the role of countercyclical measures in controlling the

... to gain clients and expand their portfolio, irrespective of the risks they expose to. It is easy to see that if banks’ incentives all work in the same direction, i.e. if cyclical changes in credit standards become characteristic of the banking sector as a whole, then these incentives will strengthen ...

... to gain clients and expand their portfolio, irrespective of the risks they expose to. It is easy to see that if banks’ incentives all work in the same direction, i.e. if cyclical changes in credit standards become characteristic of the banking sector as a whole, then these incentives will strengthen ...

Who Uses E-Banking? Changes From 1995 to 2001

... your mind tomorrow, can you take it back, since it’s within the 3-day cooling off period? ...

... your mind tomorrow, can you take it back, since it’s within the 3-day cooling off period? ...

DISPROPORTIONS IN THE WORLD ECONOMY

... Since the beginning of 1980th could be seen more and more distinct transition from regulated by countries economic system, established by Bretton Woods agreements of 1944, to the system ruled by the markets of capital, headed by transnational corporations and transnational banks. Consistent failures ...

... Since the beginning of 1980th could be seen more and more distinct transition from regulated by countries economic system, established by Bretton Woods agreements of 1944, to the system ruled by the markets of capital, headed by transnational corporations and transnational banks. Consistent failures ...

The Promise and Challenges of Bank Capital Reform

... using demand deposits to fund mortgage lending). Thus, they are subject to the risk of bank runs in which lenders (including depositors) refuse to continue financing the bank. At the same time it may be difficult for the bank to raise funds by selling its assets, and so it is at risk of failure. Cap ...

... using demand deposits to fund mortgage lending). Thus, they are subject to the risk of bank runs in which lenders (including depositors) refuse to continue financing the bank. At the same time it may be difficult for the bank to raise funds by selling its assets, and so it is at risk of failure. Cap ...

Chapter 3: Australia`s existing regulatory framework

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

... company and distribution of its assets before the potential losses become too great. The process of winding-up any company, but particularly financial institutions, can be lengthy, complex and expensive. ...

2009 Pillar 3 - Sucden Financial

... Counterparty exposure is managed by a formal acceptance policy, limit setting (both volume and credit limits for all accounts), exposure monitoring and exception reporting. Legal agreements are entered into according to product. Internal ratings are applied to all counterparty/client accounts in acc ...

... Counterparty exposure is managed by a formal acceptance policy, limit setting (both volume and credit limits for all accounts), exposure monitoring and exception reporting. Legal agreements are entered into according to product. Internal ratings are applied to all counterparty/client accounts in acc ...

Vice President for Finance and CFO Since 1935, Southeastern

... Professionally, the successful candidate will have at least fifteen years of increasing experience in financial leadership, possess an MBA and have been awarded the CPA distinction at some point in their career. Ideally, this person will have successfully served as CFO or had equivalent responsibili ...

... Professionally, the successful candidate will have at least fifteen years of increasing experience in financial leadership, possess an MBA and have been awarded the CPA distinction at some point in their career. Ideally, this person will have successfully served as CFO or had equivalent responsibili ...

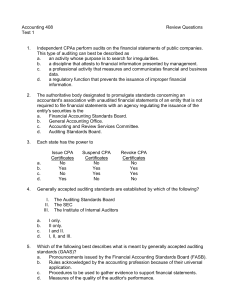

Test 1, Review Questions

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

CADC2005

... •Assess client “readiness” levels and focus efforts accordingly • Sponsor or provide risk conferences, seminars or training sessions • Understand each client plan’s primary objective and benchmark(s) • Understand the client’s current portfolio asset mix • Deal in “knowns” such as annualized 4-5 year ...

... •Assess client “readiness” levels and focus efforts accordingly • Sponsor or provide risk conferences, seminars or training sessions • Understand each client plan’s primary objective and benchmark(s) • Understand the client’s current portfolio asset mix • Deal in “knowns” such as annualized 4-5 year ...

PDF format

... periods up to the collapse of Lehman Brothers, as shown in issuing samurai bonds 40 percent more year-on-year basis. However, situation of domestic financial markets literally changed dramatically by the collapse of Lehman Brothers. The first change was the funding difficulties of international bank ...

... periods up to the collapse of Lehman Brothers, as shown in issuing samurai bonds 40 percent more year-on-year basis. However, situation of domestic financial markets literally changed dramatically by the collapse of Lehman Brothers. The first change was the funding difficulties of international bank ...

THe NK Approach to Exchange Rate Policy Analysis: Looking Forward

... Bad news hit ! informational asymmetries become more acute ! Market participants cast doubts on the value of the assets ...

... Bad news hit ! informational asymmetries become more acute ! Market participants cast doubts on the value of the assets ...

Capital flow-2006-05

... To highlight (possibly different) roles of financial development and property rights institutions in international capital flows ...

... To highlight (possibly different) roles of financial development and property rights institutions in international capital flows ...

Russian experience Digital BRICS conference, New Delhi, 29.04.2016

... of society. They are empowering the more entrepreneurial individuals, but may put psychological stress on others. ...

... of society. They are empowering the more entrepreneurial individuals, but may put psychological stress on others. ...

File

... – Exchange of short-term instruments—less than one year – Highly liquid, minimal risk – Use of a temporary surplus of funds by banks or businesses – Commercial paper—short-term liabilities of prime business firms and finance companies • Bank Certificates of Deposits—liabilities of issuing bank, inte ...

... – Exchange of short-term instruments—less than one year – Highly liquid, minimal risk – Use of a temporary surplus of funds by banks or businesses – Commercial paper—short-term liabilities of prime business firms and finance companies • Bank Certificates of Deposits—liabilities of issuing bank, inte ...

2017 ACT Reg - Capital Defense Network

... the case, effective teamwork, investigation and presentation of mitigation evidence, including trauma history, race and culture on the team and in the case, working effectively with experts, plea strategies, and victim work. In the small group workshops, you will engage with your team members as wel ...

... the case, effective teamwork, investigation and presentation of mitigation evidence, including trauma history, race and culture on the team and in the case, working effectively with experts, plea strategies, and victim work. In the small group workshops, you will engage with your team members as wel ...

PPT

... • Based on careful theoretical and empirical analyses, research show that it is entirely possible for a financial crisis to occur even when a country's fundamentals are totally sound. It may arise because of changes in investor sentiment or perceptions which may be triggered off entirely by external ...

... • Based on careful theoretical and empirical analyses, research show that it is entirely possible for a financial crisis to occur even when a country's fundamentals are totally sound. It may arise because of changes in investor sentiment or perceptions which may be triggered off entirely by external ...

Wirtschaftliche Struktur des deutschen Bankensystems

... Speculation with derivatives like naked short selling and credit default swaps also tends to grow explosively as the cost of entry into the market is very low for a large financial institute. In times of crisis the European stock exchange supervisory ESMA is allowed to temporarily ban naked short se ...

... Speculation with derivatives like naked short selling and credit default swaps also tends to grow explosively as the cost of entry into the market is very low for a large financial institute. In times of crisis the European stock exchange supervisory ESMA is allowed to temporarily ban naked short se ...

Three interesting OpEx trends in financial services 1) Function first

... 3) Verbal commitment is easy, financial commitment is another matter This stat is particularly surprising because at first glance it would seem to contradict everything we said in section #2. An impressive 47.5% of respondents states that process excellence is viewed as one of the top priorities wi ...

... 3) Verbal commitment is easy, financial commitment is another matter This stat is particularly surprising because at first glance it would seem to contradict everything we said in section #2. An impressive 47.5% of respondents states that process excellence is viewed as one of the top priorities wi ...

MACROPRU. 5 principles for macroprudential policy

... of their defences being overwhelmed in the bad times and hence, have too little capacity to absorb shocks That is, where there are externalities. It’s well known, for example, that banks would choose to have too little capacity to absorb losses – too little equity capital – because their current sha ...

... of their defences being overwhelmed in the bad times and hence, have too little capacity to absorb shocks That is, where there are externalities. It’s well known, for example, that banks would choose to have too little capacity to absorb losses – too little equity capital – because their current sha ...

DFSA Publishes Findings of Trade Finance Review in DIFC

... Ian Johnston was appointed as Chief Executive of the DFSA in June 2012. Ian joined the DFSA in November 2006, as a Managing Director, to head the Policy and Legal Services Division. Ian was admitted to practice Law in Australia in the early 1980s and has spent most of his career in the private secto ...

... Ian Johnston was appointed as Chief Executive of the DFSA in June 2012. Ian joined the DFSA in November 2006, as a Managing Director, to head the Policy and Legal Services Division. Ian was admitted to practice Law in Australia in the early 1980s and has spent most of his career in the private secto ...

Financial Stability and Resilience

... 2) To what extent capital flows affect liquidity in the financial system and the credit cycle. 3) The role played by global and regional commercial banks in the propagation of risk across countries. 4) How credit cycles affect households, firms and financial intermediaries’ economic decisions. 5) In ...

... 2) To what extent capital flows affect liquidity in the financial system and the credit cycle. 3) The role played by global and regional commercial banks in the propagation of risk across countries. 4) How credit cycles affect households, firms and financial intermediaries’ economic decisions. 5) In ...

Financial literacy - Fairfield Public Schools

... 4. Effectively apply the analysis, synthesis, and evaluative processes that enable productive problem solving. 5. Value and demonstrate personal responsibility, character, cultural understanding, and ethical behavior. Connecticut Business and Finance Technical Curriculum Frameworks – Personal Financ ...

... 4. Effectively apply the analysis, synthesis, and evaluative processes that enable productive problem solving. 5. Value and demonstrate personal responsibility, character, cultural understanding, and ethical behavior. Connecticut Business and Finance Technical Curriculum Frameworks – Personal Financ ...

AP Macro: Unit 7 - South Hills High School

... part of the current account • This is primarily the balance of payments on goods and services • The difference between the value of exports and the value of imports (in Unit 2 we called this “net exports”) ...

... part of the current account • This is primarily the balance of payments on goods and services • The difference between the value of exports and the value of imports (in Unit 2 we called this “net exports”) ...

WSO CV - Wall Street Oasis

... Learnt about the different types of clients in investment management and how a portfolio is split between equity sectors and fixed income to ensure sustainable profits for investors. Experienced equity research at first hand working together with a team of equity researches to extract financial ...

... Learnt about the different types of clients in investment management and how a portfolio is split between equity sectors and fixed income to ensure sustainable profits for investors. Experienced equity research at first hand working together with a team of equity researches to extract financial ...

PowerPoint - Kuwait Financial Forum

... Payment Services Directive 2 (PSD2) By Q1 of 2018, European banks have to completely open up their data through full APIs. Europe’s Payment Services Directive (PSD2) and Access to Accounts (XS2A) are already mandating that financial institutions give customers and third-party integrators programmati ...

... Payment Services Directive 2 (PSD2) By Q1 of 2018, European banks have to completely open up their data through full APIs. Europe’s Payment Services Directive (PSD2) and Access to Accounts (XS2A) are already mandating that financial institutions give customers and third-party integrators programmati ...