title - ARK Financial Services

... poor returns, and passive asset class funds can screen these stocks. For example, initial public offering (IPO) stocks have demonstrated poor historical returns in the initial years following the IPO. Based on this evidence, a passive asset class fund might eliminate all IPO stocks until they have s ...

... poor returns, and passive asset class funds can screen these stocks. For example, initial public offering (IPO) stocks have demonstrated poor historical returns in the initial years following the IPO. Based on this evidence, a passive asset class fund might eliminate all IPO stocks until they have s ...

Does Pre-trade Transparency Affect the Market Quality in an Order

... market quality. This effect is especially apparent for so-called floor stocks, for which pre-trade transparency is lower than that of CATS. In contrast, Boehmer et al. (2005) found that greater pre-trade transparency of the limit order book improves market quality. Hendershott and Jones (2005) also ...

... market quality. This effect is especially apparent for so-called floor stocks, for which pre-trade transparency is lower than that of CATS. In contrast, Boehmer et al. (2005) found that greater pre-trade transparency of the limit order book improves market quality. Hendershott and Jones (2005) also ...

The Efficiency of Developed Markets

... There have been many debates on whether stock price behaviour can be predicted or not. In that case, the efficient market hypothesis (EMH) can shed light on this controversial issue in the finance world. EHM was formulated and improved by [6]. In the theory, Efficient Market represents that all mark ...

... There have been many debates on whether stock price behaviour can be predicted or not. In that case, the efficient market hypothesis (EMH) can shed light on this controversial issue in the finance world. EHM was formulated and improved by [6]. In the theory, Efficient Market represents that all mark ...

securities trading policy

... Key Management Personnel need to be mindful of the market perception associated with any sale of Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (ie a vo ...

... Key Management Personnel need to be mindful of the market perception associated with any sale of Company securities and possibly the ability of the market to absorb the volume of shares being sold. With this in mind, the management of the sale of any significant volume of Company securities (ie a vo ...

Stock Markets

... • Operates as a broker-specialist market-maker system similar to NYSE Euronext • Pioneered exchange traded funds (ETFs) – ETFs are index funds that are listed on an exchange and can be traded intraday ...

... • Operates as a broker-specialist market-maker system similar to NYSE Euronext • Pioneered exchange traded funds (ETFs) – ETFs are index funds that are listed on an exchange and can be traded intraday ...

Document

... Includes 33 countries representing more than 80 percent of the combined capitalization of these countries • Countries are grouped into three major regions:Asia/Pacific, Europe/Africa, and the Americas • Each country’s index is calculated in its own currency as well as in the U.S. dollar ...

... Includes 33 countries representing more than 80 percent of the combined capitalization of these countries • Countries are grouped into three major regions:Asia/Pacific, Europe/Africa, and the Americas • Each country’s index is calculated in its own currency as well as in the U.S. dollar ...

securities trading policy

... These guidelines set out the policy on the sale and purchase of Securities in the Company by the Company Personnel. Company Personnel are those persons engaged by the Company on a full or part time basis and includes employees, contractors, consultants and management personnel controlling the activi ...

... These guidelines set out the policy on the sale and purchase of Securities in the Company by the Company Personnel. Company Personnel are those persons engaged by the Company on a full or part time basis and includes employees, contractors, consultants and management personnel controlling the activi ...

No Slide Title

... Offshore debt or equity investments where the investor wishes to achieve the best currency over the relevant time period and wishes to uncouple the timing of the investment from the currency rate setting. Perspectives of holder • Most advantageous if the realized volatility of the underlying asset p ...

... Offshore debt or equity investments where the investor wishes to achieve the best currency over the relevant time period and wishes to uncouple the timing of the investment from the currency rate setting. Perspectives of holder • Most advantageous if the realized volatility of the underlying asset p ...

Stock Market Speculation and Managerial Myopia

... much the stock-market knows about corporate decisions: a well-informed stock market can provide accurate incentives that lead to profit-maximizing decisions, but an ill-informed one distorts incentives away from profit-maximization. The question therefore arises as to how the stock market can obtain ...

... much the stock-market knows about corporate decisions: a well-informed stock market can provide accurate incentives that lead to profit-maximizing decisions, but an ill-informed one distorts incentives away from profit-maximization. The question therefore arises as to how the stock market can obtain ...

On Regret and Options - A Game Theoretic Approach for Option

... on the Black-Scholes formula is significantly higher on average than the ex-post realized volatility. In addition, this effect is more pronounced for call options whose strike price is low. This effect is often referred to as the volatility “smirk” or “smile.” As a response to these findings, there ...

... on the Black-Scholes formula is significantly higher on average than the ex-post realized volatility. In addition, this effect is more pronounced for call options whose strike price is low. This effect is often referred to as the volatility “smirk” or “smile.” As a response to these findings, there ...

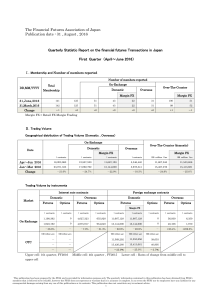

The Financial Futures Association of Japan Publication date : 31

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

SKI160217 Risk Adjusted TSR Methodology

... political) and non-systemic risk (e.g. management skills and judgement). If we can adjust for the systemic risk, then the variability in adjusted returns should be more strongly related to management performance. TSR (share price appreciation + dividends), though commonly used to benchmark longterm ...

... political) and non-systemic risk (e.g. management skills and judgement). If we can adjust for the systemic risk, then the variability in adjusted returns should be more strongly related to management performance. TSR (share price appreciation + dividends), though commonly used to benchmark longterm ...

Chapter 10 Some Lessons from Capital Market History Chapter

... – So the answer depends on the planning period under consideration • 15 – 20 years or less: use arithmetic • 20 – 40 years or so: split the difference between them • 40 + years: use the geometric ...

... – So the answer depends on the planning period under consideration • 15 – 20 years or less: use arithmetic • 20 – 40 years or so: split the difference between them • 40 + years: use the geometric ...

Investing in Stocks Chapter Sixteen

... number of outstanding shares if a share costs more than the book value the company may be overextended or it may have a lot of money in research and development ...

... number of outstanding shares if a share costs more than the book value the company may be overextended or it may have a lot of money in research and development ...

Correlated Trading and Returns

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

EUROPEAN COMMISSION Brussels, 14.7.2016 C(2016) 4390 final

... other similar financial instruments takes place in largely the same fashion, and fulfils a nearly identical economic purpose, as trading in shares admitted to trading on a regulated market, MiFIR extends its provisions to the former. In addition, MiFIR introduces an on-venue trading obligation for s ...

... other similar financial instruments takes place in largely the same fashion, and fulfils a nearly identical economic purpose, as trading in shares admitted to trading on a regulated market, MiFIR extends its provisions to the former. In addition, MiFIR introduces an on-venue trading obligation for s ...

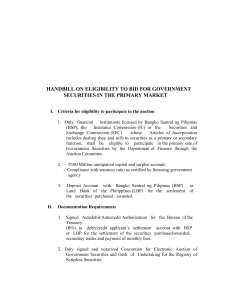

handbill on eligibility to bid for government securities in the primary

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

... UNIMPAIRED CAPITAL AND SURPLUS means the combined capital accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside fo ...

The Best Solution for Protecting Retirement Portfolios: Put and Call

... of the more prevalent higher-cost products. The latter are almost always commission-based and typically offer more investment choices and complex product features. Still, investors need to ask themselves if the extra costs are worth it. An alternative way to utilize a GLWB is with a stand-alone liv ...

... of the more prevalent higher-cost products. The latter are almost always commission-based and typically offer more investment choices and complex product features. Still, investors need to ask themselves if the extra costs are worth it. An alternative way to utilize a GLWB is with a stand-alone liv ...

An Empirical Analysis of the Determinants of Market Capitalization in

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

designated market makers - The New York Stock Exchange

... MKT security by assuming risk and displaying quotes in the exchange limit order book. In 2015, DMMs accounted for about 12% of liquidity adding volume in NYSE-listed securities, on average. • DMMs reduce volatility – DMMs provide price stability by satisfying market demand for a security at competi ...

... MKT security by assuming risk and displaying quotes in the exchange limit order book. In 2015, DMMs accounted for about 12% of liquidity adding volume in NYSE-listed securities, on average. • DMMs reduce volatility – DMMs provide price stability by satisfying market demand for a security at competi ...

Bitcoin Comes of Age

... Christian Martin. Instead, the venue settles in USD and spent about half of its time and money during the past year constructing a BTC index. Meanwhile, Digital Asset Holdings is betting to carve out solutions inside financial institutions and use the blockchain to reduce the settlement times fo ...

... Christian Martin. Instead, the venue settles in USD and spent about half of its time and money during the past year constructing a BTC index. Meanwhile, Digital Asset Holdings is betting to carve out solutions inside financial institutions and use the blockchain to reduce the settlement times fo ...

Discussion paper Transparency and liquidity

... trading platforms. This will be through the EU Regulation on markets in financial instruments (MiFIR), which enters into force on 3 January 2018. The regulation contains requirements that an operator of a market place must publish the current buy and sell prices as well as information on market dep ...

... trading platforms. This will be through the EU Regulation on markets in financial instruments (MiFIR), which enters into force on 3 January 2018. The regulation contains requirements that an operator of a market place must publish the current buy and sell prices as well as information on market dep ...

Financial Market Anomalies - Wharton Finance Department

... effects. (The same caveat has been raised regarding the magnitude of the equity premium.) Regarding the second point, the visual appearance of common co-movement between the series suggests the two effects are not entirely independent. This possibility is confirmed when the time series plots of SmB ...

... effects. (The same caveat has been raised regarding the magnitude of the equity premium.) Regarding the second point, the visual appearance of common co-movement between the series suggests the two effects are not entirely independent. This possibility is confirmed when the time series plots of SmB ...