From: > To: > Cc

... unable to work due to accident or sickness. Your mortgage is likely to be one of your most important financial commitments, and no matter how secure you feel in you with your current lifestyle and employment, it is more important than ever to protect yourself for whatever life brings to your door. R ...

... unable to work due to accident or sickness. Your mortgage is likely to be one of your most important financial commitments, and no matter how secure you feel in you with your current lifestyle and employment, it is more important than ever to protect yourself for whatever life brings to your door. R ...

Real Estate Finance: An Overview

... values – the apartment sector, which may have experienced overbuilding in the wake of the housing crisis, was especially hard hit. Commercial mortgage-backed security issuers had to start retaining 5% of the securities issued as of 12/24/16.) Dodd-Frank requires a lender to estimate in good faith th ...

... values – the apartment sector, which may have experienced overbuilding in the wake of the housing crisis, was especially hard hit. Commercial mortgage-backed security issuers had to start retaining 5% of the securities issued as of 12/24/16.) Dodd-Frank requires a lender to estimate in good faith th ...

We need to solve the mortgage problem before interest rates rise

... must consider now how best to minimise the scale of the adjustment problems these families face when interest rates start to return to normal. ...

... must consider now how best to minimise the scale of the adjustment problems these families face when interest rates start to return to normal. ...

How Housing Policy Hurts the Middle Class

... By contrast, according to CLSA Asia-Pacific Markets, middle-class households in 11 Asian nations spend an average 15% of income on supplemental education for their children—nearly as much as the 16% spent on housing and transportation combined. Americans spend only 2% on supplemental education and ...

... By contrast, according to CLSA Asia-Pacific Markets, middle-class households in 11 Asian nations spend an average 15% of income on supplemental education for their children—nearly as much as the 16% spent on housing and transportation combined. Americans spend only 2% on supplemental education and ...

Real estate terms and definitions

... Realtor® or Real Estate Agent: A professional Realtor is trusted resource in buying a home. A Realtor can help locate the neighborhood that meets a buyers needs, navigate the process, understand the paperwork, make or accept an offer, arrange inspections, address problems and negotiate the sale of ...

... Realtor® or Real Estate Agent: A professional Realtor is trusted resource in buying a home. A Realtor can help locate the neighborhood that meets a buyers needs, navigate the process, understand the paperwork, make or accept an offer, arrange inspections, address problems and negotiate the sale of ...

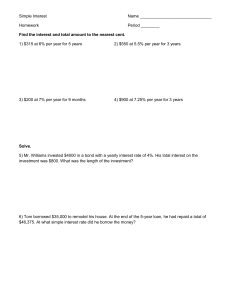

What is the difference between total costs with and without a down

... Part II: Calculate Total Costs A bank offers the fixed rate loan shown below. Calculate the following for your mortgage with and without a down payment. Show your work for parts 2 – 7. ...

... Part II: Calculate Total Costs A bank offers the fixed rate loan shown below. Calculate the following for your mortgage with and without a down payment. Show your work for parts 2 – 7. ...

Uganda Agricultural Credit Facility

... to as Participating Financial Institutions (PFIs) to facilitate the provision of medium and long term loans to projects engaged in agriculture and agro-processing on more favorable terms than are usually available from the PFIs. Loans under the ACF are disbursed to farmers and agro-processors throug ...

... to as Participating Financial Institutions (PFIs) to facilitate the provision of medium and long term loans to projects engaged in agriculture and agro-processing on more favorable terms than are usually available from the PFIs. Loans under the ACF are disbursed to farmers and agro-processors throug ...

Understanding the Role of the Federal Reserve in Today`s Economy

... If you do not pay for a credit check: Borrower is not a good risk; you do make the loan: ...

... If you do not pay for a credit check: Borrower is not a good risk; you do make the loan: ...