This PDF is a selection from an out-of-print volume from... of Economic Research

... There are as many categories of financial flows as there are types of financial instruments, i.e., types of intangible assets and liabilities that are reasonably homogeneous internally and distinguishable from each other. Within financial stocks and flows, the basic distinction is between claims, wh ...

... There are as many categories of financial flows as there are types of financial instruments, i.e., types of intangible assets and liabilities that are reasonably homogeneous internally and distinguishable from each other. Within financial stocks and flows, the basic distinction is between claims, wh ...

Hannover Life Reassurance Company of America

... as to the accuracy, completeness or updated status of such information. Some of the statements in this presentation may be forward-looking statements or statements of future expectations based on currently available information. Such statements naturally are subject to risks and uncertainties. Facto ...

... as to the accuracy, completeness or updated status of such information. Some of the statements in this presentation may be forward-looking statements or statements of future expectations based on currently available information. Such statements naturally are subject to risks and uncertainties. Facto ...

Investment risk, return and volatility

... investment managers are reviewed on a regular basis. The Fund’s investment advisers in conjunction with the Fund develop the investment strategy for each of the investment options. All investment options are actively managed and take a long-term investment approach to delivering the targeted return ...

... investment managers are reviewed on a regular basis. The Fund’s investment advisers in conjunction with the Fund develop the investment strategy for each of the investment options. All investment options are actively managed and take a long-term investment approach to delivering the targeted return ...

lect8

... With respect to publicly traded corporations in a well-functioning market economy, we can look at share values prior to reform P and after it. But for assets that have been privatized, we cannot do this even in market economies, because prereform values are not available. Moreover, in economies in t ...

... With respect to publicly traded corporations in a well-functioning market economy, we can look at share values prior to reform P and after it. But for assets that have been privatized, we cannot do this even in market economies, because prereform values are not available. Moreover, in economies in t ...

A note on portfolio selection, diversification and

... the FoF portfolio charges active management fees for a product that essentially mimics the stock holdings and index weights of the benchmark. Since Markowitz’ (1952) seminal paper on portfolio selection, a number of studies have examined the relationship between risk and return according to the num ...

... the FoF portfolio charges active management fees for a product that essentially mimics the stock holdings and index weights of the benchmark. Since Markowitz’ (1952) seminal paper on portfolio selection, a number of studies have examined the relationship between risk and return according to the num ...

The Best of Times and the Worst of Times for Institutional Investors

... he past decade started with the internet bubble and ended with the bursting of the credit bubble. Sometimes referred to as the “lost decade” by investors, it was the first time in recent economic history that household net worth and net job growth remained flat for a period of 10 years in the United ...

... he past decade started with the internet bubble and ended with the bursting of the credit bubble. Sometimes referred to as the “lost decade” by investors, it was the first time in recent economic history that household net worth and net job growth remained flat for a period of 10 years in the United ...

CONSEQUENCES OF MM - City University London

... No easy practical solutions to the capital structure question once we take into account the complexities of the real world. Many influences on the perceived optimal debt-equity mix -the cost of financial distress/monitoring -agency and incentive problems - MBO’s and LBO’s (an unsatisfied ‘clientele’ ...

... No easy practical solutions to the capital structure question once we take into account the complexities of the real world. Many influences on the perceived optimal debt-equity mix -the cost of financial distress/monitoring -agency and incentive problems - MBO’s and LBO’s (an unsatisfied ‘clientele’ ...

Canadians Hop Aboard Strategic-Beta Bandwagon

... latter include "closet index" stock funds that ape the market without admitting to the fact; "enhancedindex" funds that explicitly control for industry exposure but give the manager the freedom to pick stocks; and many plain-vanilla bond funds. Alternative active funds have no green. (They may also ...

... latter include "closet index" stock funds that ape the market without admitting to the fact; "enhancedindex" funds that explicitly control for industry exposure but give the manager the freedom to pick stocks; and many plain-vanilla bond funds. Alternative active funds have no green. (They may also ...

Babson Capital Management presentation

... • Global growth below trend – U.S., Euro zone, China and Japan expected to grow below long term average rate • Central bank intervention in markets – Fed, ECB, BOE and BOJ balance sheets total nearly $9 trillion • Extended low rate environment – major developed economy policy rates at all-time lows ...

... • Global growth below trend – U.S., Euro zone, China and Japan expected to grow below long term average rate • Central bank intervention in markets – Fed, ECB, BOE and BOJ balance sheets total nearly $9 trillion • Extended low rate environment – major developed economy policy rates at all-time lows ...

AMG Macro Insight - HSBC Global Asset Management

... overseas bond exposures but typically leave foreign equity asset classes unhedged. ...

... overseas bond exposures but typically leave foreign equity asset classes unhedged. ...

Methodological note to the table 1.4

... El Venture capital is defined as the stock of Eurostat. Structural resources used to finance firms having Indicators. difficulty in gaining access to other sources of financing during their early or expansion stage. This indicator is expressed as a percentage of current GDP. ...

... El Venture capital is defined as the stock of Eurostat. Structural resources used to finance firms having Indicators. difficulty in gaining access to other sources of financing during their early or expansion stage. This indicator is expressed as a percentage of current GDP. ...

The Capital Structure Puzzle

... For example, think of the early cross-sectional studies which attempted to test MM's Proposition I. These studies tried to find out whether differences in leverageaffected the market value of the firm (or the market capitalization rate for its operating income). With hindsight, we can quickly see th ...

... For example, think of the early cross-sectional studies which attempted to test MM's Proposition I. These studies tried to find out whether differences in leverageaffected the market value of the firm (or the market capitalization rate for its operating income). With hindsight, we can quickly see th ...

Thanigaimani Ph.D. 2 - Welcome to Bharathidasan University

... average cost of capital and leverage, and between the stock yield and debtequity ratio. For the purpose of his study, he utilized cross-section data from three different industries namely rail road, departmental stores and cement industries. Unlike Modigliani-Miller’s study, his observations have go ...

... average cost of capital and leverage, and between the stock yield and debtequity ratio. For the purpose of his study, he utilized cross-section data from three different industries namely rail road, departmental stores and cement industries. Unlike Modigliani-Miller’s study, his observations have go ...

Tangible Capital Asset Policy - Asset Management Saskatchewan

... a) are held for use in the production or supply of goods and services, for rental to others, for administrative purposes or for the development, construction, maintenance or repair of other tangible capital assets; b) have useful economic lives extending beyond one year; c) are used on a continuing ...

... a) are held for use in the production or supply of goods and services, for rental to others, for administrative purposes or for the development, construction, maintenance or repair of other tangible capital assets; b) have useful economic lives extending beyond one year; c) are used on a continuing ...

Financial Markets in the Face of the Apocalypse

... law, it is reasonably clear to market participants their willingness to abstain from political activities contrary to the prevailing regime provides adequate cover to engage in commercial activities, including but not limited to stock-market transactions. In contrast, for our examples cited from the ...

... law, it is reasonably clear to market participants their willingness to abstain from political activities contrary to the prevailing regime provides adequate cover to engage in commercial activities, including but not limited to stock-market transactions. In contrast, for our examples cited from the ...

determinants of capital structure of croatian enterprises before and

... issuing a sufficiently high amount of debt. The pecking order theory 4 describes the order in which firms prefer to finance firms’ future activities and growth. According to this theory, a firm will rather borrow than issue equity 5, when internal cash flow is not sufficient to fund capital expendit ...

... issuing a sufficiently high amount of debt. The pecking order theory 4 describes the order in which firms prefer to finance firms’ future activities and growth. According to this theory, a firm will rather borrow than issue equity 5, when internal cash flow is not sufficient to fund capital expendit ...

Characterizing world market integration through time

... the increased opportunity set, active foreign participation as well as higher savings and growth made possible by international risk-sharing should lead to signiÞcant welfare gains.1 Indeed, the globalization of EMs has implications beyond the traditional issues in corporate Þnance and investments a ...

... the increased opportunity set, active foreign participation as well as higher savings and growth made possible by international risk-sharing should lead to signiÞcant welfare gains.1 Indeed, the globalization of EMs has implications beyond the traditional issues in corporate Þnance and investments a ...

US Equity International Equity Real Estate Aggregate Bond

... – Do you prefer the stability of cash rents or do you prefer the added risks/rewards that may come from share leases? ...

... – Do you prefer the stability of cash rents or do you prefer the added risks/rewards that may come from share leases? ...

What is a Security?

... No such thing as immediate IPO, or even 1 year to IPO. It’s a myth that a company can “go public” on its first capital raise! Or even within 5 years of start-up. Generally 5 to 10 years to IPO. Generally companies with 300+ employees and $1 million in net income are those that go public. ...

... No such thing as immediate IPO, or even 1 year to IPO. It’s a myth that a company can “go public” on its first capital raise! Or even within 5 years of start-up. Generally 5 to 10 years to IPO. Generally companies with 300+ employees and $1 million in net income are those that go public. ...

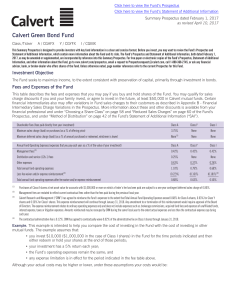

Calvert Green Bond Fund

... of an active market, reduced number and capacity of traditional market participants to make a market in fixed-income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, caus ...

... of an active market, reduced number and capacity of traditional market participants to make a market in fixed-income securities, and may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal, caus ...

the enlightenment and the financial crisis of 2008: an

... assume that all individuals have the same estimates for the expected return, variance, and covariance of securities.38 (Finance theorists refer to this assumption as the “homogeneous expectations” theory.39) It is important to note that it is not necessary that all market actors are rational or inde ...

... assume that all individuals have the same estimates for the expected return, variance, and covariance of securities.38 (Finance theorists refer to this assumption as the “homogeneous expectations” theory.39) It is important to note that it is not necessary that all market actors are rational or inde ...

Baird Core Intermediate Municipal Bond Fund Summary Prospectus

... conditions or other adverse circumstances. Ratings are essentially opinions of the credit quality of an issuer and may prove to be inaccurate. Non-Investment Grade Quality Risks Non-investment grade debt obligations (sometimes referred to as “high yield” or “junk” bonds) involve greater risk than in ...

... conditions or other adverse circumstances. Ratings are essentially opinions of the credit quality of an issuer and may prove to be inaccurate. Non-Investment Grade Quality Risks Non-investment grade debt obligations (sometimes referred to as “high yield” or “junk” bonds) involve greater risk than in ...

An Introduction to Asset Pricing Models

... assets that are consistently superior to the consensus market evaluation to earn better risk-adjusted rates of return than the average investor ...

... assets that are consistently superior to the consensus market evaluation to earn better risk-adjusted rates of return than the average investor ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.