Chapter 13 The Cost of Capital

... 1.3.1 The Rf is the minimum rate required by all investors for an investment whose returns are certain. It is given in questions as: (a) the return on Treasury bills or (b) the return on government gilts (英國公債). 1.3.2 Once funds have been advanced to a company, an investor faces the risk that they w ...

... 1.3.1 The Rf is the minimum rate required by all investors for an investment whose returns are certain. It is given in questions as: (a) the return on Treasury bills or (b) the return on government gilts (英國公債). 1.3.2 Once funds have been advanced to a company, an investor faces the risk that they w ...

Knowledge Discovering in Corporate Securities Fraud by Using

... fraud including the number of defrauded investors, assets size, losses and financial distress of the firm. The authors concluded that only financial distress has a significant impact on the presence or absence of an enforcement action. In general, since the result of the enforcement action is either ...

... fraud including the number of defrauded investors, assets size, losses and financial distress of the firm. The authors concluded that only financial distress has a significant impact on the presence or absence of an enforcement action. In general, since the result of the enforcement action is either ...

Ethan Frome - Eurex Exchange

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

Stock Price Manipulation Detection Based on Mathematical Models

... action of buying stock, making the price to go higher, and then selling to others for a profit. Spoof trading is an action of sending passive orders in large volume to trick others that the stock should be sold at that price. After the manipulators secure enough benefits from that artificial price, ...

... action of buying stock, making the price to go higher, and then selling to others for a profit. Spoof trading is an action of sending passive orders in large volume to trick others that the stock should be sold at that price. After the manipulators secure enough benefits from that artificial price, ...

Risk

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

ENDOLOGIX INC /DE/ (Form: 10-Q, Received: 07/31/2014 13:40:04)

... accordance with generally accepted accounting principles in the United States of America ("GAAP") and the rules and regulations of the U.S. Securities and Exchange Commission ("SEC"). These financial statements include the financial position, results of operations, and cash flows of the Company, inc ...

... accordance with generally accepted accounting principles in the United States of America ("GAAP") and the rules and regulations of the U.S. Securities and Exchange Commission ("SEC"). These financial statements include the financial position, results of operations, and cash flows of the Company, inc ...

How to Read Your Form 1099-B

... Box 4: This is the federal income tax withheld from the sales proceeds. Withholding generally occurs only if the taxpayer is subject to backup withholding. This is not common. Box 5: Shows the amount of a nondeductible loss in a wash sale transaction. (Very generally, a wash sale occurs when a taxpa ...

... Box 4: This is the federal income tax withheld from the sales proceeds. Withholding generally occurs only if the taxpayer is subject to backup withholding. This is not common. Box 5: Shows the amount of a nondeductible loss in a wash sale transaction. (Very generally, a wash sale occurs when a taxpa ...

View MDA - Till Capital

... Americas Bullion Royalty Corp., formerly Golden Predator Corp., acquired all of the shares of Till, a Bermuda corporation, for approximately US$1.4 million. Till owns all of the issued and outstanding shares of RRL, a Bermuda corporation that holds a Bermuda Class 3A insurance license and, at the cl ...

... Americas Bullion Royalty Corp., formerly Golden Predator Corp., acquired all of the shares of Till, a Bermuda corporation, for approximately US$1.4 million. Till owns all of the issued and outstanding shares of RRL, a Bermuda corporation that holds a Bermuda Class 3A insurance license and, at the cl ...

CEE macro outlook: is Emerging Europe on the way to a

... In the United Kingdom, this publication is being communicated on a confidential basis only to clients of UniCredit Markets & Investment Banking Division (acting through Bayerische Hypo- und Vereinsbank, London Branch ("HVB London") and/or CA IB International Markets Limited and/or CAIB Corporate Fin ...

... In the United Kingdom, this publication is being communicated on a confidential basis only to clients of UniCredit Markets & Investment Banking Division (acting through Bayerische Hypo- und Vereinsbank, London Branch ("HVB London") and/or CA IB International Markets Limited and/or CAIB Corporate Fin ...

Jindal Saw (SAWPIP)

... • Jindal Saw reported a mixed set of Q3FY16 numbers wherein the topline, EBITDA and PAT came in lower than our estimates. Pipes sales volume came in lower than our estimate. EBITDA margins, however, surprised positively during the quarter • Topline for the quarter came in at | 1077.0 crore (down 39. ...

... • Jindal Saw reported a mixed set of Q3FY16 numbers wherein the topline, EBITDA and PAT came in lower than our estimates. Pipes sales volume came in lower than our estimate. EBITDA margins, however, surprised positively during the quarter • Topline for the quarter came in at | 1077.0 crore (down 39. ...

Rolling Up a Put Option as Prices Increase

... The disadvantages of put options are generally related to the put option premium values, which must be paid by the purchaser up front and may not equal futures contract price changes. Another disadvantage is that the time value component generally decreases with the passage of time. This decrease ...

... The disadvantages of put options are generally related to the put option premium values, which must be paid by the purchaser up front and may not equal futures contract price changes. Another disadvantage is that the time value component generally decreases with the passage of time. This decrease ...

capital markets execution

... paid under the Loan than as required under this Instrument and the Note at the time such action was taken by Lender and such redefined amortization shall not result in a change in the amount of the monthly payment due under the Note. The Borrower shall only be required to make one payment under such ...

... paid under the Loan than as required under this Instrument and the Note at the time such action was taken by Lender and such redefined amortization shall not result in a change in the amount of the monthly payment due under the Note. The Borrower shall only be required to make one payment under such ...

Dividend Policy as a Signaling Mechanism Under Different Market

... problems and allow insiders, i.e. controlling shareholders, to expropriate resources out of firms in emerging stock markets. Firms with high amount of retained earnings are obvious candidates for any expropriation by insiders. Agency theory suggests that, in the absence of proper corporate governanc ...

... problems and allow insiders, i.e. controlling shareholders, to expropriate resources out of firms in emerging stock markets. Firms with high amount of retained earnings are obvious candidates for any expropriation by insiders. Agency theory suggests that, in the absence of proper corporate governanc ...

Bernard L. Madoff Investment and Securities: Broker

... returned as much, or even more, than Madoff’s. So it wasn’t his returns that bothered me so much – his returns each month were possible – it was that he always returned a profit. There was no existing mathematical model that could explain the consistency.”5 Madoff, in reality, never made the invest ...

... returned as much, or even more, than Madoff’s. So it wasn’t his returns that bothered me so much – his returns each month were possible – it was that he always returned a profit. There was no existing mathematical model that could explain the consistency.”5 Madoff, in reality, never made the invest ...

Supplement - Causeway Capital Management

... also applies a proprietary quantitative risk model to adjust return forecasts based on risk assessments. Using a value style means that the Investment Manager buys stocks that it believes have lower prices than their true worth. For example, stocks may be “undervalued” because the issuing companies ...

... also applies a proprietary quantitative risk model to adjust return forecasts based on risk assessments. Using a value style means that the Investment Manager buys stocks that it believes have lower prices than their true worth. For example, stocks may be “undervalued” because the issuing companies ...

Taiwan 2015 - 2016.docx

... investment trust enterprise exercising the voting rights associated with shares it holds in a securities investment trust fund based on authorization in Article 23 of Regulations Governing Securities Investment Trust Enterprises. According to the new direction, funds have to meet two conditions in o ...

... investment trust enterprise exercising the voting rights associated with shares it holds in a securities investment trust fund based on authorization in Article 23 of Regulations Governing Securities Investment Trust Enterprises. According to the new direction, funds have to meet two conditions in o ...

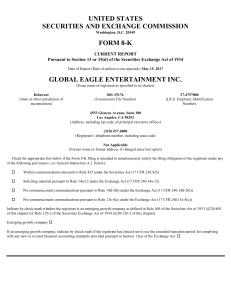

Global Eagle Entertainment Inc. (Form: 8

... On May 19, 2017, the Company submitted to NASDAQ the Company’s plan to regain compliance with the NASDAQ Listing Rule. If it accepts the Company’s plan, NASDAQ can grant an exception of up to 180 calendar days from the due date of the Annual Report (which would be September 12, 2017) for the Company ...

... On May 19, 2017, the Company submitted to NASDAQ the Company’s plan to regain compliance with the NASDAQ Listing Rule. If it accepts the Company’s plan, NASDAQ can grant an exception of up to 180 calendar days from the due date of the Annual Report (which would be September 12, 2017) for the Company ...

04.06.2016Dividend policy

... the company is profitable and financially strong. When a firm changes its dividend policy in a significant manner, investors assume that it is in response to an expected change in the firm’s profitability which will last long. An increase in payout ratio signals to shareholders a permanent or long t ...

... the company is profitable and financially strong. When a firm changes its dividend policy in a significant manner, investors assume that it is in response to an expected change in the firm’s profitability which will last long. An increase in payout ratio signals to shareholders a permanent or long t ...

Dr. Krzysztof Ostaszewski, FSA, CFA, MAAA Actuarial Program

... and a repayment of principal. If however, the borrower business is unable to make the promised payments and becomes bankrupt, you, the lender, are likely to end up with a share of the business, instead of the promised payments of interest and principal, thus becoming a shareholder of the business, a ...

... and a repayment of principal. If however, the borrower business is unable to make the promised payments and becomes bankrupt, you, the lender, are likely to end up with a share of the business, instead of the promised payments of interest and principal, thus becoming a shareholder of the business, a ...

Document

... Neither PS1 nor PF1 is known at the time the hedge is undertaken. As the basis fluctuates, so does the potential gain or loss on the hedge. Basis risk exposure on the futures position may be lower than the price risk in the cash market, especially when the cash and futures instruments are iden ...

... Neither PS1 nor PF1 is known at the time the hedge is undertaken. As the basis fluctuates, so does the potential gain or loss on the hedge. Basis risk exposure on the futures position may be lower than the price risk in the cash market, especially when the cash and futures instruments are iden ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.