a guide to - Atkinson White Partnership

... they could take all their pension savings as a lump sum, draw them down over time, or buy an annuity. The Government will also explore with interested parties whether those tax rules that prevent individuals aged 75 and over from claiming tax relief on their pension contributions should be amended o ...

... they could take all their pension savings as a lump sum, draw them down over time, or buy an annuity. The Government will also explore with interested parties whether those tax rules that prevent individuals aged 75 and over from claiming tax relief on their pension contributions should be amended o ...

Informational Asymmetry and the Demand for IPOs: An Explanation

... IPO markets, and various economic theories about such markets still argue over which entities do and which do not have reliable information regarding the value of a firm. There are many entities involved in the initial public offering process. Each group has its own agenda and acts rationally toward ...

... IPO markets, and various economic theories about such markets still argue over which entities do and which do not have reliable information regarding the value of a firm. There are many entities involved in the initial public offering process. Each group has its own agenda and acts rationally toward ...

re-examining risk tolerance using worst

... their target levels and at the same time cause investors to become overly complacent with their stock holdings—a dangerous combination. Examining your portfolio and seeing how it would fare under the worst-case bear market conditions gives you the chance to inject a dose of reality into your portfol ...

... their target levels and at the same time cause investors to become overly complacent with their stock holdings—a dangerous combination. Examining your portfolio and seeing how it would fare under the worst-case bear market conditions gives you the chance to inject a dose of reality into your portfol ...

Title in Arial bold Subhead in Arial

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

... – SF arranges security on a portfolio basis on behalf of all eligible companies – all eligible companies (based on minimum credit rating) must participate ...

Angel Broking-Restricted Scrips Policy Dealing in Restricted Scrips

... any contract has open interest below Rs 25 lacs. We will not allow the trading to happen on all Odin terminals. This doesn’t mean we will be blocking the contract from trading. For such orders we can placed from the centralized desk to avoid any malpractices or erroneous trading. ...

... any contract has open interest below Rs 25 lacs. We will not allow the trading to happen on all Odin terminals. This doesn’t mean we will be blocking the contract from trading. For such orders we can placed from the centralized desk to avoid any malpractices or erroneous trading. ...

An Empirical Analysis of the Determinants of Market Capitalization in

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

... perpetuity, funds to state and local government without pressures and ample time to repay loans. Similarly, the study by Maku and Atanda(2009,2010) shows that stock prices and depreciating Naira rate are positively related while all share index is more responsive to changes in macroeconomic variable ...

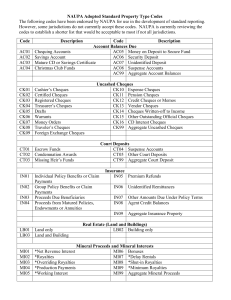

Alberta Tax and Revenue Administration

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

... NAUPA Adopted Standard Property Type Codes The following codes have been endorsed by NAUPA for use in the development of standard reporting. However, some jurisdictions do not currently accept these codes. NAUPA is currently reviewing the codes to establish a shorter list that would be acceptable to ...

Weak-form Market Efficiency of Shanghai Stock Exchange: An

... second approach, we attempt to predict the future rates of return to the portfolios on the basis of risk variables estimated in previous periods. The empirical results suggest that there is no positive or linear relation existing between the individual stocks’ returns and their market betas, and tha ...

... second approach, we attempt to predict the future rates of return to the portfolios on the basis of risk variables estimated in previous periods. The empirical results suggest that there is no positive or linear relation existing between the individual stocks’ returns and their market betas, and tha ...

equities

... Equity securities, generally referred to as shares or stocks, represent ownership units in the issuing company. In Hong Kong, shares are listed either on the Main Board or on the Growth Enterprise Market (GEM) of The Stock Exchange of Hong Kong Limited (Stock Exchange), a wholly-owned subsidiary of ...

... Equity securities, generally referred to as shares or stocks, represent ownership units in the issuing company. In Hong Kong, shares are listed either on the Main Board or on the Growth Enterprise Market (GEM) of The Stock Exchange of Hong Kong Limited (Stock Exchange), a wholly-owned subsidiary of ...

Dividends per Share of Common Stock for the Fiscal Year Ended

... of Directors today resolved to pay the year-end dividends for its common stocks as stated below. The record date thereof is March 31, 2013. MUFG will submit the proposal therefor at the General Meeting of Shareholders to be held on June 27, ...

... of Directors today resolved to pay the year-end dividends for its common stocks as stated below. The record date thereof is March 31, 2013. MUFG will submit the proposal therefor at the General Meeting of Shareholders to be held on June 27, ...

Testimony Of James Goulka Managing Director Arizona Technology

... having experienced the financial meltdown of the past several years, are not enthusiastic about banks taking on this kind of risky business. We do have investors who are interested in providing capital to this segment: individuals, generally referred to as angels, and institutions, generally called ...

... having experienced the financial meltdown of the past several years, are not enthusiastic about banks taking on this kind of risky business. We do have investors who are interested in providing capital to this segment: individuals, generally referred to as angels, and institutions, generally called ...

Audited group results for the year ended 30 June 2002

... The Directors of Comair have resolved to declare a dividend of 2,0 cents per share to all shareholders. The last day to trade ("cum" dividend) in order to participate in the dividend will be Thursday 19 September 2002. Shares will commence trading ex-dividend from the commencement of trading on Frid ...

... The Directors of Comair have resolved to declare a dividend of 2,0 cents per share to all shareholders. The last day to trade ("cum" dividend) in order to participate in the dividend will be Thursday 19 September 2002. Shares will commence trading ex-dividend from the commencement of trading on Frid ...

Circular to shareholders 2016

... Members”) at the ratio of five (5) shares for each three (3) shares held by each of the Eligible Members, subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or legal or practical problems under the laws of, or the ...

... Members”) at the ratio of five (5) shares for each three (3) shares held by each of the Eligible Members, subject to such exclusions or other arrangements as the Directors may deem necessary or expedient in relation to fractional entitlements or legal or practical problems under the laws of, or the ...

How are stock prices a!ected by the location of trade?

... world's largest and most liquid multinational companies are strongly in#uenced by locational factors. Speci"cally, we test whether location matters by examining &Siamese-twin' company stocks, or pairs of corporations whose charter "xes the division of current and future equity cash #ows to each twin ...

... world's largest and most liquid multinational companies are strongly in#uenced by locational factors. Speci"cally, we test whether location matters by examining &Siamese-twin' company stocks, or pairs of corporations whose charter "xes the division of current and future equity cash #ows to each twin ...

an analysis of the price/book ratio of two maltese

... There are different methods that can be used to build an efficient investing portfolio, including (a) momentum investing (b) growth investing, and (c) value investing. Momentum Investing. Investors using this investing approach buy shares as prices go up and sell them as soon as prices start to decl ...

... There are different methods that can be used to build an efficient investing portfolio, including (a) momentum investing (b) growth investing, and (c) value investing. Momentum Investing. Investors using this investing approach buy shares as prices go up and sell them as soon as prices start to decl ...

Mutual Funds - Iowa State University Extension and Outreach

... from than there are stocks listed on the New York Stock Exchange. To narrow your search look at financial magazines and Web sites that evaluate funds. Then read the fund’s prospectus. This is a document a mutual fund company must provide you before you invest. The Securities and Exchange Commission ...

... from than there are stocks listed on the New York Stock Exchange. To narrow your search look at financial magazines and Web sites that evaluate funds. Then read the fund’s prospectus. This is a document a mutual fund company must provide you before you invest. The Securities and Exchange Commission ...

Fact Sheet - ProShares

... dividend payments are not taken into consideration. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the index at reconstitution. ³Bloomberg: The total return of the index has been higher than the S&P 500 si ...

... dividend payments are not taken into consideration. There is no guarantee dividends will be paid. Companies may reduce or eliminate dividends at any time, and those that do will be dropped from the index at reconstitution. ³Bloomberg: The total return of the index has been higher than the S&P 500 si ...

Easing Creeping Acquisition Norm

... authority, you can be said to be in control of the company mandating an open offer, even though you may not have acquired any shares. Further Mr. Nishchal Joshipura, Practice Head, Mergers and Acquisitions, Nishith Desai Associates explained, "MNCs with Indian listed subsidiaries that are interested ...

... authority, you can be said to be in control of the company mandating an open offer, even though you may not have acquired any shares. Further Mr. Nishchal Joshipura, Practice Head, Mergers and Acquisitions, Nishith Desai Associates explained, "MNCs with Indian listed subsidiaries that are interested ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.