multi-market trading and market liquidity: the post-mifid picture

... 3 MTFs with significant market shares ● Chi-X for all securities ● BATS Europe more specifically on large UK equities ● Turquoise more specifically on Euronext large equities ...

... 3 MTFs with significant market shares ● Chi-X for all securities ● BATS Europe more specifically on large UK equities ● Turquoise more specifically on Euronext large equities ...

BC Securities Commission Capital Raising for Small Business

... they are your customer or former client. A person is also not your close business associate if you have approached them to invest after only a brief acquaintance. • Accredited investors An accredited investor is a person who meets at least one of the following financial qualification tests, or qual ...

... they are your customer or former client. A person is also not your close business associate if you have approached them to invest after only a brief acquaintance. • Accredited investors An accredited investor is a person who meets at least one of the following financial qualification tests, or qual ...

Options Scanner Manual

... underlying price. Gamma is derived from Delta, perhaps the most well-known Greek. Delta measures a contract’s sensitivity to more minor changes in the underlying price. Low - option price gains less than 0.25 % for a 1 % move in underlying price Moderate - option price gains less than 5 % for a 1 % ...

... underlying price. Gamma is derived from Delta, perhaps the most well-known Greek. Delta measures a contract’s sensitivity to more minor changes in the underlying price. Low - option price gains less than 0.25 % for a 1 % move in underlying price Moderate - option price gains less than 5 % for a 1 % ...

NATIONAL FINANCIAL SERVICES LLC STATEMENT OF

... recorded at their contractual amounts plus accrued interest. These agreements are generally collateralized by U.S. Government and agency securities. It is the Company’s policy to take possession of securities purchased under resale agreements with a market value in excess of the principal amount loa ...

... recorded at their contractual amounts plus accrued interest. These agreements are generally collateralized by U.S. Government and agency securities. It is the Company’s policy to take possession of securities purchased under resale agreements with a market value in excess of the principal amount loa ...

Form 51-102F1 KOKOMO ENTERPRISES INC. Forward

... The exploration of mineral properties involves significant risks which even experience, knowledge and careful evaluation may not be able to avoid. The prices of metals have fluctuated widely, particularly in recent years as it is affected by numerous factors which are beyond the Company’s control in ...

... The exploration of mineral properties involves significant risks which even experience, knowledge and careful evaluation may not be able to avoid. The prices of metals have fluctuated widely, particularly in recent years as it is affected by numerous factors which are beyond the Company’s control in ...

Fact Sheet - Toroso Investments

... The Toroso Strategy is subject to underlying expenses such as the annual expense ratios of the Exchange-Traded Products (ETPs) used to construct the portfolio, which generally include an embedded investment management fee paid to the investment adviser of the ETP. In addition, trading and transactio ...

... The Toroso Strategy is subject to underlying expenses such as the annual expense ratios of the Exchange-Traded Products (ETPs) used to construct the portfolio, which generally include an embedded investment management fee paid to the investment adviser of the ETP. In addition, trading and transactio ...

Chap025 - U of L Class Index

... • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely changes hands, but when a warrant is exercis ...

... • To a firm, a warrant is substantially different from a call option. - A call option sold on the firm’s stock is a private transaction between investors, in which the firm is not directly involved. - When a call option is exercised, existing stock merely changes hands, but when a warrant is exercis ...

Notice of change of interests of substantial holder

... This notice is given by IOOF Holdings Limited on behalf of itself and its subsidiaries. There was a change in the interest of the substantial holder on: ...

... This notice is given by IOOF Holdings Limited on behalf of itself and its subsidiaries. There was a change in the interest of the substantial holder on: ...

View PDF in new window - Tetragon Financial Group

... operations, financial condition and liquidity may differ materially and adversely from the forward-looking statements contained in this press release. Forward-looking statements speak only as of the day they are made and TFG does not undertake to update its forward-looking statements unless required ...

... operations, financial condition and liquidity may differ materially and adversely from the forward-looking statements contained in this press release. Forward-looking statements speak only as of the day they are made and TFG does not undertake to update its forward-looking statements unless required ...

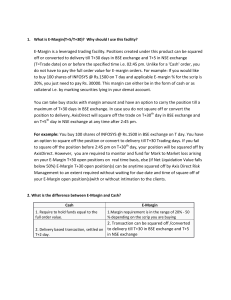

E-Margin is a leveraged trading facility. Positions

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

... (T=Trade date) on or before the specified time i.e. 02:45 pm. Unlike for a 'Cash' order, you do not have to pay the full order value for E-margin orders. For example: If you would like to buy 100 shares of INFOSYS @ Rs.1500 on T day and applicable E-margin % for the scrip is 20%, you just need to pa ...

GEM * Majeure Gestion d*Actifs

... You are a portfolio manager. The economic research team has given you the following expectations for the risk free rate, 2%, and the market return 8% with a variance of 18%. You can invest in a stock AA which has a covariance to the market portfolio of 0.56. 1) Graph the CML and situate the stock. W ...

... You are a portfolio manager. The economic research team has given you the following expectations for the risk free rate, 2%, and the market return 8% with a variance of 18%. You can invest in a stock AA which has a covariance to the market portfolio of 0.56. 1) Graph the CML and situate the stock. W ...

download

... executive to purchase one share of Nichols’ $5 par value common stock at a price of $20 per share. The options were exercisable within a 2-year period beginning January 1, 2008, if the grantee is still employed by the company at the time of the exercise. On the grant date, Nichols’ stock was trading ...

... executive to purchase one share of Nichols’ $5 par value common stock at a price of $20 per share. The options were exercisable within a 2-year period beginning January 1, 2008, if the grantee is still employed by the company at the time of the exercise. On the grant date, Nichols’ stock was trading ...

METLIFE FIDELITY CORPORATE BOND FUND 16 YEAR

... Products and services are offered by MetLife Europe d.a.c. which is an affiliate of MetLife, Inc. and operates under the “MetLife” brand. MetLife Europe d.a.c. is a private company limited by shares and is registered in Ireland under company number 415123. Registered office at 20 on Hatch, Lower Hat ...

... Products and services are offered by MetLife Europe d.a.c. which is an affiliate of MetLife, Inc. and operates under the “MetLife” brand. MetLife Europe d.a.c. is a private company limited by shares and is registered in Ireland under company number 415123. Registered office at 20 on Hatch, Lower Hat ...

Pricing and Fees

... What is back to base currency conversion? Back to Base automatically converts any realised profits and losses, adjustments, fees and charges that are denominated in another currency, back to the base currency of your account before applying them to your account. For example, if your base currency is ...

... What is back to base currency conversion? Back to Base automatically converts any realised profits and losses, adjustments, fees and charges that are denominated in another currency, back to the base currency of your account before applying them to your account. For example, if your base currency is ...

state residents urged to be on guard against affinity fraud

... some CDs aren't what they seem. That's the message behind a handy checklist now available from the Agency. With many elderly investors complaining they've been misled into buying "callable" CDs with 10- to 30 -year maturities, State securities regulators hope investors will use the checklist to avoi ...

... some CDs aren't what they seem. That's the message behind a handy checklist now available from the Agency. With many elderly investors complaining they've been misled into buying "callable" CDs with 10- to 30 -year maturities, State securities regulators hope investors will use the checklist to avoi ...

Chapter 10 PPP

... Explain the basic investment elements of bonds and their use as investment means. ...

... Explain the basic investment elements of bonds and their use as investment means. ...

Delivering Active Management in REITs

... load. The fund imposes a 1.00% redemption fee on shares held less than 60 days. Performance does not reflect the redemption fee. Had the load or redemption fee been reflected, total returns would be reduced. Performance data quoted represents past performance and does not guarantee future results. ...

... load. The fund imposes a 1.00% redemption fee on shares held less than 60 days. Performance does not reflect the redemption fee. Had the load or redemption fee been reflected, total returns would be reduced. Performance data quoted represents past performance and does not guarantee future results. ...

Balancing Public Market Benefits and Burdens for Smaller

... The Article proceeds in three parts. Part I describes the costs and benefits of being a public company under the SEC’s regulatory regime. Part II describes the OTCBB eligibility rule, Regulation FD, and Sarbanes-Oxley and then discusses how they have added to the regulatory burden on small businesse ...

... The Article proceeds in three parts. Part I describes the costs and benefits of being a public company under the SEC’s regulatory regime. Part II describes the OTCBB eligibility rule, Regulation FD, and Sarbanes-Oxley and then discusses how they have added to the regulatory burden on small businesse ...

a guide to - Atkinson White Partnership

... they could take all their pension savings as a lump sum, draw them down over time, or buy an annuity. The Government will also explore with interested parties whether those tax rules that prevent individuals aged 75 and over from claiming tax relief on their pension contributions should be amended o ...

... they could take all their pension savings as a lump sum, draw them down over time, or buy an annuity. The Government will also explore with interested parties whether those tax rules that prevent individuals aged 75 and over from claiming tax relief on their pension contributions should be amended o ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.