CMHC Newcomer

... Newcomers with non-permanent resident status have access to CMHC-insured financing of up to 90% loan-to-value ratio for the purchase of a 1 unit owner-occupied residential property. No additional fees or premiums as a result of residency status – standard product specific premiums apply. No minimum ...

... Newcomers with non-permanent resident status have access to CMHC-insured financing of up to 90% loan-to-value ratio for the purchase of a 1 unit owner-occupied residential property. No additional fees or premiums as a result of residency status – standard product specific premiums apply. No minimum ...

invest in syndicate mortgages

... schedules may make assumptions on what the market will be 1-3 years down the road, such as competing projects, which may impact sales. Delays can also occur during construction, primarily during underground construction. The reason for this is the unknowns that potentially exist with water or soil c ...

... schedules may make assumptions on what the market will be 1-3 years down the road, such as competing projects, which may impact sales. Delays can also occur during construction, primarily during underground construction. The reason for this is the unknowns that potentially exist with water or soil c ...

Baca abstrak - Data Mahasiswa | Atdikbud London

... Abstract Loan loss provision is an account consisting of money set aside by banks’ managers to cover potential losses. This paper seeks to examine the determinants of loan loss provisions in Indonesian banking system over the period of 2006-2011 with regard to banks’ efficiency. Efficiency is estima ...

... Abstract Loan loss provision is an account consisting of money set aside by banks’ managers to cover potential losses. This paper seeks to examine the determinants of loan loss provisions in Indonesian banking system over the period of 2006-2011 with regard to banks’ efficiency. Efficiency is estima ...

Loans Classified by Special Provision

... The VA will also issue a certificate of reasonable value for the property being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ...

... The VA will also issue a certificate of reasonable value for the property being purchased, stating its current market value based on a VAapproved appraisal. The appraiser uses a form called a URAR (Uniform Residential Appraisal Report) to present the appraisal results to the lender. The CRV places a ...

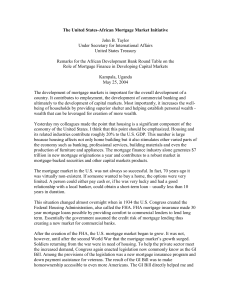

The United States-African Mortgage Market Initiative

... The United States-African Mortgage Market Initiative John B. Taylor Under Secretary for International Affairs United States Treasury Remarks for the African Development Bank Round Table on the Role of Mortgage Finance in Developing Capital Markets Kampala, Uganda May 25, 2004 The development of mort ...

... The United States-African Mortgage Market Initiative John B. Taylor Under Secretary for International Affairs United States Treasury Remarks for the African Development Bank Round Table on the Role of Mortgage Finance in Developing Capital Markets Kampala, Uganda May 25, 2004 The development of mort ...

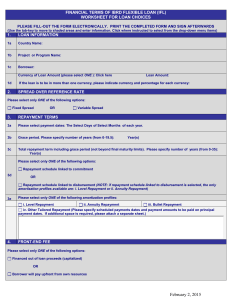

English - World Bank Treasury

... (written or oral) of the Bank as a recommendation to take the Loan upon the terms selected herein, it being understood that information and explanations related to the terms and conditions of the Loan will not be considered a recommendation to take the Loan. The Borrower further represents that it u ...

... (written or oral) of the Bank as a recommendation to take the Loan upon the terms selected herein, it being understood that information and explanations related to the terms and conditions of the Loan will not be considered a recommendation to take the Loan. The Borrower further represents that it u ...

Reading: Ethics in Finance

... ability to cover their monthly living expenses. Although their mortgage broker knew that the couple most likely wouldn’t be able to afford their adjustable rate mortgage in two years, he believed that in that time, Jose would have a better paying job or they would move out of the house anyway. Furth ...

... ability to cover their monthly living expenses. Although their mortgage broker knew that the couple most likely wouldn’t be able to afford their adjustable rate mortgage in two years, he believed that in that time, Jose would have a better paying job or they would move out of the house anyway. Furth ...

Products, services, customers, geography

... at 18% APR, with a nonrefundable loan application fee of $10.00. The fee applies to all loan applicants, whether or not the loan is granted, and thus is not included in the finance charge. ...

... at 18% APR, with a nonrefundable loan application fee of $10.00. The fee applies to all loan applicants, whether or not the loan is granted, and thus is not included in the finance charge. ...

Housing Finance

... Under reasonable assumptions, an insurance costs estimation in Chile would be of 4.8% of the property value. ...

... Under reasonable assumptions, an insurance costs estimation in Chile would be of 4.8% of the property value. ...

Mortgage rates are not the when-to-buy factor Market Trend Scorecard

... offset by gains in other sectors of the economy. Just in the last year, gains support this expectation. The national unemployment rate (July 2014 to July 2015) has dropped from 6.2% to 5.3%. Locally for the same period, the rate went from 6.6% to 6.2%, effectively putting about 2,900 people back to ...

... offset by gains in other sectors of the economy. Just in the last year, gains support this expectation. The national unemployment rate (July 2014 to July 2015) has dropped from 6.2% to 5.3%. Locally for the same period, the rate went from 6.6% to 6.2%, effectively putting about 2,900 people back to ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

... What is an Alternative (or Private) Loan? • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were ...

![[Int`lFinance]FinalPaper_KWAKJeeEun5](http://s1.studyres.com/store/data/020902525_1-8b3bd67b6fcbe05022cd6ab5ab1a1f0a-300x300.png)