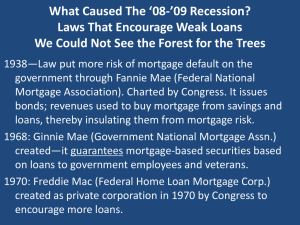

What Caused This Mess? Bad Laws Built Up Over Time

... Most important is liquidity in banking sector—keep credit flowing to strong businesses or they must contract and make recession far worse. TARP guaranteed bank and financial firm solvency. Almost all money repaid. Moral hazard problem? Get cash into banks for lending purposes, not to guarantee their ...

... Most important is liquidity in banking sector—keep credit flowing to strong businesses or they must contract and make recession far worse. TARP guaranteed bank and financial firm solvency. Almost all money repaid. Moral hazard problem? Get cash into banks for lending purposes, not to guarantee their ...

Praha, 2 - Raiffeisenbank

... loans (save for the variable mortgage loan and loans with one- or two-year fixation of the interest rate) by 0.3 percentage point. A standard mortgage loan with the most often used three-year fixation can be thus obtained now from 3.49 percent. „This offer applies to clients holding an account with ...

... loans (save for the variable mortgage loan and loans with one- or two-year fixation of the interest rate) by 0.3 percentage point. A standard mortgage loan with the most often used three-year fixation can be thus obtained now from 3.49 percent. „This offer applies to clients holding an account with ...

Housing Finance

... House Leasings are today an alternative that allow financing up to 95% of the property value. This alternative has been used primarily in houses priced below US$ 35.000 However, costs in house leasings are higher than what banks or mortgage loan corporations (MLC) usually charge, since the main fina ...

... House Leasings are today an alternative that allow financing up to 95% of the property value. This alternative has been used primarily in houses priced below US$ 35.000 However, costs in house leasings are higher than what banks or mortgage loan corporations (MLC) usually charge, since the main fina ...

Final Residential RE Seminar

... Division of primary loans into 2 types; Government insured and Non government insured ...

... Division of primary loans into 2 types; Government insured and Non government insured ...

Chapter 19 Residential Real Estate Finance: Mortgage

... practice of redlining is prohibited, i.e. the lender is not permitted to make blanket designations of geographic areas that are considered to be unacceptable loan risks “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

... practice of redlining is prohibited, i.e. the lender is not permitted to make blanket designations of geographic areas that are considered to be unacceptable loan risks “Real Estate Principles for the New Economy”: Norman G. Miller and David M. Geltner ...

Falling US Mortgage Rates

... Birmingham, Ala. "They will be dusting off files" of would-be borrowers who didn't act last summer. His bank took 283 loan applications last week, versus just 161 applications the week before Christmas. At ABN Amro Mortgage Group, a unit of ABN Amro Bank NV, loan applications doubled last week from ...

... Birmingham, Ala. "They will be dusting off files" of would-be borrowers who didn't act last summer. His bank took 283 loan applications last week, versus just 161 applications the week before Christmas. At ABN Amro Mortgage Group, a unit of ABN Amro Bank NV, loan applications doubled last week from ...

PDF Download

... Mortgage debt in percent of GDP differs widely across the EU-15 countries (Table 1). The Netherlands, Denmark and the UK exhibit percentages between 70 and nearly 100, while Italy, Greece and France are in the range between 13 and 25 percent. The share in the European mortgage market is highest for ...

... Mortgage debt in percent of GDP differs widely across the EU-15 countries (Table 1). The Netherlands, Denmark and the UK exhibit percentages between 70 and nearly 100, while Italy, Greece and France are in the range between 13 and 25 percent. The share in the European mortgage market is highest for ...

Risk Based Capital for Mortgage Securitization Firms

... Islamic Islamic finance window (purchase of deferred payments sales and housing leasing contracts) ...

... Islamic Islamic finance window (purchase of deferred payments sales and housing leasing contracts) ...

What`s Ahead for EU Mortgage Markets? ELRA General Assembly

... Missing products: ERL; fixed-rate & sub-prime products In principle, there is room for improvement ...

... Missing products: ERL; fixed-rate & sub-prime products In principle, there is room for improvement ...

Why you need to shop around for a mortgage

... So how, exactly, can you ensure you’re getting the best possible mortgage? Verret suggests getting some baseline rate information online via sites like RateHub.ca or RateSupermarket.ca. From there, be sure you have a clear sense of exactly what you’re dealing with. “Understand mortgage terminolo ...

... So how, exactly, can you ensure you’re getting the best possible mortgage? Verret suggests getting some baseline rate information online via sites like RateHub.ca or RateSupermarket.ca. From there, be sure you have a clear sense of exactly what you’re dealing with. “Understand mortgage terminolo ...

Everett mortgage email e-mail

... breaking local, national and global news, finance, sports, music, movies and more. We provide information on financial assistance programs, charities, non-profits and other resources that can help people make it through a difficult period. Home refinancing typically means that you pay off your curre ...

... breaking local, national and global news, finance, sports, music, movies and more. We provide information on financial assistance programs, charities, non-profits and other resources that can help people make it through a difficult period. Home refinancing typically means that you pay off your curre ...

Mortgages

... A mortgage is a long-term loan that uses your house and the land it sits on as collateral. Signing a mortgage loan gives the lender a lien against your property, which means if you fail to pay the loan, the lender can foreclose on your property. When beginning to look at obtaining a mortgage loan yo ...

... A mortgage is a long-term loan that uses your house and the land it sits on as collateral. Signing a mortgage loan gives the lender a lien against your property, which means if you fail to pay the loan, the lender can foreclose on your property. When beginning to look at obtaining a mortgage loan yo ...