Ch. 15: Financial Markets

... – lower interest rates. – an increase in future expected dividends. – A lower tax rate on dividends. ...

... – lower interest rates. – an increase in future expected dividends. – A lower tax rate on dividends. ...

Nasdaq Equal Weighted Index Shares: QQQE

... The Net Expense Ratio includes management fees and other operating expenses, but does not include Acquired Fund Fees and Expenses. The Funds’ Advisor, Rafferty Asset Management, LLC (“Rafferty”) has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contr ...

... The Net Expense Ratio includes management fees and other operating expenses, but does not include Acquired Fund Fees and Expenses. The Funds’ Advisor, Rafferty Asset Management, LLC (“Rafferty”) has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contr ...

practice chapter 9

... A firm is a ______ when it can sell as much as it wants at some given price P, but nothing at any higher price. A. Monopoly B. Oligopoly C. Price taker D. Price setter A firm that is a price taker faces a perfectly ______ demand curve. A. Horizontal B. Vertical C. Inelastic D. Convex A price-taking ...

... A firm is a ______ when it can sell as much as it wants at some given price P, but nothing at any higher price. A. Monopoly B. Oligopoly C. Price taker D. Price setter A firm that is a price taker faces a perfectly ______ demand curve. A. Horizontal B. Vertical C. Inelastic D. Convex A price-taking ...

Facing Pressure to Cut Costs, Fifth Third CEO Plays the Long Game

... Carmichael could not comment for this article because Fifth Third is in a quiet period ahead of its firstquarter results. But he has said that he expects investments in a slick new mobile app and improved riskmanagement systems will start paying off next year. "They are extremely important investm ...

... Carmichael could not comment for this article because Fifth Third is in a quiet period ahead of its firstquarter results. But he has said that he expects investments in a slick new mobile app and improved riskmanagement systems will start paying off next year. "They are extremely important investm ...

The Risk-Return Relationship in Asean-5 Stock Markets

... risk. So, investing in the stock market, the investors must bear the risk-return tradeoffs. Changing in global economic conditions provides the significant shocks to the stock markets, making the price volatility occur. So, investors have to ensure that investing in the risky assets, they will be co ...

... risk. So, investing in the stock market, the investors must bear the risk-return tradeoffs. Changing in global economic conditions provides the significant shocks to the stock markets, making the price volatility occur. So, investors have to ensure that investing in the risky assets, they will be co ...

Indian Financial Markets - Learning Financial Management

... • Long Term Funds • Raised by • Government • Corporates ...

... • Long Term Funds • Raised by • Government • Corporates ...

Download attachment

... financial derivatives. This means that the reinsurer sells a put anticipating a bullish or flat stock market whereas the cedant buys a put to protect against a bearish market, each party positioning itself accordingly with its market expectations. This type of contract requires that we evaluate the ...

... financial derivatives. This means that the reinsurer sells a put anticipating a bullish or flat stock market whereas the cedant buys a put to protect against a bearish market, each party positioning itself accordingly with its market expectations. This type of contract requires that we evaluate the ...

April 2015 Factsheet - Electric and General Investment Fund

... The prices of shares in open ended investment companies and income received from them can go down as well as up and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Changes in the rates of currency exchanges may have an adverse effect on th ...

... The prices of shares in open ended investment companies and income received from them can go down as well as up and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Changes in the rates of currency exchanges may have an adverse effect on th ...

Scrip reference price - Euromoney Institutional Investor PLC

... This announcement should be read in conjunction with the announcement by the Company on May 17 2012 of a proposed interim cash dividend (the “Interim Dividend”) of 7.00 pence per ordinary share in the Company ("Ordinary Share") in respect of the Company's interim financial results for the six months ...

... This announcement should be read in conjunction with the announcement by the Company on May 17 2012 of a proposed interim cash dividend (the “Interim Dividend”) of 7.00 pence per ordinary share in the Company ("Ordinary Share") in respect of the Company's interim financial results for the six months ...

How do I tender my Savanna Common Shares to the Offer?

... registered Common Shareholder and wish to accept the Offer, but are unable to deposit your share certificate(s) by the Expiry Time in accordance with the rules and instructions set out in the Letter of Transmittal, you can accept the Offer by following the procedures for guaranteed delivery describe ...

... registered Common Shareholder and wish to accept the Offer, but are unable to deposit your share certificate(s) by the Expiry Time in accordance with the rules and instructions set out in the Letter of Transmittal, you can accept the Offer by following the procedures for guaranteed delivery describe ...

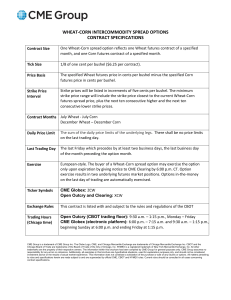

Wheat-Corn Intercommodity Spread Options Contract

... CME Group is a trademark of CME Group Inc. The Globe Logo, CME, and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercant ...

... CME Group is a trademark of CME Group Inc. The Globe Logo, CME, and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercant ...

Don`t Expect the Easy Market Gains of the Reagan Era

... from earnings growth and dividends to be somewhat offset by valuation contraction. Global equity returns are likely to be somewhat higher, in our central case. Because the economic and earnings recovery in Europe and Japan has been slower and more fragile, there’s far more potential for economic gro ...

... from earnings growth and dividends to be somewhat offset by valuation contraction. Global equity returns are likely to be somewhat higher, in our central case. Because the economic and earnings recovery in Europe and Japan has been slower and more fragile, there’s far more potential for economic gro ...

Change of Control Amendment/Termination New Plan Benefits

... • If the Committee reasonably determines in good faith that Awards will not be honored or assumed and equitable replacement awards will not be made by a successor employer immediately following the change of control, then (i) any Option and SAR will become fully exercisable, (ii) the restrictions fo ...

... • If the Committee reasonably determines in good faith that Awards will not be honored or assumed and equitable replacement awards will not be made by a successor employer immediately following the change of control, then (i) any Option and SAR will become fully exercisable, (ii) the restrictions fo ...

1934 Act - Cengage

... • A company that has never registered securities under the 1933 Act becomes subject to the reporting requirements of the 1934 Act when it has both: – More than 500 shareholders. – Assets of more than $10 million. • Deregistration from the 1934 Act is allowed if: – An entity has less than 300 shareho ...

... • A company that has never registered securities under the 1933 Act becomes subject to the reporting requirements of the 1934 Act when it has both: – More than 500 shareholders. – Assets of more than $10 million. • Deregistration from the 1934 Act is allowed if: – An entity has less than 300 shareho ...

The Great Depression

... The bank runs of 1930 were followed by similar banking panics in the spring and fall of 1931 and the fall of 1932. In some instances, bank runs were started simply by rumours of a bank’s inability or unwillingness to pay out funds. In December 1930, the New York Times reported that a small mer ...

... The bank runs of 1930 were followed by similar banking panics in the spring and fall of 1931 and the fall of 1932. In some instances, bank runs were started simply by rumours of a bank’s inability or unwillingness to pay out funds. In December 1930, the New York Times reported that a small mer ...

Investment Guidelines

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

WHOLE FOODS MARKET INC (Form: 8

... On September 22, 1999, the Board of Directors of Whole Foods Market, Inc. (the "Company") declared a dividend of one right to purchase preferred stock ("Right") for each outstanding share of the Company's Common Stock, with no par value ("Common Stock"), to shareholders of record at the close of bus ...

... On September 22, 1999, the Board of Directors of Whole Foods Market, Inc. (the "Company") declared a dividend of one right to purchase preferred stock ("Right") for each outstanding share of the Company's Common Stock, with no par value ("Common Stock"), to shareholders of record at the close of bus ...

Rule 1: Think Like a Fundamentalist

... Rule 7: Institutional Ownership My approach is to buy stocks that have the propensity to move higher in share price. I look for all of the indicators that I can find that will make that propensity greater and greater. One such indicator is institutional ownership. Financial institutions such as bank ...

... Rule 7: Institutional Ownership My approach is to buy stocks that have the propensity to move higher in share price. I look for all of the indicators that I can find that will make that propensity greater and greater. One such indicator is institutional ownership. Financial institutions such as bank ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.