presentation source

... tried to avoid selling much of the roughly 300,000 shares of InfoSpace.com now worth about $12.7 million, for which he holds options to buy at only a penny a share. Mr. Marcus, the 24-yr old programmer …recalled... that times got so tight initially he had to sell his car, carry groceries home in his ...

... tried to avoid selling much of the roughly 300,000 shares of InfoSpace.com now worth about $12.7 million, for which he holds options to buy at only a penny a share. Mr. Marcus, the 24-yr old programmer …recalled... that times got so tight initially he had to sell his car, carry groceries home in his ...

Ross Template

... The Price-Earnings (P/E) ratio can also be used to value stocks The P/E ratio is influenced by: – the earnings and sales growth of the firm – the risk (or volatility in performance) – the debt-equity structure of the firm – the dividend policy – the quality of management – a number of other factors ...

... The Price-Earnings (P/E) ratio can also be used to value stocks The P/E ratio is influenced by: – the earnings and sales growth of the firm – the risk (or volatility in performance) – the debt-equity structure of the firm – the dividend policy – the quality of management – a number of other factors ...

Preferential Treatment of Derivative Contracts

... a whole. One factor that will influence these studies is that Lehman’s U.S. and UK entities were often the counterparties that were custodying collateral assets. Prior to the financial crisis, most end-users in OTC derivatives transactions were viewed as the less credit-worthy counterparty and were ...

... a whole. One factor that will influence these studies is that Lehman’s U.S. and UK entities were often the counterparties that were custodying collateral assets. Prior to the financial crisis, most end-users in OTC derivatives transactions were viewed as the less credit-worthy counterparty and were ...

Principles of Economics

... outcome with low production, high prices, and monopoly profits. However, competition is more beneficial to society and the invisible hand can make the ...

... outcome with low production, high prices, and monopoly profits. However, competition is more beneficial to society and the invisible hand can make the ...

7 tips to weather market volatility and stay

... As you saw on page 1, fixed income as a broad asset class typically does not move in lockstep with the stock market. Because of its low correlation to equities, fixed income provides a good source of diversification and can help manage the volatility of the stock market. It’s important to also under ...

... As you saw on page 1, fixed income as a broad asset class typically does not move in lockstep with the stock market. Because of its low correlation to equities, fixed income provides a good source of diversification and can help manage the volatility of the stock market. It’s important to also under ...

The Price to Earnings Growth (PEG) Ratio

... Price Earnings multiple of 10 times would have a PEG of 0.5. Conversely a company growing at 10% per annum trading on a price earnings multiple of 20 times would have a PEG of 2.0. In this example, on the face of it the company on a PEG of 0.5 would be significantly cheaper than a company on a PEG o ...

... Price Earnings multiple of 10 times would have a PEG of 0.5. Conversely a company growing at 10% per annum trading on a price earnings multiple of 20 times would have a PEG of 2.0. In this example, on the face of it the company on a PEG of 0.5 would be significantly cheaper than a company on a PEG o ...

CF Canlife Asia Pacific Fund

... accumulation shares Closing net asset value per share * after direct transaction costs of: ...

... accumulation shares Closing net asset value per share * after direct transaction costs of: ...

Would a Stock By Any Other Ticker Smell as Sweet? Alex Head

... NASDAQ/NYSE portfolio, with the value of each portfolio normalized to equal 1 on the first trading day. The clever-ticker portfolio lagged behind slightly until 1993, and then spurted ahead over the next decade. Overall, the value of clever-ticker portfolio increased to 85.84 (a 23.6% annual compoun ...

... NASDAQ/NYSE portfolio, with the value of each portfolio normalized to equal 1 on the first trading day. The clever-ticker portfolio lagged behind slightly until 1993, and then spurted ahead over the next decade. Overall, the value of clever-ticker portfolio increased to 85.84 (a 23.6% annual compoun ...

MYLAN LABORATORIES INC

... Net earnings per share were $.12 for the quarter ended June 30, 1996 compared to the record high $.28 for the same quarter a year ago and $.15 for the quarter ended March 31, 1996. Net sales of $98,543,000 and gross profit of $42,764,000 representing 43% of net sales for the current quarter are down ...

... Net earnings per share were $.12 for the quarter ended June 30, 1996 compared to the record high $.28 for the same quarter a year ago and $.15 for the quarter ended March 31, 1996. Net sales of $98,543,000 and gross profit of $42,764,000 representing 43% of net sales for the current quarter are down ...

Long Term Effect of Liquidity on Stock Market Development

... market. From the theoretical perspective, higher stock price volatility discourages savers and thus inhibits investment. In addition to this, investors tend to demand higher risk premium during high stock price volatility which increases cost of capital thus choking investment thereby leading to low ...

... market. From the theoretical perspective, higher stock price volatility discourages savers and thus inhibits investment. In addition to this, investors tend to demand higher risk premium during high stock price volatility which increases cost of capital thus choking investment thereby leading to low ...

Download attachment

... result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary market will ensure transparency, which is about price discovery, together with investor prot ...

... result in a benchmark security which market participants will use in setting up their trading, investment / lending and borrowing policies. The financial markets thrive on information. An efficient secondary market will ensure transparency, which is about price discovery, together with investor prot ...

IMPORTANT REMINDERS Record Dates, Shareholder Meeting

... share issuances. Sections 711 through 713, respectively, of the Company Guide outline the Exchange’s shareholder approval requirements in this regard. Section 122 of the Company Guide outlines the Exchange’s voting rights requirements. The Exchange is unable to authorize transactions that violate it ...

... share issuances. Sections 711 through 713, respectively, of the Company Guide outline the Exchange’s shareholder approval requirements in this regard. Section 122 of the Company Guide outlines the Exchange’s voting rights requirements. The Exchange is unable to authorize transactions that violate it ...

accf 5224

... The company will issue a note of 100 million U.S dollars (USD) in three months (90 days) time. The note will have six-month (180 days) term, and the proceeds will be used to meet the working capital needs of Vameda’s U.S operations. Max must first decide whether to hedge the interest rate exposure ...

... The company will issue a note of 100 million U.S dollars (USD) in three months (90 days) time. The note will have six-month (180 days) term, and the proceeds will be used to meet the working capital needs of Vameda’s U.S operations. Max must first decide whether to hedge the interest rate exposure ...

Chapter 14

... It is sometimes argued that there is an optimum price for a stock; that is, a price at which WACC will be minimized, giving rise to a maximum price for any given earnings. If a firm can use stock dividends or stock splits to keep its shares selling at this price (or in this price range), then stock ...

... It is sometimes argued that there is an optimum price for a stock; that is, a price at which WACC will be minimized, giving rise to a maximum price for any given earnings. If a firm can use stock dividends or stock splits to keep its shares selling at this price (or in this price range), then stock ...

Equity Trading Strategy

... Worst Case Scenario: The value of shares invested may turn to zero; clients may lose all of their investment capital. Click here for an updated status on our equity trading strategy (ETS) ideas. ...

... Worst Case Scenario: The value of shares invested may turn to zero; clients may lose all of their investment capital. Click here for an updated status on our equity trading strategy (ETS) ideas. ...

Cost Basis Reporting Law - Wolters Kluwer Financial Services

... Adjusted Basis for Covered Securities Brokers are required to report cost basis adjusted for corporate actions and wash sales for identical securities within each client account, and to account for holding periods for covered securities. Important to note is that some brokers may report basis of cov ...

... Adjusted Basis for Covered Securities Brokers are required to report cost basis adjusted for corporate actions and wash sales for identical securities within each client account, and to account for holding periods for covered securities. Important to note is that some brokers may report basis of cov ...

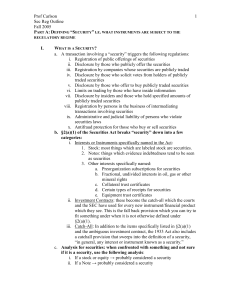

chapter 5 - BYU Marriott School

... and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fun ...

... and standard deviation fall, it is not yet clear whether the move is beneficial. The disadvantage of the shift is apparent from the fact that, if my client is willing to accept an expected return on his total portfolio of 11.2%, he can achieve that return with a lower standard deviation using my fun ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.