Intermediate Financial Management, 5th Ed.

... purchase or sale of a financial (or real) asset at some future date, but at a price determined today. Futures (and other derivatives) can be used either as highly leveraged speculations (More...) or to hedge and thus reduce risk. ...

... purchase or sale of a financial (or real) asset at some future date, but at a price determined today. Futures (and other derivatives) can be used either as highly leveraged speculations (More...) or to hedge and thus reduce risk. ...

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form? 6. Explain any two key factor ...

... 2. What are the two components of Indian capital market? 3. What are the determinants of expected return? 4. In what way the financial investment is different from general investment? 5. On what basis strong form of efficient market hypothesis differ from the weak form? 6. Explain any two key factor ...

the importance of capital market in economy

... this type of market offers to the owners of shares and bonds the possibility to capitalize them before they bring a profit (dividends or interests). The secondary market represents, at the same time, the way to concentrate in the same place private or institutional investors who can sell or buy secu ...

... this type of market offers to the owners of shares and bonds the possibility to capitalize them before they bring a profit (dividends or interests). The secondary market represents, at the same time, the way to concentrate in the same place private or institutional investors who can sell or buy secu ...

DESCRIPTION OF FINANCIAL INSTRUMENT TYPES AND

... underlying asset price volatility effect. However, note that the fluctuations of prices of derivatives and their underlying assets may be different. When trading in derivatives is conducted for profit purposes, the customer should be aware that such a trade entails high risks. Certain derivatives ar ...

... underlying asset price volatility effect. However, note that the fluctuations of prices of derivatives and their underlying assets may be different. When trading in derivatives is conducted for profit purposes, the customer should be aware that such a trade entails high risks. Certain derivatives ar ...

Weekly Market Update - The Fuhr

... Shaw Communications (SJR.B) – we believe the stock offers an attractive risk/reward profile and an attractive dividend yield of 5.04%*. Shaw recently closed the acquisition of WIND Mobile, shifting its operating profile to one that is more consistent with its larger Canadian peers and, based on Scot ...

... Shaw Communications (SJR.B) – we believe the stock offers an attractive risk/reward profile and an attractive dividend yield of 5.04%*. Shaw recently closed the acquisition of WIND Mobile, shifting its operating profile to one that is more consistent with its larger Canadian peers and, based on Scot ...

ANTICIPATION GUIDE for Chapters 6

... acquire the things that they want rather than working for them? What are the consequences of ...

... acquire the things that they want rather than working for them? What are the consequences of ...

chapter 1

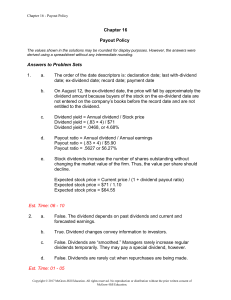

... cash. If the company wants to maintain its all-equity financing position, it must finance the extra cash dividend by selling more shares. This results in a transfer of value from the old to the new shareholders. Assume the company pays the dividend first and then later replaces the additional $1 mil ...

... cash. If the company wants to maintain its all-equity financing position, it must finance the extra cash dividend by selling more shares. This results in a transfer of value from the old to the new shareholders. Assume the company pays the dividend first and then later replaces the additional $1 mil ...

Report Draft

... The stock trades started as early as 7th century BCE, but the modern stock markets as it is known today started really in 1973 with the opening of the Chicago Board Of Exchange (CBOE) and the development of Black-Scholes model option pricing model the same year. “In their simplest form, stock option ...

... The stock trades started as early as 7th century BCE, but the modern stock markets as it is known today started really in 1973 with the opening of the Chicago Board Of Exchange (CBOE) and the development of Black-Scholes model option pricing model the same year. “In their simplest form, stock option ...

New Hampshire High Schooler is Capital Markets

... companies. This means that not all one's investments are in a certain industry such as technology or entertainment. If an investor is in this situation where all his or her investments are linked in the same genre of companies, the risk factor is extremely high. An incident could occur overnight aff ...

... companies. This means that not all one's investments are in a certain industry such as technology or entertainment. If an investor is in this situation where all his or her investments are linked in the same genre of companies, the risk factor is extremely high. An incident could occur overnight aff ...

Lecture 17

... fraction of the period they are outstanding. When stock dividends or stock splits occur, computation of the weighted average number of shares requires restatement of the shares outstanding before the stock dividend or split (they are assumed to have been outstanding since the beginning of the year) ...

... fraction of the period they are outstanding. When stock dividends or stock splits occur, computation of the weighted average number of shares requires restatement of the shares outstanding before the stock dividend or split (they are assumed to have been outstanding since the beginning of the year) ...

Taiwan Stock Bubble Burst in the late 1980s: A

... some answer for this question. The economic development of Taiwan occurred relatively earlier than China’s. Up to the end of 1980s, Taiwan had experienced a fast economic growth over three decades (on average 9% annual GDP growth rate). Due to a large accumulated amount of trade surplus with USA and ...

... some answer for this question. The economic development of Taiwan occurred relatively earlier than China’s. Up to the end of 1980s, Taiwan had experienced a fast economic growth over three decades (on average 9% annual GDP growth rate). Due to a large accumulated amount of trade surplus with USA and ...

Securities Trading Floor Monthly Reports (April

... The activities of the Securities Trading Floor continued as usual, although the cumulative trading turnover increased only marginally. The value of share transactions amounted to Rf 149,775 during the period of 14th April 2002 to 31st July 2002. Total (1)market capitalization as at 31st July 2002 wa ...

... The activities of the Securities Trading Floor continued as usual, although the cumulative trading turnover increased only marginally. The value of share transactions amounted to Rf 149,775 during the period of 14th April 2002 to 31st July 2002. Total (1)market capitalization as at 31st July 2002 wa ...

securities trading policy

... The restrictions in this policy apply to dealings in Securities by or on behalf of a director or Executive of the Company or any spouse or child of any of them and any other dealing in which they are directly or indirectly interested. For this purpose: Executive means the CEO, any direct executive r ...

... The restrictions in this policy apply to dealings in Securities by or on behalf of a director or Executive of the Company or any spouse or child of any of them and any other dealing in which they are directly or indirectly interested. For this purpose: Executive means the CEO, any direct executive r ...

Class D Shares - Accumulating - USD

... profitability of the companies the Sub-Fund invests in and also the value of the Sub-Fund's investments. Exchange derivatives risk: Some commodity exchanges place limits on how much prices are allowed to fluctuate in the course of a day. There is therefore a risk that the Sub-Fund might not be able ...

... profitability of the companies the Sub-Fund invests in and also the value of the Sub-Fund's investments. Exchange derivatives risk: Some commodity exchanges place limits on how much prices are allowed to fluctuate in the course of a day. There is therefore a risk that the Sub-Fund might not be able ...

information circular: northern lights fund trust iv

... and the Index is rebalanced quarterly. If, upon review, the Inspire Impact Score of a security falls below an acceptable level, the security is removed from the Index and replaced with a higher scoring security. Under normal market conditions, the Fund invests at least 80% of its assets (defined as ...

... and the Index is rebalanced quarterly. If, upon review, the Inspire Impact Score of a security falls below an acceptable level, the security is removed from the Index and replaced with a higher scoring security. Under normal market conditions, the Fund invests at least 80% of its assets (defined as ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.