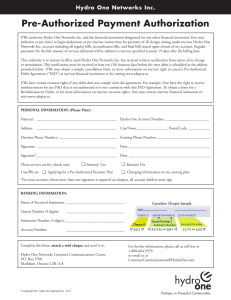

Pre-Authorized form En

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

... I/We authorize Hydro One Networks Inc. and the financial institution designated (or any other financial institution I/we may authorize at any time) to begin deductions as per my/our instructions for payment of all charges arising under my/our Hydro One Networks Inc. account including all regular bil ...

Basel III An analysis of the new global capital regulatory

... bring in accountability to the rating agencies by making them liable for the ratings issued; it has also mandated that sole reliance on external ratings would not be allowed. The new Basel III regulations remain silent on these issues. ...

... bring in accountability to the rating agencies by making them liable for the ratings issued; it has also mandated that sole reliance on external ratings would not be allowed. The new Basel III regulations remain silent on these issues. ...

How to Characterise Financial Systems

... Financial transactions are conducted on the basis of a direct and generally longer-term relationship between two entities, usually a customer and a bank. The lender has information about the borrower which is not available publicly. This gives the lender direct influence on the borrower and monopoli ...

... Financial transactions are conducted on the basis of a direct and generally longer-term relationship between two entities, usually a customer and a bank. The lender has information about the borrower which is not available publicly. This gives the lender direct influence on the borrower and monopoli ...

Global Financial Crisis and Its Impact on India

... worthiness on the assumption that housing prices would continue to rise. Later, the financial institutions repackaged these debts into financial instruments called Collateralized Debt Obligations and sold them to investors world-wide. In this way the risk was passed on multifold through derivatives ...

... worthiness on the assumption that housing prices would continue to rise. Later, the financial institutions repackaged these debts into financial instruments called Collateralized Debt Obligations and sold them to investors world-wide. In this way the risk was passed on multifold through derivatives ...

Smyrna Soccer Club Financial Aid Application Page 1 of 3

... It is the policy of SSC to attempt to provide financial aid to those players who might not otherwise be able to participate with the Smyrna Soccer Club. This program assists players with a portion of annual dues. It does not over the cost of uniforms, travel or tournament fees. Because SSC financial ...

... It is the policy of SSC to attempt to provide financial aid to those players who might not otherwise be able to participate with the Smyrna Soccer Club. This program assists players with a portion of annual dues. It does not over the cost of uniforms, travel or tournament fees. Because SSC financial ...

投影片 1 - centerforpbbefr.rutgers.edu

... Further amendments that (1) will enable the courts to invalidate any transfer of assets by a CEO or senior manager where there are reasonable grounds for suspecting that such transfer is in violation of the law, and (2) will establish a procedure for a speedy hearing and decision by the judicial aut ...

... Further amendments that (1) will enable the courts to invalidate any transfer of assets by a CEO or senior manager where there are reasonable grounds for suspecting that such transfer is in violation of the law, and (2) will establish a procedure for a speedy hearing and decision by the judicial aut ...

Syllabus

... Students will learn the fundamentals of future cash flow valuation; in particular, discounted cash flow analysis and its application to valuation of bonds, stocks, and corporate capital assets. Students will be introduced to the following topics: time value of money; bond and stock markets; pricing ...

... Students will learn the fundamentals of future cash flow valuation; in particular, discounted cash flow analysis and its application to valuation of bonds, stocks, and corporate capital assets. Students will be introduced to the following topics: time value of money; bond and stock markets; pricing ...

CHAPTER 1 An Overview of Financial Management

... Debt instruments have a finite life or maturity date Advantage is that the debt instrument is a contractual promise to pay with legal rights to ...

... Debt instruments have a finite life or maturity date Advantage is that the debt instrument is a contractual promise to pay with legal rights to ...

Economic surveillance after the crisis: Reflections from a small full

... countries during recent months. This has provided new challenges for understanding transmission channels between economies and for forecasting inflation. 6 At the same time, however, the stronger relationship between commodity markets and investment flows could potentially allow us to use commodity ...

... countries during recent months. This has provided new challenges for understanding transmission channels between economies and for forecasting inflation. 6 At the same time, however, the stronger relationship between commodity markets and investment flows could potentially allow us to use commodity ...

APPLICATION FOR LuSE MEMBERSHIP

... apply to the CEO of LuSE in writing in such form as the Board may determine In the case of a company submit an updated copy of it’s articles of association provide proof to the satisfaction of the board that it’s financial position is such as would enable him at the time of making the application to ...

... apply to the CEO of LuSE in writing in such form as the Board may determine In the case of a company submit an updated copy of it’s articles of association provide proof to the satisfaction of the board that it’s financial position is such as would enable him at the time of making the application to ...

Appendices - NT Treasury

... Transactions in which the ownership of an asset (other than cash and inventories) is transferred from one institutional unit to another, in which cash is transferred to enable the recipient to acquire another asset, or in which the funds realised by the disposal of another asset are transferred, for ...

... Transactions in which the ownership of an asset (other than cash and inventories) is transferred from one institutional unit to another, in which cash is transferred to enable the recipient to acquire another asset, or in which the funds realised by the disposal of another asset are transferred, for ...

Parallel Computing Method of Valuing for Multi-Asset

... and services, but also rely on the balance of demand and serve of underlying asset. ...

... and services, but also rely on the balance of demand and serve of underlying asset. ...

financial market

... 1994 report published by US General Accounting Office (GAO) titled Financial Derivatives: Actions Needed to Protect the Financial System: Derivatives serves as an important function of the global financial marketplace, providing endusers with opportunities to better manage financial risks associated ...

... 1994 report published by US General Accounting Office (GAO) titled Financial Derivatives: Actions Needed to Protect the Financial System: Derivatives serves as an important function of the global financial marketplace, providing endusers with opportunities to better manage financial risks associated ...

Econometrics of Financial Markets

... Authors make the observation that, without uncertainty, the problems of financial economics reduce to exercises in basic microeconomics. The inclusion of uncertainty is really the starting point for financial economics as a separate discipline. This role of uncertainty will have important implicatio ...

... Authors make the observation that, without uncertainty, the problems of financial economics reduce to exercises in basic microeconomics. The inclusion of uncertainty is really the starting point for financial economics as a separate discipline. This role of uncertainty will have important implicatio ...

. E C O N O M I C and

... The disruptions arising from the changing character of the economy have intensified the pressure on elected officials and business and community leaders to adopt policies that stimulate local growth. Casino gambling is seen by some as an important economic development tool. At the request of public ...

... The disruptions arising from the changing character of the economy have intensified the pressure on elected officials and business and community leaders to adopt policies that stimulate local growth. Casino gambling is seen by some as an important economic development tool. At the request of public ...

here - Educators Financial Group

... advice that we provide with the other aspects of their financial life.” “For example, educators have a pension plan, and our advice integrates with this pension plan. Education members can also participate in a deferred salary program such as a “4 over 5” where they can take 80 per cent of their sal ...

... advice that we provide with the other aspects of their financial life.” “For example, educators have a pension plan, and our advice integrates with this pension plan. Education members can also participate in a deferred salary program such as a “4 over 5” where they can take 80 per cent of their sal ...

A Macroprudential Perspective in the Conduct of Monetary Policy Ryuzo Miyao

... of monetary policy has become more widely recognized as of essential importance. When one says “macroprudential,” it is usually in the context of how to ensure financial stability. In a macroprudential approach, risks are analyzed and evaluated from the viewpoint of the entire financial system, and ...

... of monetary policy has become more widely recognized as of essential importance. When one says “macroprudential,” it is usually in the context of how to ensure financial stability. In a macroprudential approach, risks are analyzed and evaluated from the viewpoint of the entire financial system, and ...

Ch 11: 1.1

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

... a. Traditional pension plans are defined benefit plans under which retirement payouts are fixed by a formula that is typically based on the worker’s years on the job and final salary. 401(k) plans are defined contribution plans under which payouts depend on the return earned by the plan’s investment ...

SMSFs drop the ball on risk in asset allocation

... 2. Property is less liquid than shares. Investors should demand a premium for this lack of liquidity over shares, which is currently not available. In addition, property promoters constantly spruik investments in off-the-plan property developments, which are even more risky than normal unlisted prop ...

... 2. Property is less liquid than shares. Investors should demand a premium for this lack of liquidity over shares, which is currently not available. In addition, property promoters constantly spruik investments in off-the-plan property developments, which are even more risky than normal unlisted prop ...

From Emerging Trend to Developed Solution: the Global Rise of

... compete, they often collaborate to combine their strengths to originate and structure business. As such, corporates not only benefit from increased choice in the new financial landscape, but are also able to access solutions that reflect the diversity of players. Learning from the Emerging Markets I ...

... compete, they often collaborate to combine their strengths to originate and structure business. As such, corporates not only benefit from increased choice in the new financial landscape, but are also able to access solutions that reflect the diversity of players. Learning from the Emerging Markets I ...

Slide 1

... intermediaries and management companies; 2. Unified and simplified procedure for admission to trading of foreign companies on the Bulgarian regulated market; 3. Transparency Directive and price-sensitive information disclosure; ...

... intermediaries and management companies; 2. Unified and simplified procedure for admission to trading of foreign companies on the Bulgarian regulated market; 3. Transparency Directive and price-sensitive information disclosure; ...

Surgical Oncology Associates of South Texas

... Thank you for choosing us as your health care provider. We are committed to providing you the highest level of care. The following is a statement of our Financial Policy that we require you to read and sign prior to any treatment. Unless you are a member of one of our contracted insurance plans, or ...

... Thank you for choosing us as your health care provider. We are committed to providing you the highest level of care. The following is a statement of our Financial Policy that we require you to read and sign prior to any treatment. Unless you are a member of one of our contracted insurance plans, or ...

How Dodd-Frank and Other New U

... Street Reform and Consumer Protection Act and the Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010. ...

... Street Reform and Consumer Protection Act and the Comprehensive Iran Sanctions, Accountability, and Divestment Act of 2010. ...

Presentation to the 18th Annual Hyman P. Minsky Conference on... World Economies—“Meeting the Challenges of the Financial Crisis”

... a limb they had gone. Many of those who thought they were in the hedge category were shocked to discover that, in fact, they were speculative or Ponzi units. At the same time, securitization added distance between borrowers and lenders. As a result, underwriting standards were significantly relaxed. ...

... a limb they had gone. Many of those who thought they were in the hedge category were shocked to discover that, in fact, they were speculative or Ponzi units. At the same time, securitization added distance between borrowers and lenders. As a result, underwriting standards were significantly relaxed. ...

Financial crisis and economic downturn: Where did they come from

... arrangements for dealing with potential liquidity problems insufficiently robust • Indeed, the business case of some financial institutions based on the assumption that they would always be able to access wholesale markets for funding ...

... arrangements for dealing with potential liquidity problems insufficiently robust • Indeed, the business case of some financial institutions based on the assumption that they would always be able to access wholesale markets for funding ...