Chapter 11 Dividend Policy

... dividends companies can pay. For example, in the UK in the 1960’s as part of a prices and income policy. ...

... dividends companies can pay. For example, in the UK in the 1960’s as part of a prices and income policy. ...

Efficient Price Discovery in Stock Index Cash and Futures Markets

... stock quotes and prices were extracted for the same period from the CDs supplied by the Paris Bourse. We used the TMP and PIBOR of various maturities to evaluate the cost of carry of the futures. These rates are from DATASTREAMtm. The daily number of shares issued by each firm and the dividend data ...

... stock quotes and prices were extracted for the same period from the CDs supplied by the Paris Bourse. We used the TMP and PIBOR of various maturities to evaluate the cost of carry of the futures. These rates are from DATASTREAMtm. The daily number of shares issued by each firm and the dividend data ...

Holding the middle ground with convertible securities

... Topics presented in this paper are not necessarily applicable to funds managed by the authors, which may employ strategies not covered here. See the fund’s prospectus for details. The opinions expressed here are those of Eric Harthun and Robert Salvin and are not intended as investment advice. They ...

... Topics presented in this paper are not necessarily applicable to funds managed by the authors, which may employ strategies not covered here. See the fund’s prospectus for details. The opinions expressed here are those of Eric Harthun and Robert Salvin and are not intended as investment advice. They ...

Portfolio1 - people.bath.ac.uk

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

... • Other issue: fund managers are careerist. When the payoffperformance relationship is convex, there are incentives to take high risks. This might hurts investors’ return. • It has been found that net flows into funds are highly sensitive to performance. This can generate incentive to be excessivel ...

Hedge Accounts - Dorman Trading

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

... (3) Non-Enumerated Cases. Upon specific request made in accordance with section 1.47 of the regulations, the Commission may recognize transactions and positions other than those enumerated in paragraph (2) of this section as bone fide hedging in such amounts and under such terms and conditions as it ...

Distressed Properties - Valdosta real estate and homes for sale in

... the owner losing money. This is because the need to sell ...

... the owner losing money. This is because the need to sell ...

Disconcerting Discourse Communities: the CIG

... “ ‘Language’ is a misleading term; it too often suggests ‘grammar.’ It is a truism that a person can know perfectly the grammar of a language and not know how to use that language,” (Gee, 483). You may know the grammar of a certain group, but it the ability to apply the language that will make you ...

... “ ‘Language’ is a misleading term; it too often suggests ‘grammar.’ It is a truism that a person can know perfectly the grammar of a language and not know how to use that language,” (Gee, 483). You may know the grammar of a certain group, but it the ability to apply the language that will make you ...

The International Diversification Fallacy of Exchange

... They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the returns for their respective benchmarks. Another vehicle available to investors who wish to add "international" securities to their portfolios is the American depository receipt (ADR). ...

... They find that the country funds listed on the U.S. exchanges are more highly correlated with the S&P 500 than the returns for their respective benchmarks. Another vehicle available to investors who wish to add "international" securities to their portfolios is the American depository receipt (ADR). ...

Networking Solutions for the Financial Trading Industry

... Over The Counter (OTC) are venues outside formal exchanges, used generally for trading stocks or other instruments that have falled dramatically in value or have been decertified from the main exchanges. Derivatives are often traded on OTC. Stocks on OTC do not have to meet the stringent requirement ...

... Over The Counter (OTC) are venues outside formal exchanges, used generally for trading stocks or other instruments that have falled dramatically in value or have been decertified from the main exchanges. Derivatives are often traded on OTC. Stocks on OTC do not have to meet the stringent requirement ...

Futures - HSBC Broking Services

... You should carefully consider whether futures contract trading is suitable for you in light of your financial condition, experience and investment objectives. The following is a summary of some of the risks involving futures contract trading and it is NOT an exhaustive list. You are advised to exerc ...

... You should carefully consider whether futures contract trading is suitable for you in light of your financial condition, experience and investment objectives. The following is a summary of some of the risks involving futures contract trading and it is NOT an exhaustive list. You are advised to exerc ...

Macro View Canadian Markets U.S. Markets

... investment products which may be offered to their residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constit ...

... investment products which may be offered to their residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constit ...

True False Questions – set 2

... contracts now so that I can lock in the price of Treasuries today! 2. If you are a speculator and you buy a futures contract on wheat then you are a bear, since if wheat prices (both spot and expected) are lower at some future date, you can buy the futures contract back at a lower price than you sol ...

... contracts now so that I can lock in the price of Treasuries today! 2. If you are a speculator and you buy a futures contract on wheat then you are a bear, since if wheat prices (both spot and expected) are lower at some future date, you can buy the futures contract back at a lower price than you sol ...

Exercises - lasse h. pedersen

... more investors want to be allocated shares than what is for sale. Other IPOs are undersubscribed, meaning that the firm and its underwriter struggle to sell the shares. - In which case do you expect that the return after the IPO is the highest? - Suppose that you bid for an allocation for IPO shares ...

... more investors want to be allocated shares than what is for sale. Other IPOs are undersubscribed, meaning that the firm and its underwriter struggle to sell the shares. - In which case do you expect that the return after the IPO is the highest? - Suppose that you bid for an allocation for IPO shares ...

Impact of Dividend Policy on Market Capitalization of Firms Listed in

... exchange was gathered. Sample size of the study was determined by randomly selecting five companies from the respective sector. Dividend policy is kept as an independent variable which is measured through dividend yield and payout ratios while market capitalization is the dependent variable which is ...

... exchange was gathered. Sample size of the study was determined by randomly selecting five companies from the respective sector. Dividend policy is kept as an independent variable which is measured through dividend yield and payout ratios while market capitalization is the dependent variable which is ...

Theory of speculative bubble

... The starting point of Le Bon mass psychology Analysis of collective soul This collective soul establishes in the place where is some group of people and where an event occurs People do not deal as a individuals but deal as a mass. Personal characteristics of individuals are put down and replac ...

... The starting point of Le Bon mass psychology Analysis of collective soul This collective soul establishes in the place where is some group of people and where an event occurs People do not deal as a individuals but deal as a mass. Personal characteristics of individuals are put down and replac ...

High Dividend Value Select UMA Schafer Cullen

... more concerned about risk. Consequently there is increasing demand for lower-risk investment strategies. However, while many such strategies lessen downside risk, they may reduce upside potential even more. Many investors seem to believe that they must take above average risks to achieve above avera ...

... more concerned about risk. Consequently there is increasing demand for lower-risk investment strategies. However, while many such strategies lessen downside risk, they may reduce upside potential even more. Many investors seem to believe that they must take above average risks to achieve above avera ...

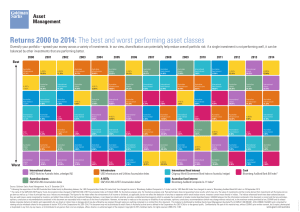

Asset Class Returns

... ^ The name of the S&P/ASX 200 Property Trusts Accumulation Index changed to S&P/ASX 200 A-REIT Accumulation Index on 5 March 2008. For illustrative purposes only. For illustrative purposes only. Past performance does not guarantee future results, which may vary. The value of investments and the inco ...

... ^ The name of the S&P/ASX 200 Property Trusts Accumulation Index changed to S&P/ASX 200 A-REIT Accumulation Index on 5 March 2008. For illustrative purposes only. For illustrative purposes only. Past performance does not guarantee future results, which may vary. The value of investments and the inco ...

6. Derivatives Market

... has surpassed the equity market turnover. The turnover of derivatives on the NSE increased from ` 23,654 million in 2000–2001 to ` 292,482,211 million in 2010–2011, and reached ` 157,585,925 million in the first half of 2011–2012. The average daily turnover in these market segment on the NSE was ` 1 ...

... has surpassed the equity market turnover. The turnover of derivatives on the NSE increased from ` 23,654 million in 2000–2001 to ` 292,482,211 million in 2010–2011, and reached ` 157,585,925 million in the first half of 2011–2012. The average daily turnover in these market segment on the NSE was ` 1 ...

Lender Claim Trust - Transfer Notice

... the following categories, or who the issuer reasonably believes comes within any of the following categories, at the time of the sale of the securities to that person: (1) Any bank as defined in section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in sectio ...

... the following categories, or who the issuer reasonably believes comes within any of the following categories, at the time of the sale of the securities to that person: (1) Any bank as defined in section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in sectio ...

Safe Primer - Y Combinator

... safe holder is issued will have a liquidation preference that is equal to the original safe investment amount, rather than based on the price of the shares issued to the investors of new money in the financing. This feature means that the liquidation preference for safe holders does not exceed the o ...

... safe holder is issued will have a liquidation preference that is equal to the original safe investment amount, rather than based on the price of the shares issued to the investors of new money in the financing. This feature means that the liquidation preference for safe holders does not exceed the o ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.