Lecture 21: Risk Neutral and Martingale Measure

... 2. Modify to make sure that the discounted stock price process is a martingale - achieved by a change of measure 3. Other derivative prices (discounted) are also martingales: therefore a formula involving an expectation is obtained to price such a derivative. 4. This price is guaranteed to be arbitr ...

... 2. Modify to make sure that the discounted stock price process is a martingale - achieved by a change of measure 3. Other derivative prices (discounted) are also martingales: therefore a formula involving an expectation is obtained to price such a derivative. 4. This price is guaranteed to be arbitr ...

The nature of Jumps in Brazil`s stock market

... not expect to be rewarded for holding this type of risk. It states that the only true risk is the market risk, and it prescribes a method to produce a market portfolio, which is regarded as a good representative of the whole market, based on its variance and expected return. As a matter of fact, man ...

... not expect to be rewarded for holding this type of risk. It states that the only true risk is the market risk, and it prescribes a method to produce a market portfolio, which is regarded as a good representative of the whole market, based on its variance and expected return. As a matter of fact, man ...

Screen Information, Trader Activity, and Bid-Ask

... representing trading in three contracts differented by expiration, but with 10 day gaps to account for any rollover activity.12 Finally, the out-of-sample period is 1/29/96 through 2/16/96. This choice eliminates an entire contract cycle before the evaluation period. Sample sizes during the estimati ...

... representing trading in three contracts differented by expiration, but with 10 day gaps to account for any rollover activity.12 Finally, the out-of-sample period is 1/29/96 through 2/16/96. This choice eliminates an entire contract cycle before the evaluation period. Sample sizes during the estimati ...

Market liquidity and stress - Bank for International Settlements

... The relationship between market and cash liquidity is a multifaceted one. Some of the links are obvious. For instance, selling an asset in a market or unwinding a profitable position is one way of raising cash. Others, however, are less apparent. In particular, it will be argued below that access to ...

... The relationship between market and cash liquidity is a multifaceted one. Some of the links are obvious. For instance, selling an asset in a market or unwinding a profitable position is one way of raising cash. Others, however, are less apparent. In particular, it will be argued below that access to ...

Volatility Strategies for 2016

... • We run our client portfolios like individual businesses • SPY and IWM are our primary vehicles for our client option portfolios that we advise… but not always as a volatility play. • Option buyers generally benefit more than option sellers… however underlying price may move up and option prices wi ...

... • We run our client portfolios like individual businesses • SPY and IWM are our primary vehicles for our client option portfolios that we advise… but not always as a volatility play. • Option buyers generally benefit more than option sellers… however underlying price may move up and option prices wi ...

6 - MyWeb

... A. prices of related goods, technology, prices of inputs, expectations, and the number of sellers. B. consumer preferences, the price of the good, and prices of related goods. C. expectations and number of buyers in the market. D. prices of related goods, technology, and consumer preferences. ...

... A. prices of related goods, technology, prices of inputs, expectations, and the number of sellers. B. consumer preferences, the price of the good, and prices of related goods. C. expectations and number of buyers in the market. D. prices of related goods, technology, and consumer preferences. ...

securities trading on multiple marketplaces

... The Canadian capital markets have recently evolved with the emergence of several Alternate Trading Systems (ATS) and other marketplaces which improve liquidity and provide more competitive pricing than the TSX, the predominant marketplace for Canadian securities. As our client, you should be aware h ...

... The Canadian capital markets have recently evolved with the emergence of several Alternate Trading Systems (ATS) and other marketplaces which improve liquidity and provide more competitive pricing than the TSX, the predominant marketplace for Canadian securities. As our client, you should be aware h ...

Empirical Evidence : CAPM and APT

... – Individual stock returns are so volatile that one cannot reject the null hypothesis that average returns across different stocks are the same (s ≈ 30 – 80% p.a., hence cannot reject the null that average returns across different stocks are the same.) – Betas are measured with errors ...

... – Individual stock returns are so volatile that one cannot reject the null hypothesis that average returns across different stocks are the same (s ≈ 30 – 80% p.a., hence cannot reject the null that average returns across different stocks are the same.) – Betas are measured with errors ...

The impact of short-selling constraints on financial market

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

... The practice of short-selling – borrowing a financial instrument from another investor to sell it immediately and close the position in the future by buying and returning the instrument – is widespread in financial markets. In fact, short-selling is the mirror image of a “long position”, where an in ...

E(R i ) - Cengage

... The Capital Market Line The line connecting Rf to the market portfolio is called the Capital Market Line (CML) CML quantifies the relationship between the expected return and standard deviation for portfolios consisting of the risk-free asset and the market portfolio, using ...

... The Capital Market Line The line connecting Rf to the market portfolio is called the Capital Market Line (CML) CML quantifies the relationship between the expected return and standard deviation for portfolios consisting of the risk-free asset and the market portfolio, using ...

Weather, Stock Returns, and the Impact of Localized Trading Behavior

... index for each of the 26 cities produces negative coefficients on cloudiness in 18 cases. In addition, logit model results suggest that cloudiness is associated with a lower probability of positive returns for 25 of the 26 cities. These findings are consistent with the casual intuition that overcas ...

... index for each of the 26 cities produces negative coefficients on cloudiness in 18 cases. In addition, logit model results suggest that cloudiness is associated with a lower probability of positive returns for 25 of the 26 cities. These findings are consistent with the casual intuition that overcas ...

Investing In Canadian Dividend Stocks

... stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a reasonable price is another important consideration. It is a truism that stocks of good companies rarely go on sale. They are widely held and very liquid, thus any mispricing is quickly seized upo ...

... stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a reasonable price is another important consideration. It is a truism that stocks of good companies rarely go on sale. They are widely held and very liquid, thus any mispricing is quickly seized upo ...

Corporate Bond Trading on a Limit Order Book Exchange by

... and the data. Section 3 presents the bid-ask spreads in the market. Section 4 describes the investor types we focus on (retail and short-term traders). Section 5 analyzes the competition between short-term traders. Section 6 analyzes the contribution of nonshort-term traders to liquidity. Section 7 ...

... and the data. Section 3 presents the bid-ask spreads in the market. Section 4 describes the investor types we focus on (retail and short-term traders). Section 5 analyzes the competition between short-term traders. Section 6 analyzes the contribution of nonshort-term traders to liquidity. Section 7 ...

put title here - Terry FitzPatrick: Reporting, Training, Media

... worth of stock changes hands every minute. Brokers constantly scramble to do their client's bidding in the battlefield of high finance. Cashin: "The floor's a rather unique kind of place. It's a place where people who have known each other many years, each day get together to compete on behalf of cl ...

... worth of stock changes hands every minute. Brokers constantly scramble to do their client's bidding in the battlefield of high finance. Cashin: "The floor's a rather unique kind of place. It's a place where people who have known each other many years, each day get together to compete on behalf of cl ...

Portfolio1 - people.bath.ac.uk

... • Core-satellite strategy: the manager has a large core portfolio that is never traded due to transactions costs. He also has a number of satellite portfolios that are actively traded. • An alternative is to use options and futures. The idea is to hold a passive portfolio, and to trade individual s ...

... • Core-satellite strategy: the manager has a large core portfolio that is never traded due to transactions costs. He also has a number of satellite portfolios that are actively traded. • An alternative is to use options and futures. The idea is to hold a passive portfolio, and to trade individual s ...

Summary The Gulf cooperation council was formed in 1981, and it

... through a basket of currencies hat were dominated by the dollar. For Saudi Arabia, as much as the number of companies that are listed in the stock market are slightly over eighty which is not such a big number compared to other developed countries, it has still taken off vigorously due to the fast d ...

... through a basket of currencies hat were dominated by the dollar. For Saudi Arabia, as much as the number of companies that are listed in the stock market are slightly over eighty which is not such a big number compared to other developed countries, it has still taken off vigorously due to the fast d ...

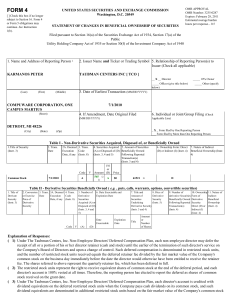

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

... ( 1) Under The Taubman Centers, Inc. Non-Employee Directors' Deferred Compensation Plan, each non-employee director may defer the receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Dir ...

Experimental Approach to Business Strategy 45-922

... objective of player i is to pick the quantity of good traded, denoted qi, to maximize the value of his or her portfolio subject to constraints that prevent short sales (selling more stock than the the seller holds) or bankruptcy (not having enough liquidity to cover purchases). The value of the port ...

... objective of player i is to pick the quantity of good traded, denoted qi, to maximize the value of his or her portfolio subject to constraints that prevent short sales (selling more stock than the the seller holds) or bankruptcy (not having enough liquidity to cover purchases). The value of the port ...

ch9_IM_1E

... 5. The Amazing.com Corporation currently pays no cash dividends, and it is not expected to for the next 5 years. Its sales have been growing at 25% per year. a. Can you apply the constant growth rate DDM to estimate its intrinsic value? Explain. b. It is expected to pay its first cash dividend $1 pe ...

... 5. The Amazing.com Corporation currently pays no cash dividends, and it is not expected to for the next 5 years. Its sales have been growing at 25% per year. a. Can you apply the constant growth rate DDM to estimate its intrinsic value? Explain. b. It is expected to pay its first cash dividend $1 pe ...

Dividend Policy

... 5. The Amazing.com Corporation currently pays no cash dividends, and it is not expected to for the next 5 years. Its sales have been growing at 25% per year. a. Can you apply the constant growth rate DDM to estimate its intrinsic value? Explain. b. It is expected to pay its first cash dividend $1 pe ...

... 5. The Amazing.com Corporation currently pays no cash dividends, and it is not expected to for the next 5 years. Its sales have been growing at 25% per year. a. Can you apply the constant growth rate DDM to estimate its intrinsic value? Explain. b. It is expected to pay its first cash dividend $1 pe ...

Volatility trading in options market: How does it a ect where

... either by informed or liquidity traders. There are two kinds of informed traders: Directionaltraders who have information on the future underlying asset price and volatility-traders who have information on the future underlying asset volatility. To exploit their private information, while avoiding f ...

... either by informed or liquidity traders. There are two kinds of informed traders: Directionaltraders who have information on the future underlying asset price and volatility-traders who have information on the future underlying asset volatility. To exploit their private information, while avoiding f ...