a predator in america`s midst: a look at predatory lending

... mortgage market. Many of those Americans felt the crunch of their ARMs and they could not keep up with the rising level of their monthly house payment. Although foreclosure is never a good sign for anyone, it is an exceptionally bad sign when banks must foreclose on a home with hardly any equity and ...

... mortgage market. Many of those Americans felt the crunch of their ARMs and they could not keep up with the rising level of their monthly house payment. Although foreclosure is never a good sign for anyone, it is an exceptionally bad sign when banks must foreclose on a home with hardly any equity and ...

More... - Kevin Kavakeb

... With the prospect of upcoming rate hikes looming over, many home buyers think that locking into the best fixed rate mortgage is the way to go. Does the idea of a mortgage with a fixed interest rate sound appealing? There are mixed messages out there about when and if interest rates are going to go u ...

... With the prospect of upcoming rate hikes looming over, many home buyers think that locking into the best fixed rate mortgage is the way to go. Does the idea of a mortgage with a fixed interest rate sound appealing? There are mixed messages out there about when and if interest rates are going to go u ...

Tightest Credit Market in 16 Years Rejects Bernanke`s Bid

... after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standards in the U.S. are so high and inflexible that former Federal Reserve Chairman Ben S. Bernanke, no ...

... after successfully financing two previous home purchases. The hitch this time: his monthly payment would have been $100 more than the lender was willing to approve. Bregenzer is in good company. Standards in the U.S. are so high and inflexible that former Federal Reserve Chairman Ben S. Bernanke, no ...

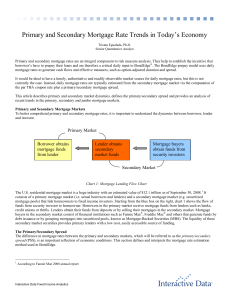

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... credit unions or thrifts. Lenders obtain their funds from deposits or by selling their mortgages in the secondary market. Mortgage buyers in the secondary market consist of financial institutions such as Fannie Mae®, Freddie Mac® and others that generate funds by debt issuance or by grouping mortgag ...

... credit unions or thrifts. Lenders obtain their funds from deposits or by selling their mortgages in the secondary market. Mortgage buyers in the secondary market consist of financial institutions such as Fannie Mae®, Freddie Mac® and others that generate funds by debt issuance or by grouping mortgag ...

Richard W. Payne III

... Fairfield County Bank, Corp., Claimant v. Genworth Mortgage Insurance Corp., Respondent, American Arbitration Assoc. # 12 195 00270 09 (Retained by Respondent) New Mexico Investment Council, et al. v. Countrywide Financial Corp., State of New Mexico County of Santa Fe First Judicial District Court, ...

... Fairfield County Bank, Corp., Claimant v. Genworth Mortgage Insurance Corp., Respondent, American Arbitration Assoc. # 12 195 00270 09 (Retained by Respondent) New Mexico Investment Council, et al. v. Countrywide Financial Corp., State of New Mexico County of Santa Fe First Judicial District Court, ...

Securitisation

... The Danish mortgage model • Mortgage institutions grant loans secured by mortgages on real property, having only one source of funding: bond sales. • Statutory loan-to-value limit: the loan can not excess 80% of the value of the property at the time of the sale. The mortgage institution has priorit ...

... The Danish mortgage model • Mortgage institutions grant loans secured by mortgages on real property, having only one source of funding: bond sales. • Statutory loan-to-value limit: the loan can not excess 80% of the value of the property at the time of the sale. The mortgage institution has priorit ...

Reading: Ethics in Finance

... What prompts this type of behavior? Why would professionals in charge of overseeing other people’s money behave in unethical ways? To begin, we must understand the nature of any business (including businesses within the finance industry) is to make a profit. This fact can run counter to an individua ...

... What prompts this type of behavior? Why would professionals in charge of overseeing other people’s money behave in unethical ways? To begin, we must understand the nature of any business (including businesses within the finance industry) is to make a profit. This fact can run counter to an individua ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... decline in numbers of first time buyers is the rise in the value of deposits paid to secure a mortgage. For first time buyers, the average deposit as a percentage of purchase price increased by almost 10% between 1988 and 2013, standing at 22% of the price of the house. ...

... decline in numbers of first time buyers is the rise in the value of deposits paid to secure a mortgage. For first time buyers, the average deposit as a percentage of purchase price increased by almost 10% between 1988 and 2013, standing at 22% of the price of the house. ...

Reverse Mortgage Tax Exemption Affidavit

... NOTE: All mortgagors must be 60 years of age. If the property is held by senior over 60 as to a life estate interest only and the remainder interest(s) are held by anyone under age 60, the mortgage tax must be paid. However in 2007 the Tax Department confirmed that if the loan was a federal reverse ...

... NOTE: All mortgagors must be 60 years of age. If the property is held by senior over 60 as to a life estate interest only and the remainder interest(s) are held by anyone under age 60, the mortgage tax must be paid. However in 2007 the Tax Department confirmed that if the loan was a federal reverse ...

A New View of Mortgages (and life)

... – Developer lets option expire without purchasing land – Farmer keeps the payment $X. ...

... – Developer lets option expire without purchasing land – Farmer keeps the payment $X. ...

Mortgage-Backed Securities, Home Values, and the Economic Crisis:

... also grow in value. The investment banks were making a great deal of money with these instruments. Many had very little cash in their reserves- they were investing everything they had. ...

... also grow in value. The investment banks were making a great deal of money with these instruments. Many had very little cash in their reserves- they were investing everything they had. ...

Chapter 7

... Requires that, if a loan is denied, lender or mortgage broker must: • Give applicant a statement of denial reasons. • Include the name of the federal agency that can be contacted if the applicant feels discriminated against. • If denial is based on information contained in the applicant’s credit rep ...

... Requires that, if a loan is denied, lender or mortgage broker must: • Give applicant a statement of denial reasons. • Include the name of the federal agency that can be contacted if the applicant feels discriminated against. • If denial is based on information contained in the applicant’s credit rep ...

USCrisis

... Collateralized Debt Obligations (CDOs): a type of structured asset-backed security (ABS) whose value and payments are derived from a portfolio of fixed-income underlying assets- in Jupiter’s case home equity lines of credit Issuers and Underwriters typically are Investment Banks Jupiter’s underwrite ...

... Collateralized Debt Obligations (CDOs): a type of structured asset-backed security (ABS) whose value and payments are derived from a portfolio of fixed-income underlying assets- in Jupiter’s case home equity lines of credit Issuers and Underwriters typically are Investment Banks Jupiter’s underwrite ...

Solving the Long-Range Problems of Housing and Mortgage Finance

... these new instruments, particularly the money-market mutual fund, assures that, in the next period of tight money, the competition of open market instruments is likely to be more severe than ever before. The second reason why the shelter of Regulation Q is eroding is the rising strength of consumeri ...

... these new instruments, particularly the money-market mutual fund, assures that, in the next period of tight money, the competition of open market instruments is likely to be more severe than ever before. The second reason why the shelter of Regulation Q is eroding is the rising strength of consumeri ...

Mortgage Rates Notch Higher

... while 37.5 percent predict further declines. None of the experts foresee mortgage rates remaining more or less unchanged in the coming week. About Bankrate.com: Bankrate.com provides consumers with the expert advice and tools needed to succeed throughout life’s financial journey. For over two decad ...

... while 37.5 percent predict further declines. None of the experts foresee mortgage rates remaining more or less unchanged in the coming week. About Bankrate.com: Bankrate.com provides consumers with the expert advice and tools needed to succeed throughout life’s financial journey. For over two decad ...

how to avoid the pitfalls of the commercial mortgage application

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

... commercial mortgages since there is a maximum loan amount of $2-3 million for most Stated Income Commercial Mortgage Programs. 3. The third reason a commercial loan may be declined is due to property type or special requirements imposed that make the loan impractical for the commercial borrower. Not ...

SUBCHAPTER 03M – MORTGAGE LENDING SECTION .0100

... entity whether disseminated by direct mail, newspaper, magazine, radio or television broadcast, electronic mail or other electronic means, billboard or similar display. The term does not include any disclosures, program descriptions, or other materials prepared or authorized by any state or federal ...

... entity whether disseminated by direct mail, newspaper, magazine, radio or television broadcast, electronic mail or other electronic means, billboard or similar display. The term does not include any disclosures, program descriptions, or other materials prepared or authorized by any state or federal ...

JohnMuellbauer

... simulation of rent based US hp model • Based on 2-equation model, incl. model for rents. • Rent model suggests rents respond v sluggishly to hp, general price level, and to user cost. • Income-tax credit of 10% of a home’s purchase price up to a cap of $8,000 for couples who were FTBs, expired in Ju ...

... simulation of rent based US hp model • Based on 2-equation model, incl. model for rents. • Rent model suggests rents respond v sluggishly to hp, general price level, and to user cost. • Income-tax credit of 10% of a home’s purchase price up to a cap of $8,000 for couples who were FTBs, expired in Ju ...

UK property markets

... The possession rate is the number of properties taken into possession per quarter as a per cent of outstanding mortgage loans at the start of the quarter. The write-off rate is the value of loans written-off per quarter as a per cent of the mortgage stock at the start of the quarter. This series cov ...

... The possession rate is the number of properties taken into possession per quarter as a per cent of outstanding mortgage loans at the start of the quarter. The write-off rate is the value of loans written-off per quarter as a per cent of the mortgage stock at the start of the quarter. This series cov ...

Real Estate Finance: An Overview

... thrifts, credit unions. One important function is insuring deposits (FDIC and NCUA), another is establishing real estate lending and appraisal practices that institutions must follow, and another is setting minimum capital requirements. If an institution has sufficient capital (equity financing) its ...

... thrifts, credit unions. One important function is insuring deposits (FDIC and NCUA), another is establishing real estate lending and appraisal practices that institutions must follow, and another is setting minimum capital requirements. If an institution has sufficient capital (equity financing) its ...

2009 - Homex

... New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...

... New Homes Registry (RUV) New Homes Registry (RUV) is a system and data base where all homes being built by developers are registered before construction begins and until the new homes are finish and finally sold ...

Frequently Asked Questions

... The amount the College shares is defined by the following formula: deferred interest mortgage/housing price. For example: Purchase a home 7/1/2001 for Down payment Wellesley 1st mortgage Wellesley second mortgage Second percent (400/650) = ...

... The amount the College shares is defined by the following formula: deferred interest mortgage/housing price. For example: Purchase a home 7/1/2001 for Down payment Wellesley 1st mortgage Wellesley second mortgage Second percent (400/650) = ...